Form 944 For 2020

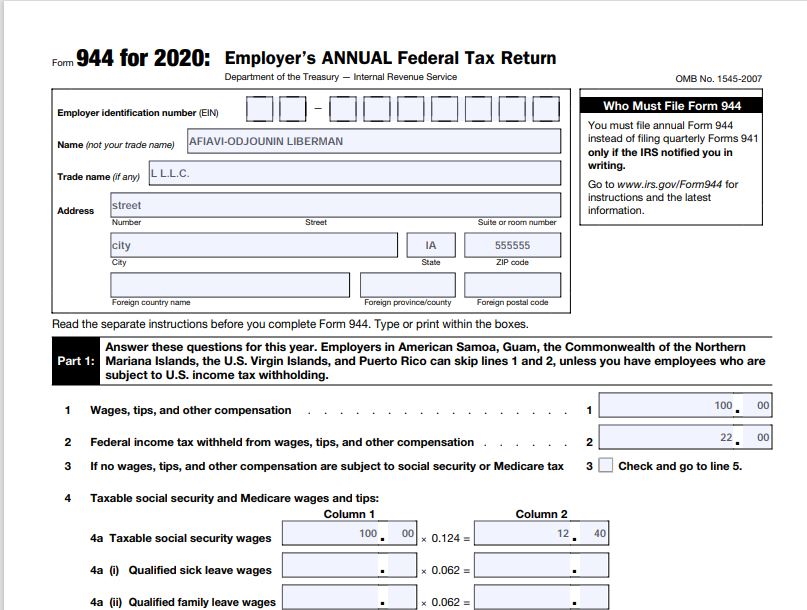

Form 944 For 2020 - Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. •the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d. 23 by the internal revenue service. The deadline for filing the form is feb. Use this form to correct errors on a form 944 that you previously filed. Web finalized versions of the 2020 form 944 and its instructions are available. Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? Web who must file form 944? Enter your owner’s name first and last name whether you are a sole proprietor, llc, or llc taxed as s corp.

Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld income taxes) to pay yearly, not quarterly. Web finalized versions of the 2020 form 944 and its instructions are available. Use this form to correct errors on a form 944 that you previously filed. The finalized versions of the 2020 form 944, employer’s annual federal tax return, and its instructions were released nov. Have it in on your computer and start to fill it out. •the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d. Web building your business business taxes what is irs form 944? Web who must file form 944? Enter your business ein number.

Web who must file form 944? Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld income taxes) to pay yearly, not quarterly. Enter your owner’s name first and last name whether you are a sole proprietor, llc, or llc taxed as s corp. Web form 944 for 2020: Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. •the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d. How to determine your erc amount finances and taxes. Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? 23 by the internal revenue service. Related your employee retention credit calculator for 2020 and 2021:

944 Form 2021 2022 IRS Forms Zrivo

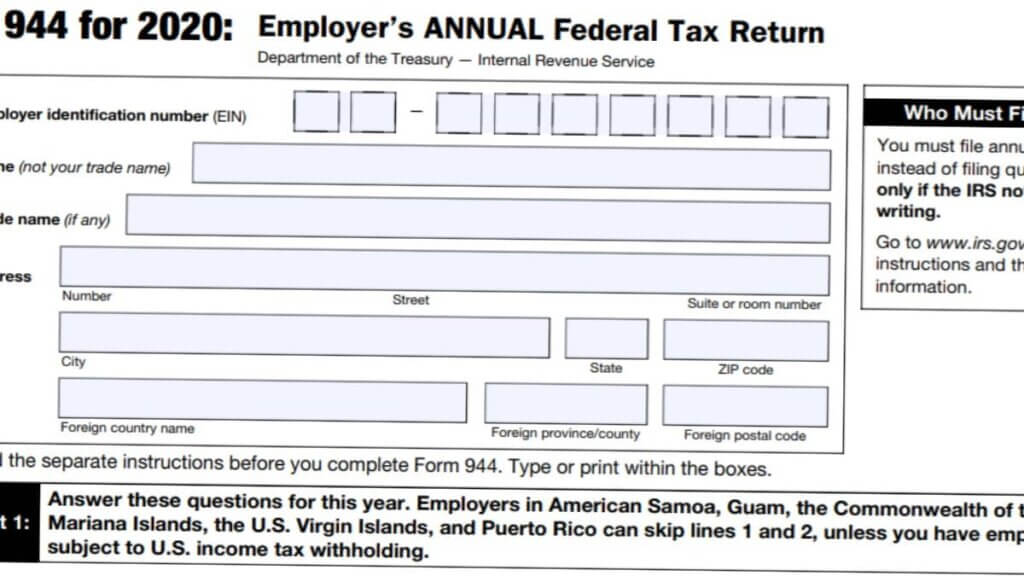

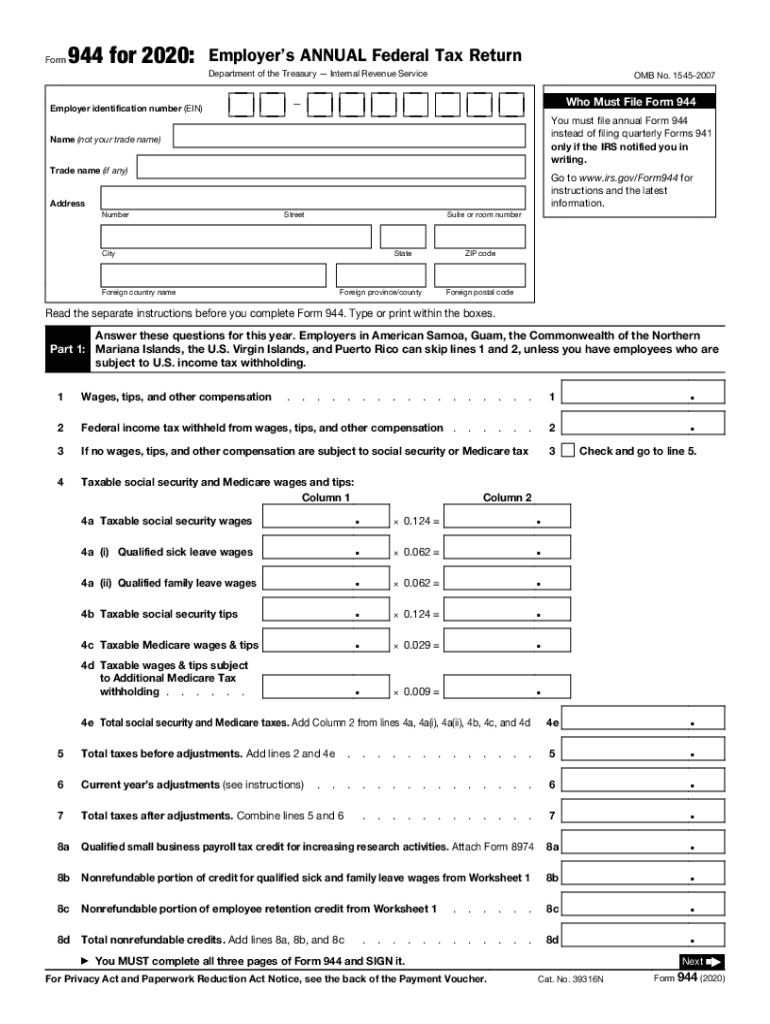

How to determine your erc amount finances and taxes. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. Use this form to correct errors on a form 944 that you previously filed. Enter your business ein number. The finalized versions of the 2020 form 944, employer’s annual federal tax return, and its instructions were.

2020 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

Enter your business ein number. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. •the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d. Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld income taxes) to.

IRS 944 2019 Fill and Sign Printable Template Online US Legal Forms

Web who must file form 944? Enter your business ein number. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your employees’ paychecks. •the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable,.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

Use this form to correct errors on a form 944 that you previously filed. •the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d. Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. Have it in on your computer.

IRS Form 944 Instructions and Who Needs to File It

Peopleimage / getty images irs form 944 is the. The deadline for filing the form is feb. Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. How to determine your erc amount finances and taxes. Irs.

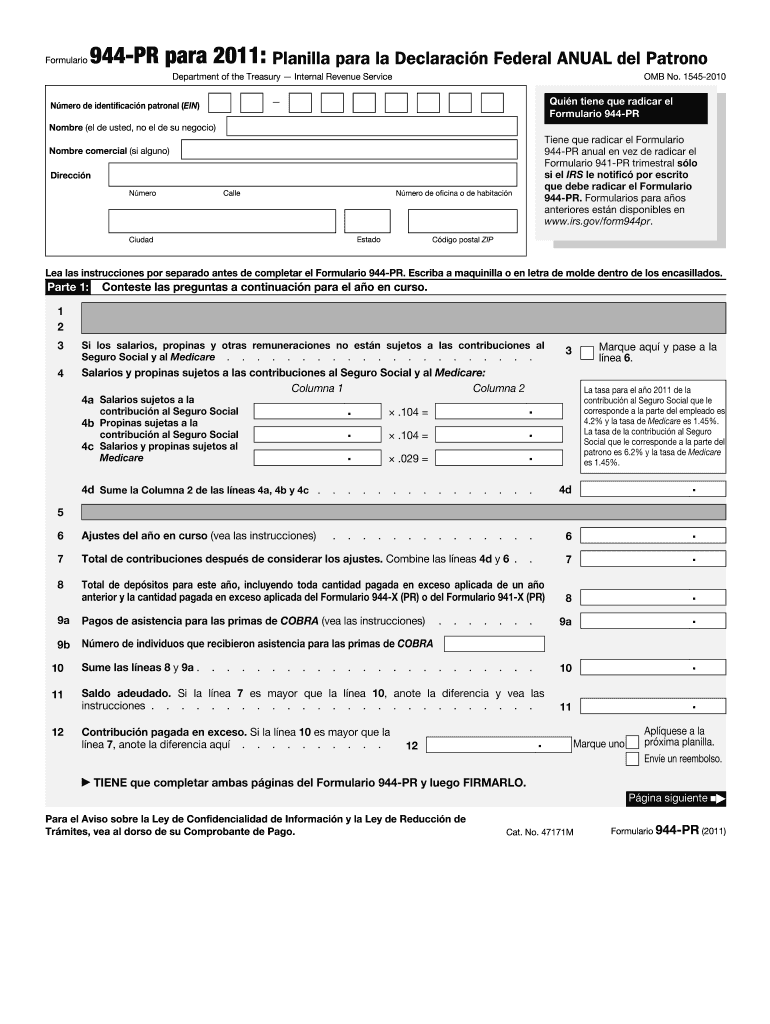

944 Pr Fill Out and Sign Printable PDF Template signNow

Use this form to correct errors on a form 944 that you previously filed. The finalized versions of the 2020 form 944, employer’s annual federal tax return, and its instructions were released nov. Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. Web form 944 for 2020: 23 by.

How to Complete Form 944 for 2020 Employer’s Annual Federal Tax

Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. Related your employee retention credit calculator for 2020 and 2021: Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld income taxes) to pay yearly, not quarterly. Employer’s annual federal tax return department.

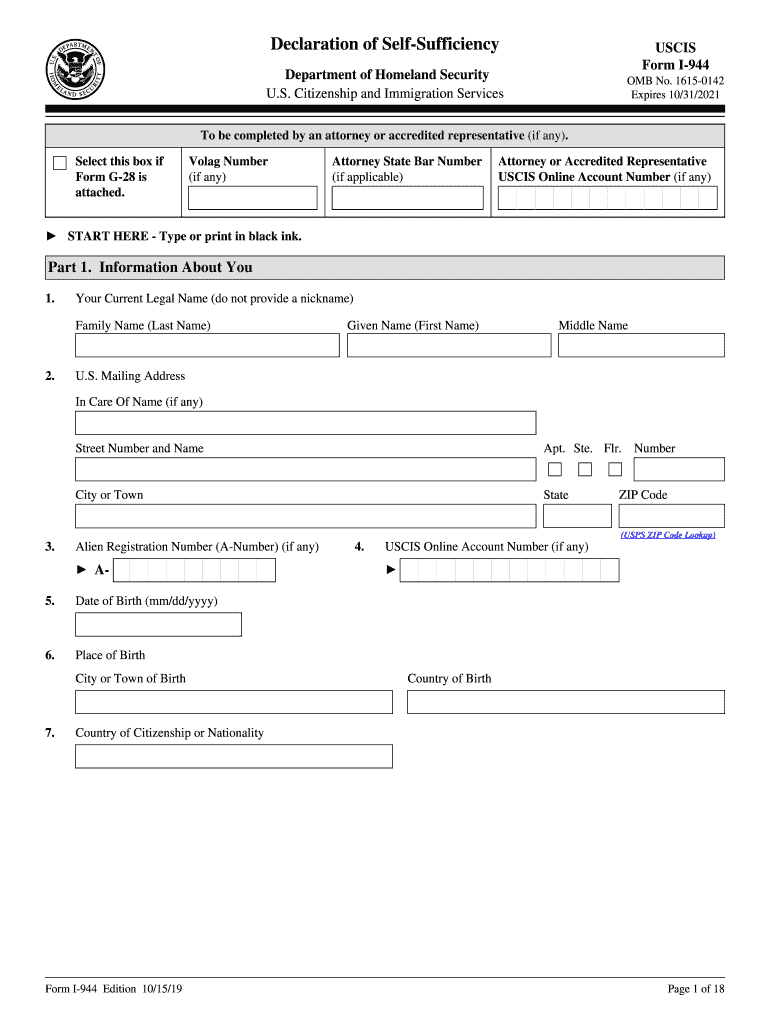

I 944 Pdf 20202021 Fill and Sign Printable Template Online US

Enter your owner’s name first and last name whether you are a sole proprietor, llc, or llc taxed as s corp. Web who must file form 944? Related your employee retention credit calculator for 2020 and 2021: Web building your business business taxes what is irs form 944? Web form 944, employer’s annual federal tax return, is a form that.

How To Fill Out Form I944 StepByStep Instructions [2021]

Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your employees’ paychecks. Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? Web form 944, employer’s annual federal tax return,.

Form 944 2020 Fill Out and Sign Printable PDF Template signNow

Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Have it in on your computer and start to fill it out. How to determine your erc amount.

Related Your Employee Retention Credit Calculator For 2020 And 2021:

Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. Enter your business ein number. Web who must file form 944? Employer’s annual federal tax return department of the treasury — internal revenue service omb no.

23 By The Internal Revenue Service.

Web building your business business taxes what is irs form 944? Irs form 944 explained by jean murray updated on july 23, 2020 in this article view all what is form 944? Use this form to correct errors on a form 944 that you previously filed. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file.

The Deadline For Filing The Form Is Feb.

•the new credit for qualified sick and family leave wages is reported on line 8b and, if applicable, line 10d. The finalized versions of the 2020 form 944, employer’s annual federal tax return, and its instructions were released nov. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your employees’ paychecks. Have it in on your computer and start to fill it out.

Form 944 Allows Small Employers ($1,000 Or Less Of Annual Liability For Social Security, Medicare, And Withheld Income Taxes) To Pay Yearly, Not Quarterly.

Peopleimage / getty images irs form 944 is the. Web finalized versions of the 2020 form 944 and its instructions are available. Web form 944 for 2020: How to determine your erc amount finances and taxes.

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)