Form 990-Ez Schedule A Instructions

Form 990-Ez Schedule A Instructions - Web schedule a (form 990) department of the treasury internal revenue service. This form is used for tax filing purposes, and it will be sent to the. Web schedule o (form 990) 2022 omb no. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Complete if the organization is a section. Reason for public charity status to complete schedule a, all organizations should check any one of the boxes. Open to public go to www.irs.gov/form990 for instructions and the latest information. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Web instructions for schedule a. Complete, edit or print tax forms instantly.

Web (1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether it is a private foundation. Click on the button get form to open it and begin. Complete, edit or print tax forms instantly. Web schedule o (form 990) 2022 omb no. For paperwork reduction act notice, see the separate instructions. Schedule a (form 990) 2021 (all organizations must complete this part.) see. These instructions are intended for local ptas to help clarify the “instructions for schedule a (990ez)” as published by the internal revenue. Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Enter amount of tax imposed on organization managers or disqualified. Complete, edit or print tax forms instantly.

Enter amount of tax imposed on organization managers or disqualified. For paperwork reduction act notice, see the separate instructions. Complete if the organization is a section. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Web schedule o (form 990) 2022 omb no. Return of organization exempt from income tax. Web instructions for schedule a. Open to public go to www.irs.gov/form990 for instructions and the latest information. Complete, edit or print tax forms instantly. Upload, modify or create forms.

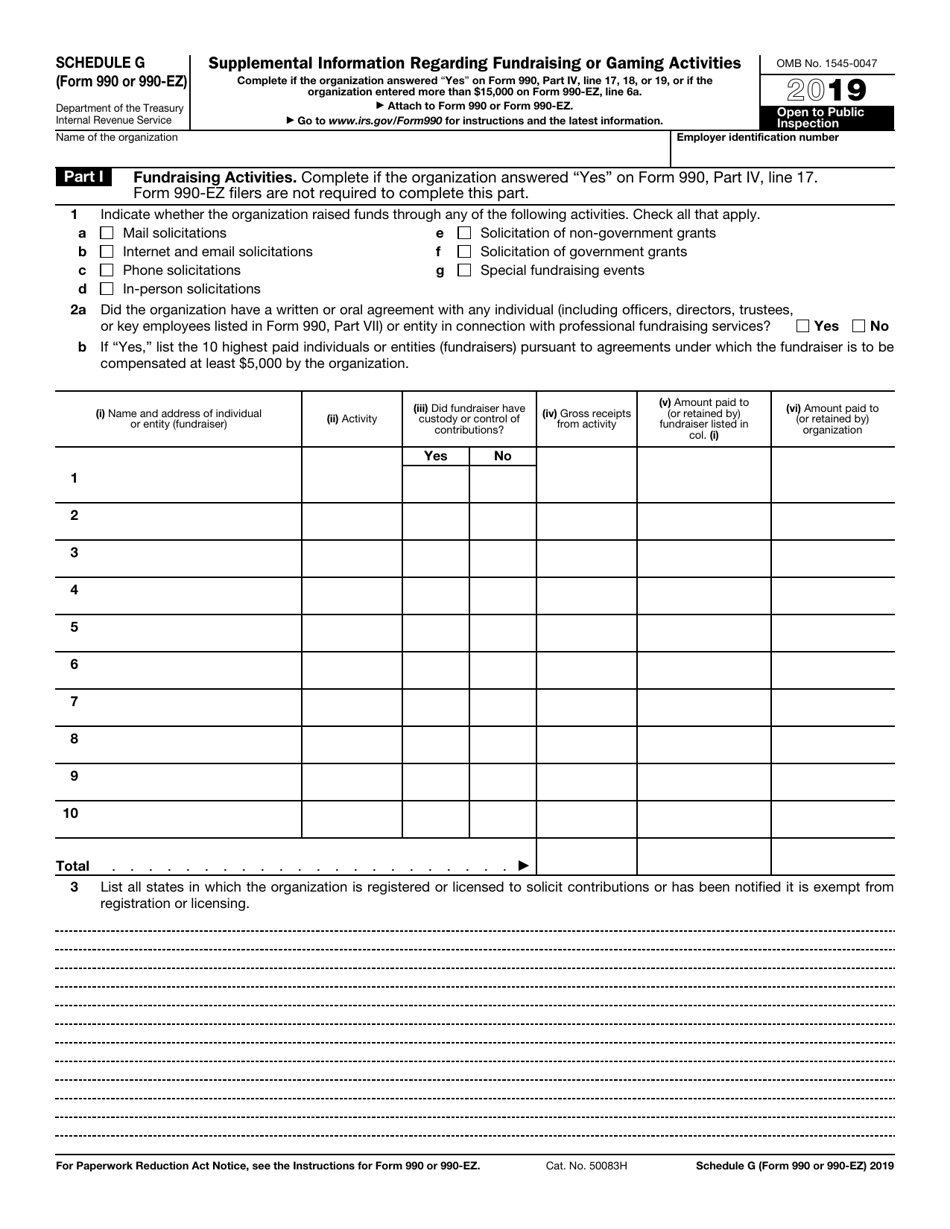

IRS Form 990 (990EZ) Schedule G Download Fillable PDF or Fill Online

Complete, edit or print tax forms instantly. Enter amount of tax imposed on organization managers or disqualified. Try it for free now! Schedule a (form 990) 2022 (all organizations must complete this part.) see. These instructions are intended for local ptas to help clarify the “instructions for schedule a (990ez)” as published by the internal revenue.

2023 Form 990 Schedule F Instructions Fill online, Printable

Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. Complete if the organization is a section. Web schedule o (form 990) 2022 omb no. Try it for free now! Web schedule a (form 990) department of the treasury internal revenue service.

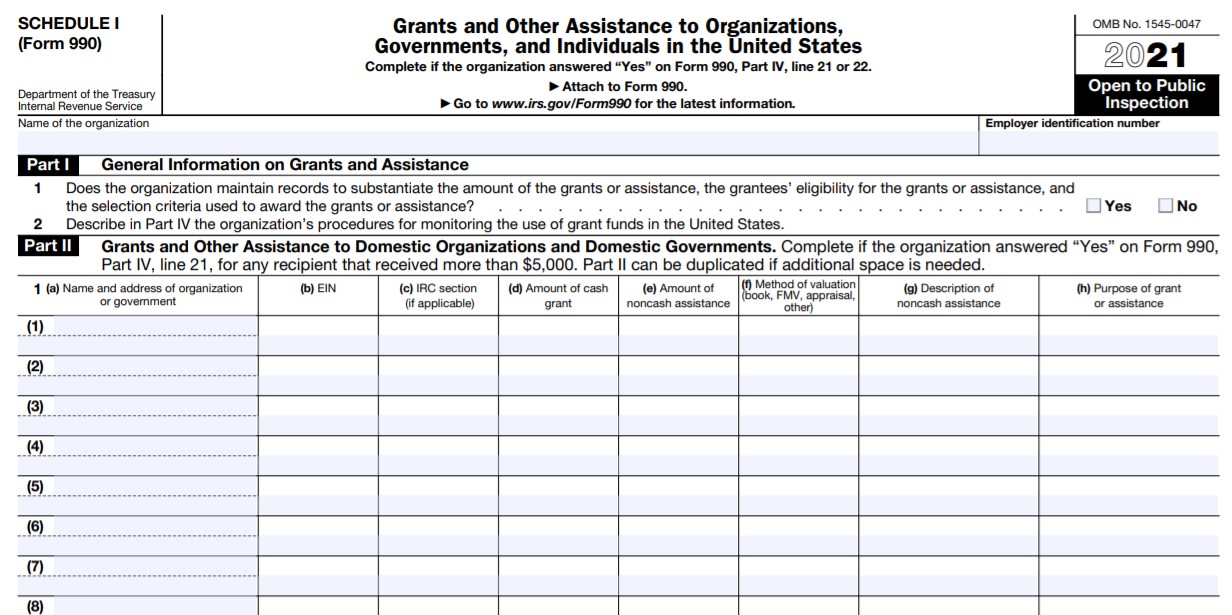

IRS Form 990 Schedule I Instructions Grants & Other Assistance

Enter amount of tax imposed on organization managers or disqualified. Public charity status and public support. Web schedule a (form 990) department of the treasury internal revenue service. Web instructions for schedule a. Web a section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether.

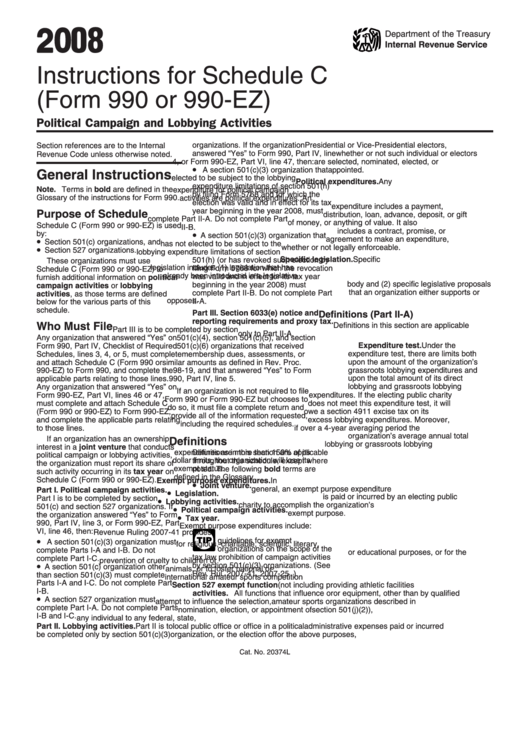

Instructions For Schedule C (Form 990 Or 990Ez) 2008 printable pdf

Return of organization exempt from income tax. Complete, edit or print tax forms instantly. Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. Web schedule a (form 990) department of the treasury internal revenue service. Ad get ready for tax season deadlines by completing any required tax forms today.

2020 Form IRS Instructions Schedule A (990 or 990EZ) Fill Online

Return of organization exempt from income tax. Complete, edit or print tax forms instantly. Reason for public charity status to complete schedule a, all organizations should check any one of the boxes. Upload, modify or create forms. Web a section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for schedule a (form 990), public charity status and public.

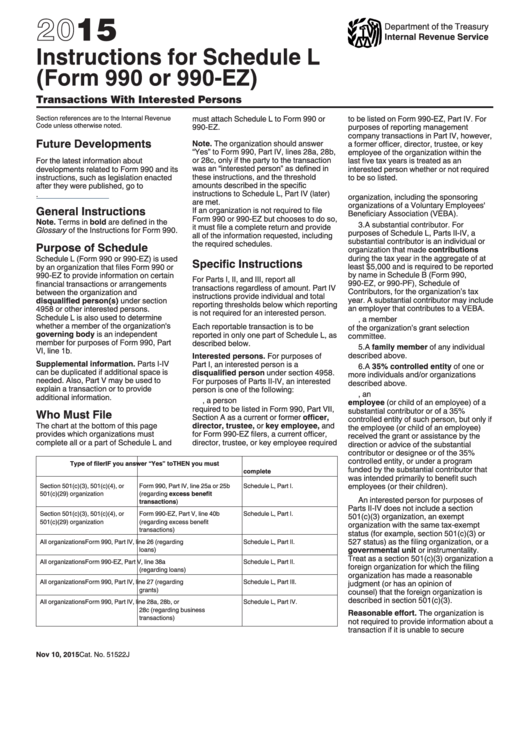

Instructions For Schedule L (Form 990 Or 990Ez) Transactions With

Web (1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether it is a private foundation. Web schedule o (form 990) 2022 omb no. Public charity status and public support. These instructions are intended for local ptas to help clarify the “instructions for schedule a (990ez)” as published by.

199N E Postcard Fill Out and Sign Printable PDF Template signNow

Complete if the organization is a section. Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Return of organization exempt from income tax. Open to public go to www.irs.gov/form990 for instructions and the latest information. Ad get ready for tax season deadlines by completing any required tax forms today.

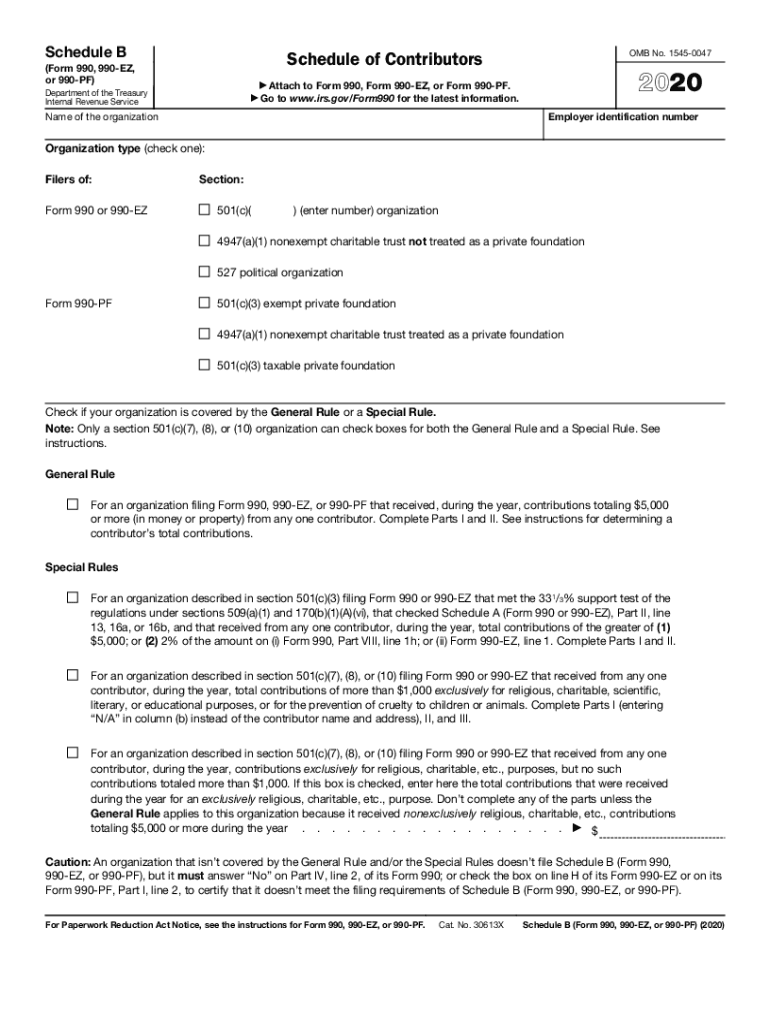

Gallery of Irs form 990 Ez Schedule B Instructions Unique Ibss Federal

Schedule a (form 990) 2022 (all organizations must complete this part.) see. Web expresstaxexempt is here to generate the correct schedules for your nonprofit and help you file on time. Reason for public charity status to complete schedule a, all organizations should check any one of the boxes. These instructions are intended for local ptas to help clarify the “instructions.

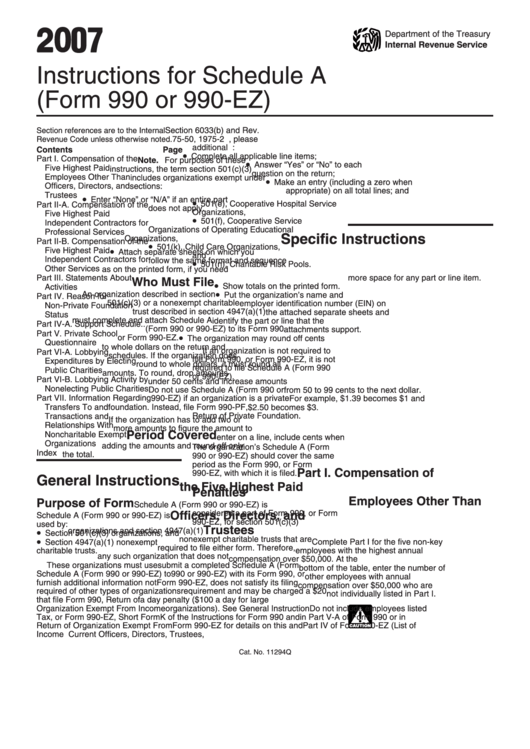

Instructions For Schedule A (Form 990 Or 990Ez) 2007 printable pdf

This form is used for tax filing purposes, and it will be sent to the. Short form return of organization exempt from income tax. Reason for public charity status to complete schedule a, all organizations should check any one of the boxes. Upload, modify or create forms. Web schedule a (form 990) department of the treasury internal revenue service.

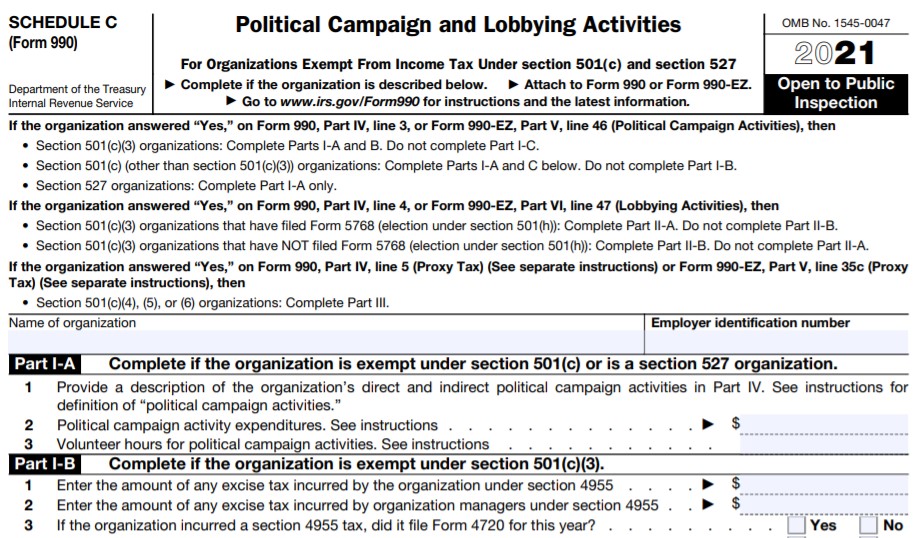

IRS Form 990/990EZ Schedule C Instructions Political Campaign and

Upload, modify or create forms. Open to public go to www.irs.gov/form990 for instructions and the latest information. Enter amount of tax imposed on organization managers or disqualified. These instructions are intended for local ptas to help clarify the “instructions for schedule a (990ez)” as published by the internal revenue. Web expresstaxexempt is here to generate the correct schedules for your.

Schedule A (Form 990) 2022 Teea0401L 09/09/22 Northwest Ct Community.

This form is used for tax filing purposes, and it will be sent to the. Public charity status and public support. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Ad get ready for tax season deadlines by completing any required tax forms today.

Web If Yes, Complete Schedule L, Part I Section 501(C)(3), 501(C)(4), And 501(C)(29) Organizations.

Complete, edit or print tax forms instantly. Web instructions for schedule a. Complete, edit or print tax forms instantly. Web expresstaxexempt is here to generate the correct schedules for your nonprofit and help you file on time.

Open To Public Go To Www.irs.gov/Form990 For Instructions And The Latest Information.

Complete if the organization is a section. For paperwork reduction act notice, see the separate instructions. Web schedule o (form 990) 2022 omb no. Reason for public charity status to complete schedule a, all organizations should check any one of the boxes.

Return Of Organization Exempt From Income Tax.

Short form return of organization exempt from income tax. Web a section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether. Web (1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether it is a private foundation. Try it for free now!