Form 990 Instructions Schedule L

Form 990 Instructions Schedule L - Form 990 schedule l the next installment in our series on the schedules of the irs form 990 focuses on schedule l, transactions with. Baa for paperwork reduction act. Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the. Was the organization controlled directly or indirectly at any time during the tax year by one or more. Schedule r (form 990) 2022: What types of transactions are reportable on schedule l, form 990? Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Form 990, part iv, line 28a: Complete part vi of form 990. Web if yes, complete part i of schedule l (form 990).

Enter amount of tax imposed on organization managers or disqualified. Web for paperwork reduction act notice, see the instructions for form 990. 7 8 did the organization make a loan to a disqualified person (as defined in section 4958). Certain transactions between your organization and interested persons — including excess benefit transactions, loans, grants, and business. Web expresstaxexempt is here to generate the correct schedules for your nonprofit and help you file on time. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Complete part vi of form 990. What types of transactions are reportable on schedule l, form 990? Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the. Web transactions with “interested persons” are reported on schedule l (form 990) schedule l contains four parts for this reporting:

If yes, provide detail in if yes, provide detail in if yes, provide detail in. Was the organization controlled directly or indirectly at any time during the tax year by one or more. Form 990 schedule l the next installment in our series on the schedules of the irs form 990 focuses on schedule l, transactions with. Web for paperwork reduction act notice, see the instructions for form 990. Web if yes, complete part i of schedule l (form 990). Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the. Schedule r (form 990) 2022: Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. 7 8 did the organization make a loan to a disqualified person (as defined in section 4958). What types of transactions are reportable on schedule l, form 990?

Instruction 990 Schedule D (Form 990) 2011 printable pdf download

Was the organization controlled directly or indirectly at any time during the tax year by one or more. If yes, complete part i of schedule l (form 990). Schedule r (form 990) 2022: Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Web transactions with “interested persons” are.

Form 990 Instructions For Schedule R 2010 printable pdf download

Baa for paperwork reduction act. What types of transactions are reportable on schedule l, form 990? Schedule r (form 990) 2022: Web expresstaxexempt is here to generate the correct schedules for your nonprofit and help you file on time. Complete part vi of form 990.

irs form 990 instructions 2017 Fill Online, Printable, Fillable Blank

Web expresstaxexempt is here to generate the correct schedules for your nonprofit and help you file on time. An organization that answered yes to form 990, part iv, checklist of required schedules, line 17, 18, or. Web with one of the following parties (see schedule l instructions for the applicable filing thresholds, conditions, and exceptions)? 8 9a was the organization.

Form 990 Schedule L Instructions

Read the following instructions to use cocodoc to start editing and drawing up your form 990 schedule l: Web transactions with “interested persons” are reported on schedule l (form 990) schedule l contains four parts for this reporting: Schedule r (form 990) 2022: Certain transactions between your organization and interested persons — including excess benefit transactions, loans, grants, and business..

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Read the following instructions to use cocodoc to start editing and drawing up your form 990 schedule l: Web nonprofit tax tidbits: Web if yes, complete part i of schedule l (form 990). Form 990 schedule l the next installment in our series on the schedules of the irs form 990 focuses on schedule l, transactions with. Baa for paperwork.

Form 990 or 990EZ Schedule E 2019 2020 Blank Sample to Fill out

Was the organization controlled directly or indirectly at any time during the tax year by one or more. Web for paperwork reduction act notice, see the instructions for form 990. Web expresstaxexempt is here to generate the correct schedules for your nonprofit and help you file on time. Read the following instructions to use cocodoc to start editing and drawing.

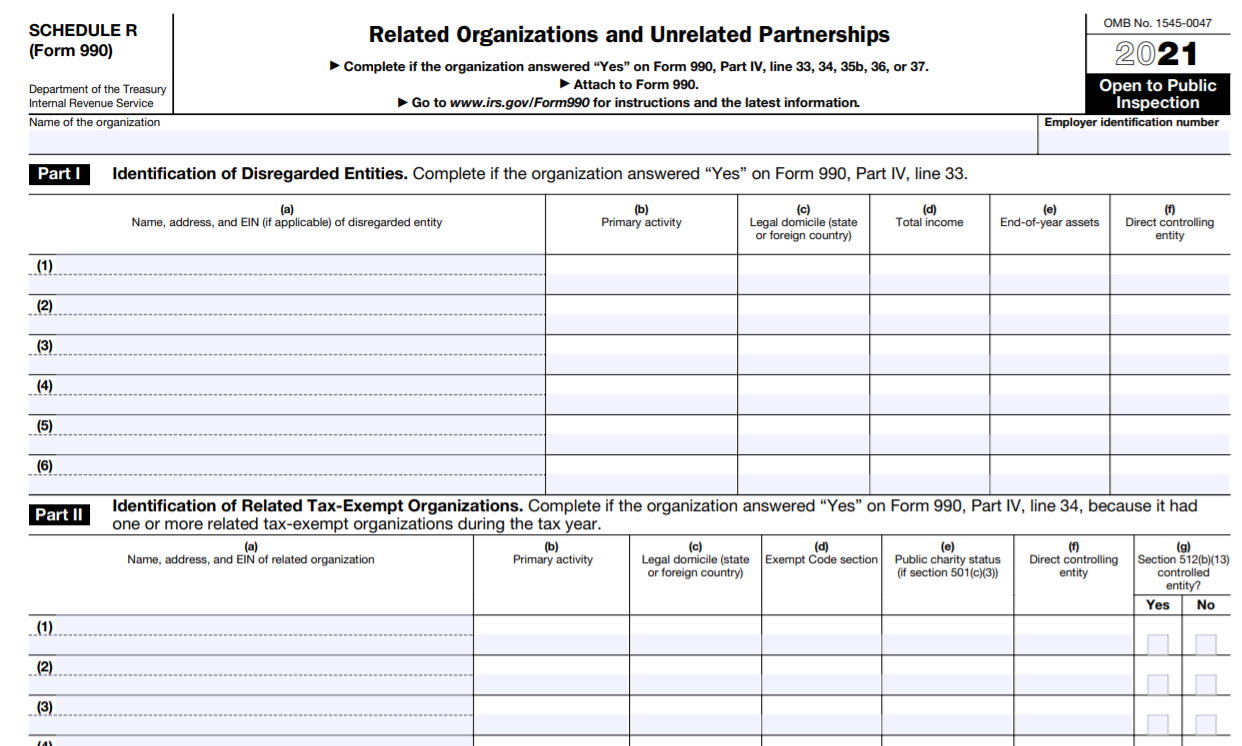

IRS Form 990 Schedule R Instructions Related Organizations and

Web with one of the following parties (see schedule l instructions for the applicable filing thresholds, conditions, and exceptions)? Web august 17, 2016. Web nonprofit tax tidbits: Web how to edit and draw up form 990 schedule l online. An organization that answered yes to form 990, part iv, checklist of required schedules, line 17, 18, or.

2010 FORM 990 INSTRUCTIONS 2010 FORM 990 INSTRUCTIONS

If yes, complete part i of schedule l (form 990). 7 8 did the organization make a loan to a disqualified person (as defined in section 4958). Schedule r (form 990) 2022: Read the following instructions to use cocodoc to start editing and drawing up your form 990 schedule l: Form 990, part iv, line 28a:

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Schedule r (form 990) 2022: Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv,. Web if yes, complete part i of schedule l (form 990). Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Complete part vi of form 990.

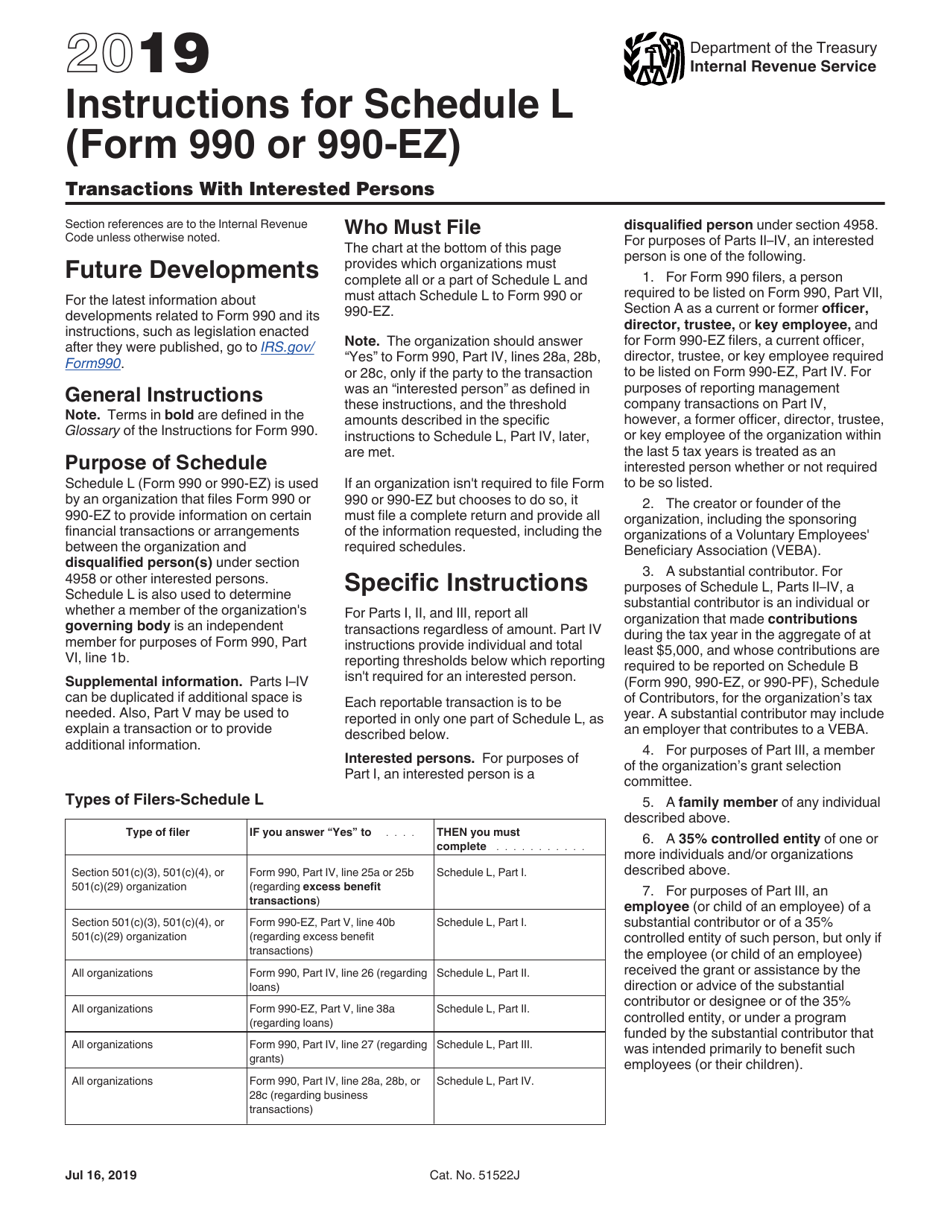

Download Instructions for IRS Form 990, 990EZ Schedule L Transactions

Enter amount of tax imposed on organization managers or disqualified. Web august 17, 2016. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv,. Was the organization controlled directly or indirectly at any time during the tax year by one or more. Web for paperwork reduction act notice, see the instructions for form 990.

Schedule R (Form 990) 2022:

Web with one of the following parties (see schedule l instructions for the applicable filing thresholds, conditions, and exceptions)? Complete part vi of form 990. An organization that answered yes to form 990, part iv, checklist of required schedules, line 17, 18, or. Enter amount of tax imposed on organization managers or disqualified.

Web Expresstaxexempt Is Here To Generate The Correct Schedules For Your Nonprofit And Help You File On Time.

7 8 did the organization make a loan to a disqualified person (as defined in section 4958). Schedule r (form 990) 2022: Web transactions with “interested persons” are reported on schedule l (form 990) schedule l contains four parts for this reporting: Web august 17, 2016.

What Types Of Transactions Are Reportable On Schedule L, Form 990?

Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv,. Web if yes, complete part i of schedule l (form 990). Web for paperwork reduction act notice, see the instructions for form 990. If yes, provide detail in if yes, provide detail in if yes, provide detail in.

Read The Following Instructions To Use Cocodoc To Start Editing And Drawing Up Your Form 990 Schedule L:

Web nonprofit tax tidbits: Only form 990 filers that answer yes to any of the questions in form 990, part iv, lines. Web if yes, complete part i of schedule l (form 990). If yes, complete part i of schedule l (form 990).