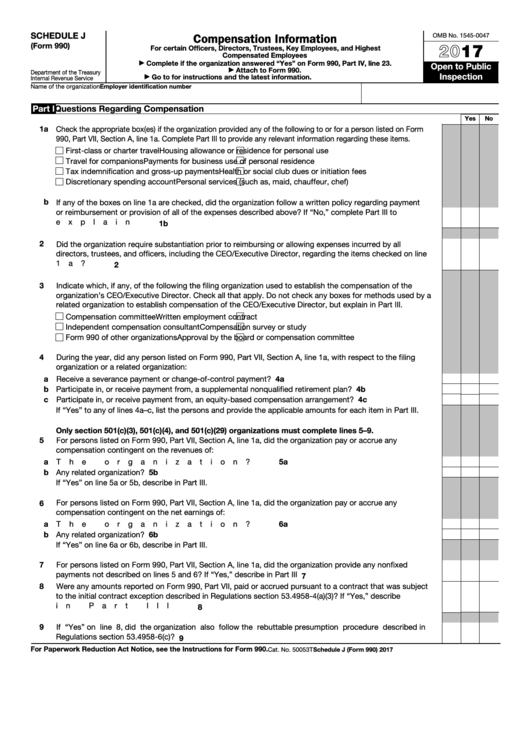

Form 990 Schedule J

Form 990 Schedule J - The society's total revenues in 2019 were. Complete, edit or print tax forms instantly. Schedule j (form 990) 2020 page 2. Get ready for tax season deadlines by completing any required tax forms today. The amount reported in column b(iii) is the sum of employee. Read the irs instructions for 990 forms. Web like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Web form 990 schedules with instructions. Web tax filings and audits by year. Read the irs instructions for 990.

Web form 990 schedules with instructions. Schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers,. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year. The amount reported in column b(iii) is the sum of employee. Web a standard form 990 contains a wealth of information and could run over 100 pages in length, depending upon the financial standing of the entity. (column (b) must equal form 990, part x, col. The society's total revenues in 2019 were. Read the irs instructions for 990 forms. Ad access irs tax forms. Complete, edit or print tax forms instantly.

Web the information reported on schedule j of the acs 2019 form 990 reflects the fact that acs is a large and complex organization. The society's total revenues in 2019 were. Complete, edit or print tax forms instantly. Web tax filings and audits by year. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Ad access irs tax forms. Web tax filings and audits by year. Schedule j (form 990) 2020 page 2. Web which persons must be listed as officers, directors, trustees, key employees, and five highest compensated employees on the core form’s part vii?

Form 990 (Schedule R) 2019 Blank Sample to Fill out Online in PDF

Web form 990 schedules with instructions. Complete, edit or print tax forms instantly. Web the information reported on schedule j of the acs 2019 form 990 reflects the fact that acs is a large and complex organization. Complete, edit or print tax forms instantly. The society's total revenues in 2019 were.

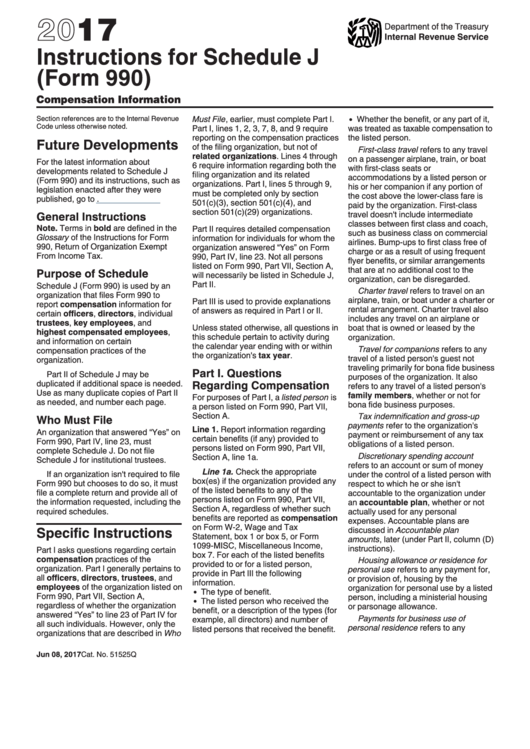

Fillable Schedule J (Form 990) Compensation Information 2017

The society's total revenues in 2019 were. Web which persons must be listed as officers, directors, trustees, key employees, and five highest compensated employees on the core form’s part vii? Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. Web a standard form 990 contains a wealth of information and could run over 100 pages.

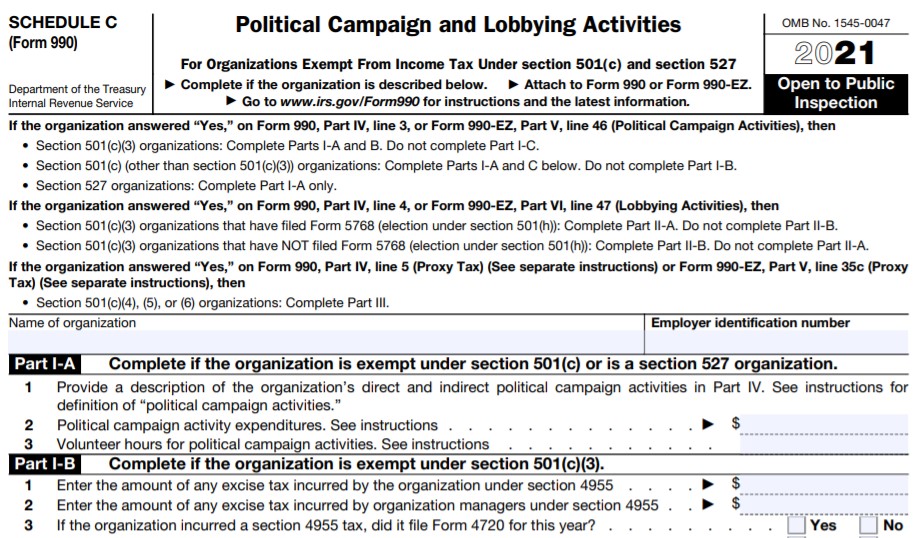

IRS Form 990/990EZ Schedule C Instructions Political Campaign and

Web tax filings and audits by year. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web the information reported on schedule j of the acs 2019 form 990.

Form 990 (Schedule J) online Washington Fill Exactly for Your State

Get ready for tax season deadlines by completing any required tax forms today. Web tax filings and audits by year. Read the irs instructions for 990. Purpose of schedule schedule j (form 990) is used by an organization that files form 990 to report. Web purpose of schedule.

2017 schedule j form 990 Fill Online, Printable, Fillable Blank

Web form 990 schedules with instructions. Web like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Web tax filings and audits by year. Ad access irs tax forms. The society's total revenues in 2019 were.

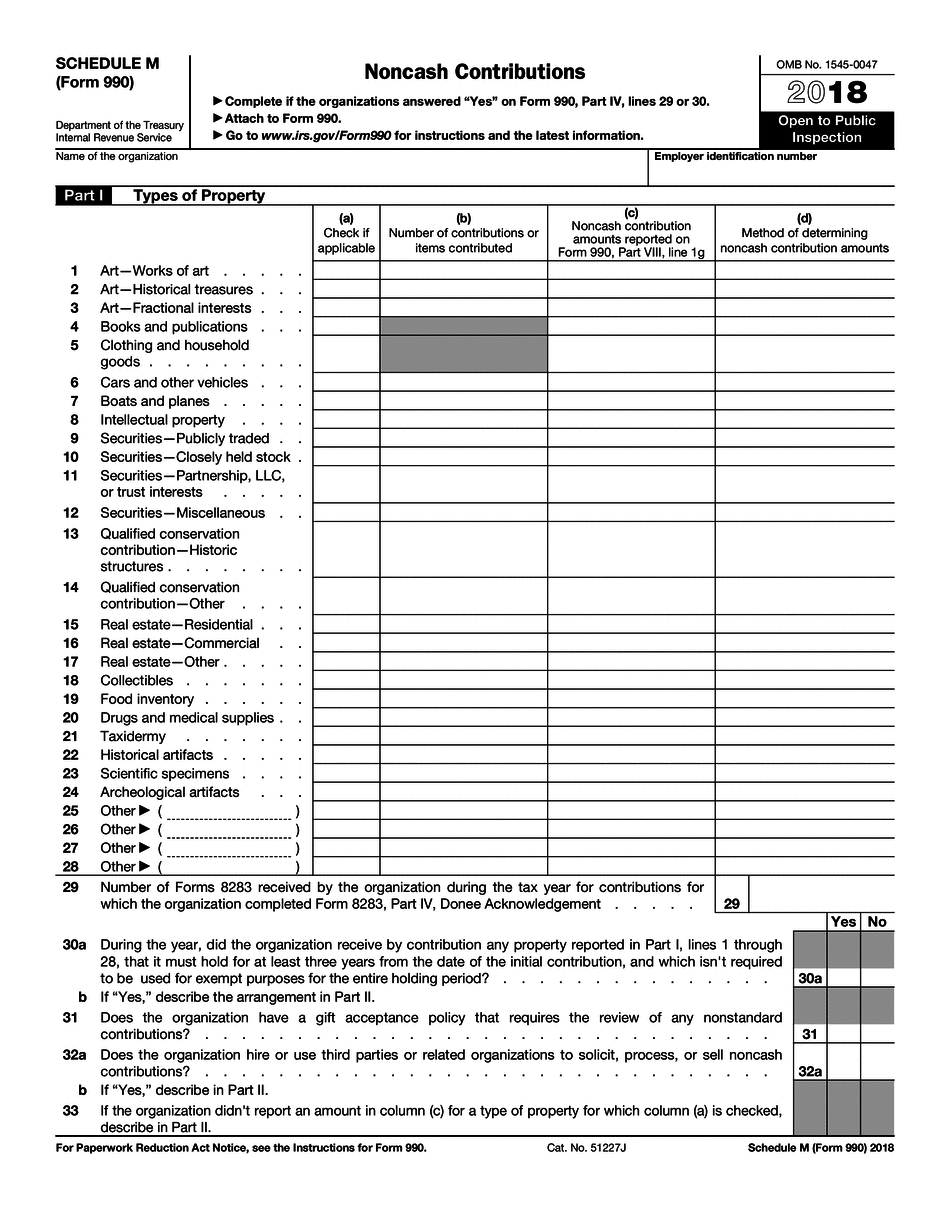

IRS Form 990 (Schedule M) 2018 2019 Fillable and Editable PDF Template

Get ready for tax season deadlines by completing any required tax forms today. Web which persons must be listed as officers, directors, trustees, key employees, and five highest compensated employees on the core form’s part vii? Read the irs instructions for 990 forms. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c).

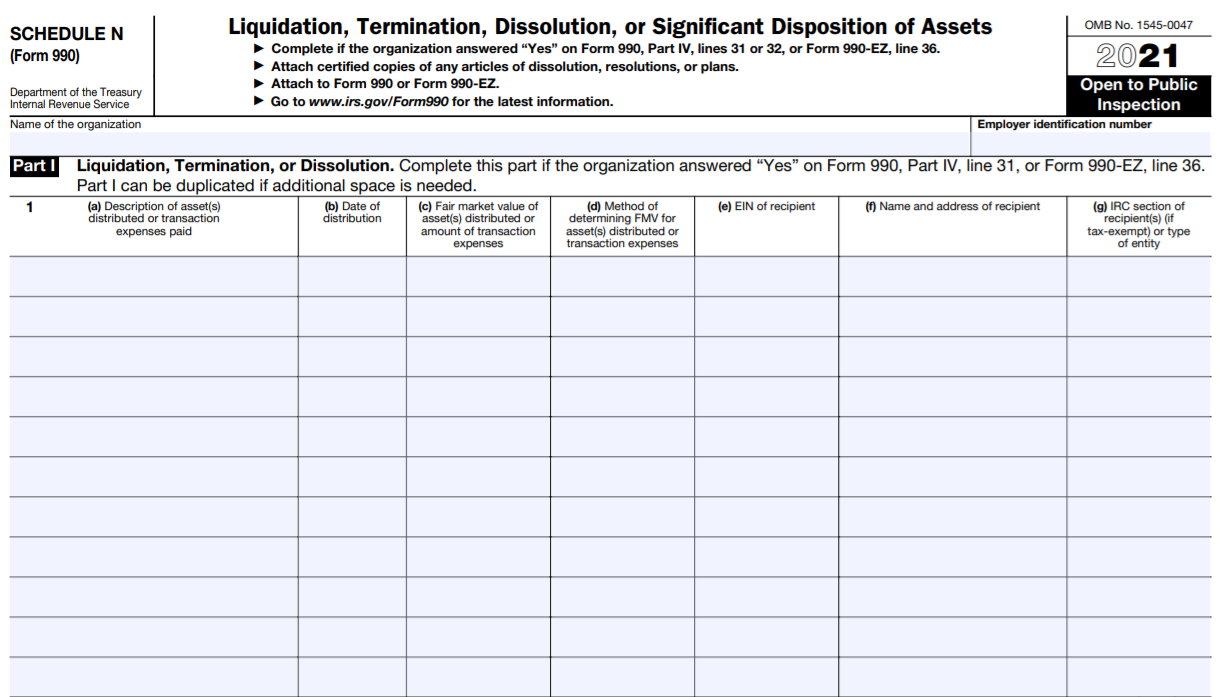

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Get ready for tax season deadlines by completing any required tax forms today. Purpose of schedule schedule j (form 990) is used by an organization that files form 990 to report. Schedule j (form 990) 2020 page 2. Read the irs instructions for 990 forms. Web like current compensation payable to such employees, deferred compensation must be reported annually on.

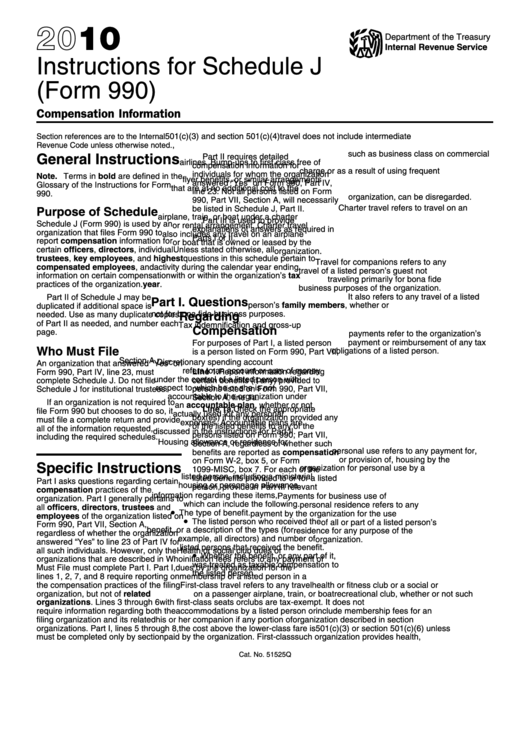

Form 990 Instructions For Schedule J printable pdf download

The society's total revenues in 2019 were. Get ready for tax season deadlines by completing any required tax forms today. Purpose of schedule schedule j (form 990) is used by an organization that files form 990 to report. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or.

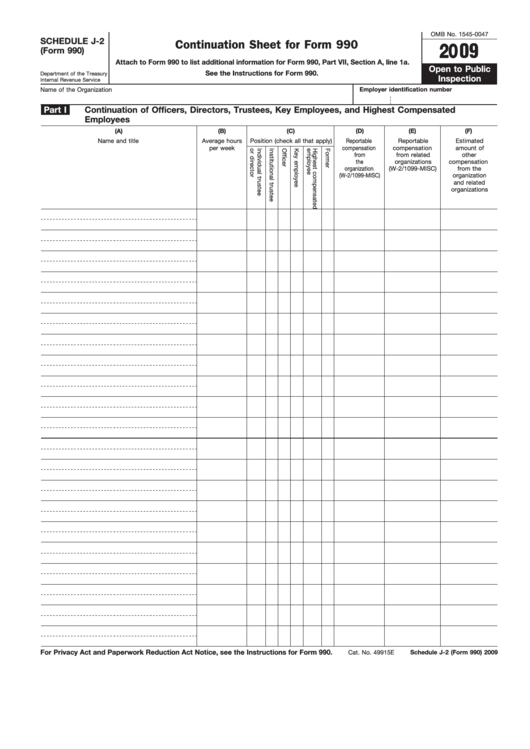

Fillable Schedule J2 (Form 990) Continuation Sheet For Form 990

Schedule j (form 990) 2020 page 2. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year. Web like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Purpose of schedule schedule j (form 990).

Instructions For Schedule J (Form 990) printable pdf download

The amount reported in column b(iii) is the sum of employee. Web form 990 schedules with instructions. Ad access irs tax forms. The society's total revenues in 2019 were. Web the information reported on schedule j of the acs 2019 form 990 reflects the fact that acs is a large and complex organization.

Ad Access Irs Tax Forms.

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web tax filings and audits by year. Schedule j (form 990) 2020 page 2.

The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

Complete, edit or print tax forms instantly. Web purpose of schedule. Web form 990 schedules with instructions. Read the irs instructions for 990.

Web Which Persons Must Be Listed As Officers, Directors, Trustees, Key Employees, And Five Highest Compensated Employees On The Core Form’s Part Vii?

Web like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Read the irs instructions for 990 forms. Web the information reported on schedule j of the acs 2019 form 990 reflects the fact that acs is a large and complex organization. Purpose of schedule schedule j (form 990) is used by an organization that files form 990 to report.

The Society's Total Revenues In 2019 Were.

Web instructions for form 990, return of organization exempt from income tax. Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web the compensation reported in part vii, section a and in schedule j should be for the calendar year ending with or within the organization’s tax year.