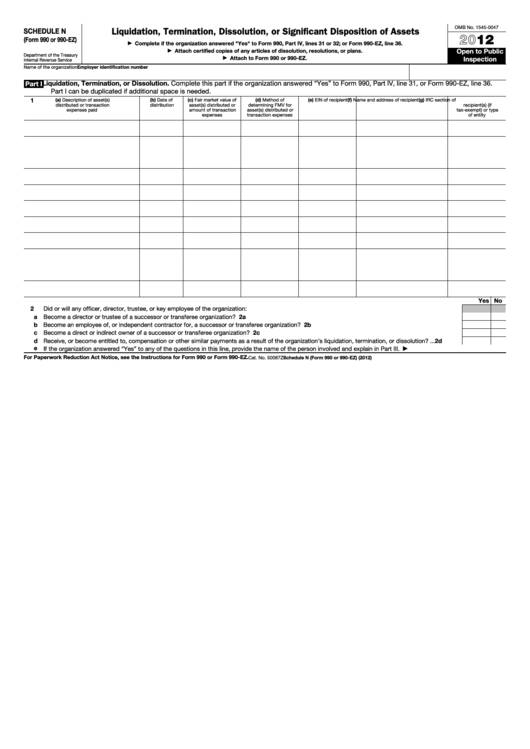

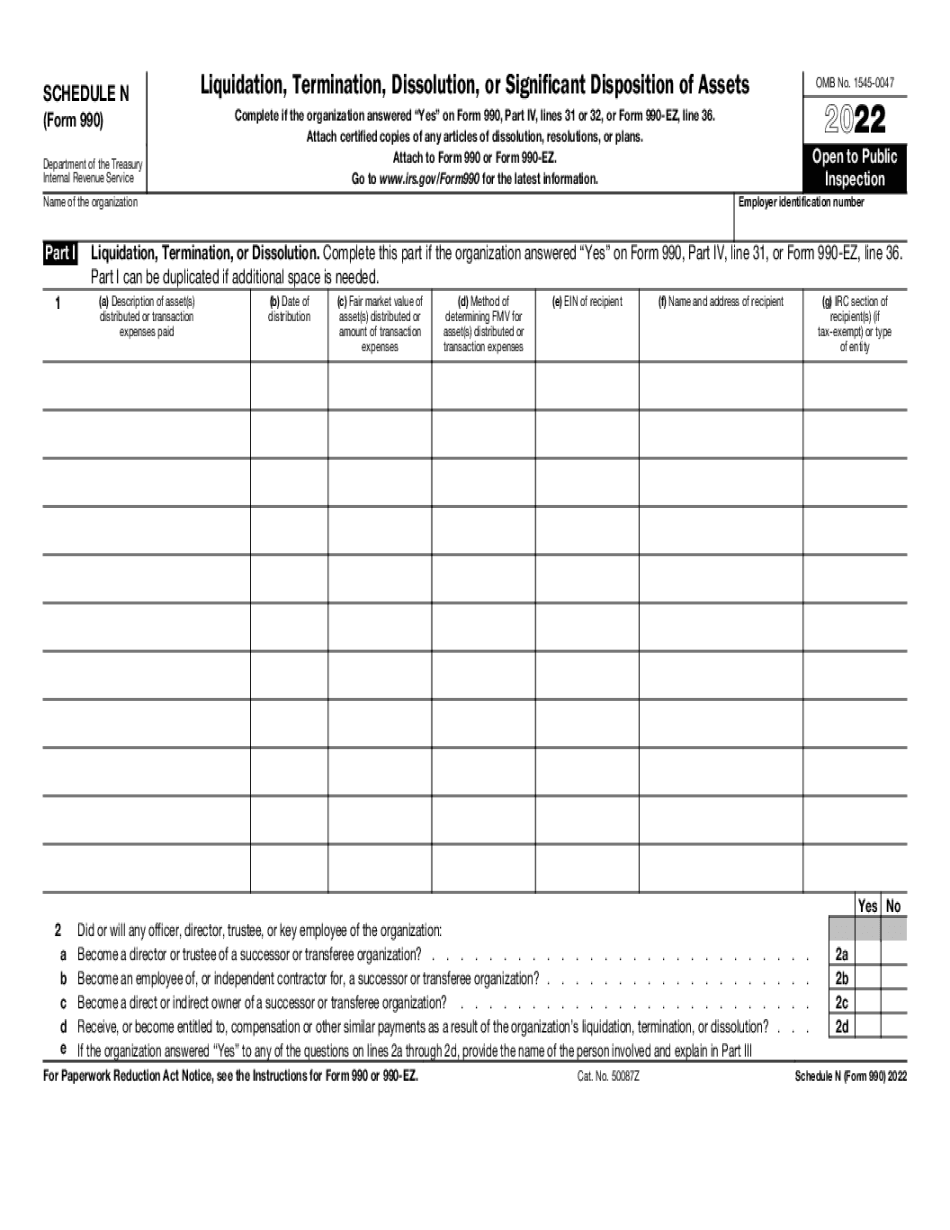

Form 990 Schedule N

Form 990 Schedule N - Generating/preparing a short year return;. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Instructions for these schedules are. Nonprofit organizations and private foundations must use this schedule b to provide information. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. The download files are organized by month. If you are an organization that answered “yes” to checklist of required schedules, part iv form 990,. Web there are 16 schedules associated with the form 990, they all report different information on an in depth level. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web all private foundations, regardless of income.

Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. Generating/preparing a short year return;. If you are an organization that answered “yes” to checklist of required schedules, part iv form 990,. Read the irs instructions for 990 forms. Web form 990 schedules along with your 990 forms, the irs may also require you to attach additional documents through schedules. Nonprofit organizations and private foundations must use this schedule b to provide information. There were concerns that small nonprofits were operating under the radar. Reason for public charity status. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

The download files are organized by month. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. If you are an organization that answered “yes” to checklist of required schedules, part iv form 990,. This can be a bit overwhelming, so hang in. There were concerns that small nonprofits were operating under the radar. On this page you may download the 990 series filings on record for 2021. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Instructions for these schedules are. Generating/preparing a short year return;.

Form 990 schedule n 2023 Fill online, Printable, Fillable Blank

For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Nonprofit organizations and private foundations must use this schedule b to provide information. Reason for public charity status. Web all private foundations, regardless of income. Web form 990 schedules along with your 990 forms, the irs may also require you to attach.

Form 990 Schedule O Edit, Fill, Sign Online Handypdf

Read the irs instructions for 990 forms. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Instructions for these schedules are. On this page you may download the 990 series filings on record for 2021. If you checked 12d of part i, complete sections a and d, and complete part.

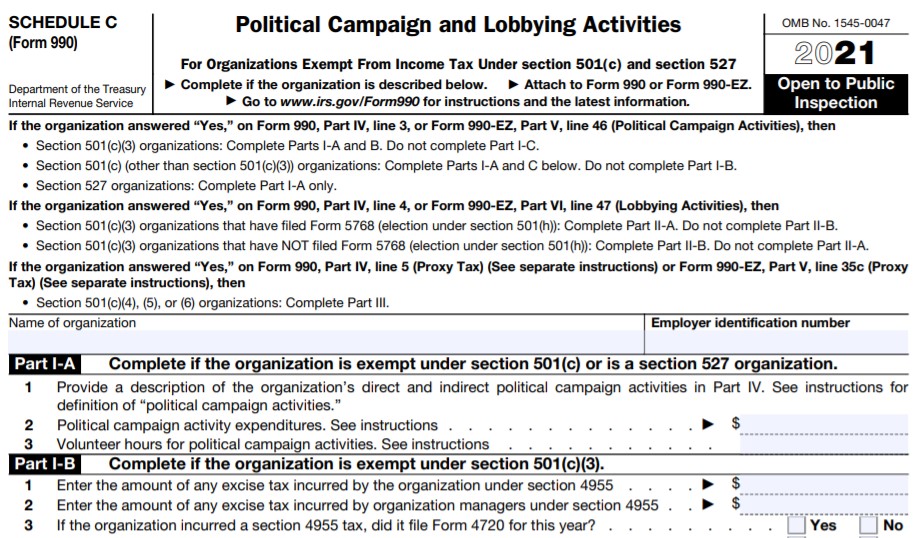

IRS Form 990/990EZ Schedule C Instructions Political Campaign and

There are 16 schedules available. Nonprofit organizations and private foundations must use this schedule b to provide information. Web there are 16 schedules associated with the form 990, they all report different information on an in depth level. On this page you may download the 990 series filings on record for 2021. Web an organization that isn’t covered by the.

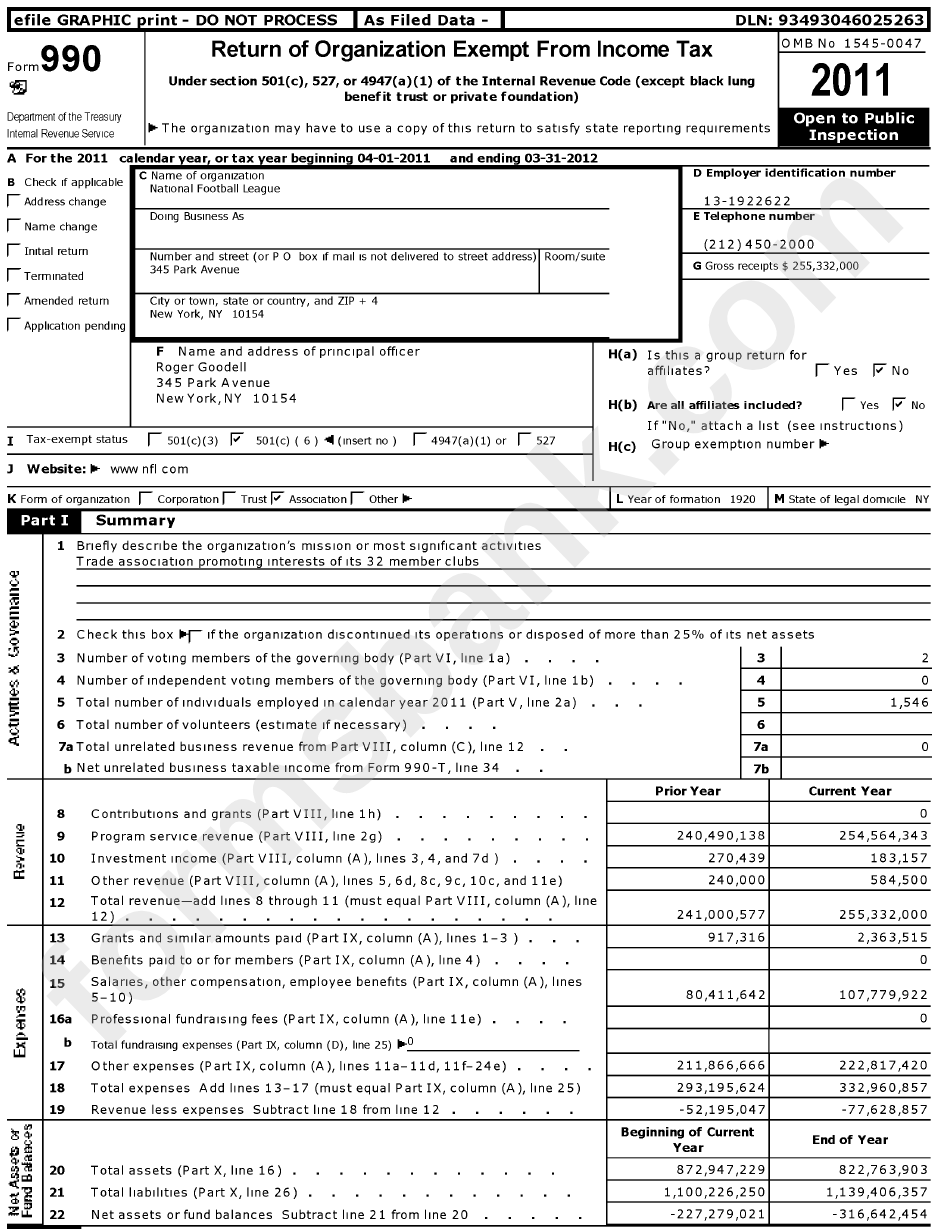

Form 990 2011 Sample printable pdf download

Web all private foundations, regardless of income. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. Web form 990 schedules along with your 990 forms, the irs may also require you to attach additional documents through schedules. This can be a bit overwhelming, so hang in. Web.

2017 IRS Form 990 or 990EZ Schedule L Editable Online Blank in PDF

If you checked 12d of part i, complete sections a and d, and complete part v.). On this page you may download the 990 series filings on record for 2021. If you are an organization that answered “yes” to checklist of required schedules, part iv form 990,. Reason for public charity status. Instructions for these schedules are.

Electronic IRS Form 990 (Schedule K) 2018 2019 Printable PDF Sample

There are 16 schedules available. Web who is required to prepare and file schedule n and tax form 990 or 990ez? There were concerns that small nonprofits were operating under the radar. If you are an organization that answered “yes” to checklist of required schedules, part iv form 990,. If you checked 12d of part i, complete sections a and.

Form 990 Return of Organization Exempt From Tax Definition

Read the irs instructions for 990 forms. If you checked 12d of part i, complete sections a and d, and complete part v.). The download files are organized by month. There are 16 schedules available. This can be a bit overwhelming, so hang in.

IRS Form 990 (Schedule F) 2019 Fillable and Editable PDF Template

Web who is required to prepare and file schedule n and tax form 990 or 990ez? Generating/preparing a short year return;. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; On this page you may download.

IRS 990 Form Schedule O Fillable and Printable in PDF

Instructions for these schedules are. Web form 990 schedules along with your 990 forms, the irs may also require you to attach additional documents through schedules. There are 16 schedules available. Reason for public charity status. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on.

Fillable Schedule N (Form 990 Or 990Ez) Liquidation, Termination

Instructions for these schedules are. Generating/preparing a short year return;. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. If you checked 12d of part i, complete sections a and d, and complete part v.). Web who is required to prepare and file schedule n and tax form 990 or 990ez?

Web Who Is Required To Prepare And File Schedule N And Tax Form 990 Or 990Ez?

This can be a bit overwhelming, so hang in. Nonprofit organizations and private foundations must use this schedule b to provide information. If you are an organization that answered “yes” to checklist of required schedules, part iv form 990,. Web all private foundations, regardless of income.

Generating/Preparing A Short Year Return;.

The download files are organized by month. On this page you may download the 990 series filings on record for 2021. There are 16 schedules available. Web form 990 schedules along with your 990 forms, the irs may also require you to attach additional documents through schedules.

Web The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

If you checked 12d of part i, complete sections a and d, and complete part v.). Read the irs instructions for 990 forms. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on. There were concerns that small nonprofits were operating under the radar.

Reason For Public Charity Status.

Instructions for these schedules are. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Web there are 16 schedules associated with the form 990, they all report different information on an in depth level.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)