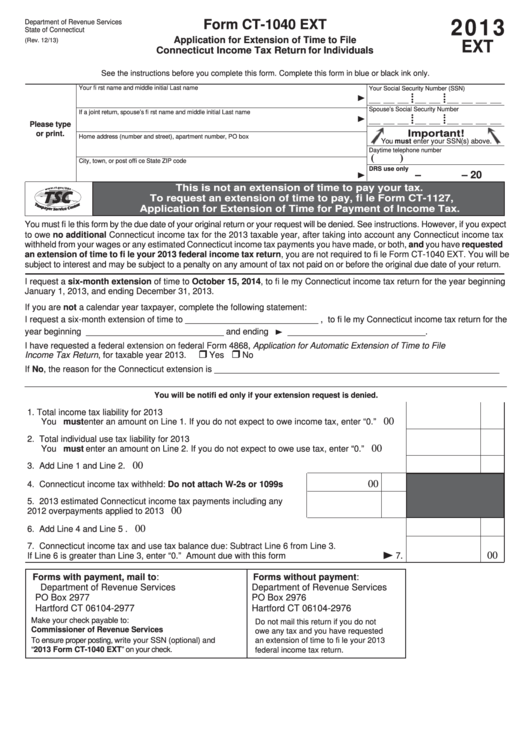

Form Ct 1040 Ext

Form Ct 1040 Ext - Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf plugin. Simple, secure, and can be completed from the comfort of your home. Free, easy returns on millions of items. 16, 2023 and the connecticut paper filing due date is october 16, 2023. Free shipping on qualified orders. Ad shop a wide variety of tax forms from top brands at staples®. Web must file form ct‑1040 ext whether or not you owe additional connecticut income tax. We last updated the connecticut resident income tax return in january 2023, so this is the. Web connecticut individual forms availability. If your have paid all of your anticipated tax due and show no balance due on.

If your have paid all of your anticipated tax due and show no balance due on. Simple, secure, and can be completed from the comfort of your home. Web must file form ct‑1040 ext whether or not you owe additional connecticut income tax. 16, 2023 and the connecticut paper filing due date is october 16, 2023. Or, you can request an extension electronically using webfile. Benefits to electronic filing include: Web filed connecticut income tax return or extension. Ad find deals and low prices on tax forms at amazon.com. Web file your 2022 connecticut income tax return online! Free, easy returns on millions of items.

Simple, secure, and can be completed from the comfort of your home. Web must file form ct‑1040 ext whether or not you owe additional connecticut income tax. Benefits to electronic filing include: Ad shop a wide variety of tax forms from top brands at staples®. Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf plugin. Web connecticut individual forms availability. Free shipping on qualified orders. Or, you can request an extension electronically using webfile. Web filed connecticut income tax return or extension. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for.

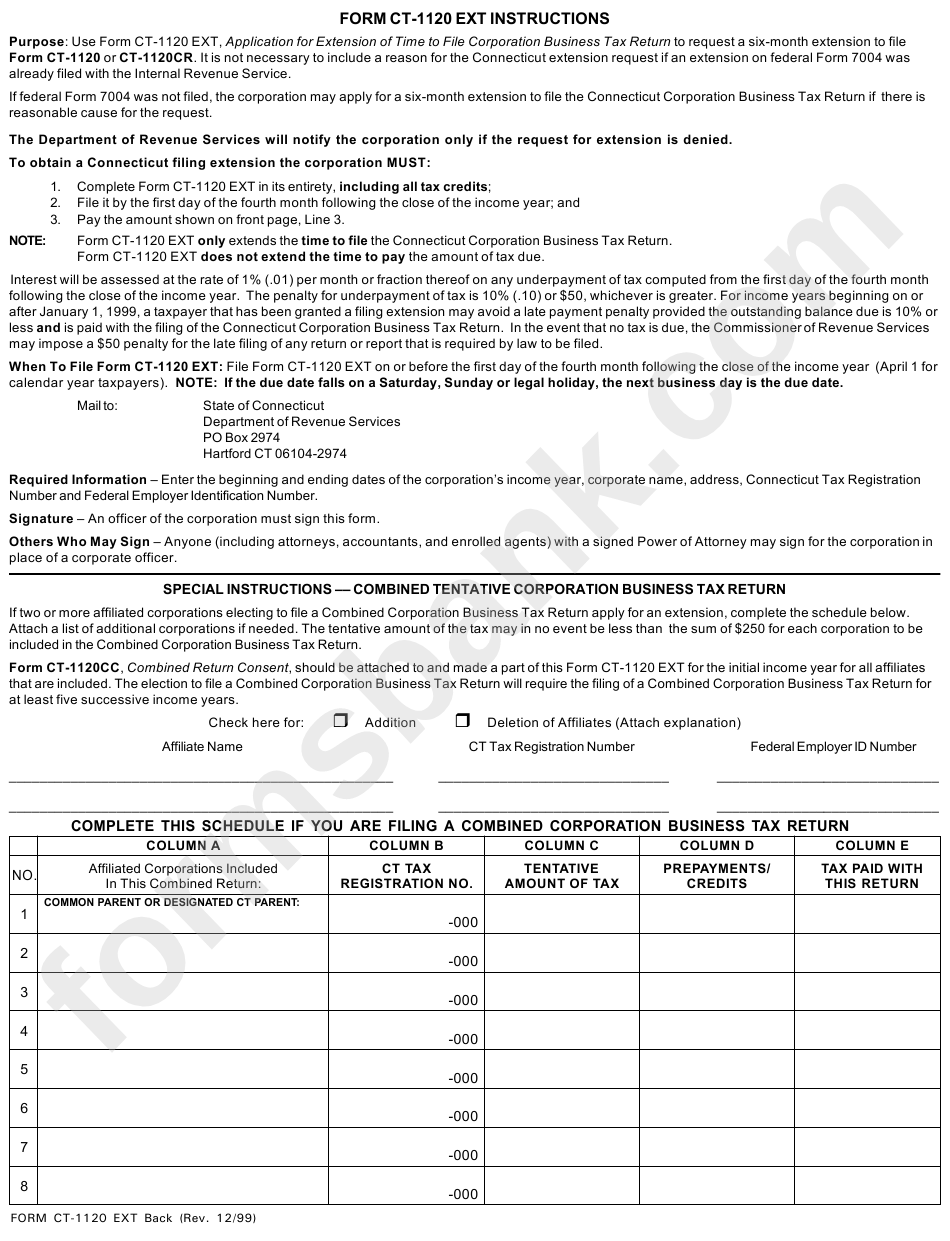

Form Ct1120 Ext Instructions printable pdf download

Web connecticut individual forms availability. Simple, secure, and can be completed from the comfort of your home. Ad shop a wide variety of tax forms from top brands at staples®. Free, easy returns on millions of items. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to.

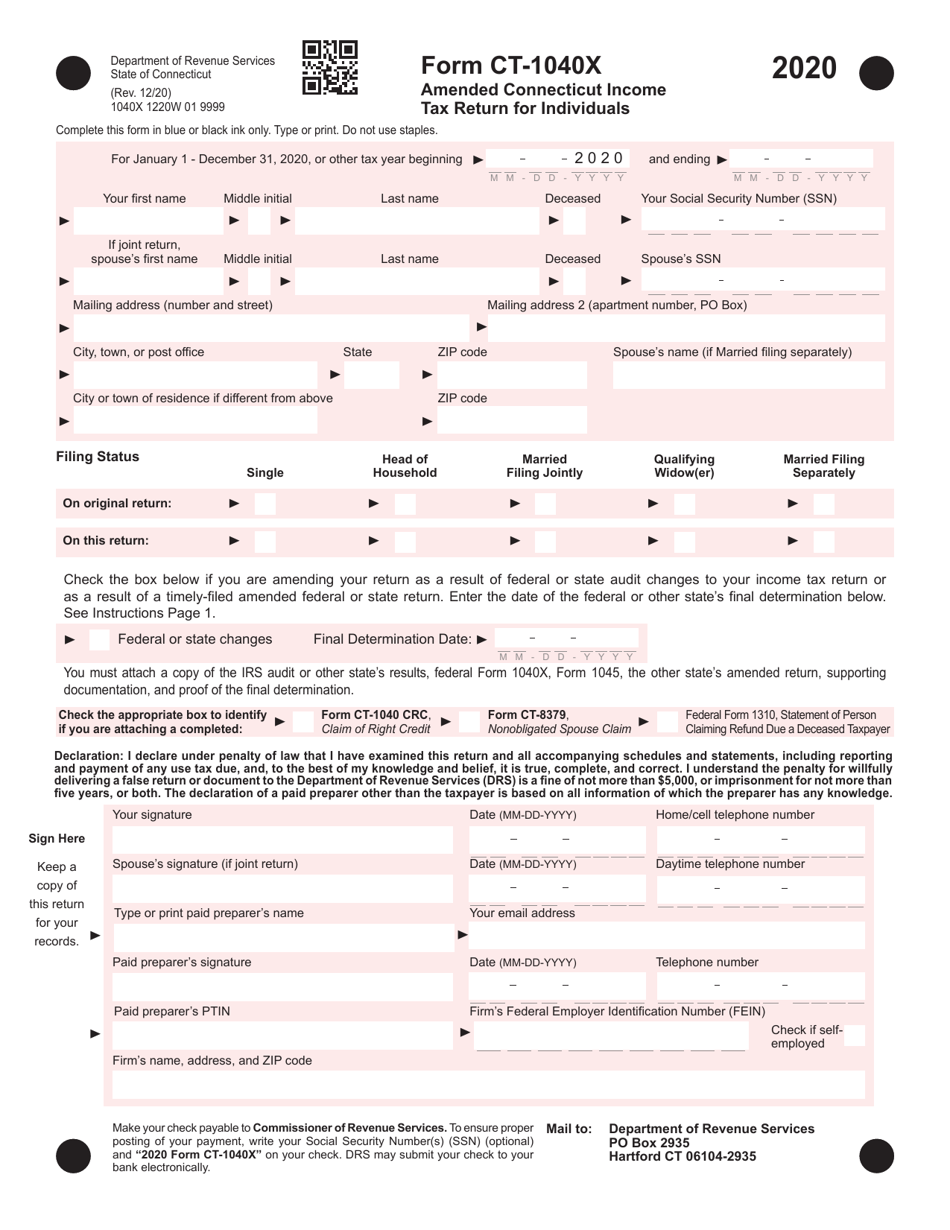

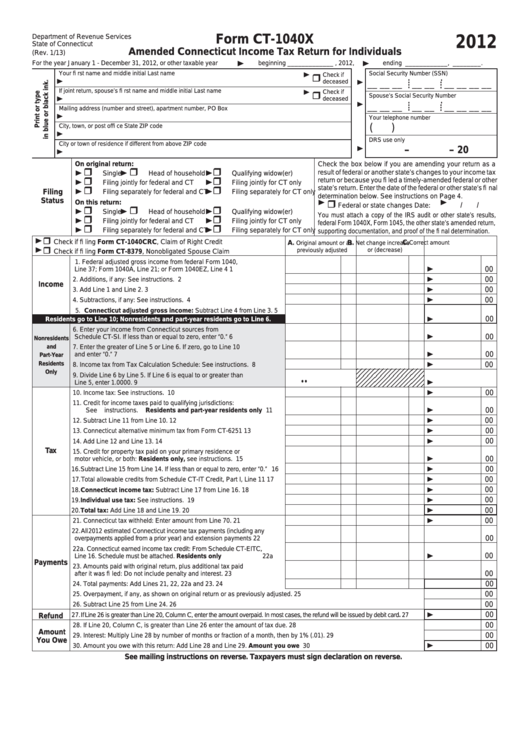

Form CT1040X 2020 Fill Out, Sign Online and Download Printable PDF

Ad shop a wide variety of tax forms from top brands at staples®. Web file your 2022 connecticut income tax return online! Free, easy returns on millions of items. Or, you can request an extension electronically using webfile. Ad find deals and low prices on tax forms at amazon.com.

ct1040extgov/drs/lib drs forms 2008forms

We last updated the connecticut resident income tax return in january 2023, so this is the. Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf plugin. If your have paid all of your anticipated tax due and show no balance.

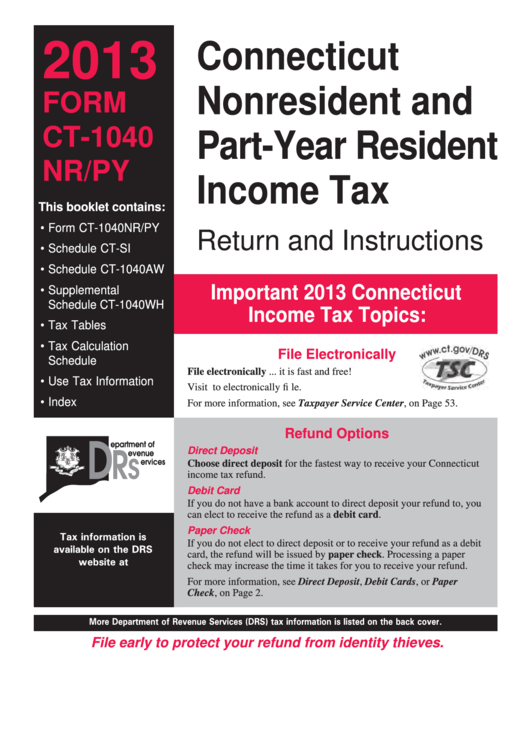

Form Ct1040 Nr/py Connecticut Nonresident And PartYear Resident

Ad shop a wide variety of tax forms from top brands at staples®. Simple, secure, and can be completed from the comfort of your home. Web filed connecticut income tax return or extension. Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have.

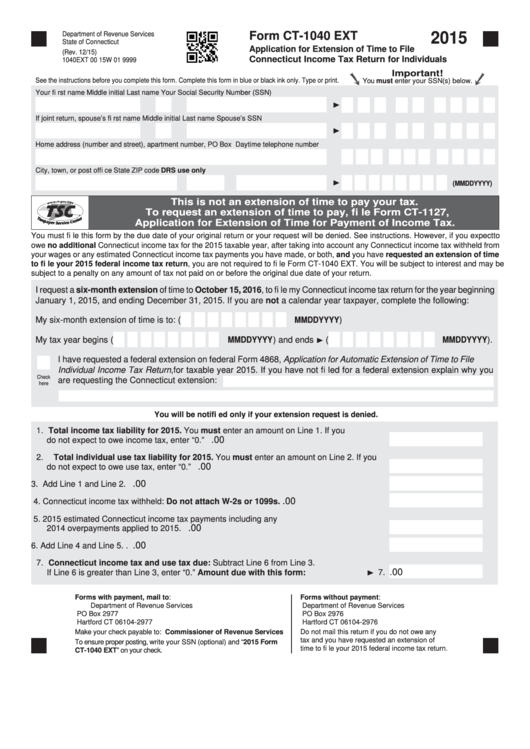

Form Ct1040 Ext Application For Extension Of Time To File

Simple, secure, and can be completed from the comfort of your home. Web filed connecticut income tax return or extension. Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf plugin. Discover a wide selection of tax forms at staples®. Free,.

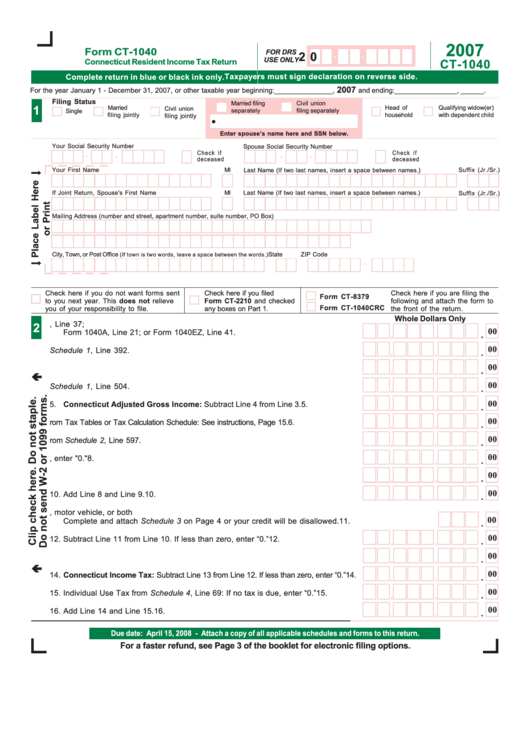

Form Ct 1040 Connecticut Resident Tax Return 2007 printable

If your have paid all of your anticipated tax due and show no balance due on. Free shipping on qualified orders. Free, easy returns on millions of items. Web file your 2022 connecticut income tax return online! Benefits to electronic filing include:

2014 Form CT DRS CT1040NR/PY Fill Online, Printable, Fillable, Blank

Or, you can request an extension electronically using webfile. 16, 2023 and the connecticut paper filing due date is october 16, 2023. Discover a wide selection of tax forms at staples®. Web must file form ct‑1040 ext whether or not you owe additional connecticut income tax. Free shipping on qualified orders.

Fillable Form Ct1040 Ext Application For Extension Of Time To File

Or, you can request an extension electronically using webfile. We last updated the connecticut resident income tax return in january 2023, so this is the. Free shipping on qualified orders. Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf plugin..

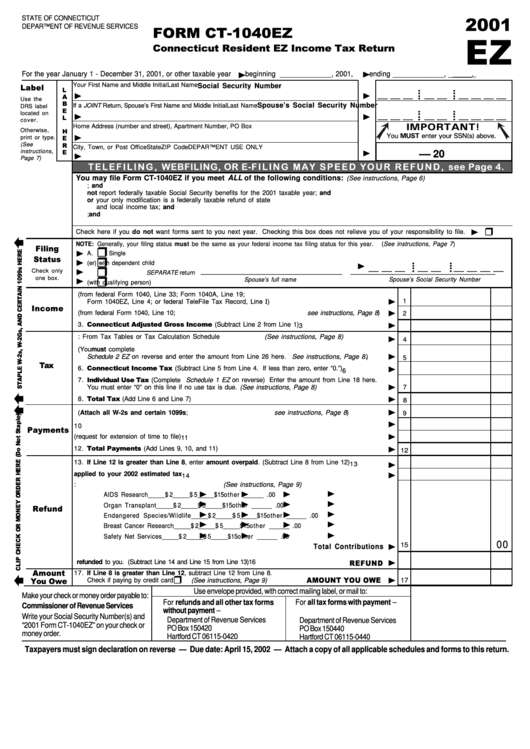

Form Ct1040ez Connecticut Resident Ez Tax Return 2001

Ad shop a wide variety of tax forms from top brands at staples®. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. Free shipping on qualified orders. If your have paid all of your anticipated tax due and show no.

Form Ct1040x Amended Connecticut Tax Return For Individuals

Web file your 2022 connecticut income tax return online! Discover a wide selection of tax forms at staples®. 16, 2023 and the connecticut paper filing due date is october 16, 2023. Ad find deals and low prices on tax forms at amazon.com. Ad shop a wide variety of tax forms from top brands at staples®.

Web To Request An Extension Of Time To File Your Return, You Must File Form Ct‑1040 Ext, Application For Extension Of Time To File Connecticut Income Tax Return For.

Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf plugin. Web must file form ct‑1040 ext whether or not you owe additional connecticut income tax. Web file your 2022 connecticut income tax return online! Ad find deals and low prices on tax forms at amazon.com.

We Last Updated The Connecticut Resident Income Tax Return In January 2023, So This Is The.

Benefits to electronic filing include: Free shipping on qualified orders. Or, you can request an extension electronically using webfile. If your have paid all of your anticipated tax due and show no balance due on.

Free, Easy Returns On Millions Of Items.

Ad shop a wide variety of tax forms from top brands at staples®. Simple, secure, and can be completed from the comfort of your home. Web connecticut individual forms availability. Web filed connecticut income tax return or extension.

Discover A Wide Selection Of Tax Forms At Staples®.

16, 2023 and the connecticut paper filing due date is october 16, 2023.