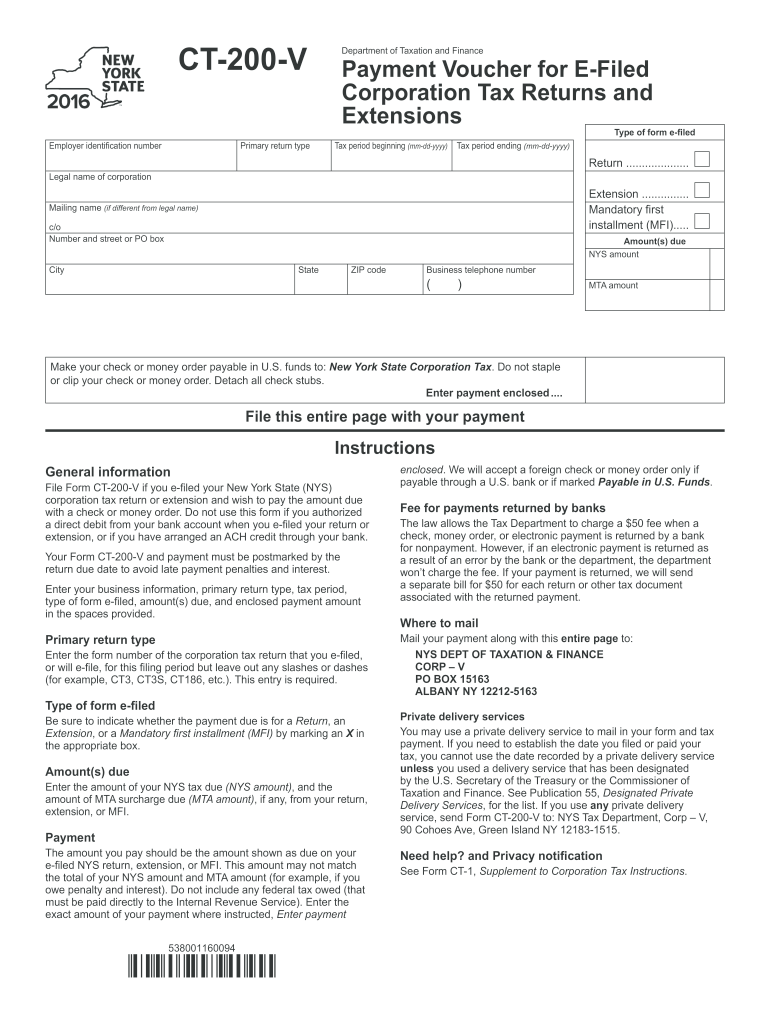

Form Ct 200 V

Form Ct 200 V - With us legal forms the entire process of creating legal documents. Download blank or fill out online in pdf format. Show details we are not affiliated with any brand or entity on this form. Web 72 rows electronic filing options. You can web file your return. Edit your ny ct 200 v 2018 online type text, add images, blackout confidential details, add comments, highlights and more. Use get form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully. Enter your business information, primary return type, tax. Edit your ct 200 v voucher online type text, add images, blackout confidential details, add comments, highlights and more.

Sign it in a few clicks draw your signature, type. • use of reproduced and computerized forms • electronic filing and electronic payment mandate • online services • web file • form ct. With us legal forms the entire process of creating legal documents. Pay your estimated tax by ach debit or ach credit. Web 72 rows electronic filing options. Complete, sign, print and send your tax documents easily with us legal forms. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save ct 200v rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8. Web please note that each form is year specific. Enter your business information, primary return type, tax. Web • is your return in processible form?

Web please note that each form is year specific. With us legal forms the entire process of creating legal documents. Edit your ct 200 v voucher online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type. Web 72 rows electronic filing options. You can web file your return. • use of reproduced and computerized forms • electronic filing and electronic payment mandate • online services • web file • form ct. Pe income/(loss) subject to tax. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save ct 200v rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8. Edit your ny ct 200 v 2018 online type text, add images, blackout confidential details, add comments, highlights and more.

CT Standard Form PD88 20152022 Fill and Sign Printable Template

Edit your ny ct 200 v 2018 online type text, add images, blackout confidential details, add comments, highlights and more. To prevent any delay in processing your return, the correct year’s form must be submitted to drs. Pay your estimated tax by ach debit or ach credit. Web follow the simple instructions below: Complete, sign, print and send your tax.

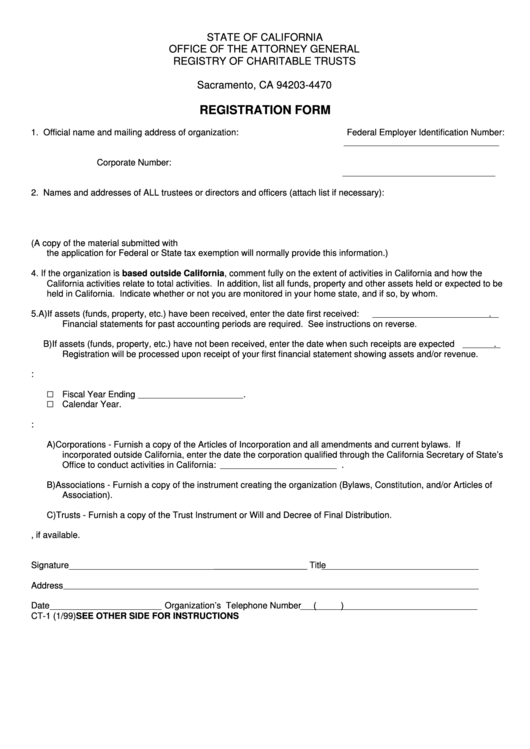

Form Ct1 Registration Form State Of California Office Of The

Pay your estimated tax by ach debit or ach credit. To prevent any delay in processing your return, the correct year’s form must be submitted to drs. • use of reproduced and computerized forms • electronic filing and electronic payment mandate • online services • web file • form ct. Web please note that each form is year specific. Pe.

CT 200 • VueMore

Web ct 200 v form use a ct 200 v template to make your document workflow more streamlined. With us legal forms the entire process of creating legal documents. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save ct 200v rating ★ ★ ★ ★ ★.

Uhn Ct Scan Requisition Form Captions Blog

New york state allows for additional. • use of reproduced and computerized forms • electronic filing and electronic payment mandate • online services • web file • form ct. To prevent any delay in processing your return, the correct year’s form must be submitted to drs. Web 72 rows electronic filing options. Web follow the simple instructions below:

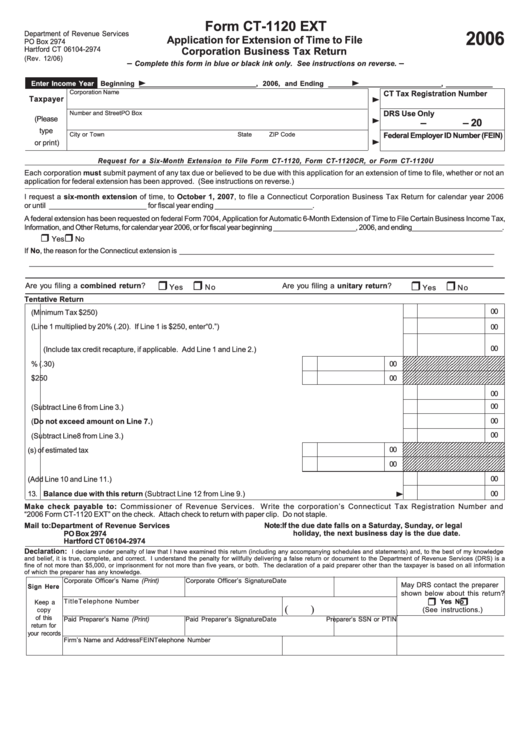

Form Ct1120 Ext Application Form For Extension Of Time To File

Complete, sign, print and send your tax documents easily with us legal forms. Edit your ny ct 200 v 2018 online type text, add images, blackout confidential details, add comments, highlights and more. New york state allows for additional. Web 72 rows electronic filing options. Edit your ct 200 v voucher online type text, add images, blackout confidential details, add.

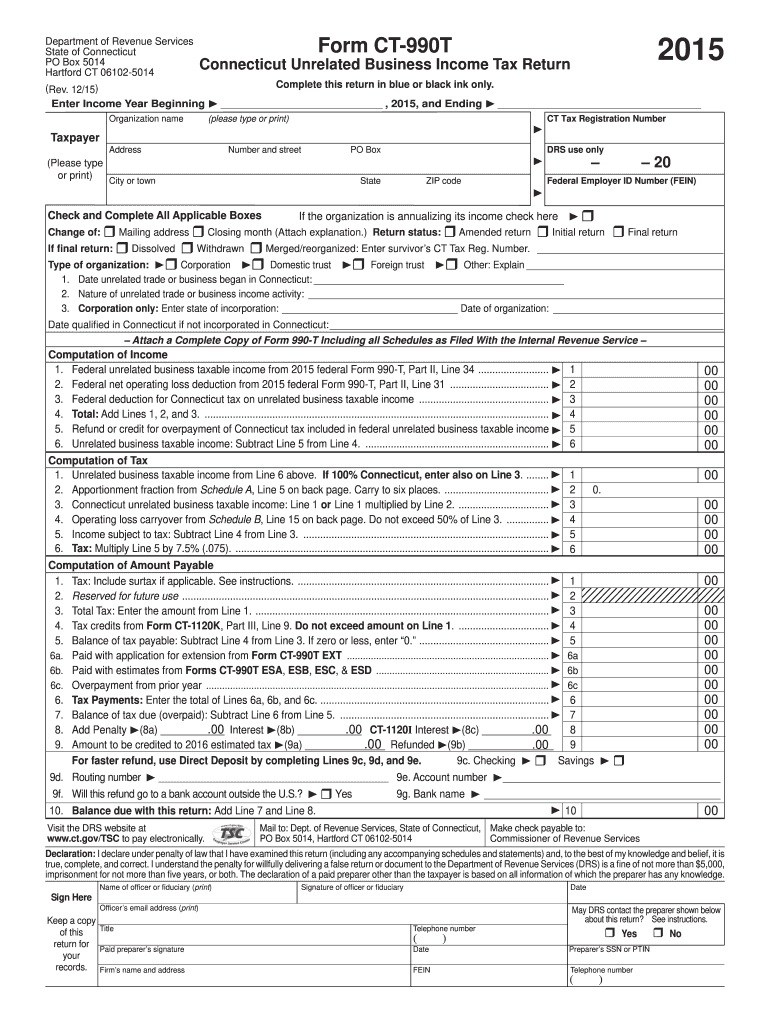

2015 Form CT DRS CT990T Fill Online, Printable, Fillable, Blank

The times of distressing complicated legal and tax forms have ended. Download blank or fill out online in pdf format. Pay your estimated tax by ach debit or ach credit. Pe income/(loss) subject to tax. Web 72 rows electronic filing options.

Ct 200 V Fill Out and Sign Printable PDF Template signNow

Sign it in a few clicks draw your signature, type. • use of reproduced and computerized forms • electronic filing and electronic payment mandate • online services • web file • form ct. Use get form or simply click on the template preview to open it in the editor. New york state allows for additional. Complete, sign, print and send.

2012 Form NY DTF CT200V Fill Online, Printable, Fillable, Blank

Sign it in a few clicks draw your signature, type. With us legal forms the entire process of creating legal documents. Web follow the simple instructions below: Pe income/(loss) subject to tax. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save ct 200v rating ★ ★.

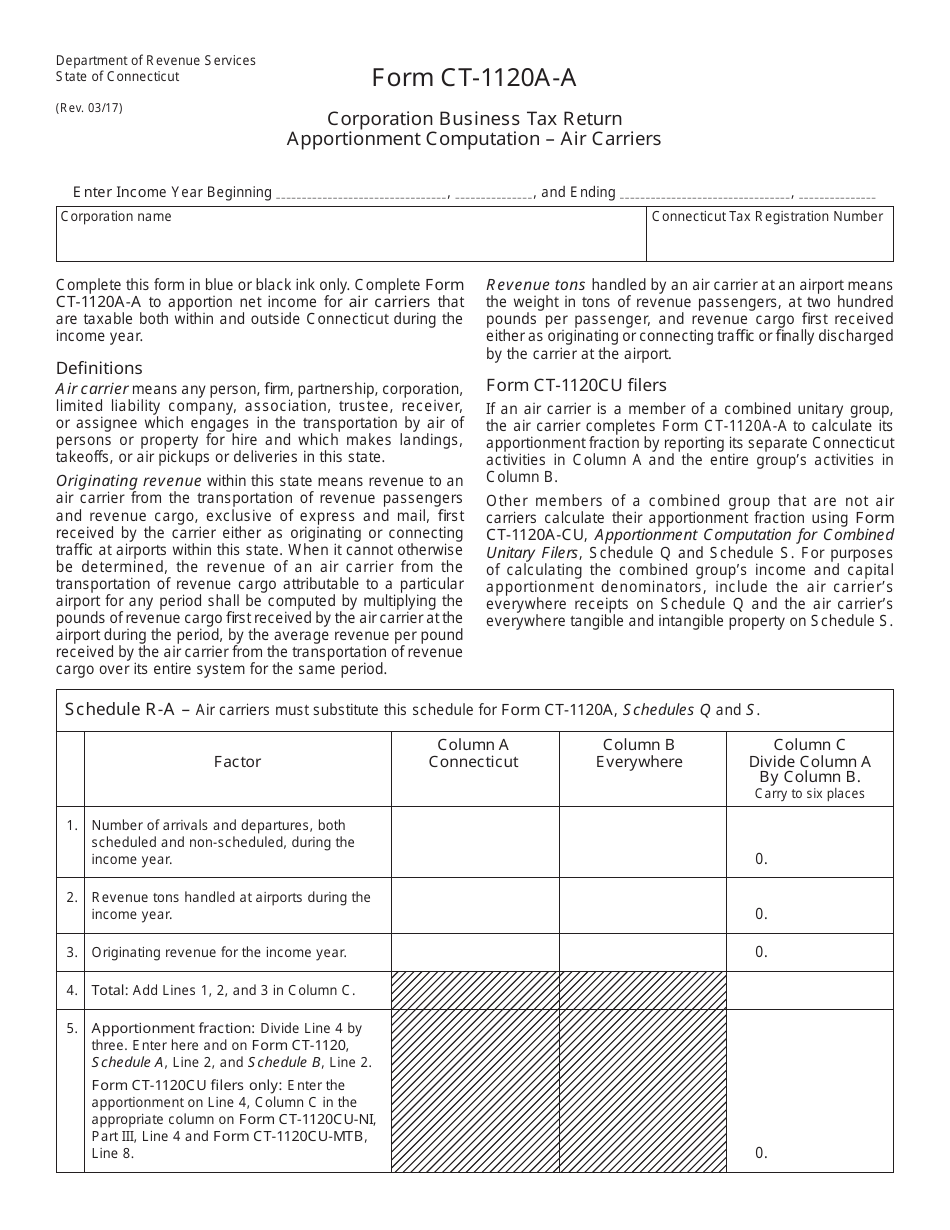

Form CT1120AA Download Printable PDF or Fill Online Corporation

Start completing the fillable fields and carefully. Complete, sign, print and send your tax documents easily with us legal forms. Web ct 200 v form use a ct 200 v template to make your document workflow more streamlined. The times of distressing complicated legal and tax forms have ended. To prevent any delay in processing your return, the correct year’s.

CT B230 20082022 Fill and Sign Printable Template Online US Legal

Edit your ny ct 200 v 2018 online type text, add images, blackout confidential details, add comments, highlights and more. To prevent any delay in processing your return, the correct year’s form must be submitted to drs. This exam measures certain cognitive abilities such. You can web file your return. Pay your estimated tax by ach debit or ach credit.

Start Completing The Fillable Fields And Carefully.

Use get form or simply click on the template preview to open it in the editor. Edit your ct 200 v voucher online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type. To prevent any delay in processing your return, the correct year’s form must be submitted to drs.

The Times Of Distressing Complicated Legal And Tax Forms Have Ended.

Pe income/(loss) subject to tax. With us legal forms the entire process of creating legal documents. Web please note that each form is year specific. Web follow the simple instructions below:

Complete, Sign, Print And Send Your Tax Documents Easily With Us Legal Forms.

Web • is your return in processible form? Download blank or fill out online in pdf format. Sign it in a few clicks draw your signature, type. Edit your ny ct 200 v 2018 online type text, add images, blackout confidential details, add comments, highlights and more.

You Can Web File Your Return.

Web 72 rows electronic filing options. Web ct 200 v form use a ct 200 v template to make your document workflow more streamlined. New york state allows for additional. Show details we are not affiliated with any brand or entity on this form.