Form D-400 Schedule A

Form D-400 Schedule A - Individual income tax instructions schedule a: Click here for help if the form does not appear after you click create form. Corporate income & franchise tax. Other deductions from federal adjusted gross income(attach explanation or schedule)13. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. You can download or print. Individual income tax forms instructions. Web we last updated north carolina schedule pn in february 2023 from the north carolina department of revenue. Were you a resident of n.c. This form is for income earned in tax year 2022,.

Web what you should send us. Corporate income & franchise tax. Web we last updated the n.c. This form is for income earned in tax year 2022, with tax returns. Other deductions from federal adjusted gross income(attach explanation or schedule)13. Individual income tax forms instructions. Click here for help if the form does not appear after you click create form. Individual income tax instructions schedule a: This form is for income earned in tax year 2022,. Were you a resident of n.c.

Web what you should send us. Corporate income & franchise tax. Web we last updated north carolina schedule pn in february 2023 from the north carolina department of revenue. This form is for income earned in tax year 2022, with tax. This form is for income earned in tax year 2022,. Web we last updated the n.c. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Individual income tax instructions schedule a: Click here for help if the form does not appear after you click create form. You can download or print.

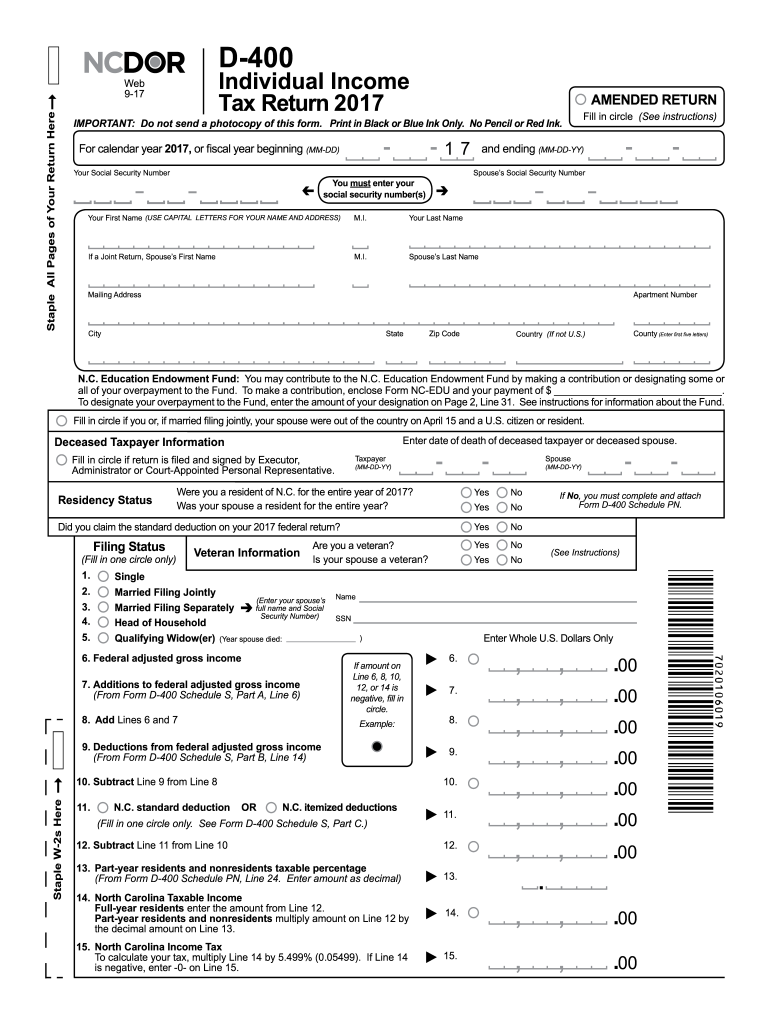

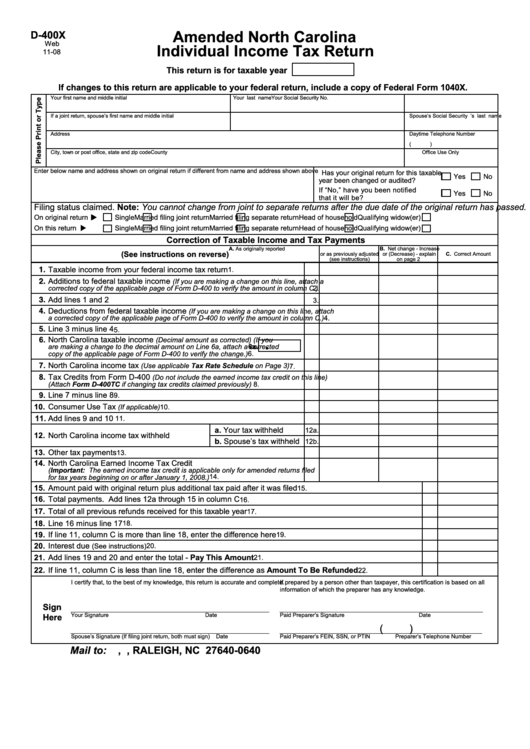

2017 D400 Fill Out and Sign Printable PDF Template signNow

Web we last updated north carolina schedule pn in february 2023 from the north carolina department of revenue. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. This form is for income earned in tax year 2022, with tax. Individual income tax instructions schedule a: You can download or print.

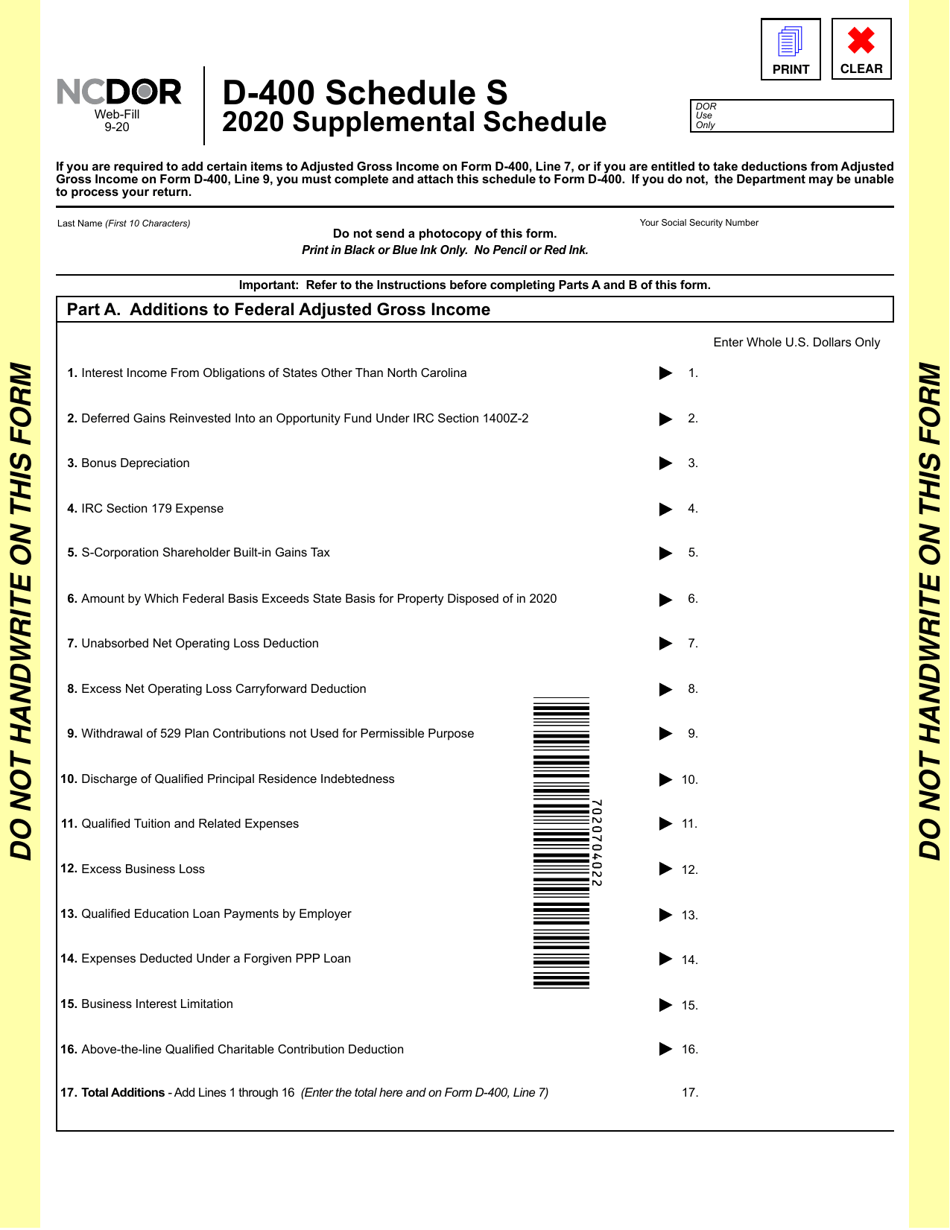

Form D400 Schedule S Download Fillable PDF or Fill Online North

This form is for income earned in tax year 2022,. Corporate income & franchise tax. Individual income tax forms instructions. Click here for help if the form does not appear after you click create form. Other deductions from federal adjusted gross income(attach explanation or schedule)13.

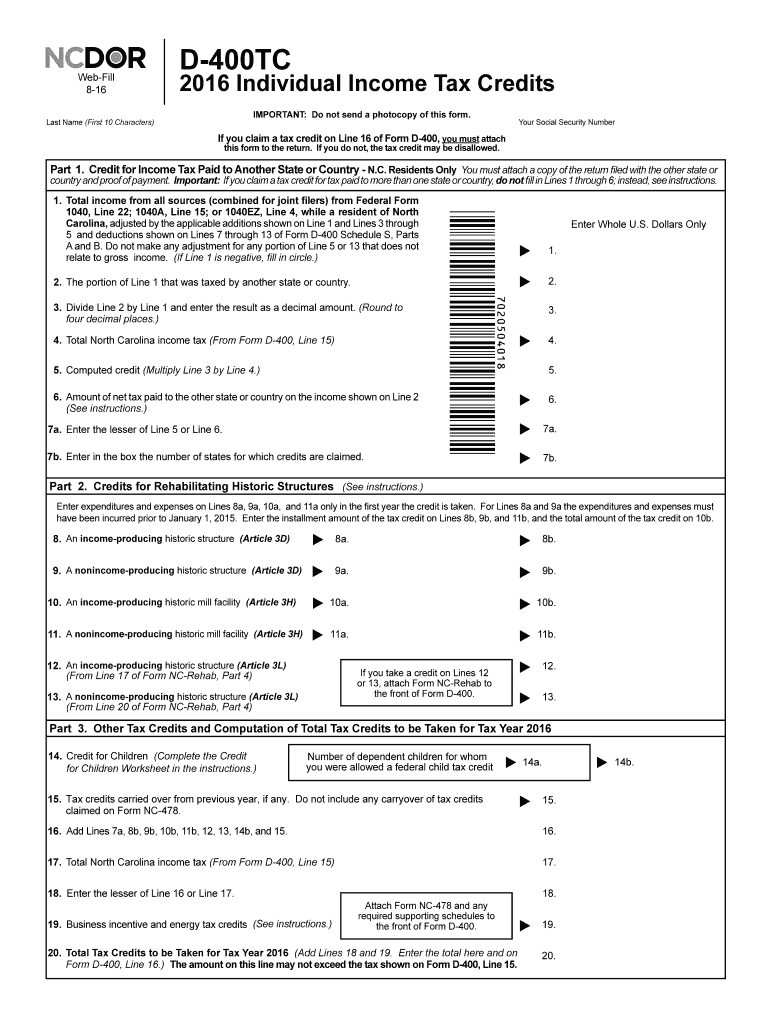

D 400Tc Fill Out and Sign Printable PDF Template signNow

Web what you should send us. Web we last updated north carolina schedule pn in february 2023 from the north carolina department of revenue. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Other deductions from federal adjusted gross income(attach explanation or schedule)13. Web we last updated the n.c.

Form D400 Schedule PN Download Fillable PDF or Fill Online PartYear

Were you a resident of n.c. This form is for income earned in tax year 2022, with tax returns. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. You can download or print. Other deductions from federal adjusted gross income(attach explanation or schedule)13.

Fill Free fillable 2019 D400 Schedule PN Webfill (North Carolina

Individual income tax instructions schedule a: Click here for help if the form does not appear after you click create form. This form is for income earned in tax year 2022, with tax. Web what you should send us. Web we last updated the n.c.

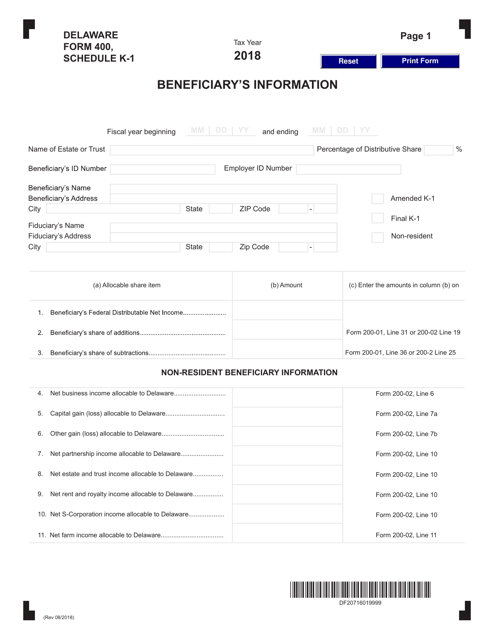

Form 400 Schedule K1 Download Fillable PDF or Fill Online Beneficiary

Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Were you a resident of n.c. This form is for income earned in tax year 2022, with tax returns. Web we last updated north carolina schedule pn in february 2023 from the north carolina department of revenue. Individual income tax forms instructions.

Individual Tax Return North Carolina Free Download

Fill in circle if you, or if married filing jointly, your spouse were out of the country on. This form is for income earned in tax year 2022,. This form is for income earned in tax year 2022, with tax returns. Web we last updated north carolina schedule pn in february 2023 from the north carolina department of revenue. Web.

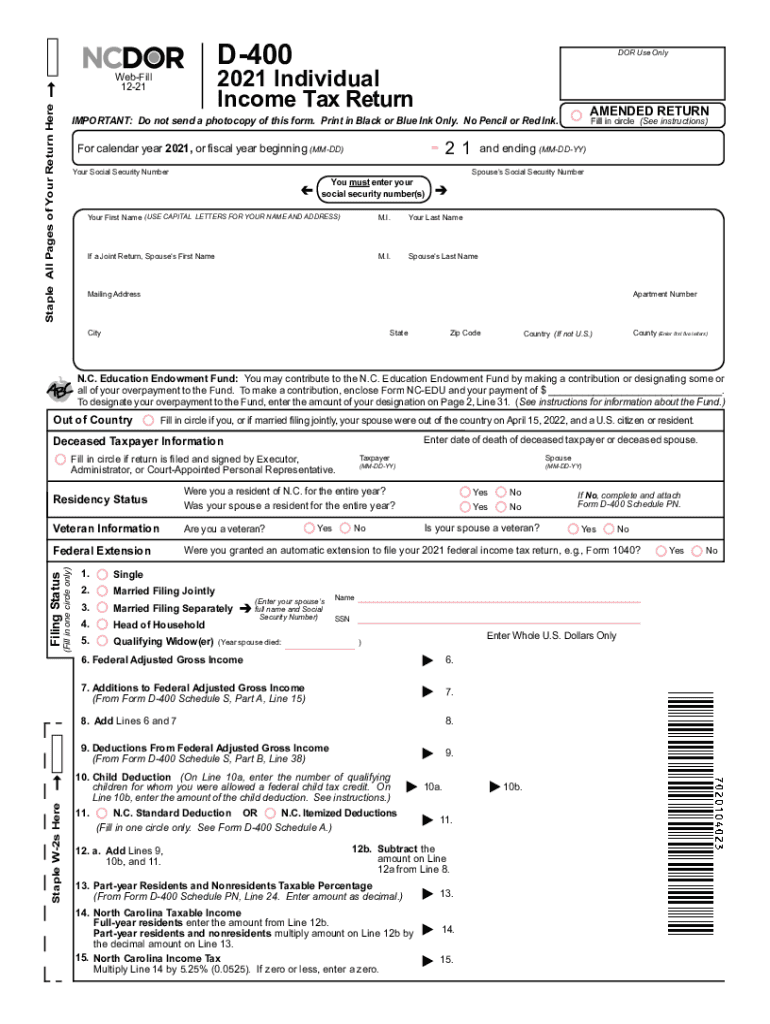

2021 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax returns. Other deductions from federal adjusted gross income(attach explanation or schedule)13. Individual income tax instructions schedule a: Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Web what you should send us.

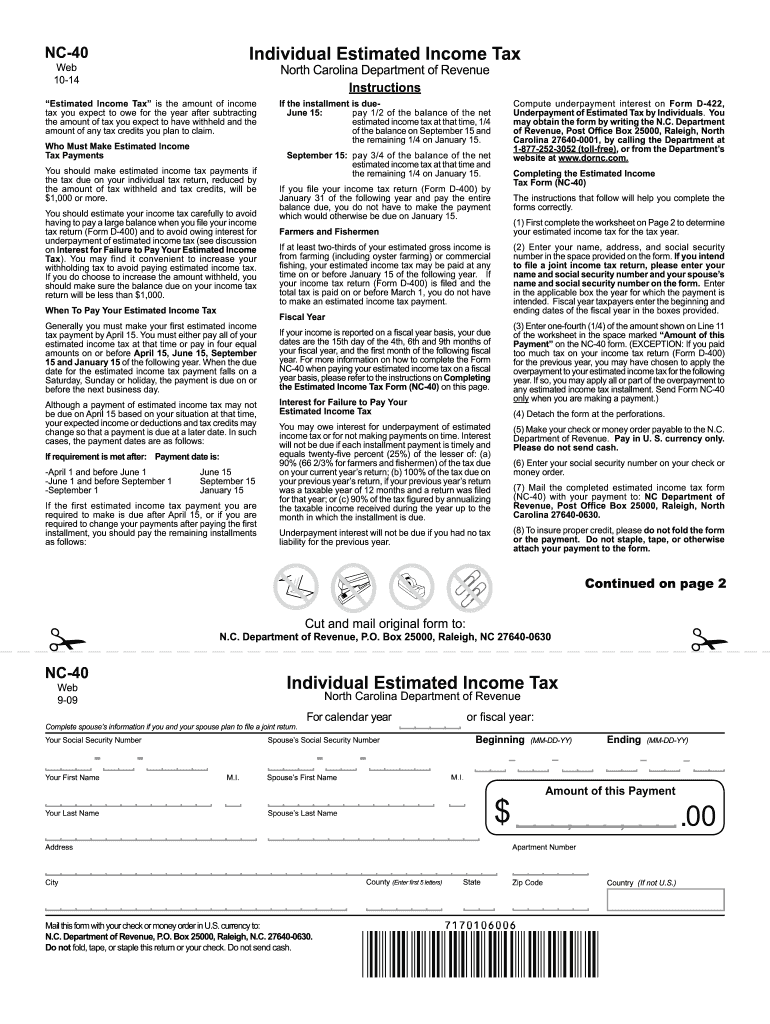

North Carolina Estimated Tax Payments Form Fill Out and Sign

Web what you should send us. You can download or print. Web we last updated north carolina schedule pn in february 2023 from the north carolina department of revenue. This form is for income earned in tax year 2022, with tax returns. Individual income tax forms instructions.

Top 9 Nc Form D400 Templates free to download in PDF format

Web we last updated north carolina schedule pn in february 2023 from the north carolina department of revenue. This form is for income earned in tax year 2022, with tax returns. Web what you should send us. This form is for income earned in tax year 2022,. You can download or print.

Web We Last Updated North Carolina Schedule Pn In February 2023 From The North Carolina Department Of Revenue.

Corporate income & franchise tax. This form is for income earned in tax year 2022, with tax. Web we last updated the n.c. Were you a resident of n.c.

You Can Download Or Print.

Fill in circle if you, or if married filing jointly, your spouse were out of the country on. This form is for income earned in tax year 2022, with tax returns. Other deductions from federal adjusted gross income(attach explanation or schedule)13. Web what you should send us.

Click Here For Help If The Form Does Not Appear After You Click Create Form.

Individual income tax forms instructions. Individual income tax instructions schedule a: This form is for income earned in tax year 2022,.