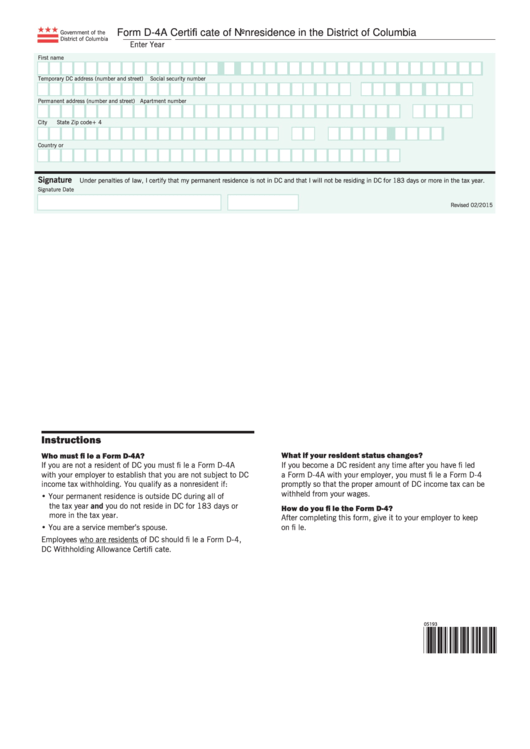

Form D-4A

Form D-4A - I have never live in dc, i live in va, but currently i am working in dc. If 10 or more exemptions are claimed or if you suspect this certificate contains false information please send a copy to: Web office of tax and revenue. Show details we are not affiliated with any brand or entity on this form. Monday to friday, 9 am to 4 pm, except district holidays. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Ask the chief financial officer. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. How it works browse for the d 4a temporary dc address customize and esign d 4a send out signed dc d certificate or print it Once filed with your employer, it will remain in effect until you file a new certificate.

Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Signature date revised 12/2016 instructions My question is what do i have to put in the question that say, temporary dc address in that form if i have never live in dc. Monday to friday, 9 am to 4 pm, except district holidays. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Office of tax and revenue, 1101 4th st., sw, washington, dc 20024 attn: How it works browse for the d 4a temporary dc address customize and esign d 4a send out signed dc d certificate or print it Web office of tax and revenue. You may file a new withholding allowance certificate any time the number of withholding allowances you are entitled to increases. If 10 or more exemptions are claimed or if you suspect this certificate contains false information please send a copy to:

Office of tax and revenue, 1101 4th st., sw, washington, dc 20024 attn: Ask the chief financial officer. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Show details we are not affiliated with any brand or entity on this form. Web office of tax and revenue. Commonwealth signature under penalties of law, i certify that my permanent residence is not in dc and that i will not be residing in dc for 183 days or more in the tax year. 1101 4th street, sw, suite 270 west, washington, dc 20024. I have never live in dc, i live in va, but currently i am working in dc. The irs uses this form to notify the district of columbia (d.c.) to not deduct taxes from your wages because you do not live in d.c. Signature date revised 12/2016 instructions

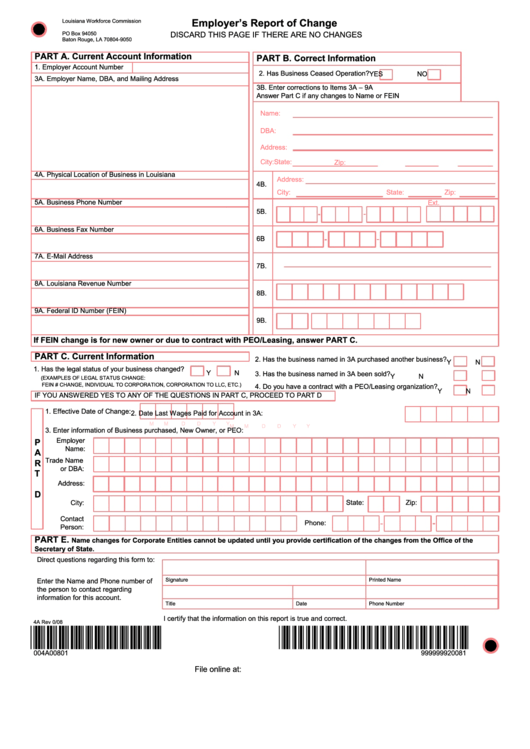

Form 4A, Form 4C, Form 4D, Form 5, Form 5/TS, Form 6, Form Form

Once filed with your employer, it will remain in effect until you file a new certificate. Web office of tax and revenue. My question is what do i have to put in the question that say, temporary dc address in that form if i have never live in dc. I have never live in dc, i live in va, but.

FORM_4A Public Law Justice

Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Commonwealth signature under penalties of law,.

Form D4a Certificate Of Nonresidence In The District Of Columbia

Office of tax and revenue, 1101 4th st., sw, washington, dc 20024 attn: 1101 4th street, sw, suite 270 west, washington, dc 20024. How it works browse for the d 4a temporary dc address customize and esign d 4a send out signed dc d certificate or print it Signature date revised 12/2016 instructions Last name temporary dc address (number and.

P&D 4A YouTube

How it works browse for the d 4a temporary dc address customize and esign d 4a send out signed dc d certificate or print it Show details we are not affiliated with any brand or entity on this form. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip.

Form 4a Employer'S Report Of Change 2008 printable pdf download

If 10 or more exemptions are claimed or if you suspect this certificate contains false information please send a copy to: Once filed with your employer, it will remain in effect until you file a new certificate. Monday to friday, 9 am to 4 pm, except district holidays. Signature date revised 12/2016 instructions Office of tax and revenue, 1101 4th.

20162022 Form DC D4A Fill Online, Printable, Fillable, Blank pdfFiller

I have never live in dc, i live in va, but currently i am working in dc. Signature date revised 12/2016 instructions Office of tax and revenue, 1101 4th st., sw, washington, dc 20024 attn: 1101 4th street, sw, suite 270 west, washington, dc 20024. Last name temporary dc address (number and street) social security number permanent address (number and.

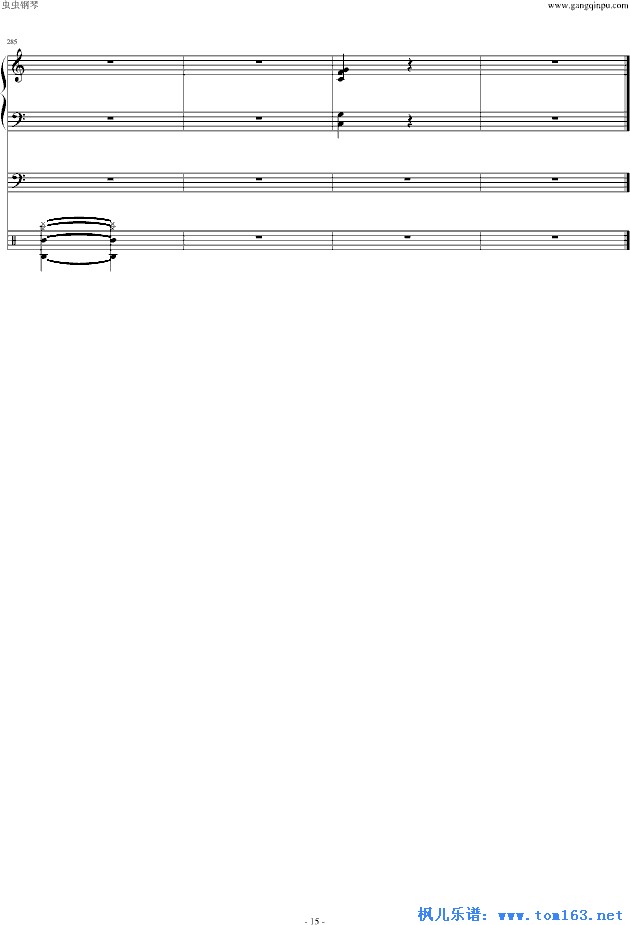

最炫民族风(蓝调版)钢琴谱 五线谱—凤凰传奇

Ask the chief financial officer. Once filed with your employer, it will remain in effect until you file a new certificate. My question is what do i have to put in the question that say, temporary dc address in that form if i have never live in dc. Monday to friday, 9 am to 4 pm, except district holidays. Signature.

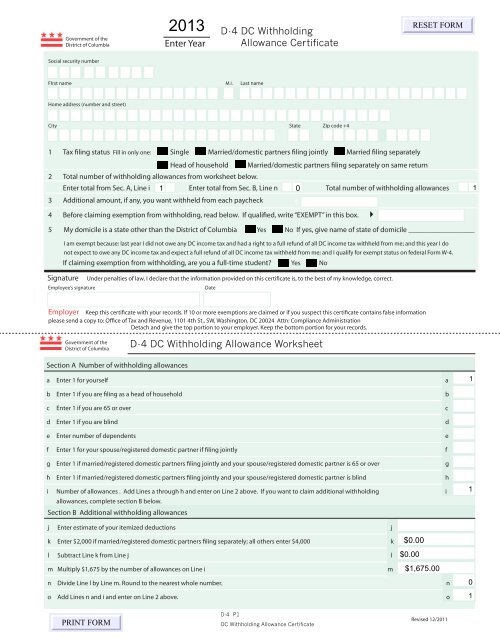

State Tax Forms 2013

You may file a new withholding allowance certificate any time the number of withholding allowances you are entitled to increases. Show details we are not affiliated with any brand or entity on this form. Signature date revised 12/2016 instructions Web office of tax and revenue. 1101 4th street, sw, suite 270 west, washington, dc 20024.

Form 4A YouTube

If 10 or more exemptions are claimed or if you suspect this certificate contains false information please send a copy to: Show details we are not affiliated with any brand or entity on this form. 1101 4th street, sw, suite 270 west, washington, dc 20024. The irs uses this form to notify the district of columbia (d.c.) to not deduct.

4A Notice of Unsatisfactory Work Padded Forms

How it works browse for the d 4a temporary dc address customize and esign d 4a send out signed dc d certificate or print it Show details we are not affiliated with any brand or entity on this form. Commonwealth signature under penalties of law, i certify that my permanent residence is not in dc and that i will not.

Once Filed With Your Employer, It Will Remain In Effect Until You File A New Certificate.

1101 4th street, sw, suite 270 west, washington, dc 20024. How it works browse for the d 4a temporary dc address customize and esign d 4a send out signed dc d certificate or print it Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Monday to friday, 9 am to 4 pm, except district holidays.

My Question Is What Do I Have To Put In The Question That Say, Temporary Dc Address In That Form If I Have Never Live In Dc.

I have never live in dc, i live in va, but currently i am working in dc. Show details we are not affiliated with any brand or entity on this form. The irs uses this form to notify the district of columbia (d.c.) to not deduct taxes from your wages because you do not live in d.c. Signature date revised 12/2016 instructions

Ask The Chief Financial Officer.

You may file a new withholding allowance certificate any time the number of withholding allowances you are entitled to increases. Commonwealth signature under penalties of law, i certify that my permanent residence is not in dc and that i will not be residing in dc for 183 days or more in the tax year. If 10 or more exemptions are claimed or if you suspect this certificate contains false information please send a copy to: Office of tax and revenue, 1101 4th st., sw, washington, dc 20024 attn:

Web Office Of Tax And Revenue.

Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s.