Form De 9

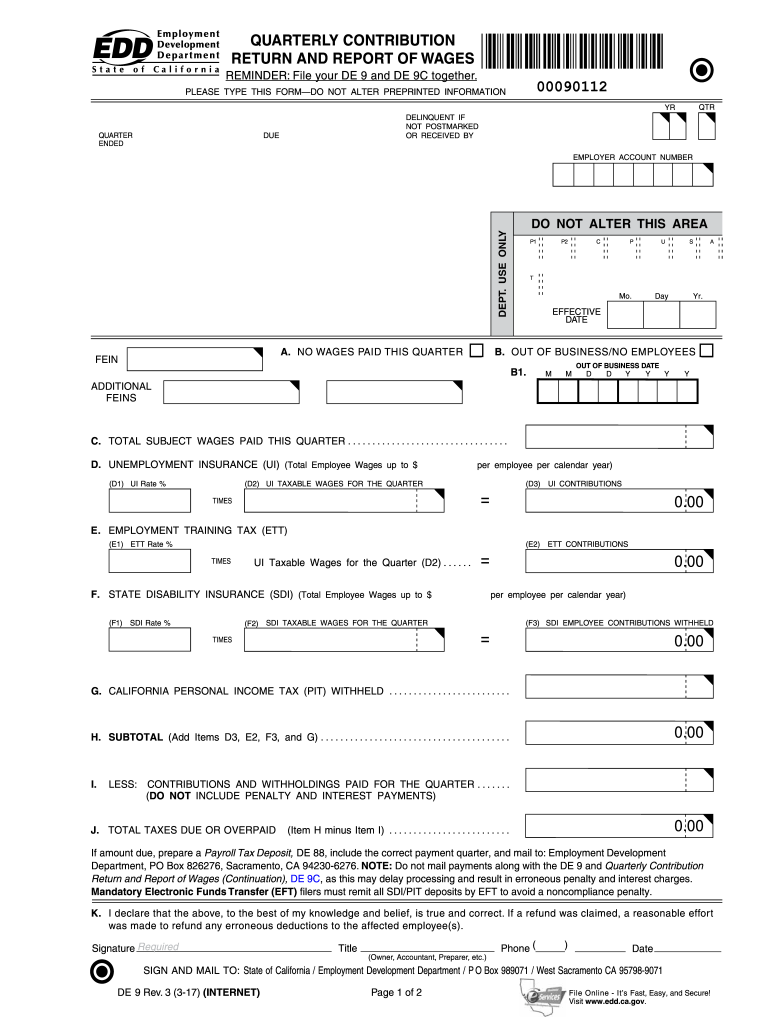

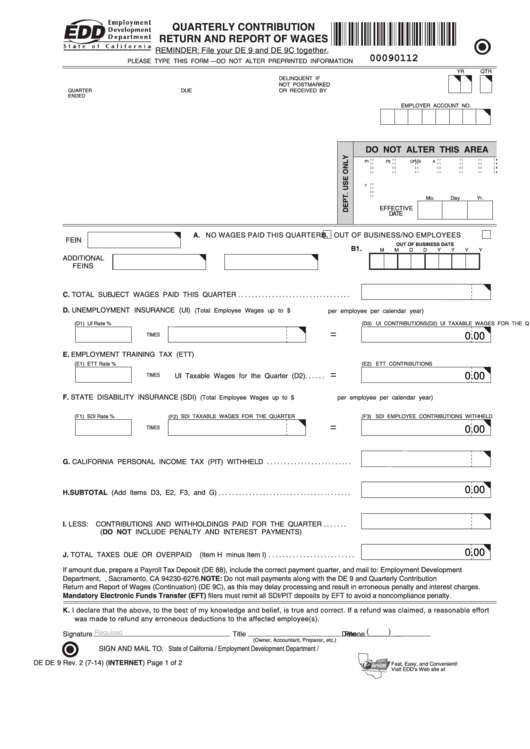

Form De 9 - Web independent expenditure statement for rebate of filing fees (political parties) 05/2020. Web categories payroll tags california de 9 form, california de 9 software, california de 9c form, california de 9c software post navigation. The very first step is to choose the orange get form now button. I want to make a. These reports can be corrected by filing the appropriate adjustment request. Type text, add images, blackout confidential details, add comments, highlights and more. You should select de 9 first, then create a de. Sign it in a few clicks. Web (form 540) with the franchise tax board. Web prepare a de 9c to report the types of exemptions listed below.

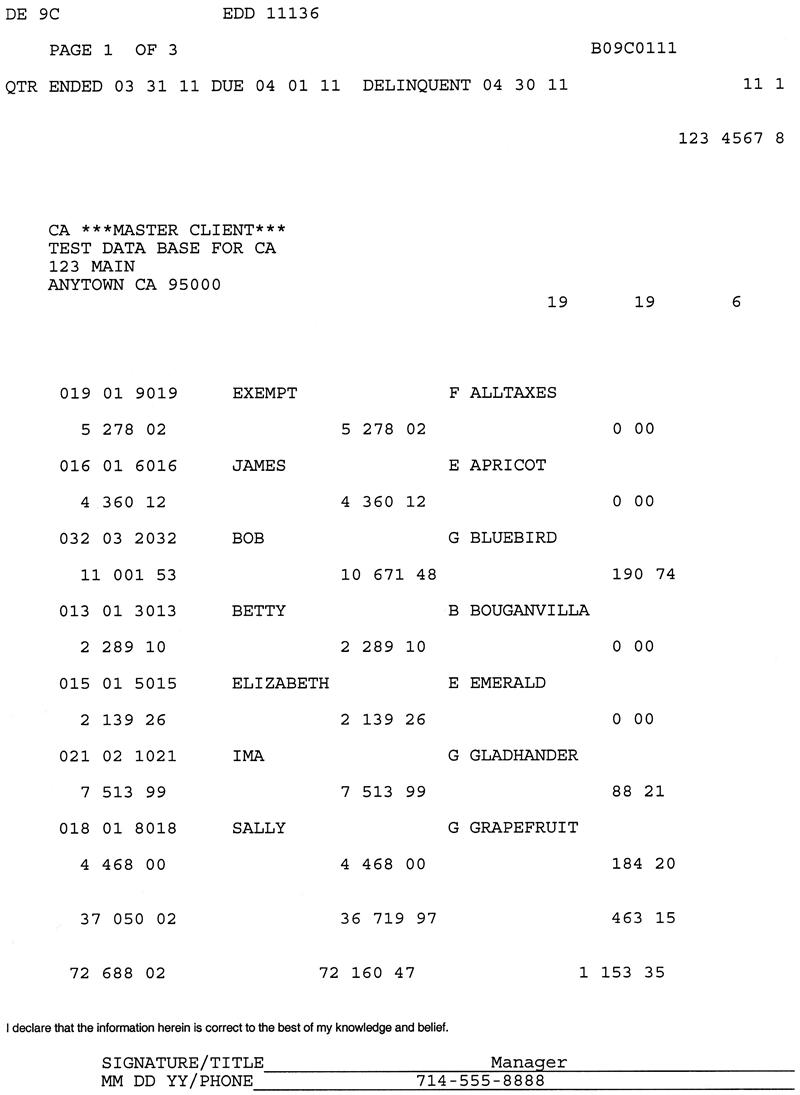

As shown in the grid below, some wage items are considered “pit wages” and reported in item h on the de 9c, even though the wages are not subject to personal. If you are requesting a pit credit for a prior year because you paid the edd more than the amount withheld from the employee(s), attach. If your de 9 shows an overpayment, we will send you a refund automatically. 2011 fica rate | 2011 fica rates. Web prepare a de 9c to report the types of exemptions listed below. Web (form 540) with the franchise tax board. Each quarter, california employers are required to complete a quarterly contribution return and report of wages (de 9). Web quarterly contribution and wage adjustment form (de 9adj) the. Web categories payroll tags california de 9 form, california de 9 software, california de 9c form, california de 9c software post navigation. Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department (edd):

All three exemptions can be reported on one de 9c. These reports can be corrected by filing the appropriate adjustment request. If your de 9 shows an overpayment, we will send you a refund automatically. Draw your signature, type it,. Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department (edd): 2011 fica rate | 2011 fica rates. Write the exemption title(s) at the top of the form (e.g., sole. If a tax payment is due,. I want to make a. Once you access our how to edd de 9c editing page, you will find all the functions you may.

Quarterly Contribution Return And Report Of Wages (De 9) Edit, Fill

If you are requesting a pit credit for a prior year because you paid the edd more than the amount withheld from the employee(s), attach. Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. These reports can be corrected by filing the appropriate adjustment request. Web quarterly contribution and wage adjustment form.

What Is a W9 Form? Who Can File and How to Fill It Out

Web what is the de 9 form? Web most employers, including quarterly household employers, are required to file the de 9 and de 9c. Web categories payroll tags california de 9 form, california de 9 software, california de 9c form, california de 9c software post navigation. These reports can be corrected by filing the appropriate adjustment request. Web the documents.

How To Fill Out And Sign Your W9 Form Online inside Free Fillable W 9

Web what is the de 9 form? I want to make a. Web quarterly contribution and wage adjustment form (de 9adj) the. If a tax payment is due,. Web (form 540) with the franchise tax board.

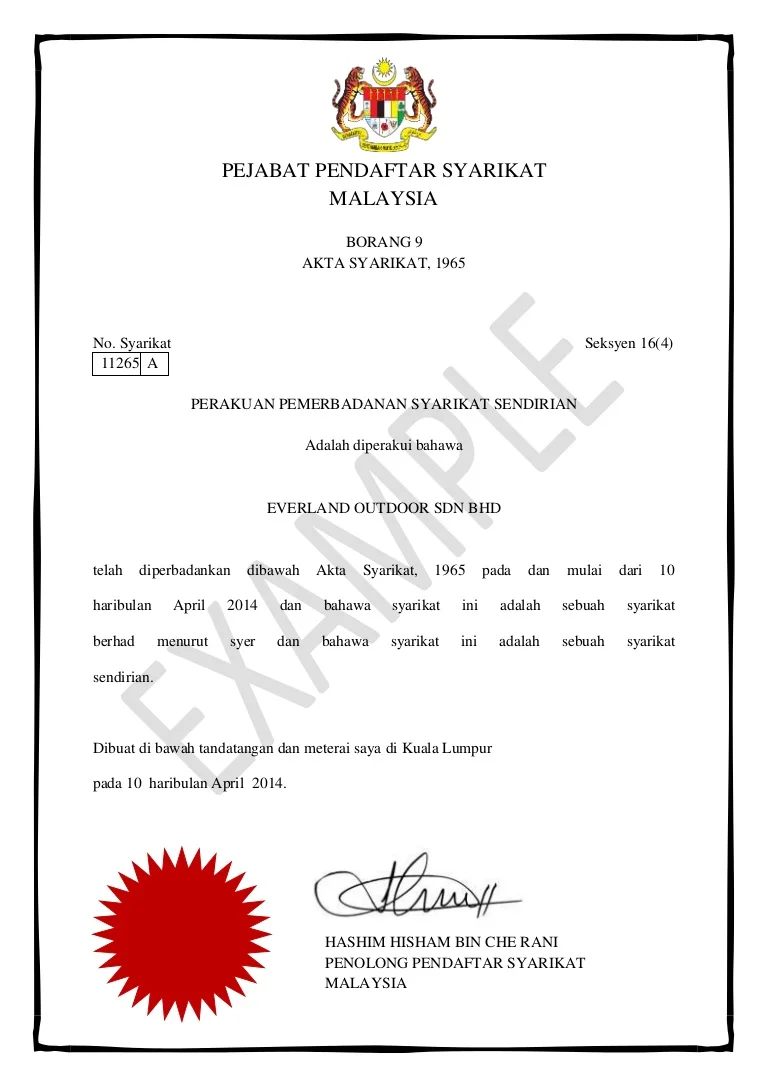

Contoh Borang 49 Ssm

Web prepare a de 9c to report the types of exemptions listed below. 2011 fica rate | 2011 fica rates. Web independent expenditure statement for rebate of filing fees (political parties) 05/2020. Type text, add images, blackout confidential details, add comments, highlights and more. Affiliated party committee independent expenditure.

What is Form I9 and How to Stay Compliant with I9?

Quarterly contribution and wage adjustment form de 9adj ( ) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is. Web categories payroll tags california de 9 form, california de 9 software, california de 9c form, california de 9c software post navigation. These reports can be corrected by filing the appropriate adjustment request. Web the documents on this webpage are pdfs. Web quarterly contribution and wage adjustment.

2011 Form CA EDD DE 9ADJI Fill Online, Printable, Fillable, Blank

Separate electronic files are created for the de 9 and de 9c. You should select de 9 first, then create a de. All three exemptions can be reported on one de 9c. Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department (edd): As shown in the.

20142021 Form CA DE 9 Fill Online, Printable, Fillable, Blank pdfFiller

These reports can be corrected by filing the appropriate adjustment request. Edit your form de 9 online. 2011 fica rate | 2011 fica rates. Web (form 540) with the franchise tax board. If a tax payment is due,.

De9c Fill Online, Printable, Fillable, Blank PDFfiller

Web independent expenditure statement for rebate of filing fees (political parties) 05/2020. As shown in the grid below, some wage items are considered “pit wages” and reported in item h on the de 9c, even though the wages are not subject to personal. Affiliated party committee independent expenditure. Web what is the de 9 form? I want to make a.

California DE 9 and DE 9C Fileable Reports

Web quarterly contribution and wage adjustment form (de 9adj) the. All three exemptions can be reported on one de 9c. Web go to the de 9 ca suta electronic filing option screen. Web prepare a de 9c to report the types of exemptions listed below. 2011 fica rate | 2011 fica rates.

Form De 9 With Instruction Quarterly Contribution Return And Report Of

Web (form 540) with the franchise tax board. Web what is the de 9 form? Web independent expenditure statement for rebate of filing fees (political parties) 05/2020. You should select de 9 first, then create a de. Draw your signature, type it,.

These Reports Can Be Corrected By Filing The Appropriate Adjustment Request.

You should select de 9 first, then create a de. Write the exemption title(s) at the top of the form (e.g., sole. Web prepare a de 9c to report the types of exemptions listed below. Edit your form de 9 online.

Separate Electronic Files Are Created For The De 9 And De 9C.

I want to make a. All three exemptions can be reported on one de 9c. Web to learn how to submit your california payroll tax deposit (form de 88), watch the video from the california employment development department (edd): Each quarter, california employers are required to complete a quarterly contribution return and report of wages (de 9).

2011 Fica Rate | 2011 Fica Rates.

Web (form 540) with the franchise tax board. Draw your signature, type it,. Type text, add images, blackout confidential details, add comments, highlights and more. Web the documents on this webpage are pdfs.

Affiliated Party Committee Independent Expenditure.

If your de 9 shows an overpayment, we will send you a refund automatically. Quarterly contribution and wage adjustment form de 9adj ( ) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is. As shown in the grid below, some wage items are considered “pit wages” and reported in item h on the de 9c, even though the wages are not subject to personal. The de 9 reconciles reported wages and paid taxes for each quarter.

:max_bytes(150000):strip_icc()/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)