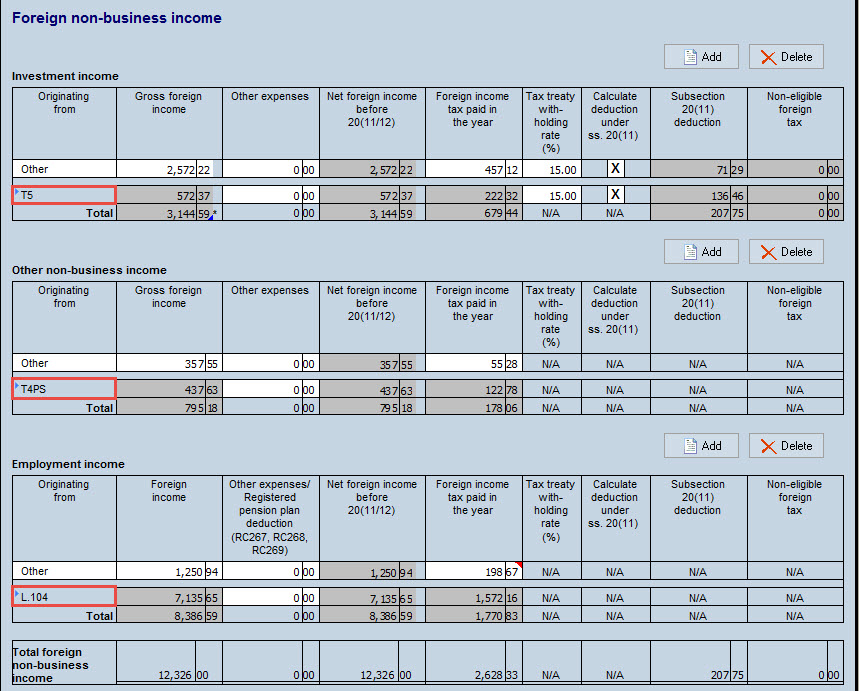

Form For Foreign Income

Form For Foreign Income - If you are a u.s. Citizens and resident aliens to report their worldwide income, including income from foreign trusts and foreign bank and other. What foreign income is taxable on my u.s. Web to claim the feie, you must attach form 2555 to form 1040. Taxes, you can exclude up to $108,700 or even more if you incurred housing costs in 2021. For your 2022 tax filing, the maximum exclusion is $112,000 of foreign earned income. Web in year 1, a pays $2,000 of foreign income taxes on passive category income other than capital gains which was reported to a on a qualified payee statement. Citizen or resident, you are required to report your worldwide income on your tax return. Web federal law requires u.s. Web schedule fa was introduced to combat tax evasion and money laundering.

Web if you’re an expat and you qualify for a foreign earned income exclusion from your u.s. Ad our international tax services can be customized to fit your specific business needs. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. Web the foreign earned income exclusion is designed to allow american citizens and legal residents who reside outside the country to exclude most or all of the income earned. Like with form 1040, you start by. Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign. This section of the program contains information for part iii of the schedule k. Web however, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($107,600 for 2020, $108,700 for. Web on the internal revenue service (irs) form 1116, there are four categories of foreign income. Tax information for foreign persons with income in the u.s.

For your 2022 tax filing, the maximum exclusion is $112,000 of foreign earned income. Web federal law requires u.s. Tax information for foreign persons with income in the u.s. Web in year 1, a pays $2,000 of foreign income taxes on passive category income other than capital gains which was reported to a on a qualified payee statement. Web the foreign earned income exclusion is designed to allow american citizens and legal residents who reside outside the country to exclude most or all of the income earned. Use form 2555 to claim. Like with form 1040, you start by. Here’s how to do it: Taxes, you can exclude up to $108,700 or even more if you incurred housing costs in 2021. Income tax return of a.

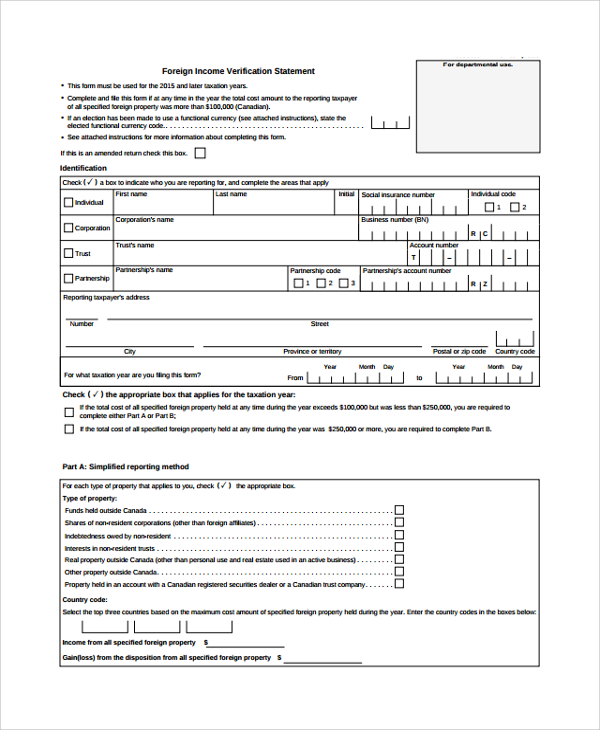

Foreign Verification Statement Form

Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. For your 2022 tax filing, the maximum exclusion is $112,000 of foreign earned income. Citizens and resident aliens with income outside the u.s. Web to claim the feie, you must attach form 2555 to.

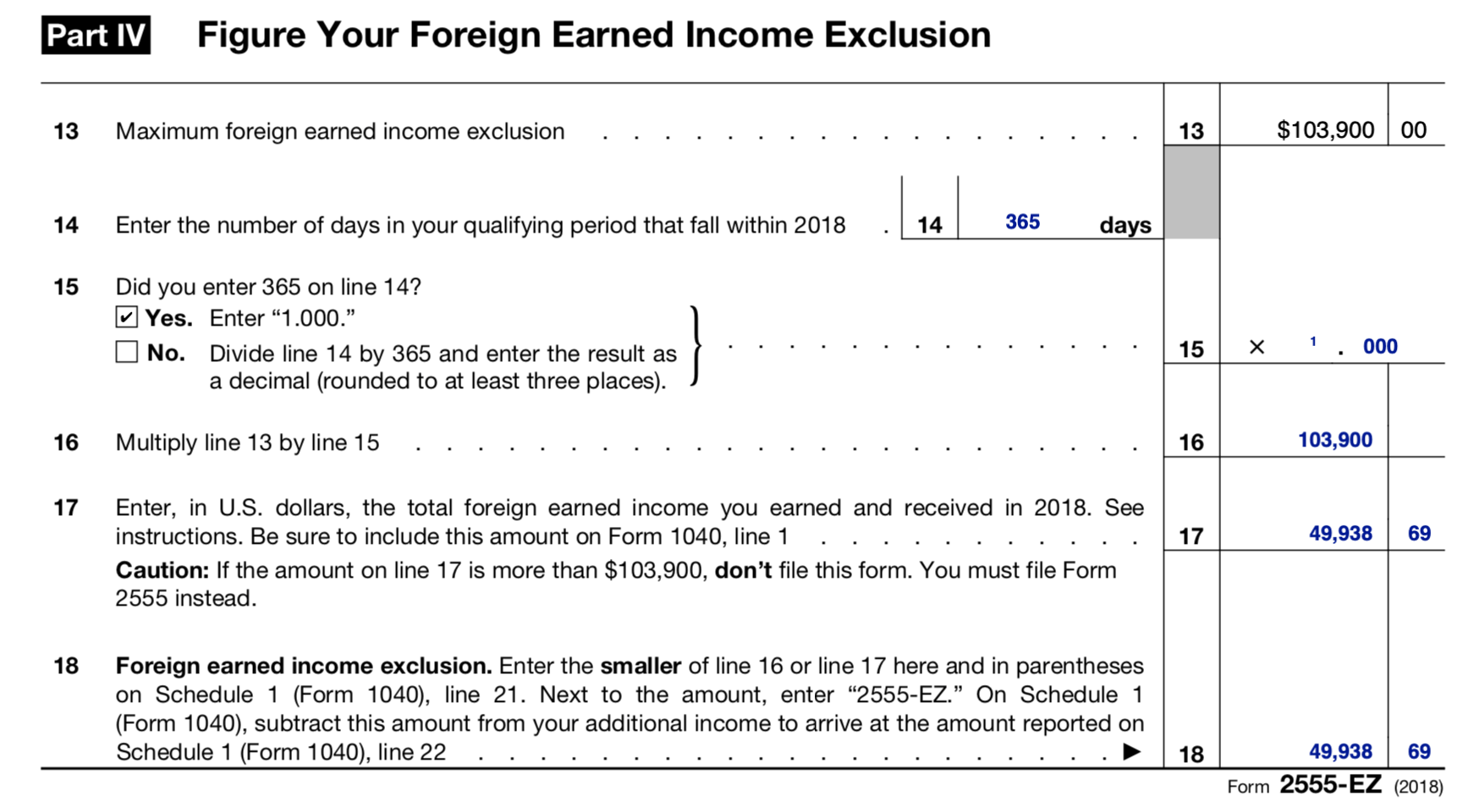

Foreign Earned Tax Worksheet Worksheet List

Web in year 1, a pays $2,000 of foreign income taxes on passive category income other than capital gains which was reported to a on a qualified payee statement. Form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of. Ad our international tax services can be customized.

Foreign and Taxes

Here’s everything you need to know about foreign income and. For your 2022 tax filing, the maximum exclusion is $112,000 of foreign earned income. Fill out your personal information. If you are a u.s. Web qualified dividends and capital gain tax worksheet,* schedule d tax worksheet,* or form 8615, whichever applies.

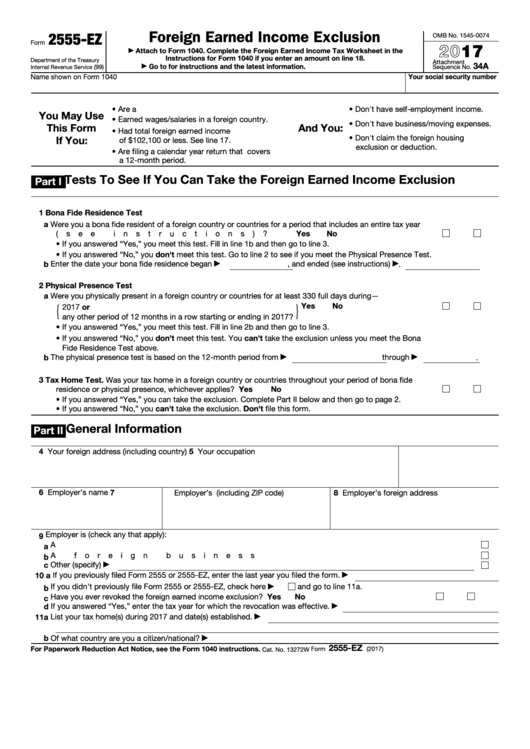

US Expat Taxes Form 2555 EZ & Foreign Earned Exclusion

Like with form 1040, you start by. Income tax return of a. Web qualified dividends and capital gain tax worksheet,* schedule d tax worksheet,* or form 8615, whichever applies. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. Web use form 1116.

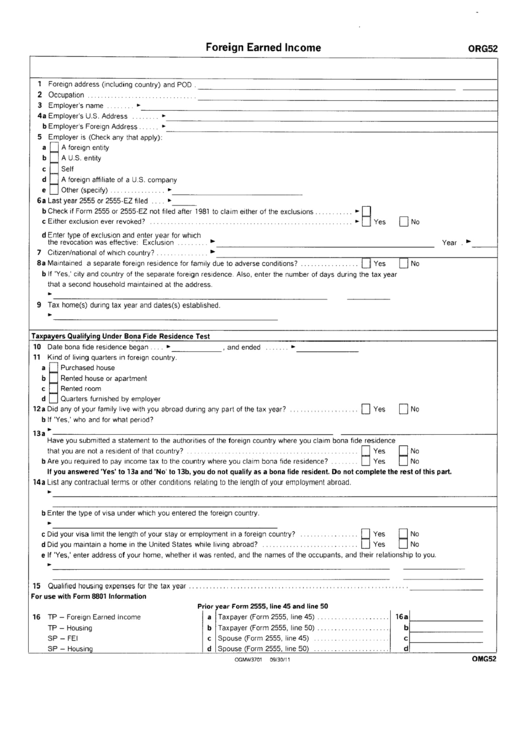

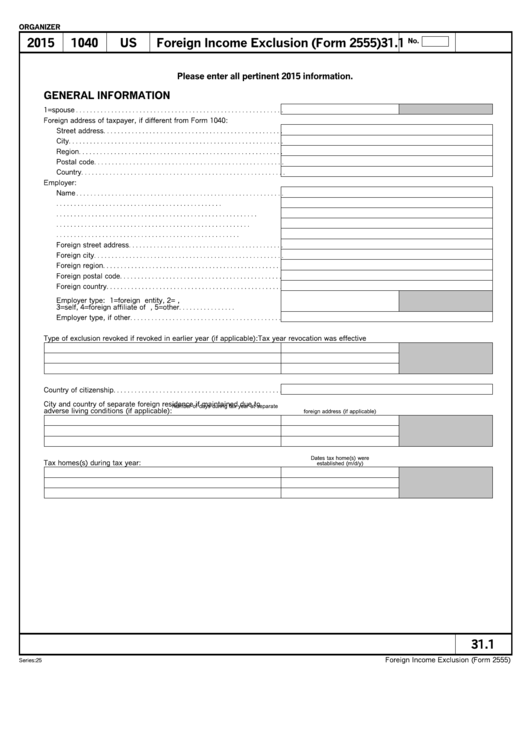

Form 0rg52 Foreign Earned Worksheet (Form 2555) printable pdf

Web for this purpose, foreign earned income is income you receive for services you perform in a foreign country in a period during which your tax home is in a foreign. Web report all gross transportation income subject to 4% tax on line 9. Citizen or resident, you are required to report your worldwide income on your tax return. For.

FREE 9+ Sample Verification Forms in PDF MS Word

Fill out your personal information. Ad our international tax services can be customized to fit your specific business needs. Web to claim the feie, you must attach form 2555 to form 1040. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. Use.

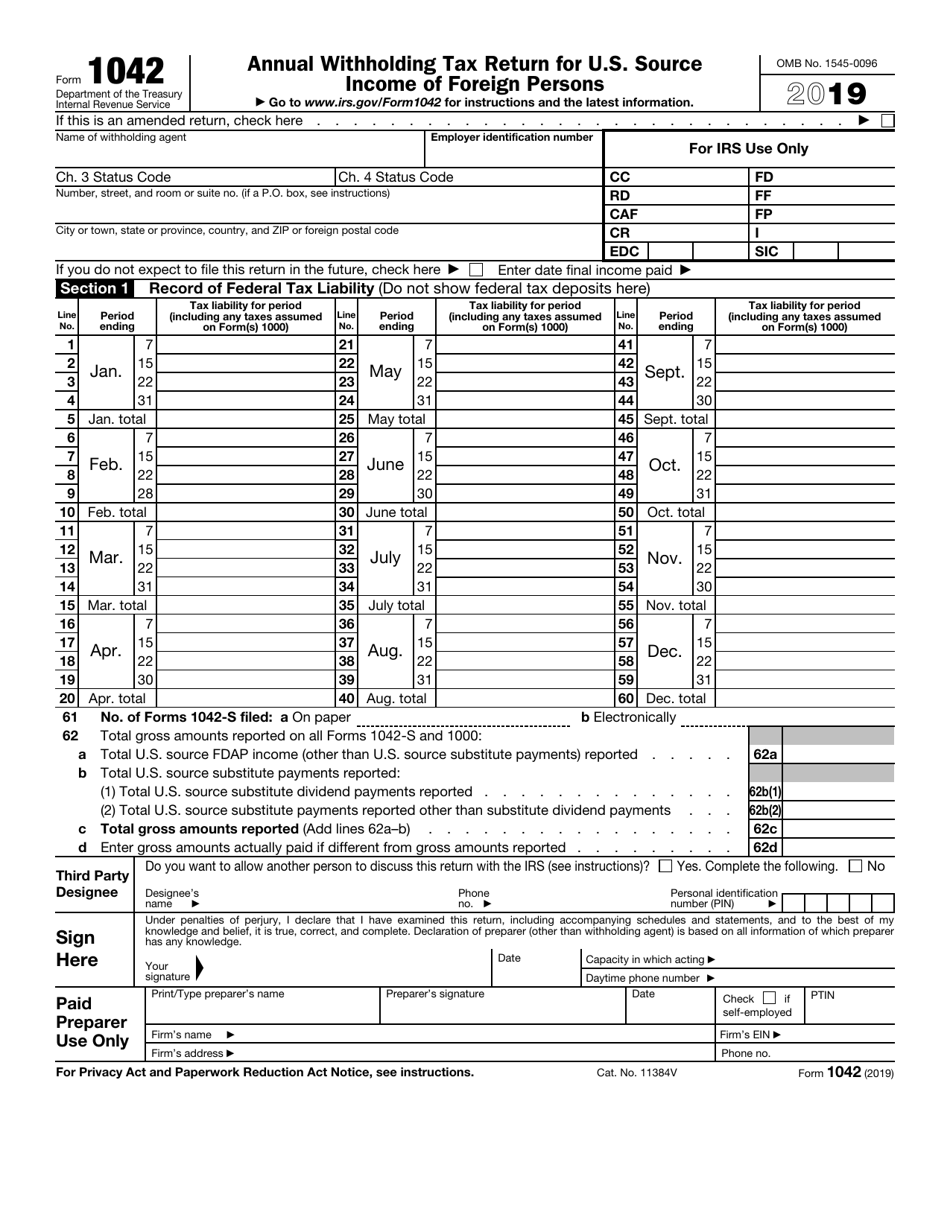

IRS Form 1042 Download Fillable PDF or Fill Online Annual Withholding

Use form 2555 to claim. (exclusion is adjusted annually for inflation). For your 2022 tax filing, the maximum exclusion is $112,000 of foreign earned income. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. This section of the program contains information for.

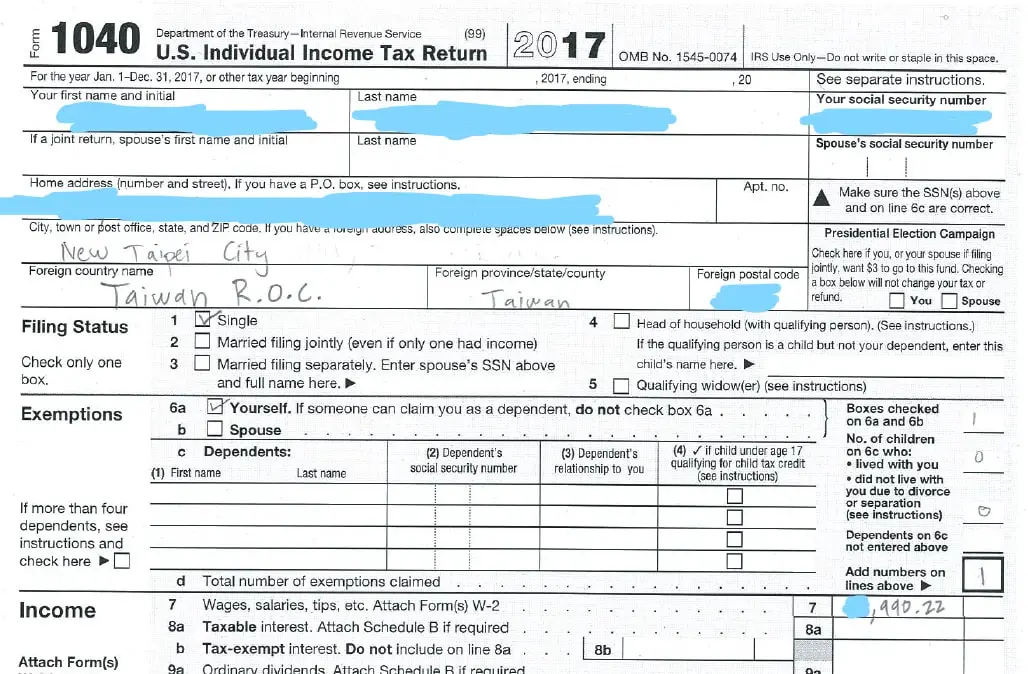

Tax Filing Guide for American Expats Abroad Foreigners in

Web report all gross transportation income subject to 4% tax on line 9. Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign. Fill out your personal information. What foreign income is taxable on my u.s. Web on the internal revenue service (irs) form.

Fillable Form 2555Ez Foreign Earned Exclusion 2017 printable

For your 2022 tax filing, the maximum exclusion is $112,000 of foreign earned income. Web if you’re an expat and you qualify for a foreign earned income exclusion from your u.s. Here’s how to do it: This section of the program contains information for part iii of the schedule k. (exclusion is adjusted annually for inflation).

2015 Foreign Exclusion (Form 2555) printable pdf download

See the instructions for line 11a to see which tax. Web for this purpose, foreign earned income is income you receive for services you perform in a foreign country in a period during which your tax home is in a foreign. Income tax return of a. If you are a u.s. Web the foreign earned income exclusion is designed to.

Web Schedule Fa Was Introduced To Combat Tax Evasion And Money Laundering.

Citizens and resident aliens to report their worldwide income, including income from foreign trusts and foreign bank and other. Web however, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($107,600 for 2020, $108,700 for. Web what is form 2555 used for? (exclusion is adjusted annually for inflation).

Web Section 43 Of The Black Money (Undisclosed Foreign Income & Assets) & Imposition Of Tax Act 2015 Has A Provision For Imposing A Penalty Of Rs.

Citizen or resident, you are required to report your worldwide income on your tax return. Citizens and resident aliens with income outside the u.s. Taxes, you can exclude up to $108,700 or even more if you incurred housing costs in 2021. Income tax return of a.

Web Report All Gross Transportation Income Subject To 4% Tax On Line 9.

Form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of. Here’s how to do it: What foreign income is taxable on my u.s. Fill out your personal information.

Web Qualified Dividends And Capital Gain Tax Worksheet,* Schedule D Tax Worksheet,* Or Form 8615, Whichever Applies.

Here’s everything you need to know about foreign income and. Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign. For your 2022 tax filing, the maximum exclusion is $112,000 of foreign earned income. Web the foreign earned income exclusion is designed to allow american citizens and legal residents who reside outside the country to exclude most or all of the income earned.