Form It-560

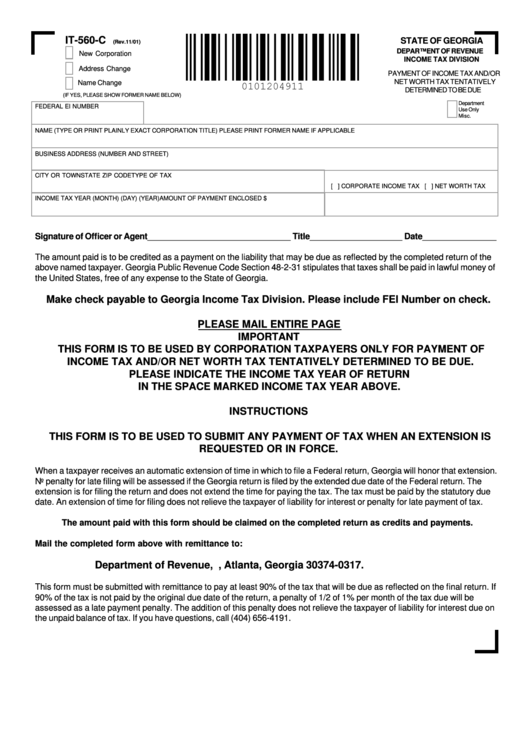

Form It-560 - Instructions for form it 560. Form 700, georgia partnership return; 2.the amount paid with this form should be. Web instructions for form it 560c. Web instructions for form it 560 individual and fiduciary. We last updated the corporate extension. Late filing and latepayment penalties together cannot exceed 25%. Web instructions for form it 560 individual and fiduciary. Web form it 560 c, composite return extension payment; Name or name of fiduciary and address:

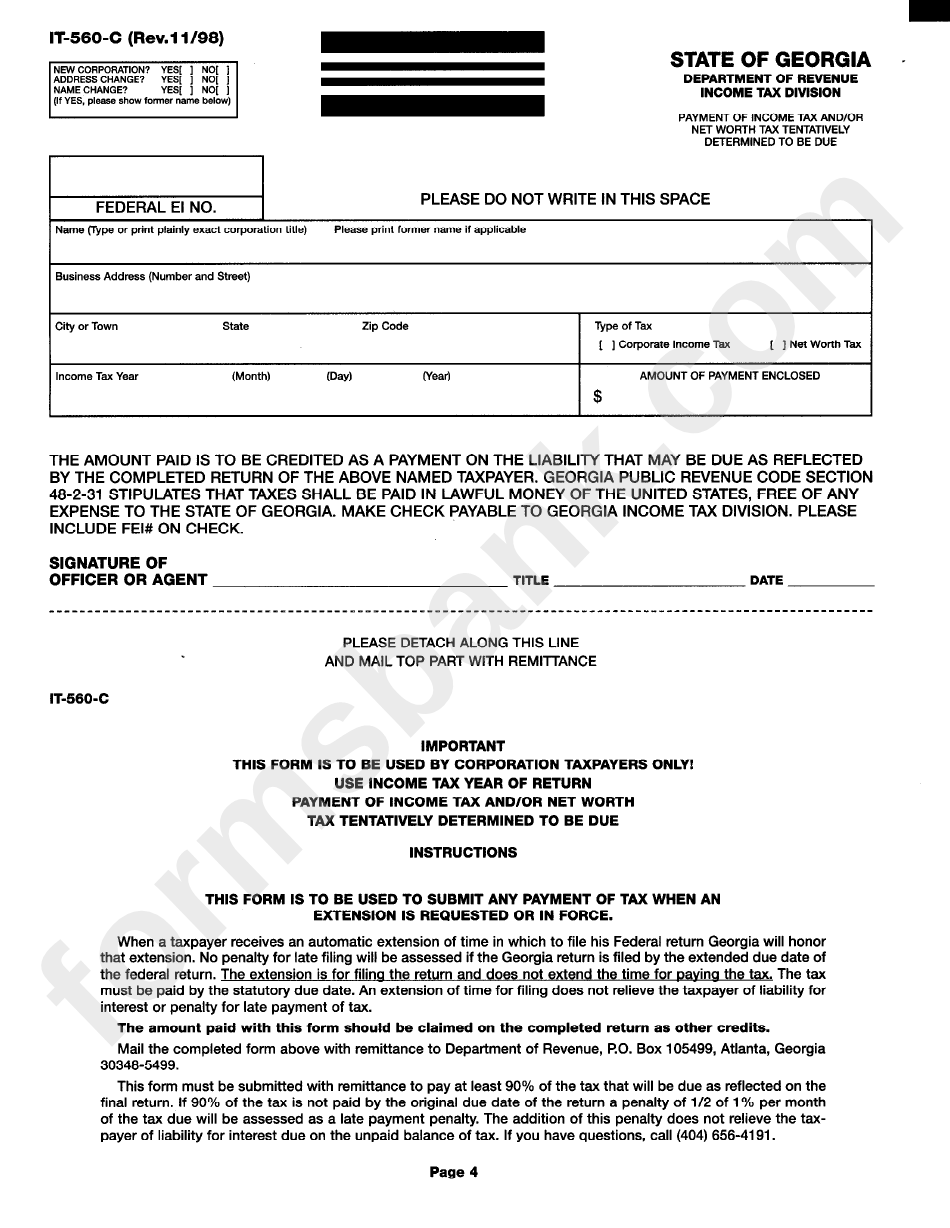

Complete the name and address field located on the upper right. Web form it 560 c, composite return extension payment; This form is for income earned in tax year 2022, with tax returns due in april. 1.this form is to be used to submit any payment of tax when an extension is requested or enforced. Instructions for form it 560. Late filing and latepayment penalties together cannot exceed 25%. This form is for income earned in tax year 2022, with tax returns due in april. Name or name of fiduciary and address: Form 700, schedule 7, modifications and georgia total income, are allocated. 2.the amount paid with this form should be.

Late filing and latepayment penalties together cannot exceed 25%. Do not use for quarterly estimate or corpora te tax payments. Web form it 560 c, composite return extension payment; 2.the amount paid with this form should be. This form is for income earned in tax year 2022, with tax returns due in april. Form 700, schedule 7, modifications and georgia total income, are allocated. This form is for income earned in tax year 2022, with tax returns due in april. 05/29/20) individual and fiduciary payment voucher. Web instructions for form it 560c 1.this form is to be used to submit any payment of tax when an extension is requested or enforced. Web instructions for form it 560c.

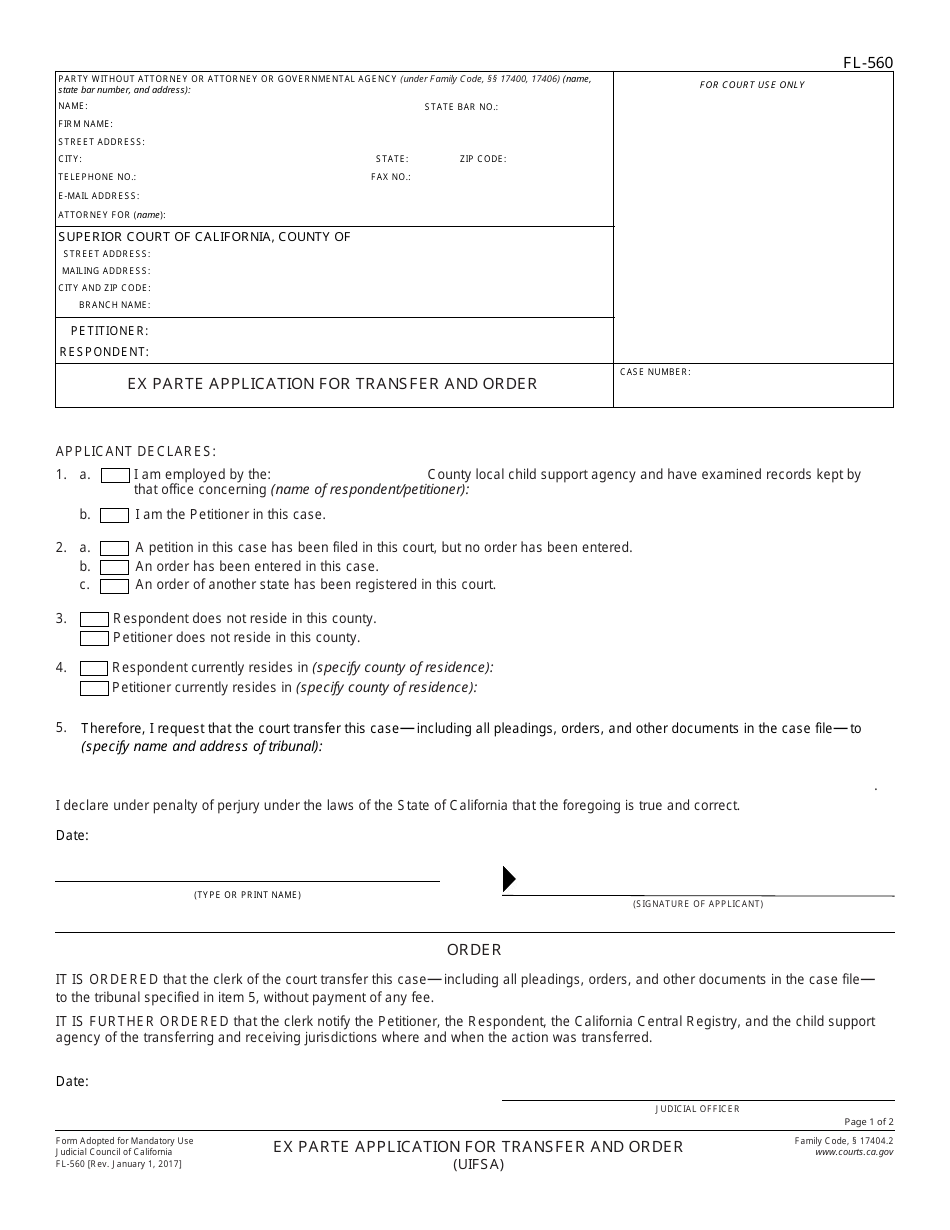

Form FL560 Download Fillable PDF or Fill Online Ex Parte Application

We last updated the corporate extension. Complete the name and address field located on the upper right. Web instructions for form it 560 individual and fiduciary. Georgia department of revenue processing center. Form 700, schedule 7, modifications and georgia total income, are allocated.

Form It560C Payment Of Tax And/or Net Worth Tax printable

Name or name of fiduciary and address: Form 700, georgia partnership return; Form 700, schedule 7, modifications and georgia total income, are allocated. Late filing and latepayment penalties together cannot exceed 25%. This form is for income earned in tax year 2022, with tax returns due in april.

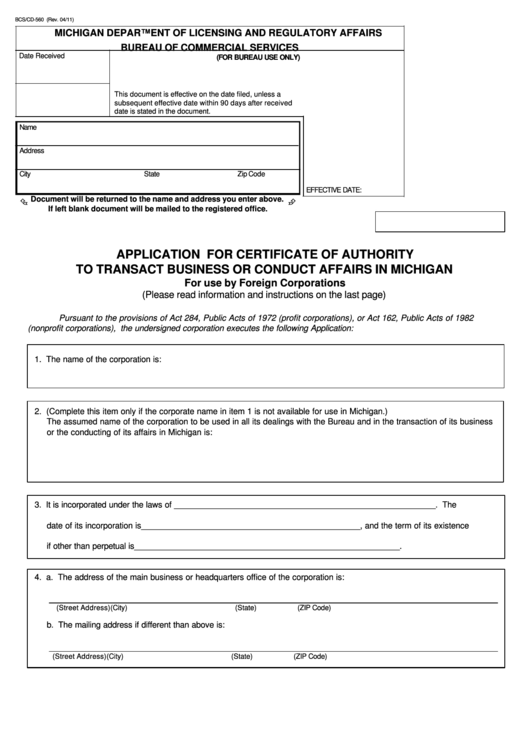

Fillable Form Bcs/cd560 Application For Certificate Of Authority To

Complete the name and address field located on the upper right. Web instructions for form it 560c. 2.the amount paid with this form should be. Name or name of fiduciary and address: Web instructions for form it 560 individual and fiduciary.

Fillable Form It560C Payment Of Tax And/or Net Worth Tax

2.the amount paid with this form should be. 1.this form is to be used to submit any payment of tax when an extension is requested or enforced. Web instructions for form it 560 individual and fiduciary. Complete the name and address field located on the upper right. Web instructions for form it 560c 1.this form is to be used to.

Tax Center Seymour & Perry, LLC CPA Firm

2.the amount paid with this form should be. Late filing and latepayment penalties together cannot exceed 25%. Web instructions for form it 560 individual and fiduciary. 2.the amount paid with this form should be. Web instructions for form it 560c 1.this form is to be used to submit any payment of tax when an extension is requested or enforced.

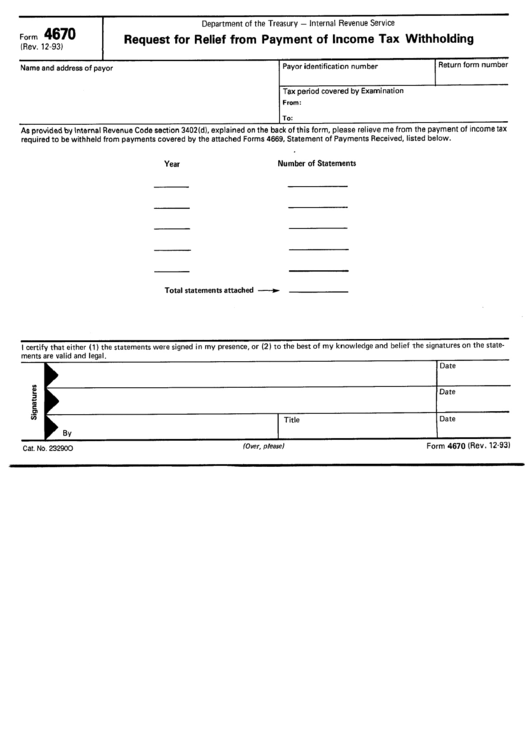

Form 4670 Request Form For Relief From Payment Of Tax

Form 700, georgia partnership return; Complete the name and address field located on the upper right. Late filing and latepayment penalties together cannot exceed 25%. Web instructions for form it 560 individual and fiduciary. Web instructions for form it 560 individual and fiduciary.

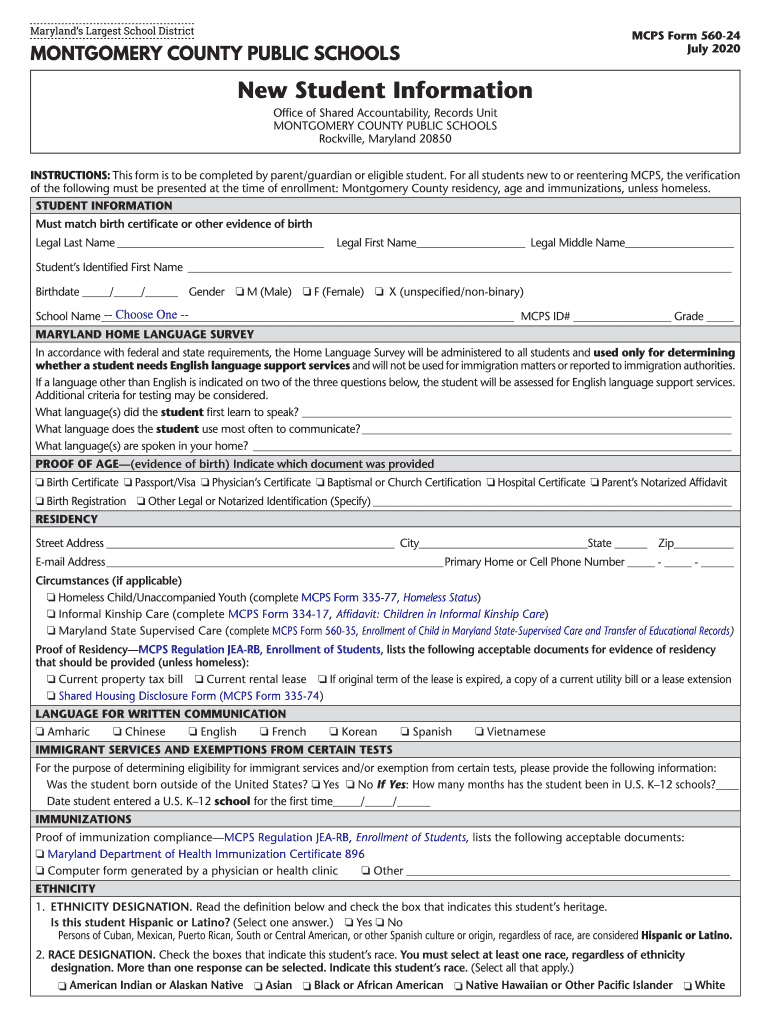

MD MCPS Form 56024 20202022 Fill and Sign Printable Template Online

Late filing and latepayment penalties together cannot exceed 25%. We last updated the corporate extension. 05/29/20) individual and fiduciary payment voucher. Form 700, schedule 7, modifications and georgia total income, are allocated. 2.the amount paid with this form should be.

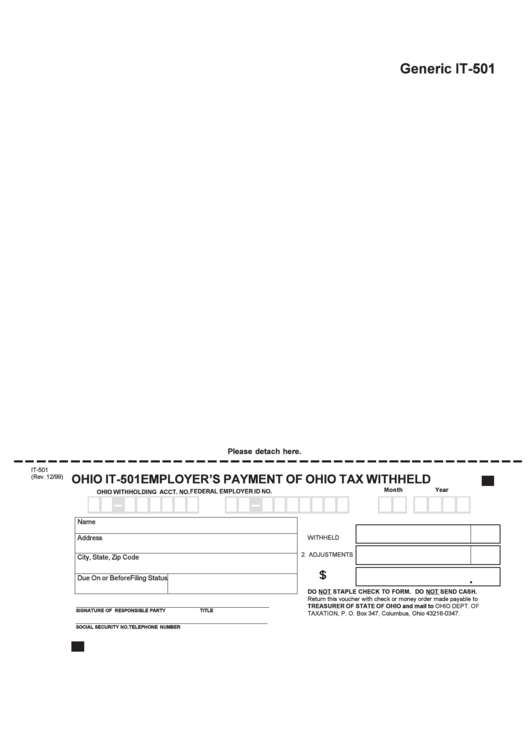

Ohio Form It501 Employers Payment Of Ohio Tax Withheld printable pdf

Web instructions for form it 560c. Georgia department of revenue processing center. 2.the amount paid with this form should be. Form 700, schedule 7, modifications and georgia total income, are allocated. Name or name of fiduciary and address:

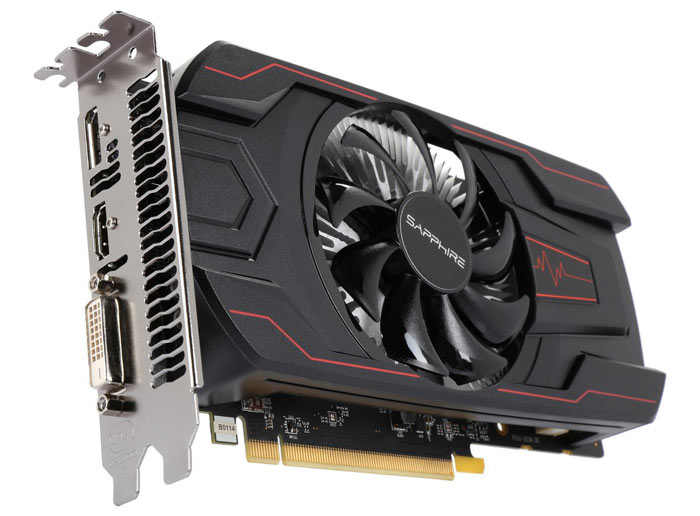

AMD quietly adds the RX 560 to its Radeon graphics card range

Web instructions for form it 560 individual and fiduciary. 05/29/20) individual and fiduciary payment voucher. Instructions for form it 560. Do not use for quarterly estimate or corpora te tax payments. Web instructions for form it 560c.

A9 re82f[1]

Web form it 560 c, composite return extension payment; 1.this form is to be used to submit any payment of tax when an extension is requested or enforced. Web instructions for form it 560 individual and fiduciary. Late filing and latepayment penalties together cannot exceed 25%. Instructions for form it 560.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Form 700, georgia partnership return; Web form it 560 c, composite return extension payment; Web instructions for form it 560c. 1.this form is to be used to submit any payment of tax when an extension is requested or enforced.

Web Instructions For Form It 560 Individual And Fiduciary.

This form is for income earned in tax year 2022, with tax returns due in april. Web instructions for form it 560 individual and fiduciary. We last updated the corporate extension. 2.the amount paid with this form should be.

Complete The Name And Address Field Located On The Upper Right.

Web instructions for form it 560c 1.this form is to be used to submit any payment of tax when an extension is requested or enforced. 05/29/20) individual and fiduciary payment voucher. Form 700, schedule 7, modifications and georgia total income, are allocated. Georgia department of revenue processing center.

2.The Amount Paid With This Form Should Be.

Web instructions for form it 560 individual and fiduciary. Instructions for form it 560. Late filing and latepayment penalties together cannot exceed 25%. Name or name of fiduciary and address:

![A9 re82f[1]](https://image.slidesharecdn.com/a9re82f1-130109182349-phpapp02/95/a9-re82f1-18-638.jpg?cb=1357756218)