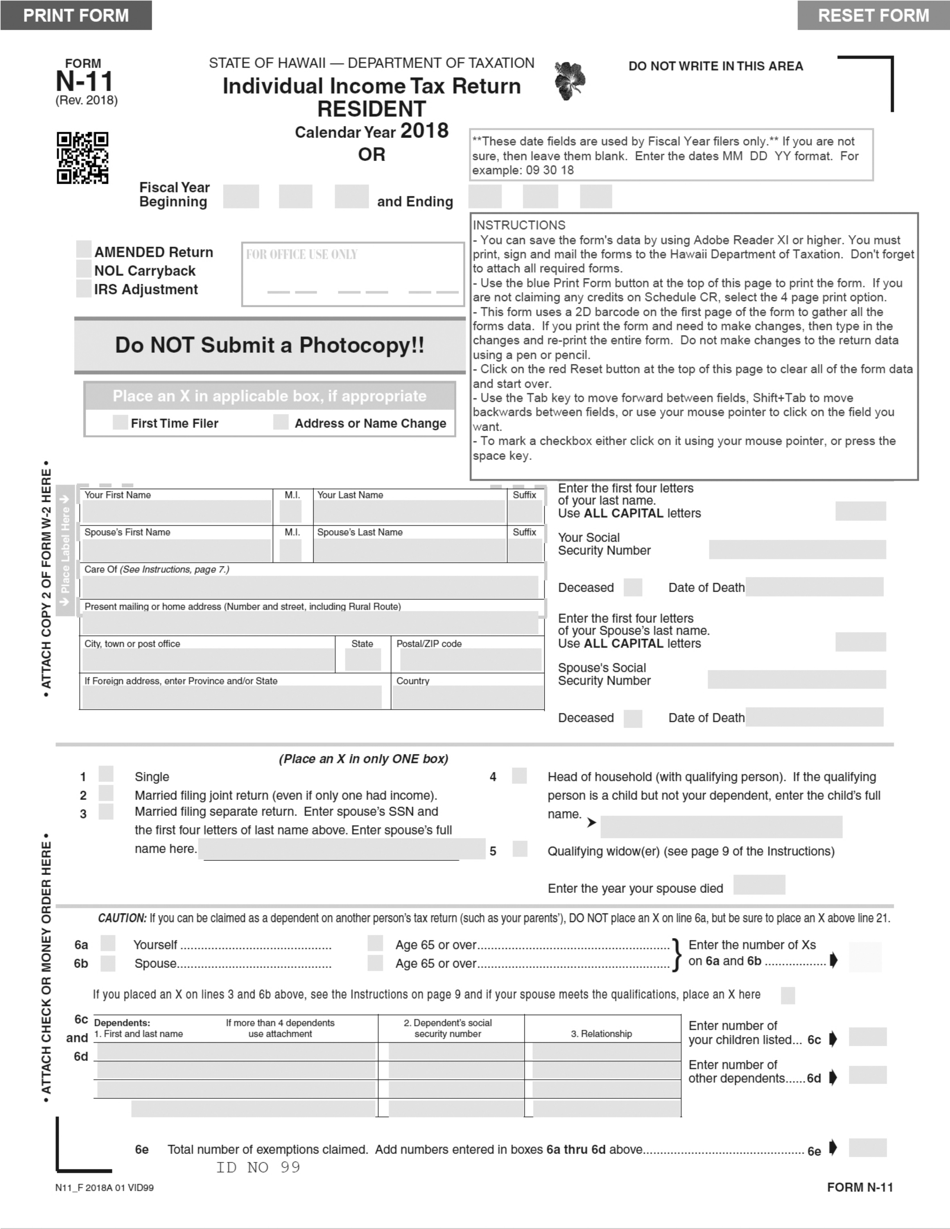

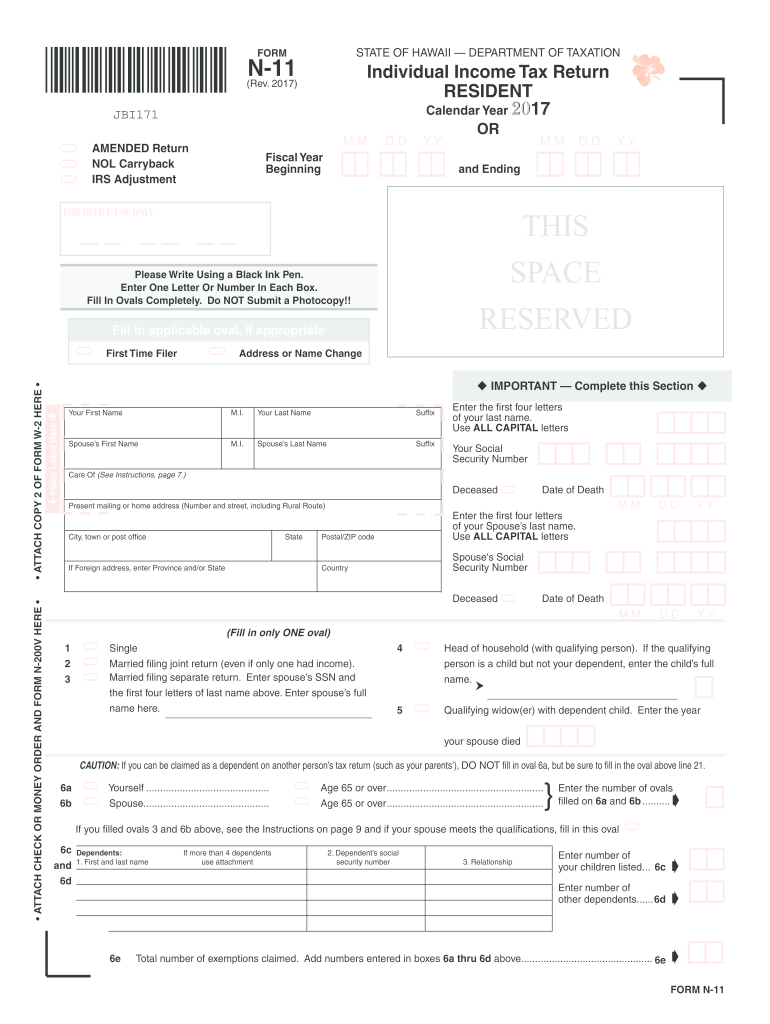

Form N-11 Hawaii

Form N-11 Hawaii - Edit your form n 11 form online type text, add images, blackout confidential details, add comments, highlights and more. 2021) n11_i 2021a 01 vid01 state of hawaii — department of taxation do not write in this area individual income tax return resident. For information and guidance in its preparation, we have helpful publications and. Web 51 rows individual housing account. 2011) page 3 of 4 your social security number your spouse’s ssn name(s) as shown on return 25 if line 20 is $89,981 or less, multiply $1,040 by the total. For more information, visit our website at tax.hawaii.gov. Sign it in a few clicks draw your signature, type it,. Web honolulu, hawaii permit no. We last updated the individual income tax return (resident form) in. Page 2 changes to note † hawaii has adopted the federal provision.

Drug deaths nationwide hit a record. Shareholder’s share of income, credits, deductions, etc. We last updated the individual income tax return (resident form) in. Web the basic income tax form for hawaii residents. However, if you are active military and you are stationed in hawaii, you are not subject to hawaii. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web honolulu, hawaii permit no. Web the hearing was particularly timely, because the u.s. 2011) page 3 of 4 your social security number your spouse’s ssn name(s) as shown on return 25 if line 20 is $89,981 or less, multiply $1,040 by the total. Web honolulu, hawaii permit no.

We last updated the individual income tax return (resident form) in. Complete, edit or print tax forms instantly. This form should be filled out electronically. Drug deaths nationwide hit a record. This form is for income earned in tax year 2022, with tax returns due in april 2023. 2011) page 3 of 4 your social security number your spouse’s ssn name(s) as shown on return 25 if line 20 is $89,981 or less, multiply $1,040 by the total. Web honolulu, hawaii permit no. This form should be filled out electronically. Complete, edit or print tax forms instantly. Edit your form n 11 form online type text, add images, blackout confidential details, add comments, highlights and more.

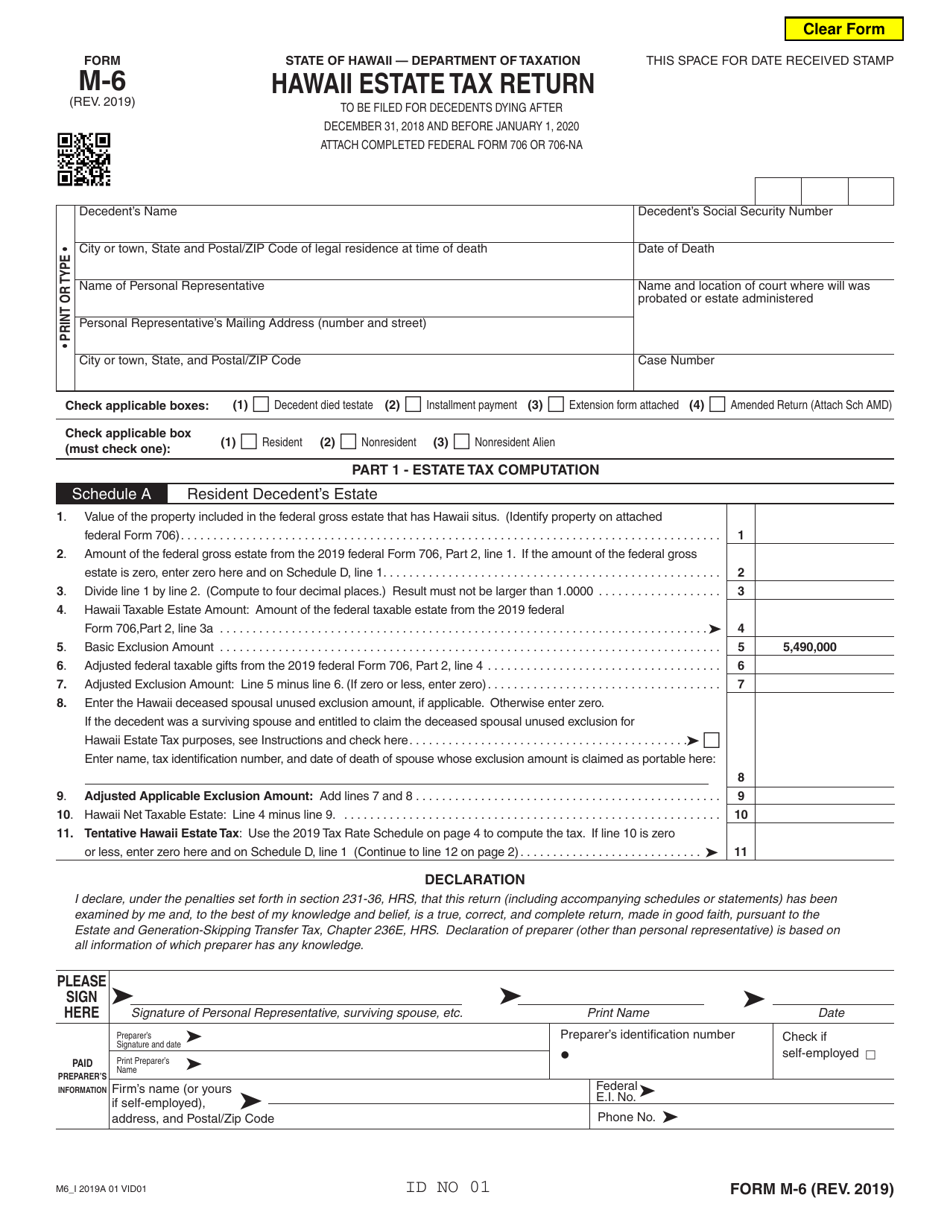

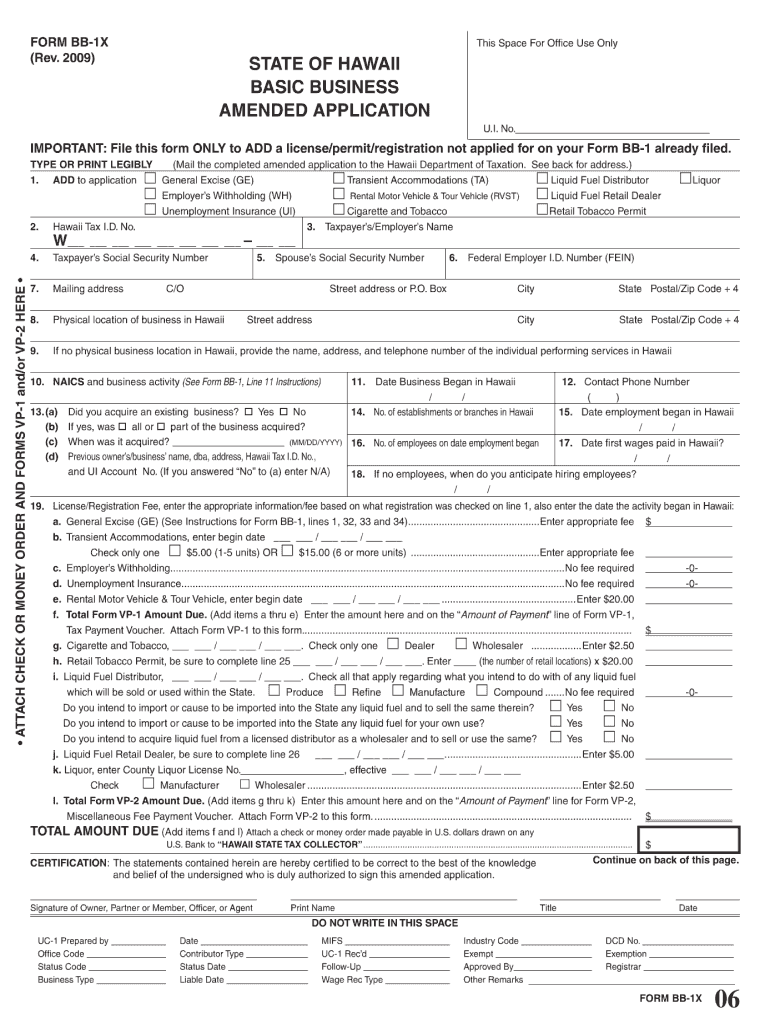

Form M6 Download Fillable PDF or Fill Online Hawaii Estate Tax Return

Web 51 rows individual housing account. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web the hearing was particularly timely, because the u.s. 2009) fiscal yearbeginning state of hawaii — department of taxation individual income tax return resident calendar year 2009 or m d d y. Web hawaii — department of.

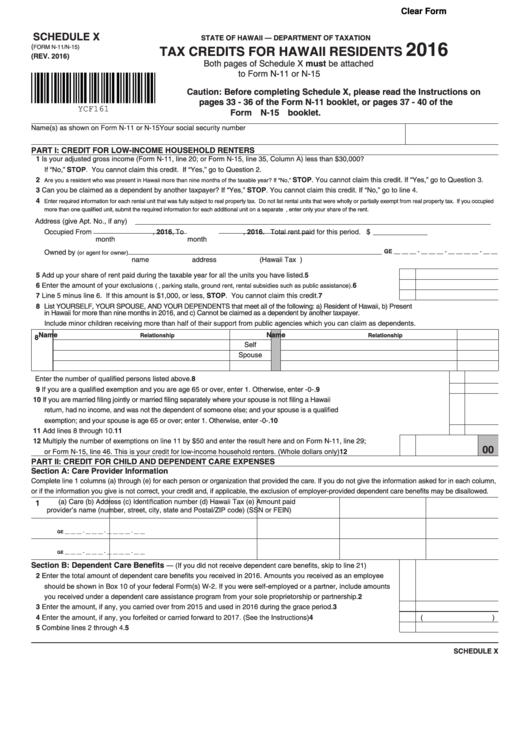

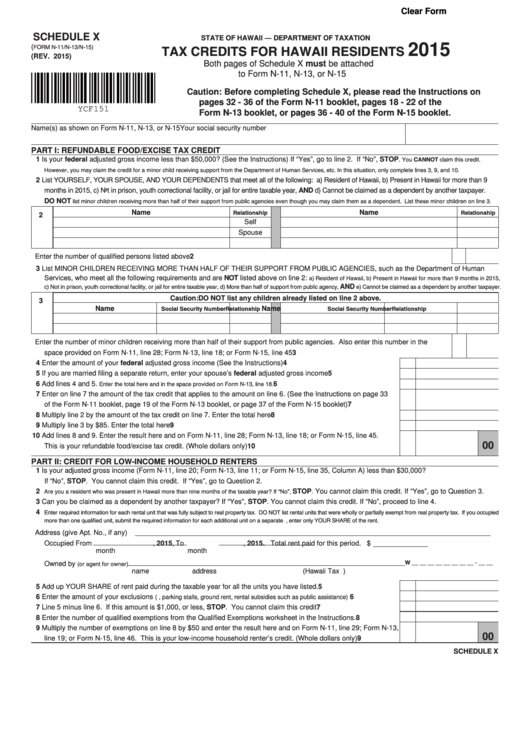

Fillable Form N11/n15 Tax Credits For Hawaii Residents printable

Is facing intensifying urgency to stop the worsening fentanyl epidemic. Web honolulu, hawaii permit no. Printable hawaii state tax forms for the 2022 tax. 2011) page 3 of 4 your social security number your spouse’s ssn name(s) as shown on return 25 if line 20 is $89,981 or less, multiply $1,040 by the total. Page 2 changes to note †.

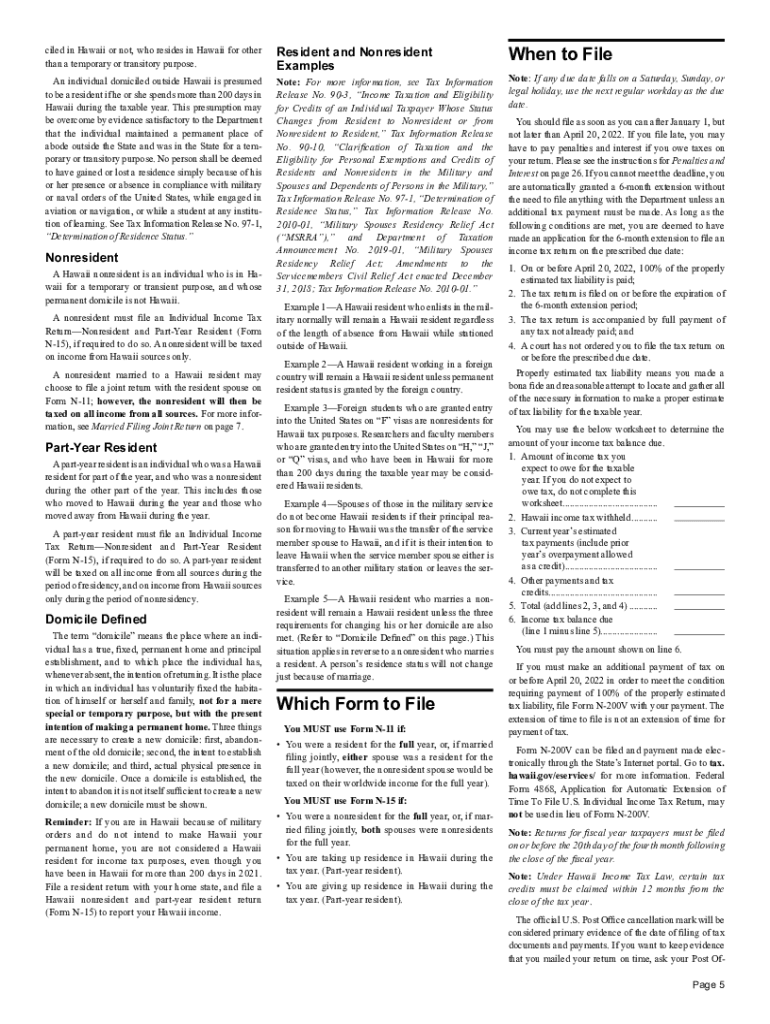

Hawaii Tax Instructions Fill Out and Sign Printable PDF Template

Sign it in a few clicks draw your signature, type it,. Web hawaii — department of taxation individual income tax return resident calendar year 2021 or n11_f 2021a 01 vid99 fiscal year beginning and ending. 2011) page 3 of 4 your social security number your spouse’s ssn name(s) as shown on return 25 if line 20 is $89,981 or less,.

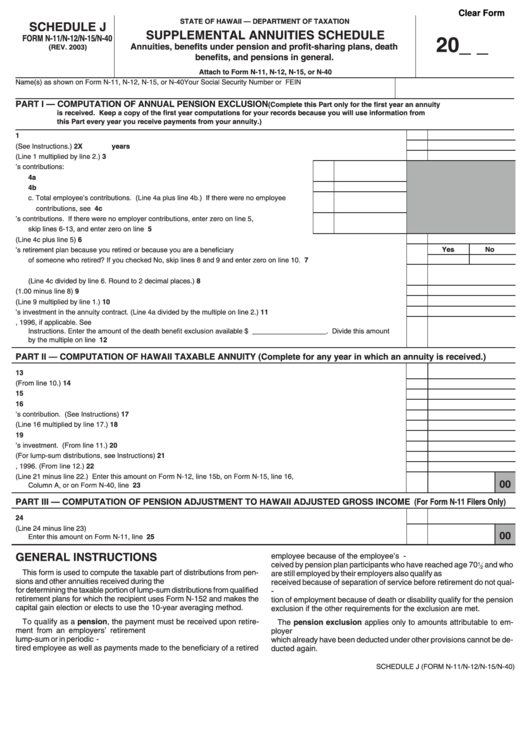

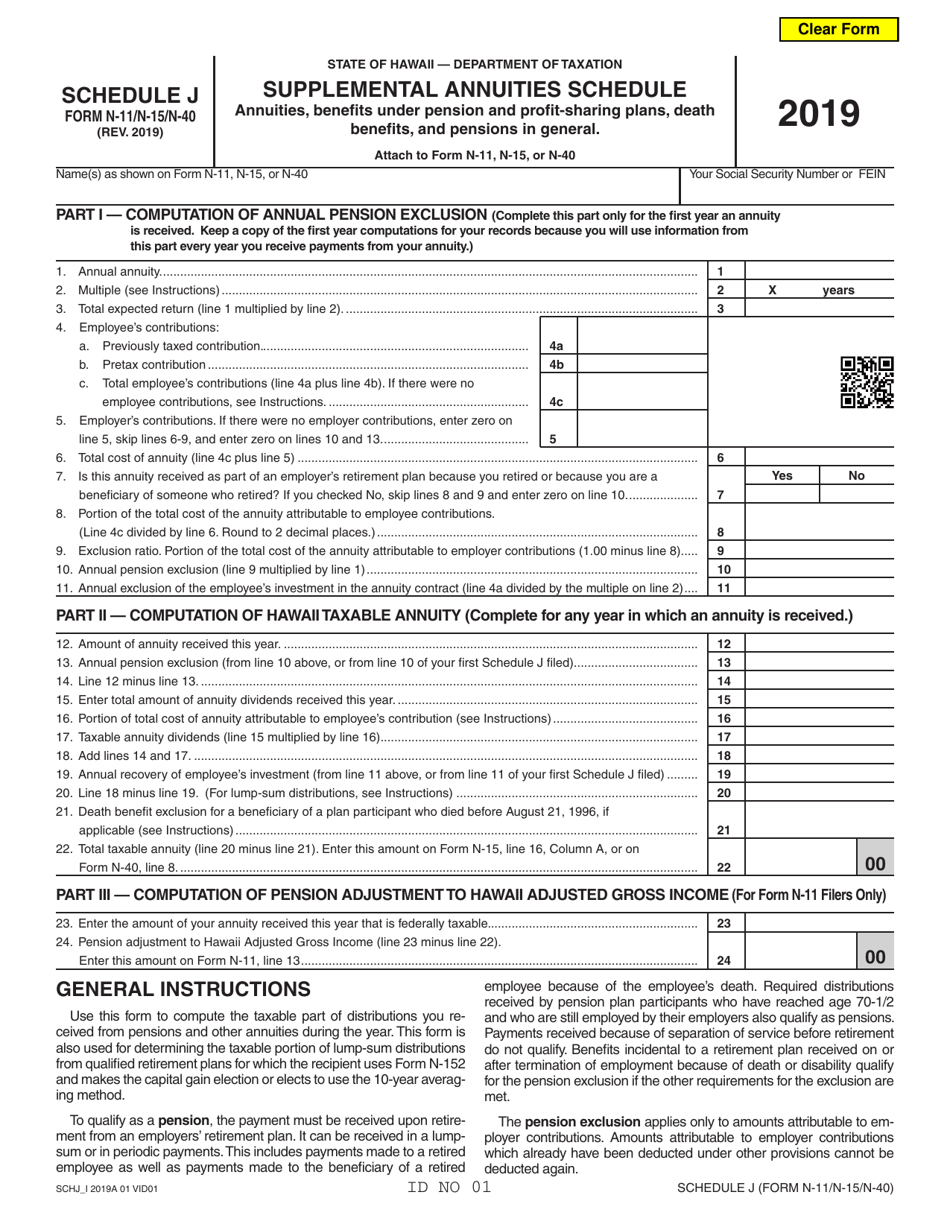

Schedule J (Form N11/n12/n15/n40) Supplemental Annuities Schedule

However, if you are active military and you are stationed in hawaii, you are not subject to hawaii. Web the hearing was particularly timely, because the u.s. Edit your form n 11 form online type text, add images, blackout confidential details, add comments, highlights and more. Web 51 rows individual housing account. Web the department of taxation has issued temporary.

Fillable Schedule X (Form N11/n13/n15) Tax Credits For Hawaii

Edit your form n 11 form online type text, add images, blackout confidential details, add comments, highlights and more. Web honolulu, hawaii permit no. Web honolulu, hawaii permit no. 2021) n11_i 2021a 01 vid01 state of hawaii — department of taxation do not write in this area individual income tax return resident. However, if you are active military and you.

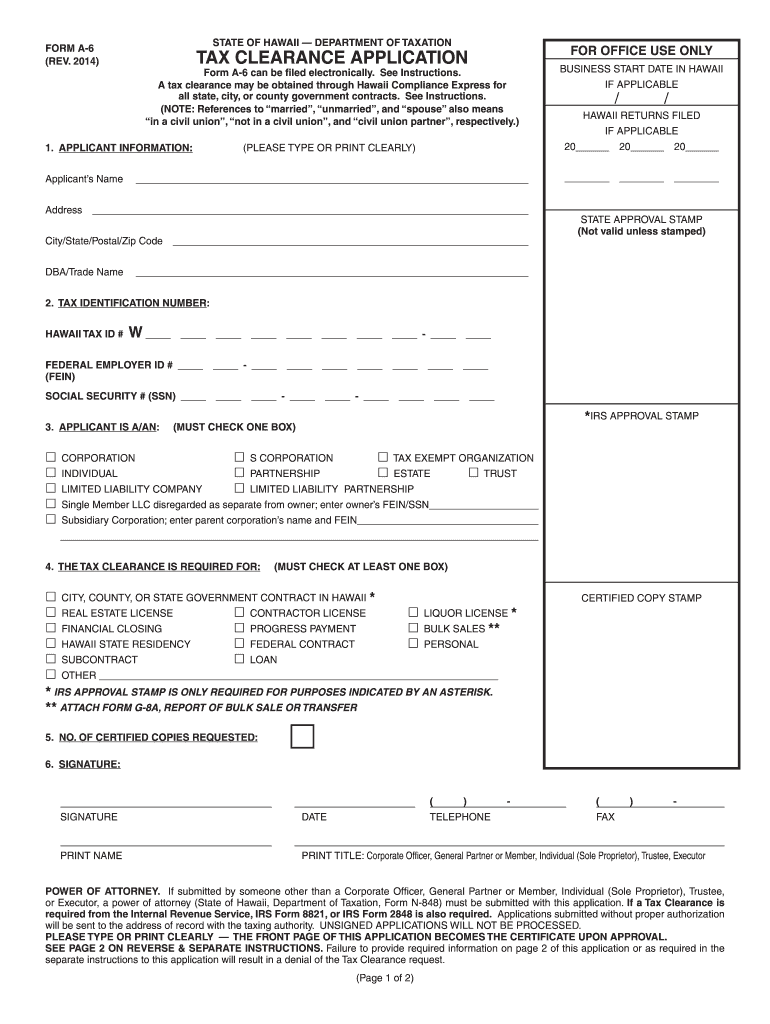

Hawaii Form A 6 Fill Out and Sign Printable PDF Template signNow

2021) n11_i 2021a 01 vid01 state of hawaii — department of taxation do not write in this area individual income tax return resident. For information and guidance in its preparation, we have helpful publications and. Complete, edit or print tax forms instantly. Edit your form n 11 form online type text, add images, blackout confidential details, add comments, highlights and.

Form N11 Download Fillable PDF or Fill Online Individual Tax

Web the department of taxation has issued temporary administrative rules that focus on the calculation of the renewable energy technologies income tax credit for other solar. Web hawaii — department of taxation individual income tax return resident calendar year 2021 or n11_f 2021a 01 vid99 fiscal year beginning and ending. 2021) n11_i 2021a 01 vid01 state of hawaii — department.

Hawaii tax forms Fill Out and Sign Printable PDF Template signNow

Sign it in a few clicks draw your signature, type it,. Drug deaths nationwide hit a record. Shareholder’s share of income, credits, deductions, etc. 2009) fiscal yearbeginning state of hawaii — department of taxation individual income tax return resident calendar year 2009 or m d d y. Printable hawaii state tax forms for the 2022 tax.

Form N11 (N15; N40) Schedule J Download Fillable PDF or Fill Online

Page 2 changes to note † hawaii has adopted the federal provision. For information and guidance in its preparation, we have helpful publications and. 2021) n11_i 2021a 01 vid01 state of hawaii — department of taxation do not write in this area individual income tax return resident. Printable hawaii state tax forms for the 2022 tax. This form is for.

Kararı nereden alınır N11 form

Sign it in a few clicks draw your signature, type it,. However, if you are active military and you are stationed in hawaii, you are not subject to hawaii. Web the department of taxation has issued temporary administrative rules that focus on the calculation of the renewable energy technologies income tax credit for other solar. Web 51 rows individual housing.

Printable Hawaii State Tax Forms For The 2022 Tax.

Web 51 rows individual housing account. Web the basic income tax form for hawaii residents. 2021) n11_i 2021a 01 vid01 state of hawaii — department of taxation do not write in this area individual income tax return resident. Web the hearing was particularly timely, because the u.s.

This Form Should Be Filled Out Electronically.

Web honolulu, hawaii permit no. For information and guidance in its preparation, we have helpful publications and. Page 2 changes to note † hawaii has adopted the federal provision. Complete, edit or print tax forms instantly.

Is Facing Intensifying Urgency To Stop The Worsening Fentanyl Epidemic.

This form should be filled out electronically. Drug deaths nationwide hit a record. For more information, visit our website at tax.hawaii.gov. Sign it in a few clicks draw your signature, type it,.

2009) Fiscal Yearbeginning State Of Hawaii — Department Of Taxation Individual Income Tax Return Resident Calendar Year 2009 Or M D D Y.

Complete, edit or print tax forms instantly. We last updated the individual income tax return (resident form) in. Shareholder’s share of income, credits, deductions, etc. 2011) page 3 of 4 your social security number your spouse’s ssn name(s) as shown on return 25 if line 20 is $89,981 or less, multiply $1,040 by the total.