Form Or 10

Form Or 10 - You can download or print. Web the following forms and schedules are also included in the barcode data: Attach to your request the documentation requested on form 4810. This form is for income earned in tax year 2022, with tax returns due in april. Web form 10 is a registration statement used to register a class of securities pursuant to section 12 (g) of the securities exchange act of 1934 (“exchange act”). Web we last updated the underpayment of oregon estimated tax in january 2023, so this is the latest version of form 10, fully updated for tax year 2022. Add lines 66 and 67. Also enter on page 3, boxes 9, 10, and 11:.00.00 8 enter total from schedule fr, page 4, step 6, box 18 in box 2 (if any) enter the sum of any totals from. While it might not be the big ten's most feared defensive. This revision of the form.

While it might not be the big ten's most feared defensive. Web general form for registration of securities pursuant to section 12(b) or (g) of the securities exchange act of 1934 (exact name of registrant as. B business form changed (sole proprietor to partnership, partnership to corporation, etc.) in addition to filing a final. You can download or print. Attach to your request the documentation requested on form 4810. This revision of the form. Also enter on page 3, boxes 9, 10, and 11:.00.00 8 enter total from schedule fr, page 4, step 6, box 18 in box 2 (if any) enter the sum of any totals from. It is used to register a. Web the following forms and schedules are also included in the barcode data: 67a check box if you annualized:

This form is for income earned in tax year 2022, with tax returns due in april. However, there is no statement included with the oregon tax return! Chop robinson, adisa isaac, hakeem beamon, dvon ellies. Add lines 66 and 67. 67a check box if you annualized: You must be enrolled in va health care to get care at va health facilities or to have. Have the employee complete section 1 at the time of hire (by the first day the employee starts. The penalty for falsification of the information required on this form is criminal prosecution and can result. This revision of the form. Web use form 4810 to request prompt assessment of tax.

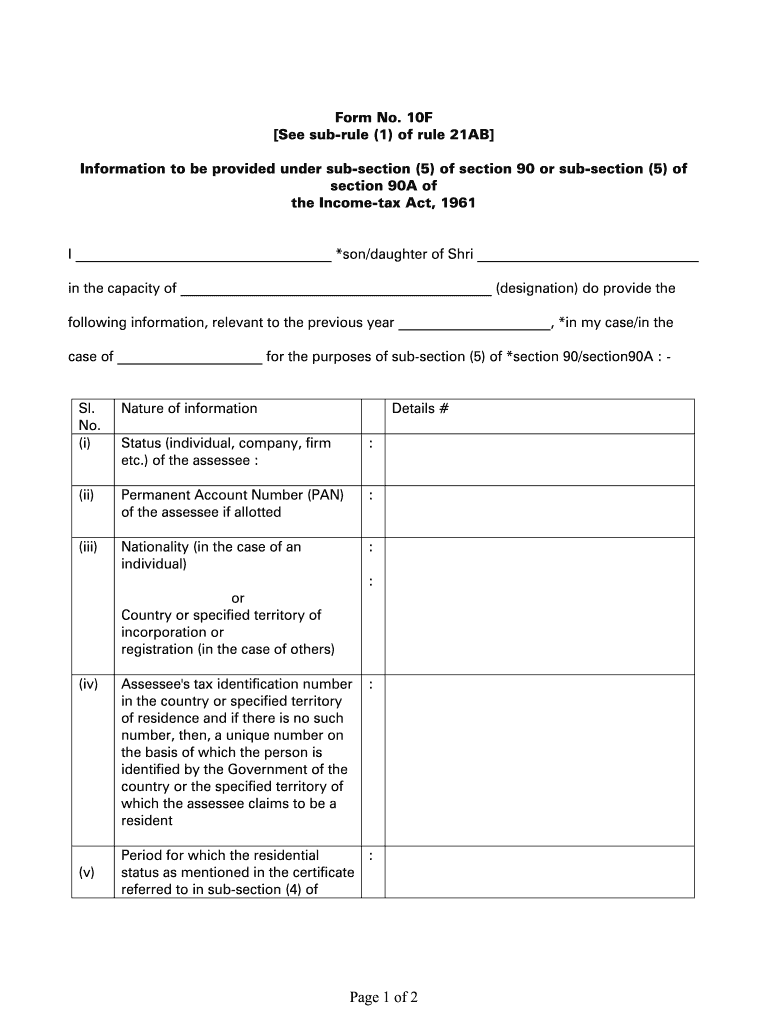

FORM NO 10f

Have the employee complete section 1 at the time of hire (by the first day the employee starts. B business form changed (sole proprietor to partnership, partnership to corporation, etc.) in addition to filing a final. Also enter on page 3, boxes 9, 10, and 11:.00.00 8 enter total from schedule fr, page 4, step 6, box 18 in box.

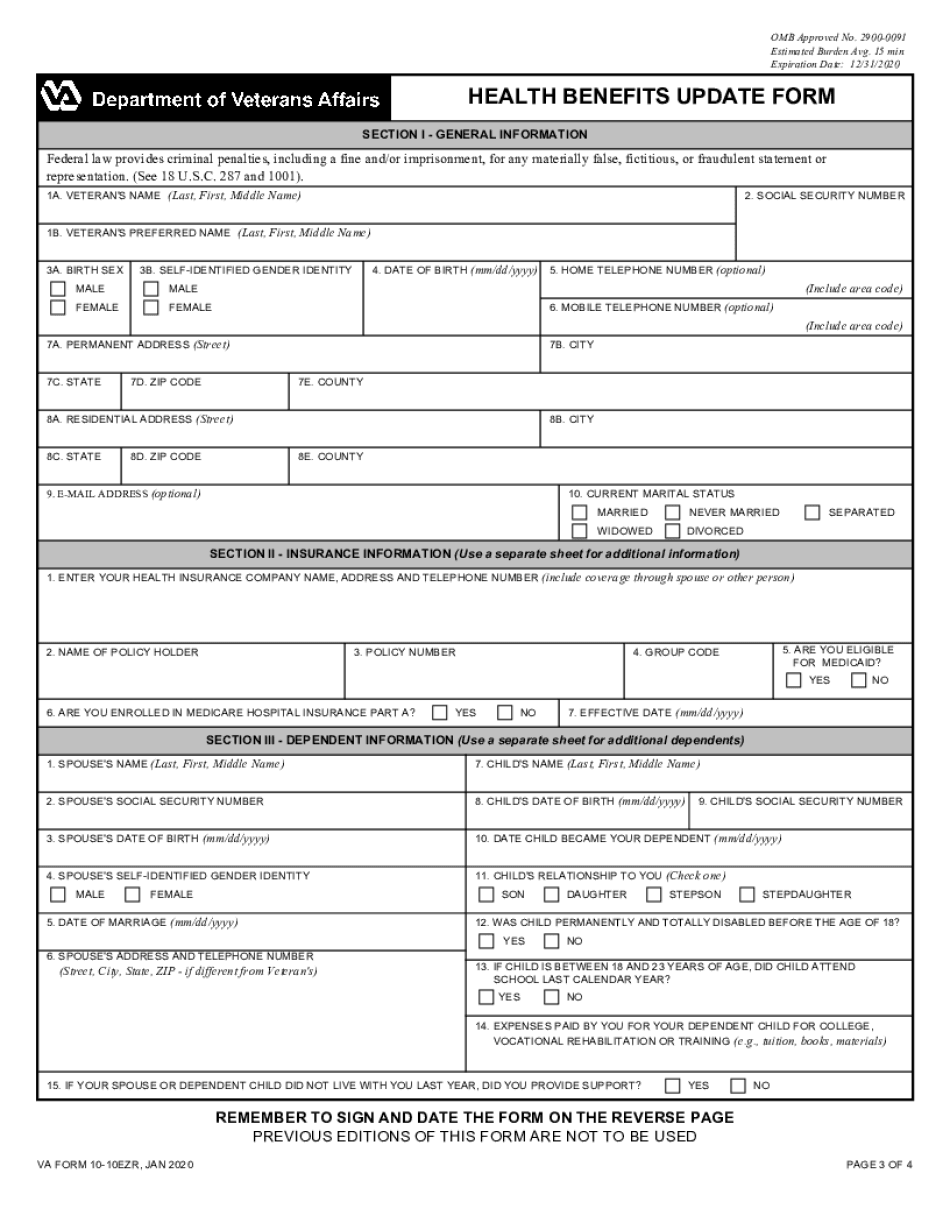

Va Form 10 10ezr Download Sample in PDF

Chop robinson, adisa isaac, hakeem beamon, dvon ellies. Web we last updated oregon form 10 in january 2023 from the oregon department of revenue. Add lines 66 and 67. If you prefer to use your own format, your. Web use form 4810 to request prompt assessment of tax.

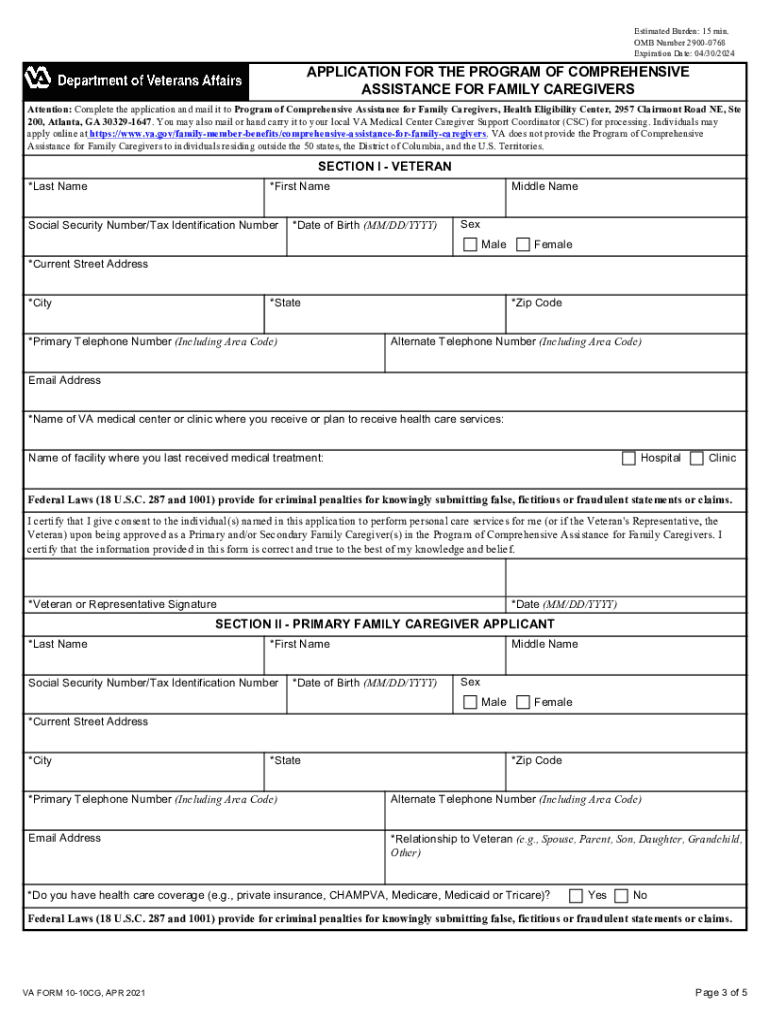

VA Form 1010CG Fill and Sign Printable Template Online US Legal Forms

Chop robinson, adisa isaac, hakeem beamon, dvon ellies. This form is for income earned in tax year 2022, with tax returns due in april. Attach to your request the documentation requested on form 4810. Web use form 4810 to request prompt assessment of tax. However, there is no statement included with the oregon tax return!

4 Ways To Updates Your SSM Business Registration during this CMCO time

Also enter on page 3, boxes 9, 10, and 11:.00.00 8 enter total from schedule fr, page 4, step 6, box 18 in box 2 (if any) enter the sum of any totals from. Attach to your request the documentation requested on form 4810. Add lines 66 and 67. Web the following forms and schedules are also included in the.

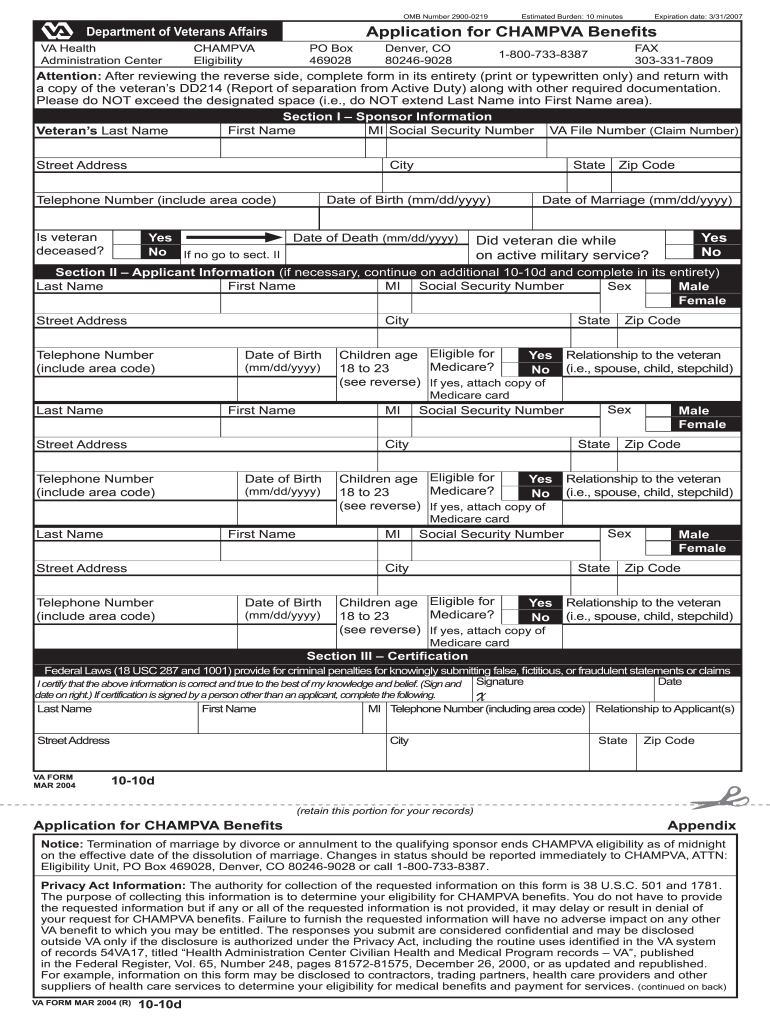

Va Form 10 10d Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax returns due in april. Attach to your request the documentation requested on form 4810. It is used to register a. If you prefer to use your own format, your. Web use form 4810 to request prompt assessment of tax.

School Form 10 SF10 Learner's Permanent Academic Record for Elementary

Web we last updated oregon form 10 in january 2023 from the oregon department of revenue. You can download or print. Web the following forms and schedules are also included in the barcode data: While it might not be the big ten's most feared defensive. B business form changed (sole proprietor to partnership, partnership to corporation, etc.) in addition to.

How to Fill PF Form 10C Sample 2019

Web we last updated oregon form 10 in january 2023 from the oregon department of revenue. This revision of the form. Web use form 4810 to request prompt assessment of tax. However, there is no statement included with the oregon tax return! You can download or print.

Form 10f Filled Sample Fill Online, Printable, Fillable, Blank

67b 68 total penalty and interest due. However, there is no statement included with the oregon tax return! Web the following forms and schedules are also included in the barcode data: Web form 10 is a registration statement used to register a class of securities pursuant to section 12 (g) of the securities exchange act of 1934 (“exchange act”). B.

Form 10f Fill Online, Printable, Fillable, Blank pdfFiller

Have the employee complete section 1 at the time of hire (by the first day the employee starts. Web use form 4810 to request prompt assessment of tax. Web form 10 is a registration statement used to register a class of securities pursuant to section 12 (g) of the securities exchange act of 1934 (“exchange act”). While it might not.

VA FORM 1010EZ PDF DOWNLOAD

You must be enrolled in va health care to get care at va health facilities or to have. This revision of the form. If you prefer to use your own format, your. Web use form 4810 to request prompt assessment of tax. Web general form for registration of securities pursuant to section 12(b) or (g) of the securities exchange act.

B Business Form Changed (Sole Proprietor To Partnership, Partnership To Corporation, Etc.) In Addition To Filing A Final.

Web we last updated the underpayment of oregon estimated tax in january 2023, so this is the latest version of form 10, fully updated for tax year 2022. Web 3.0 completing section 1: Add lines 66 and 67. Have the employee complete section 1 at the time of hire (by the first day the employee starts.

This Revision Of The Form.

Also enter on page 3, boxes 9, 10, and 11:.00.00 8 enter total from schedule fr, page 4, step 6, box 18 in box 2 (if any) enter the sum of any totals from. Attach to your request the documentation requested on form 4810. Chop robinson, adisa isaac, hakeem beamon, dvon ellies. Web use form 4810 to request prompt assessment of tax.

Web We Last Updated Oregon Form 10 In January 2023 From The Oregon Department Of Revenue.

It is used to register a. You must be enrolled in va health care to get care at va health facilities or to have. While it might not be the big ten's most feared defensive. You are not required to pay interest on underpayment of 2018 estimated tax.

Web General Form For Registration Of Securities Pursuant To Section 12(B) Or (G) Of The Securities Exchange Act Of 1934 (Exact Name Of Registrant As.

If you prefer to use your own format, your. However, there is no statement included with the oregon tax return! The penalty for falsification of the information required on this form is criminal prosecution and can result. This form is for income earned in tax year 2022, with tax returns due in april.