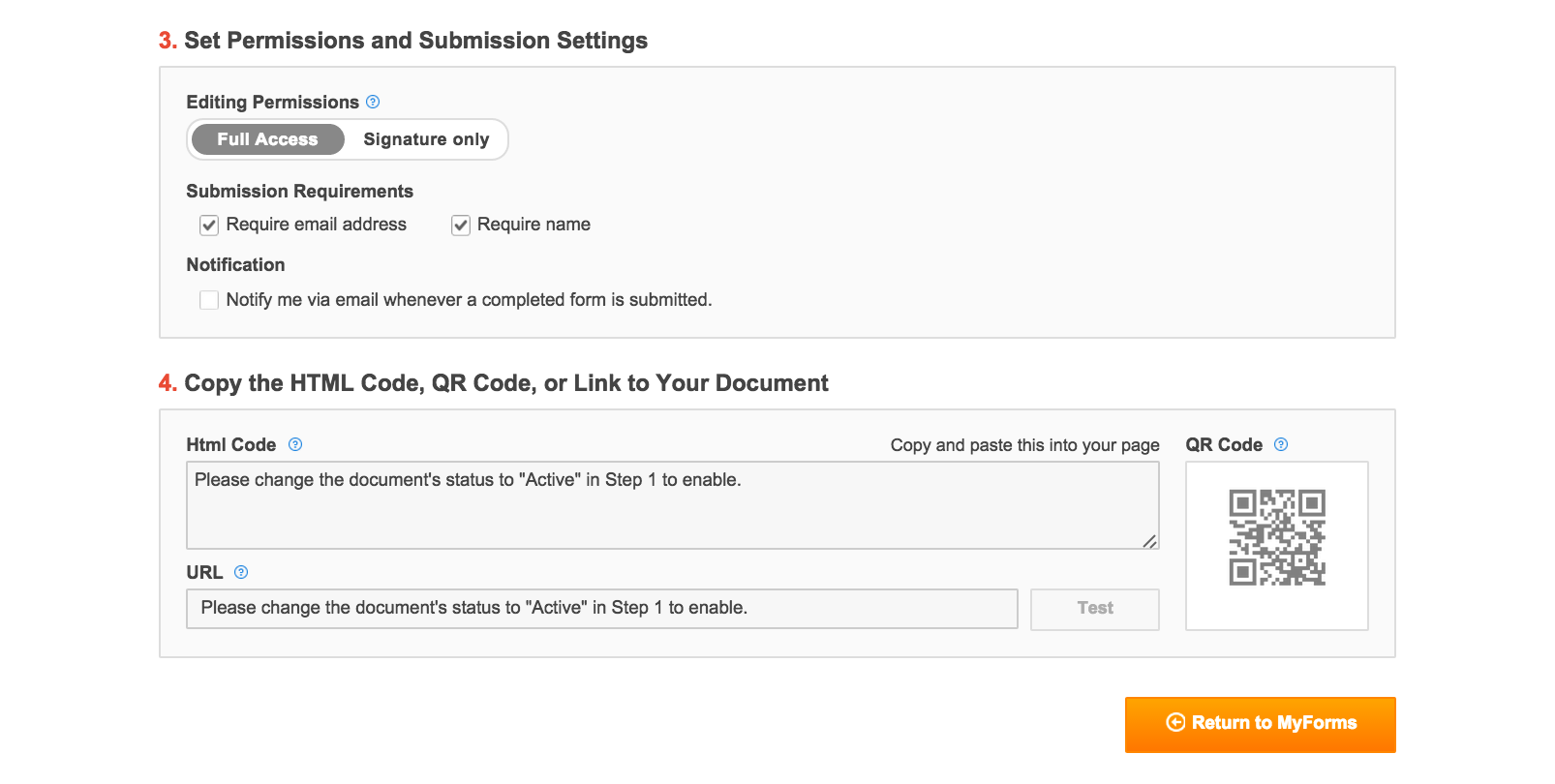

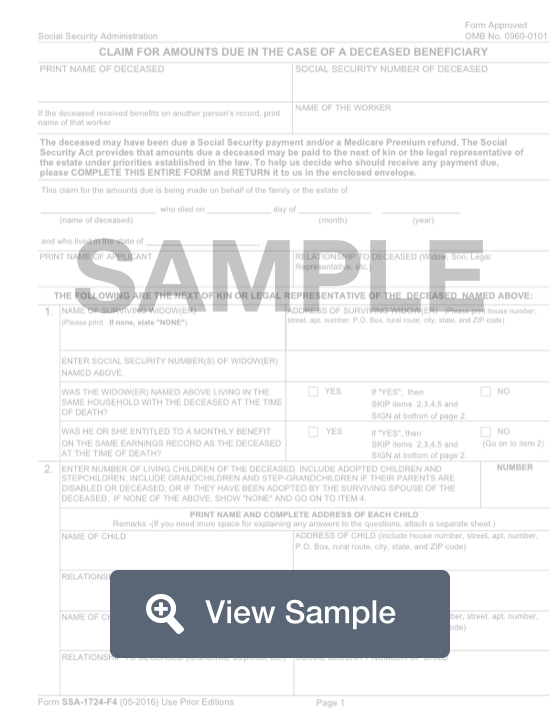

Form Ssa-1724-F4

Form Ssa-1724-F4 - The information you provide will enable us to account for the beneficiary's payments and ensures that the beneficiary's needs are being met. Web a deceased beneficiary may have been due a social security payment at the time of death. I don't understand what that situation might be. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. Claim for amounts due in the case of a deceased beneficiary. Web social security forms | social security administration forms all forms are free. Generally, it is the individual's legal next of. Form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. People should file this form when a deceased relative was due to receive a payment from the social. Web step by step instructions if you’re handling the affairs of a deceased relative, you should know that unpaid social security benefits or medicare refunds might go to the decedent’s estate.

Web step by step instructions if you’re handling the affairs of a deceased relative, you should know that unpaid social security benefits or medicare refunds might go to the decedent’s estate. Web a deceased beneficiary may have been due a social security payment at the time of death. The information you provide will enable us to account for the beneficiary's payments and ensures that the beneficiary's needs are being met. Web social security forms | social security administration forms all forms are free. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. If the deceased received benefits on another person's record, print. People should file this form when a deceased relative was due to receive a payment from the social. Generally, it is the individual's legal next of. Form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. I don't understand what that situation might be.

Web a deceased beneficiary may have been due a social security payment at the time of death. Generally, it is the individual's legal next of. Not all forms are listed. I don't understand what that situation might be. Claim for amounts due in the case of a deceased beneficiary. People should file this form when a deceased relative was due to receive a payment from the social. Print name of deceased social security number of deceased. The information you provide will enable us to account for the beneficiary's payments and ensures that the beneficiary's needs are being met. A deceased beneficiary may have been due a social security payment and/or a medicare premium refund prior to or at the time of death. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate.

How to Fill Out Form SSA1724F4 YouTube

Form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. If the deceased received benefits on another person's record, print. Generally, it is the individual's legal next of. The information you provide will enable us to account.

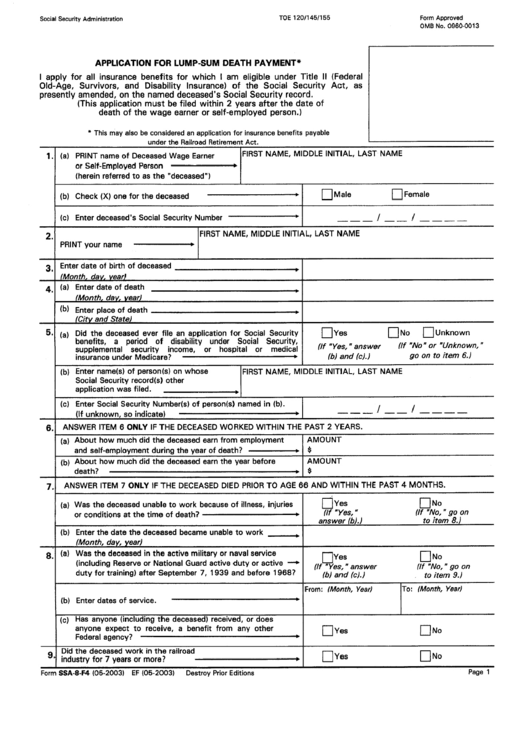

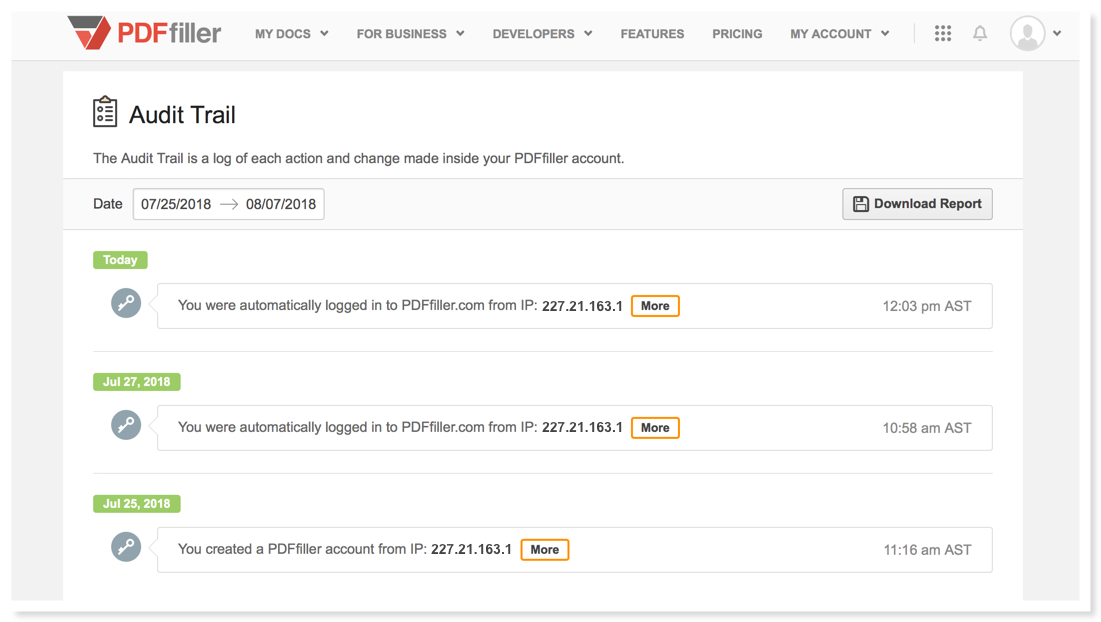

bottom pdfFiller Blog

Not all forms are listed. A deceased beneficiary may have been due a social security payment and/or a medicare premium refund prior to or at the time of death. I don't understand what that situation might be. People should file this form when a deceased relative was due to receive a payment from the social. Web a deceased beneficiary may.

SSA7050F4 2021 Fill and Sign Printable Template Online US Legal Forms

Not all forms are listed. Form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. If the deceased received benefits on another person's record, print. Claim for amounts due in the case of a deceased beneficiary. The.

howcanyoubuildandeffectivesalesfunnel pdfFiller Blog

Generally, it is the individual's legal next of. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. I don't understand what that situation might be. Web a deceased beneficiary may have been due a social security payment at the time of death. A deceased beneficiary may have been due a social.

Fillable Form Ssa1724F4 Claim For Amounts Due In The Case Of A

People should file this form when a deceased relative was due to receive a payment from the social. Web step by step instructions if you’re handling the affairs of a deceased relative, you should know that unpaid social security benefits or medicare refunds might go to the decedent’s estate. Web a deceased beneficiary may have been due a social security.

Form SSA1724 Claims on Behalf of a Deceased Person

If the deceased received benefits on another person's record, print. Web step by step instructions if you’re handling the affairs of a deceased relative, you should know that unpaid social security benefits or medicare refunds might go to the decedent’s estate. Claim for amounts due in the case of a deceased beneficiary. Not all forms are listed. The information you.

SSA1724F4 Claim for Amounts due in case of a Deceased Beneficiary

Web step by step instructions if you’re handling the affairs of a deceased relative, you should know that unpaid social security benefits or medicare refunds might go to the decedent’s estate. Web a deceased beneficiary may have been due a social security payment at the time of death. Not all forms are listed. If the deceased received benefits on another.

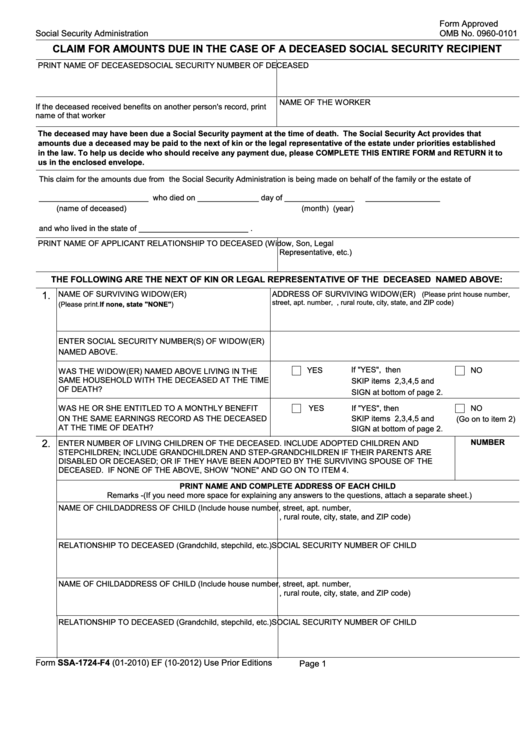

Form Ssa8F4 Application For LumpSum Death Payment printable pdf

Not all forms are listed. Web step by step instructions if you’re handling the affairs of a deceased relative, you should know that unpaid social security benefits or medicare refunds might go to the decedent’s estate. Claim for amounts due in the case of a deceased beneficiary. Form ssa 1724, claim for amounts due in the case of a deceased.

Fillable Form SSA1724 Free Printable PDF Sample FormSwift

Form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. If the deceased received benefits on another person's record, print. Generally, it is the individual's legal next of. Print name of deceased social security number of deceased..

mariamiscreenshot2 pdfFiller Blog

Print name of deceased social security number of deceased. The information you provide will enable us to account for the beneficiary's payments and ensures that the beneficiary's needs are being met. A deceased beneficiary may have been due a social security payment and/or a medicare premium refund prior to or at the time of death. Web social security forms |.

I Don't Understand What That Situation Might Be.

Form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. Web step by step instructions if you’re handling the affairs of a deceased relative, you should know that unpaid social security benefits or medicare refunds might go to the decedent’s estate. A deceased beneficiary may have been due a social security payment and/or a medicare premium refund prior to or at the time of death. Web a deceased beneficiary may have been due a social security payment at the time of death.

Not All Forms Are Listed.

Print name of deceased social security number of deceased. If the deceased received benefits on another person's record, print. Web social security forms | social security administration forms all forms are free. The information you provide will enable us to account for the beneficiary's payments and ensures that the beneficiary's needs are being met.

We May Pay Amounts Due A Deceased Beneficiary To A Family Member Or Legal Representative Of The Estate.

Claim for amounts due in the case of a deceased beneficiary. Generally, it is the individual's legal next of. People should file this form when a deceased relative was due to receive a payment from the social.