Form T2200 Canada

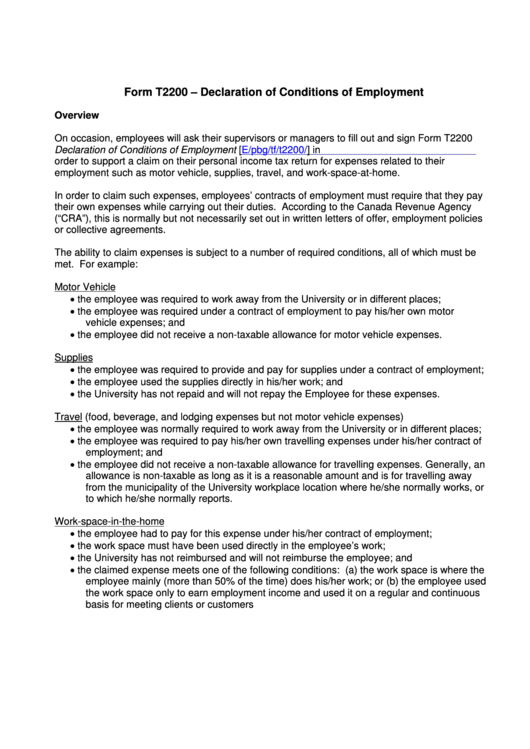

Form T2200 Canada - Web have received a signed t2200 or t2200s form from their employer the cra has confirmed the employer’s requirement for an employee to work from home may be a. For best results, download and open this form in adobe reader. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. The cra has responded to us on a number of outstanding questions relating to home office expenses. Save money and time with pdffiller Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Quickbooks online can help you maximize. Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. We’ve heard that the form t2200s covers the flat rate.

Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. As of now the t2200. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. This is an amendment of form. Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Web have received a signed t2200 or t2200s form from their employer the cra has confirmed the employer’s requirement for an employee to work from home may be a. We’ve heard that the form t2200s covers the flat rate. Save money and time with pdffiller Ad download or email t2200 & more fillable forms, register and subscribe now!

For best results, download and open this form in adobe reader. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Ad download or email t2200 & more fillable forms, register and subscribe now! Save money and time with pdffiller Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,. The cra has responded to us on a number of outstanding questions relating to home office expenses. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. This is an amendment of form. Quickbooks online can help you maximize.

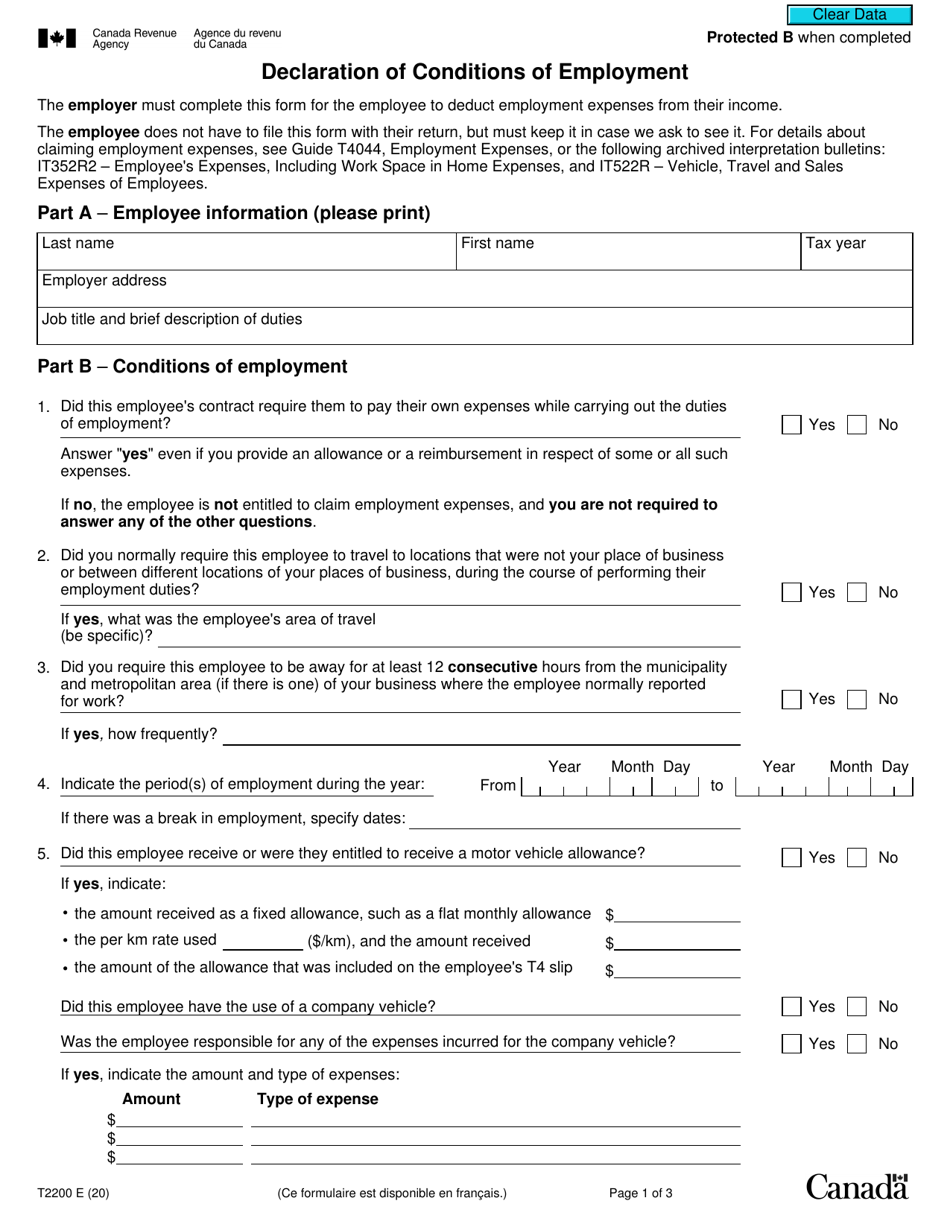

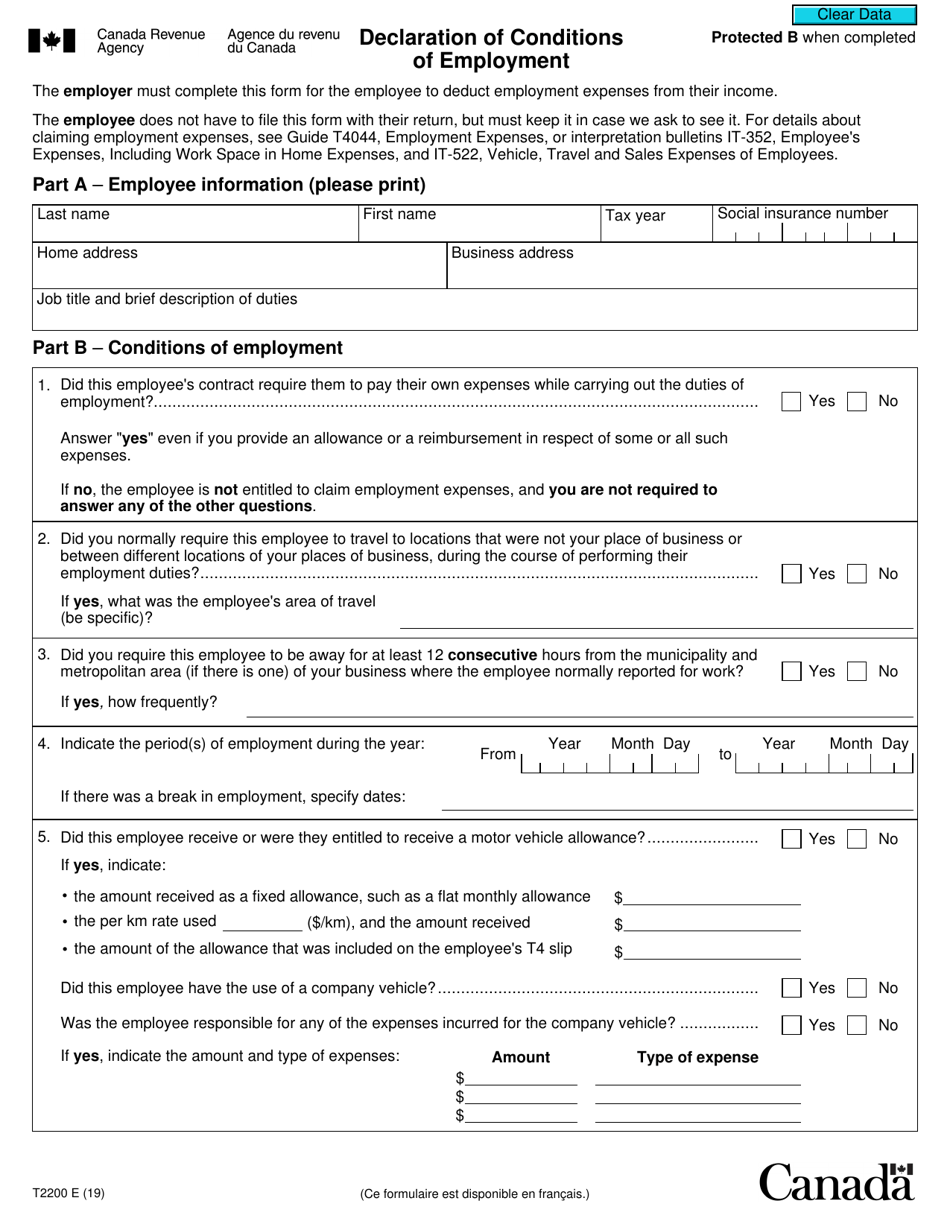

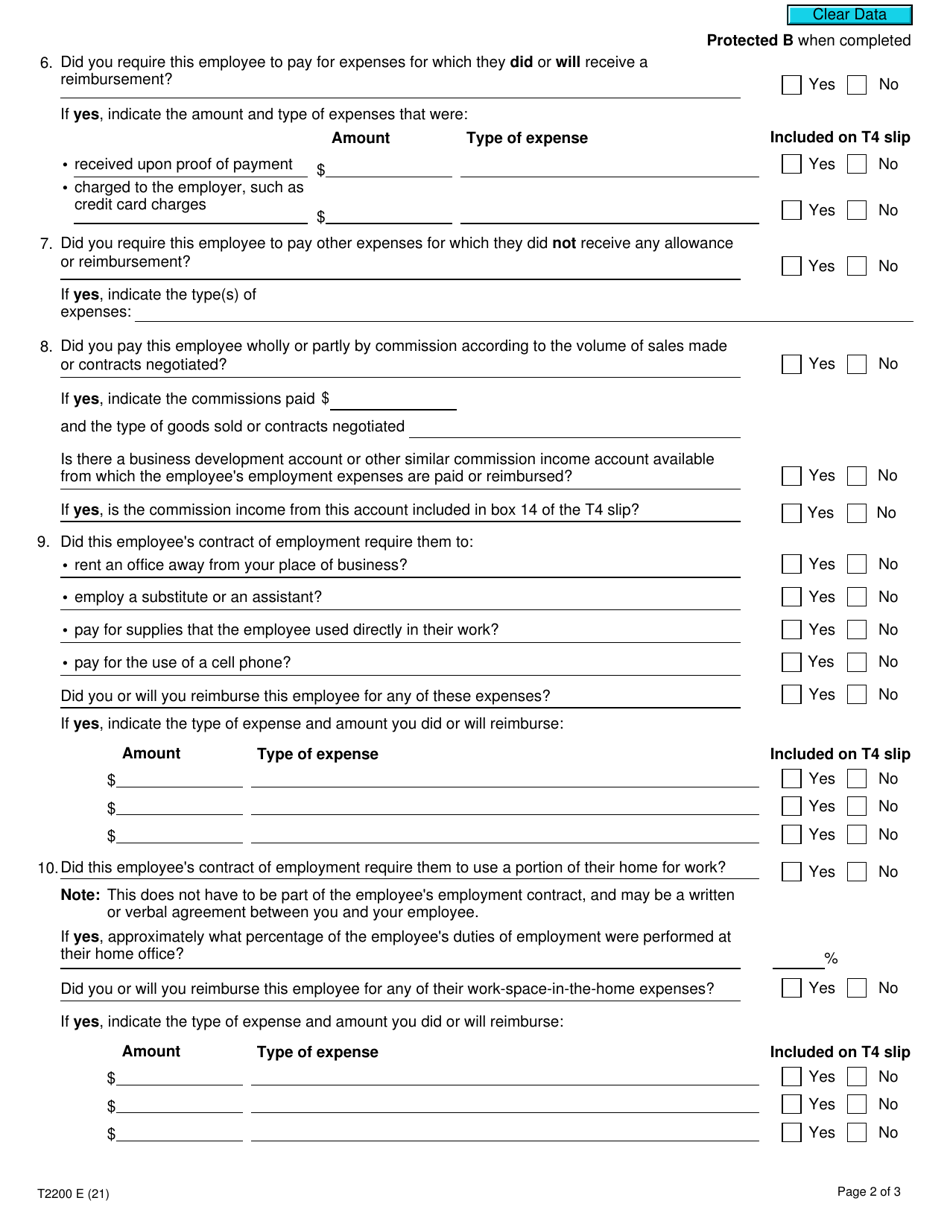

Form T2200 Download Fillable PDF or Fill Online Declaration of

Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. Web have received a signed t2200 or t2200s form from their employer the cra has confirmed the employer’s requirement for.

What You Need To Know About T2200 Forms Knit People Small Business Blog

Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. As of now the t2200. Quickbooks online can help you maximize. This is an amendment of form. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to.

Everything You Need to Know about the T2200 Form

Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. Web have received a signed t2200 or t2200s form from their employer the cra has confirmed the employer’s requirement for an employee to work from home may be a..

Form T2200 Download Fillable PDF or Fill Online Declaration of

Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. Ad download or.

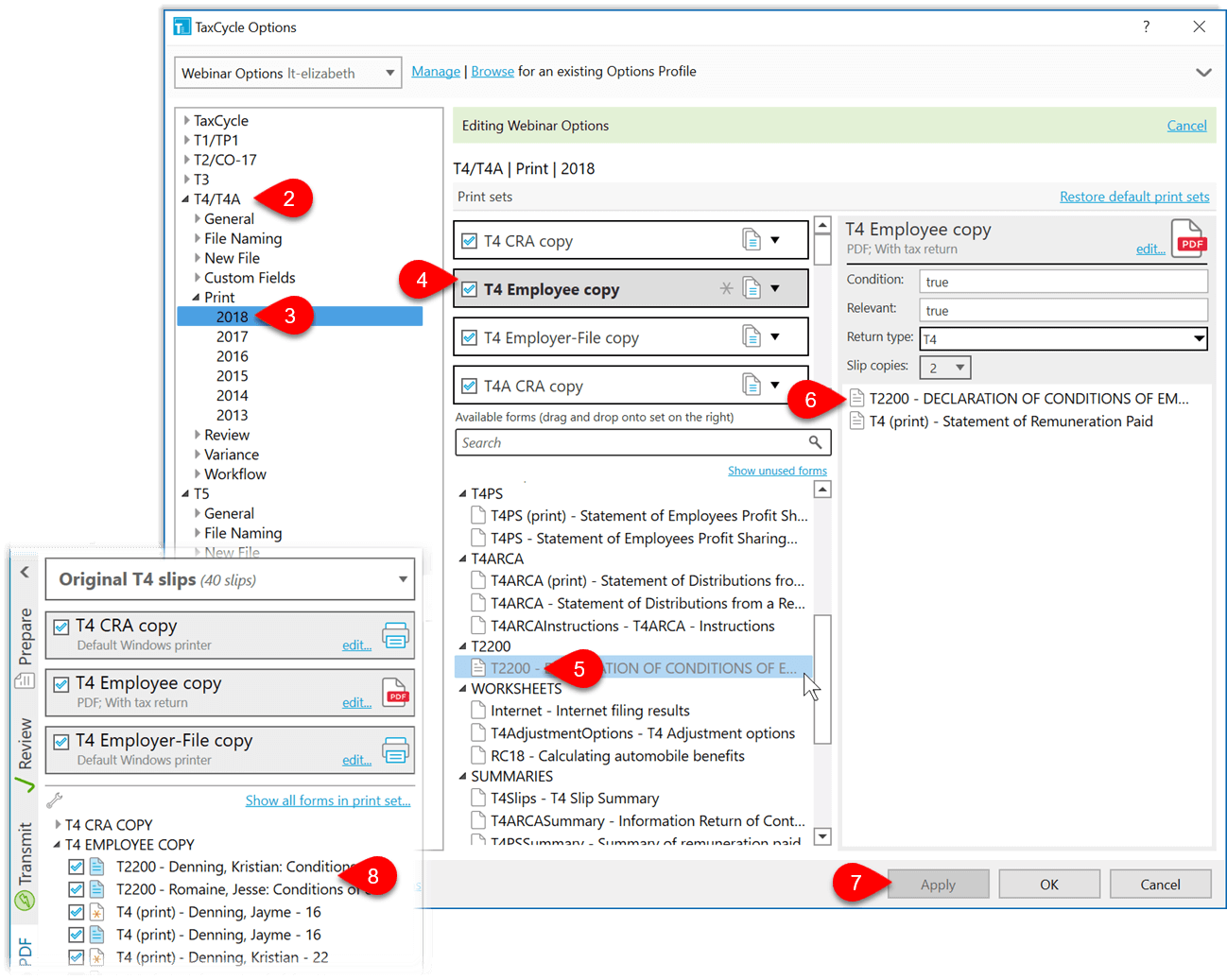

T2200 and T2200S Conditions of Employment TaxCycle

For best results, download and open this form in adobe reader. Web update on home office expenses and form t2200. The cra has responded to us on a number of outstanding questions relating to home office expenses. Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such.

Form T2200 Download Fillable PDF or Fill Online Declaration of

The cra has responded to us on a number of outstanding questions relating to home office expenses. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. For best results, download and open this form in adobe reader. Quickbooks online can help you maximize. Ad download.

T2200 Form Fillable Fill Out and Sign Printable PDF Template signNow

Save money and time with pdffiller We’ve heard that the form t2200s covers the flat rate. Quickbooks online can help you maximize. As of now the t2200. Ad download or email t2200 & more fillable forms, register and subscribe now!

Form T2200 Declaration Of Conditions Of Employment printable pdf download

This is an amendment of form. Web on september 11, 2020, the cra held a consultation via the canadian chamber of commerce to get feedback on the short t2200 form. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Web filling out form.

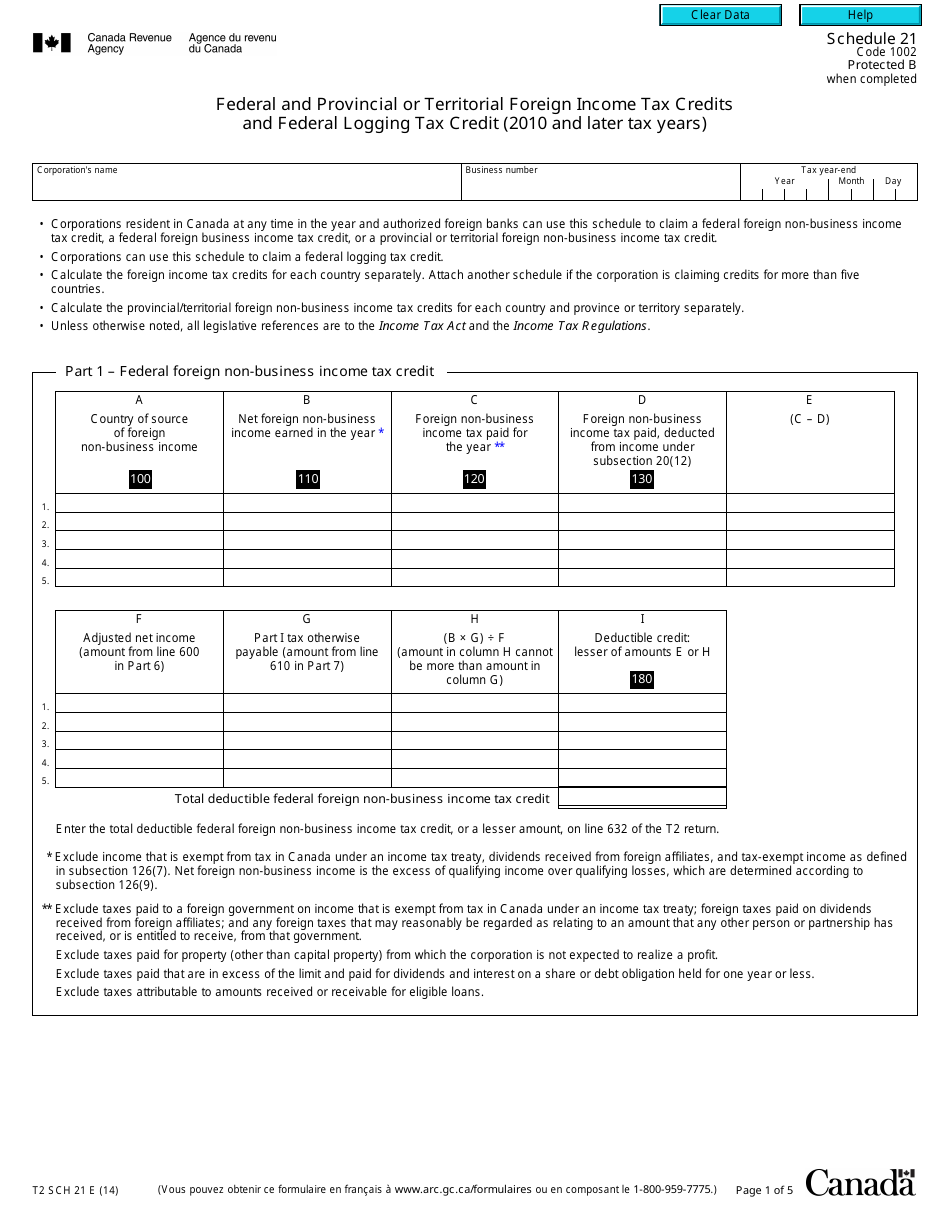

Form T2 Schedule 21 Download Fillable PDF or Fill Online Federal and

Ad download or email t2200 & more fillable forms, register and subscribe now! As of now the t2200. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses. The cra has responded to us on a number of outstanding questions relating to home office expenses. We’ve heard that the form t2200s covers the flat.

Form T2200 Download Fillable PDF or Fill Online Declaration of

This is an amendment of form. Quickbooks online can help you maximize. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. We’ve heard that the form t2200s covers the flat rate. Save money and time with pdffiller

The Cra Has Responded To Us On A Number Of Outstanding Questions Relating To Home Office Expenses.

As of now the t2200. Ad download or email t2200 & more fillable forms, register and subscribe now! Save money and time with pdffiller For best results, download and open this form in adobe reader.

Web Have Received A Signed T2200 Or T2200S Form From Their Employer The Cra Has Confirmed The Employer’s Requirement For An Employee To Work From Home May Be A.

Web the t2200 form, also referred to as the declaration of conditions of employment in canada, is a supplemental tax form that does not need to be filed with your return. Web form t2200 allows employees to claim expenses that they may incur to do their job, including running a home office, mobile phone expenses and car. Ad download or email t2200 & more fillable forms, register and subscribe now! Web form t2200 is a form provided by your employer that allows you to claim eligible expenses incurred to perform your job, such as your home office, mobile phone,.

Web On September 11, 2020, The Cra Held A Consultation Via The Canadian Chamber Of Commerce To Get Feedback On The Short T2200 Form.

We’ve heard that the form t2200s covers the flat rate. This is an amendment of form. Web update on home office expenses and form t2200. Web filling out form t2200 helps your employees maximize their tax deductions for unreimbursed employment expenses.