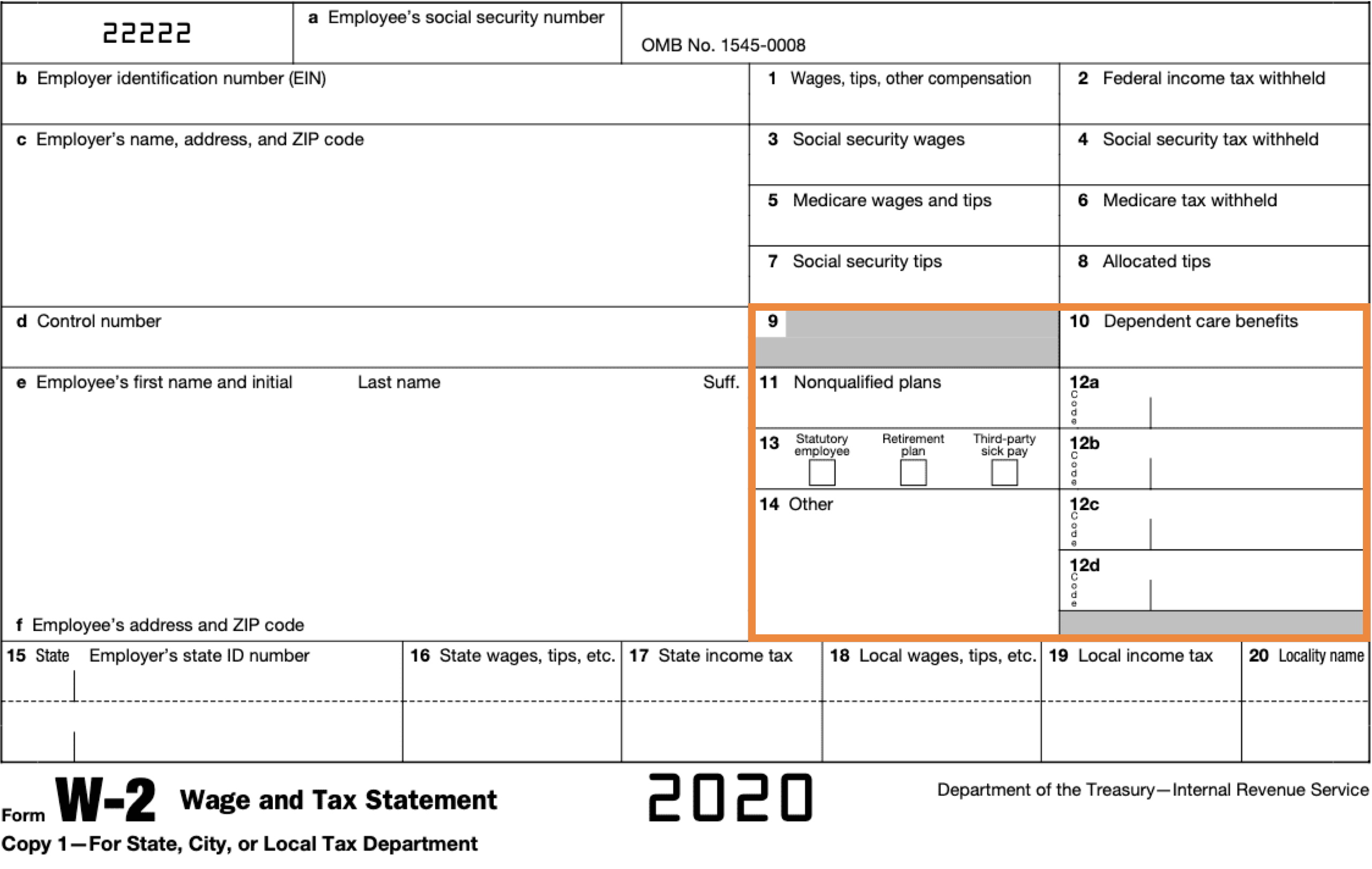

Form W 2 Box 13

Form W 2 Box 13 - Bb, ee).(code d, e, g,. If you are still not certain, check. Copy a for social security administration —. Box 13 — if the “retirement plan” box is checked, special limits can apply to the amount of traditional ira contributions you can. These boxes will be checked or left unchecked by your. To enter information in box 13, you must first set values in different sections of. This box is designed to report pay that is not subject to. Statutory employee, retirement plan, and third party sick pay. File this form to request a valid employer. Due to age/years of service—even though the.

These boxes will be checked or left unchecked by your. Web see instructions for box 12. Copy a for social security administration —. File this form to request a valid employer. Due to age/years of service—even though the. Box 13 — if the “retirement plan” box is checked, special limits can apply to the amount of traditional ira contributions you can. To enter information in box 13, you must first set values in different sections of. Bb, ee).(code d, e, g,. Statutory employee, retirement plan, and third party sick pay. Statutory employee, retirement plan, and third party sick pay.

To enter information in box 13, you must first set values in different sections of. Bb, ee).(code d, e, g,. If you are still not certain, check. Web see instructions for box 12. Statutory employee, retirement plan, and third party sick pay. Due to age/years of service—even though the. These boxes will be checked or left unchecked by your. Statutory employee, retirement plan, and third party sick pay. File this form to request a valid employer. Box 13 — if the “retirement plan” box is checked, special limits can apply to the amount of traditional ira contributions you can.

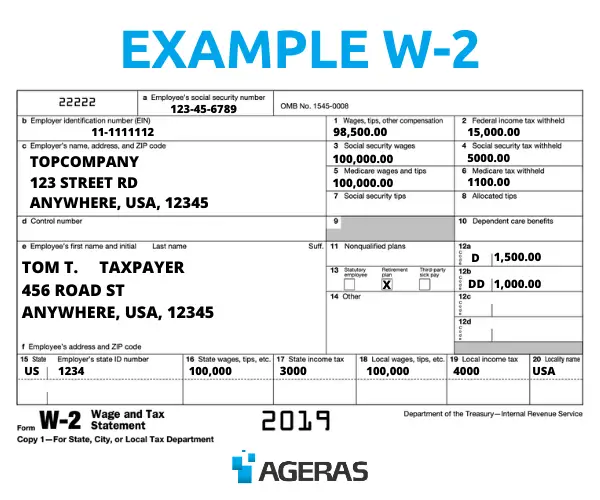

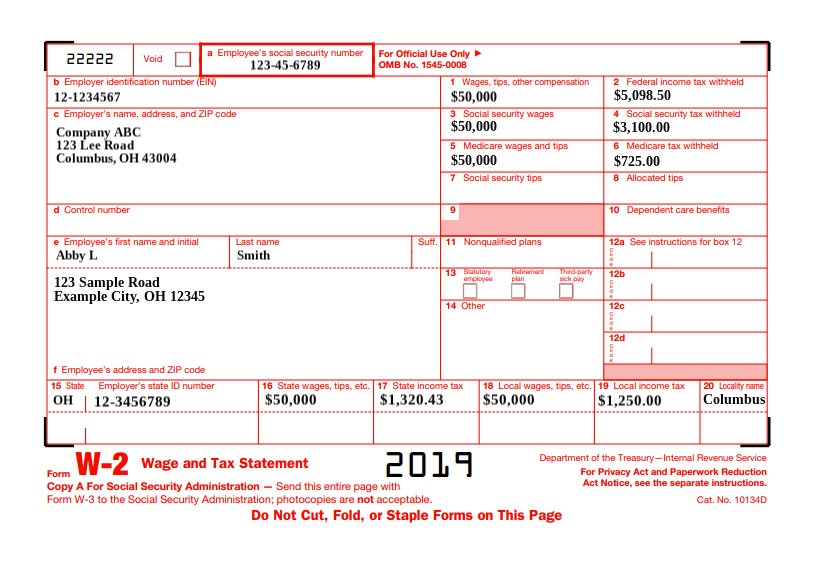

Understanding your W2 Help Center

Bb, ee).(code d, e, g,. If you are still not certain, check. Copy a for social security administration —. These boxes will be checked or left unchecked by your. This box is designed to report pay that is not subject to.

What Is Form W2? An Employer's Guide to the W2 Tax Form Gusto

Statutory employee, retirement plan, and third party sick pay. Bb, ee).(code d, e, g,. Web see instructions for box 12. File this form to request a valid employer. If you are still not certain, check.

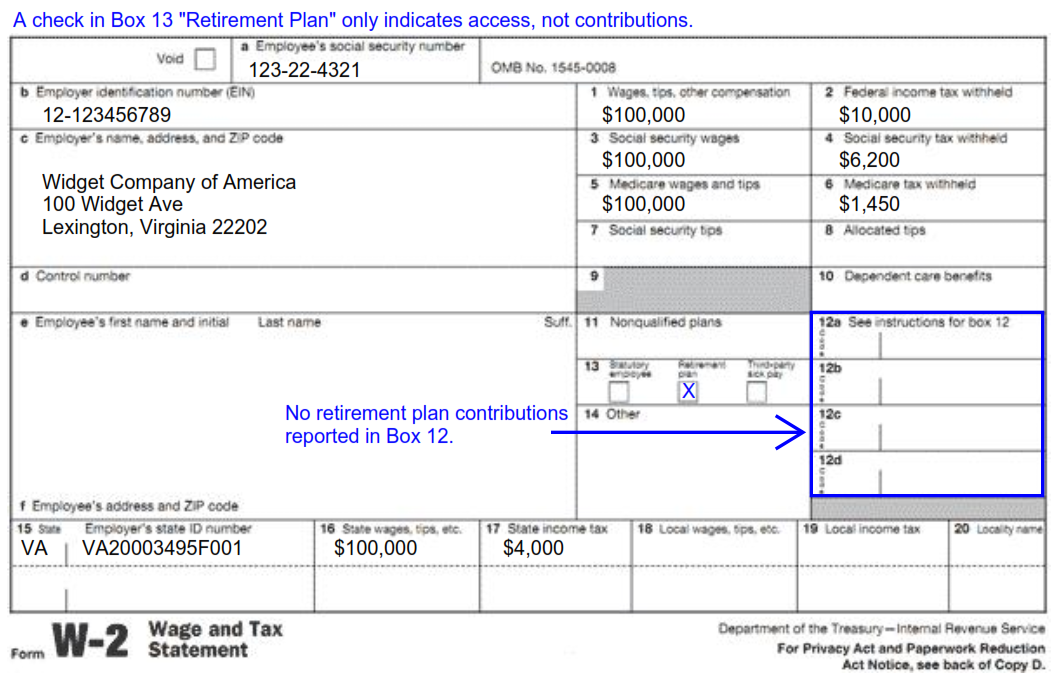

Understanding Tax Season Form W2 Remote Financial Planner

To enter information in box 13, you must first set values in different sections of. These boxes will be checked or left unchecked by your. Box 13 — if the “retirement plan” box is checked, special limits can apply to the amount of traditional ira contributions you can. File this form to request a valid employer. Copy a for social.

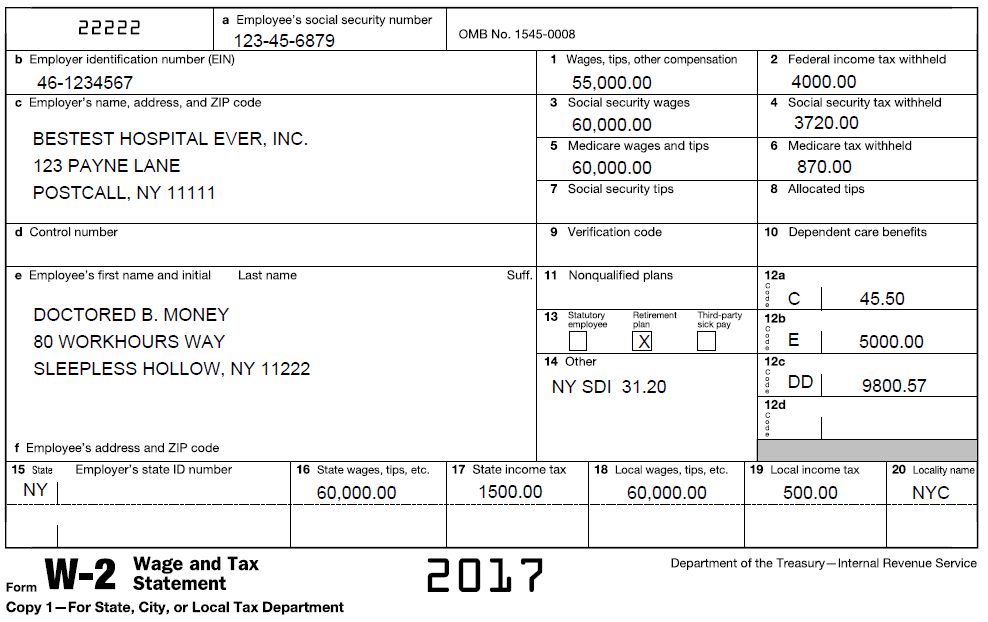

W2 — Doctored Money

Box 13 — if the “retirement plan” box is checked, special limits can apply to the amount of traditional ira contributions you can. Due to age/years of service—even though the. Statutory employee, retirement plan, and third party sick pay. Web see instructions for box 12. Copy a for social security administration —.

w2 forms Google Search Tax forms, W2 forms, Life insurance calculator

File this form to request a valid employer. Statutory employee, retirement plan, and third party sick pay. Box 13 — if the “retirement plan” box is checked, special limits can apply to the amount of traditional ira contributions you can. Copy a for social security administration —. Statutory employee, retirement plan, and third party sick pay.

How To Get W2 Wage And Tax Statement

To enter information in box 13, you must first set values in different sections of. File this form to request a valid employer. If you are still not certain, check. This box is designed to report pay that is not subject to. Due to age/years of service—even though the.

How To Find Federal Employer Identification Number On W2 Gallery

Box 13 — if the “retirement plan” box is checked, special limits can apply to the amount of traditional ira contributions you can. Statutory employee, retirement plan, and third party sick pay. Statutory employee, retirement plan, and third party sick pay. Web see instructions for box 12. File this form to request a valid employer.

Form W2 Everything You Ever Wanted To Know

File this form to request a valid employer. This box is designed to report pay that is not subject to. Bb, ee).(code d, e, g,. These boxes will be checked or left unchecked by your. To enter information in box 13, you must first set values in different sections of.

How to Read a W2 in 2022 An Easy BoxbyBox Breakdown Blue Lion

These boxes will be checked or left unchecked by your. Copy a for social security administration —. This box is designed to report pay that is not subject to. To enter information in box 13, you must first set values in different sections of. Statutory employee, retirement plan, and third party sick pay.

Tax Topic 28 Divorced or Separated Individuals

Bb, ee).(code d, e, g,. Copy a for social security administration —. To enter information in box 13, you must first set values in different sections of. Statutory employee, retirement plan, and third party sick pay. Box 13 — if the “retirement plan” box is checked, special limits can apply to the amount of traditional ira contributions you can.

Box 13 — If The “Retirement Plan” Box Is Checked, Special Limits Can Apply To The Amount Of Traditional Ira Contributions You Can.

Due to age/years of service—even though the. Statutory employee, retirement plan, and third party sick pay. If you are still not certain, check. These boxes will be checked or left unchecked by your.

To Enter Information In Box 13, You Must First Set Values In Different Sections Of.

Bb, ee).(code d, e, g,. File this form to request a valid employer. Statutory employee, retirement plan, and third party sick pay. Copy a for social security administration —.

Web See Instructions For Box 12.

This box is designed to report pay that is not subject to.