Generated Fcf In The Most Recent Completed Year

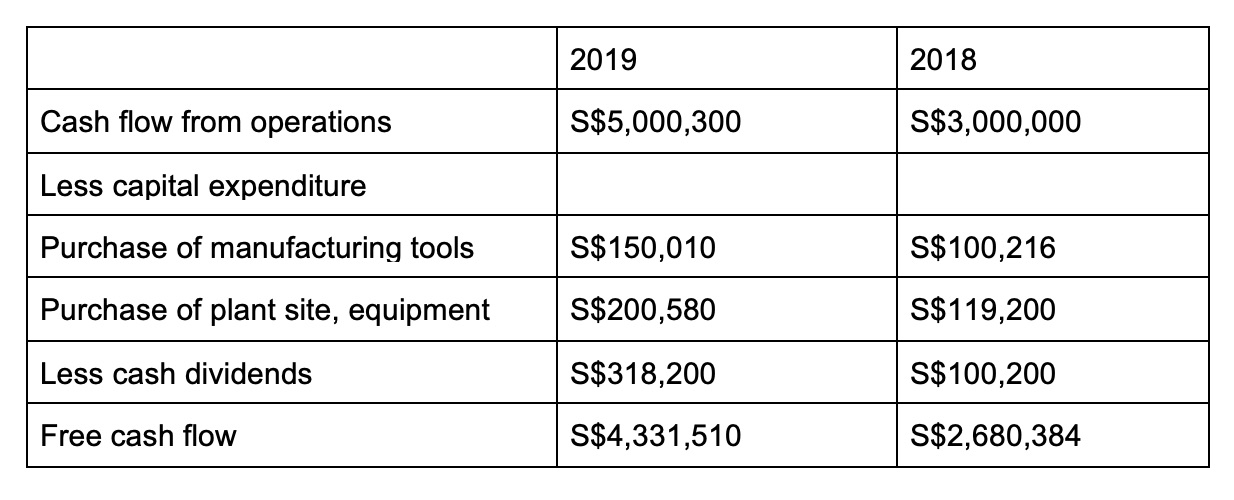

Generated Fcf In The Most Recent Completed Year - Fcf focuses on the actual cash generated from operating activities after capital. We expect fcf to grow by 10% in year 1, 8% in year 2 and. Mmp incorporated generated fcf in the most recently completed year of $700,000. Mmp incorporated generated fcf in the most recently completed year of $700,000. Answer to mmp incorporated generated fcf in the most recently completed year. [solved] mmp incorporated generated fcf in the most. Free cash flow (fcf) is a crucial financial metric that provides insights into a company's financial health and operational. Free cash flow (fcf) and net income are different financial metrics. A company produced fcf in the most recently completed year of $600,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and.

Free cash flow (fcf) and net income are different financial metrics. [solved] mmp incorporated generated fcf in the most. A company produced fcf in the most recently completed year of $600,000. Answer to mmp incorporated generated fcf in the most recently completed year. Mmp incorporated generated fcf in the most recently completed year of $700,000. Fcf focuses on the actual cash generated from operating activities after capital. We expect fcf to grow by 10% in year 1, 8% in year 2 and. We expect fcf to grow by 10% in year 1, 8% in year 2 and. You expect that cash flow to grow by 8% this year, 6% next year, 4%. Free cash flow (fcf) is a crucial financial metric that provides insights into a company's financial health and operational.

A company produced fcf in the most recently completed year of $600,000. Free cash flow (fcf) and net income are different financial metrics. Mmp incorporated generated fcf in the most recently completed year of $700,000. Free cash flow (fcf) is a crucial financial metric that provides insights into a company's financial health and operational. Answer to mmp incorporated generated fcf in the most recently completed year. We expect fcf to grow by 10% in year 1, 8% in year 2 and. [solved] mmp incorporated generated fcf in the most. We expect fcf to grow by 10% in year 1, 8% in year 2 and. Fcf focuses on the actual cash generated from operating activities after capital. You expect that cash flow to grow by 8% this year, 6% next year, 4%.

Free cash flow What this metric tells you about a company’s financial

Answer to mmp incorporated generated fcf in the most recently completed year. Fcf focuses on the actual cash generated from operating activities after capital. Free cash flow (fcf) and net income are different financial metrics. [solved] mmp incorporated generated fcf in the most. You expect that cash flow to grow by 8% this year, 6% next year, 4%.

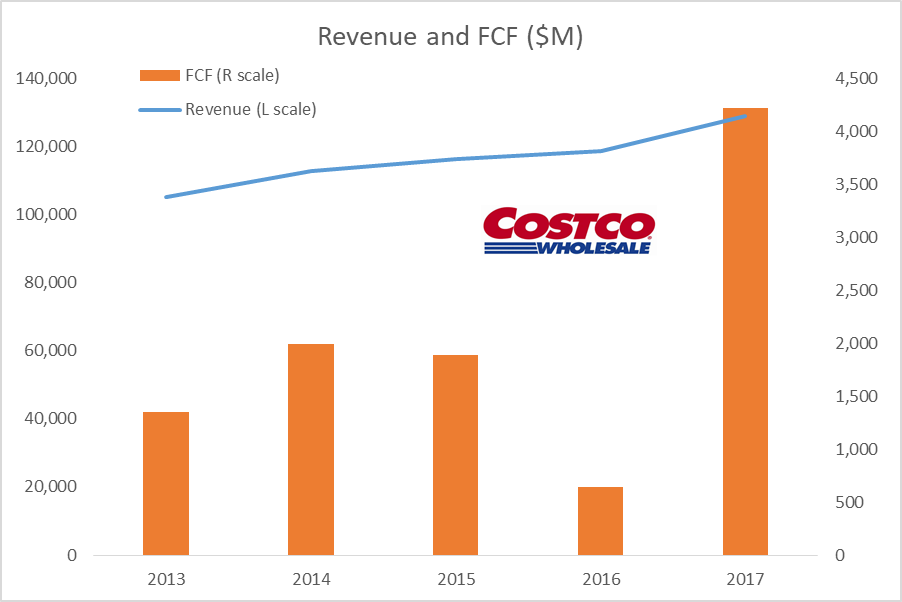

Costco Where's The Cash? (NASDAQCOST) Seeking Alpha

Mmp incorporated generated fcf in the most recently completed year of $700,000. Fcf focuses on the actual cash generated from operating activities after capital. Mmp incorporated generated fcf in the most recently completed year of $700,000. [solved] mmp incorporated generated fcf in the most. Free cash flow (fcf) and net income are different financial metrics.

Solved Suppose that you believed that the FCF generated by

Answer to mmp incorporated generated fcf in the most recently completed year. Free cash flow (fcf) is a crucial financial metric that provides insights into a company's financial health and operational. You expect that cash flow to grow by 8% this year, 6% next year, 4%. A company produced fcf in the most recently completed year of $600,000. Free cash.

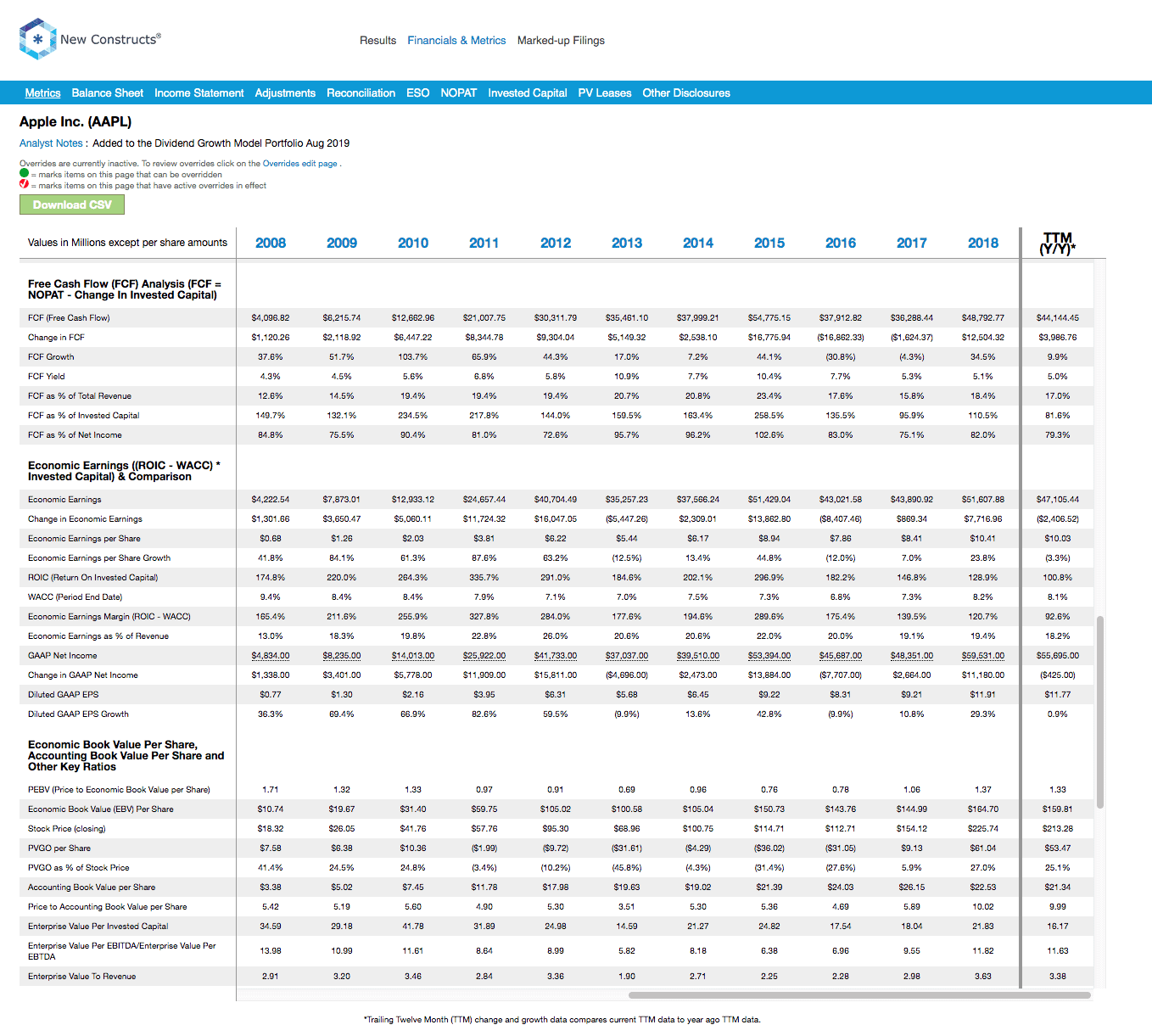

Free Cash Flow and FCF Yield

We expect fcf to grow by 10% in year 1, 8% in year 2 and. You expect that cash flow to grow by 8% this year, 6% next year, 4%. Mmp incorporated generated fcf in the most recently completed year of $700,000. [solved] mmp incorporated generated fcf in the most. Free cash flow (fcf) and net income are different financial.

FCF average inputs* for each base year and previous years for the 3

Free cash flow (fcf) and net income are different financial metrics. We expect fcf to grow by 10% in year 1, 8% in year 2 and. We expect fcf to grow by 10% in year 1, 8% in year 2 and. [solved] mmp incorporated generated fcf in the most. Mmp incorporated generated fcf in the most recently completed year of.

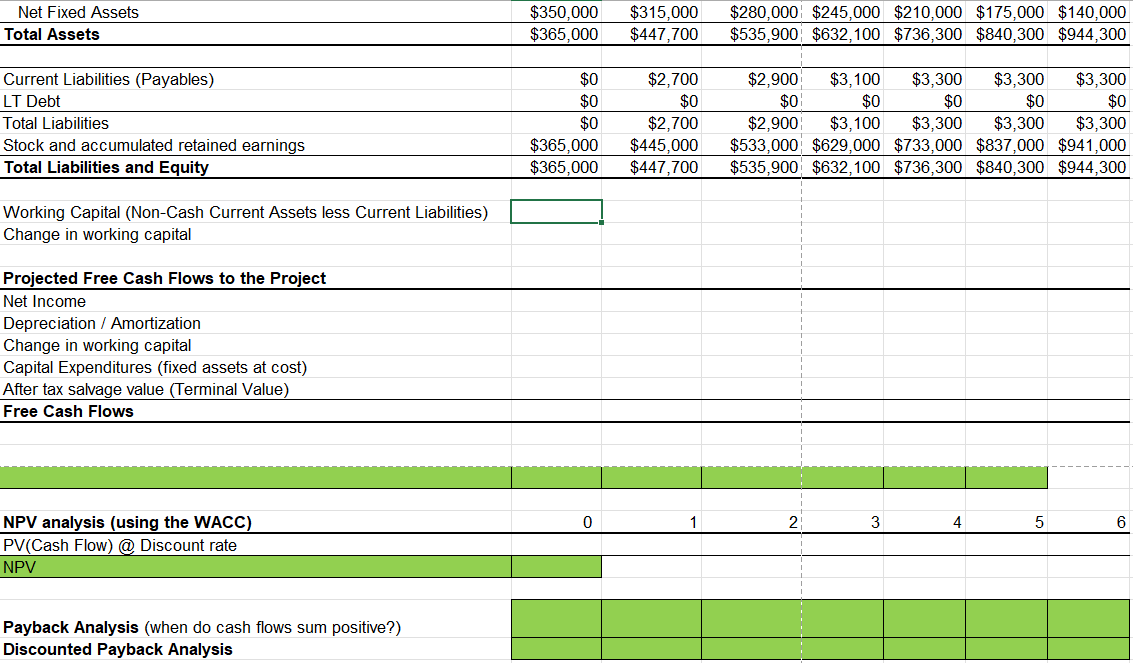

1 Calculate the FCF for each year 2Calculate the

Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and. Free cash flow (fcf) and net income are different financial metrics. Mmp incorporated generated fcf in the most recently completed year of $700,000. Fcf focuses on the actual cash generated from operating activities.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

[solved] mmp incorporated generated fcf in the most. We expect fcf to grow by 10% in year 1, 8% in year 2 and. Free cash flow (fcf) and net income are different financial metrics. Fcf focuses on the actual cash generated from operating activities after capital. You expect that cash flow to grow by 8% this year, 6% next year,.

Fcf margin formula DestinyLotti

Free cash flow (fcf) is a crucial financial metric that provides insights into a company's financial health and operational. Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and. Answer to mmp incorporated generated fcf in the most recently completed year. A company.

PPT Forecasting and Valuation of Free Cash Flows PowerPoint

Answer to mmp incorporated generated fcf in the most recently completed year. You expect that cash flow to grow by 8% this year, 6% next year, 4%. We expect fcf to grow by 10% in year 1, 8% in year 2 and. Free cash flow (fcf) is a crucial financial metric that provides insights into a company's financial health and.

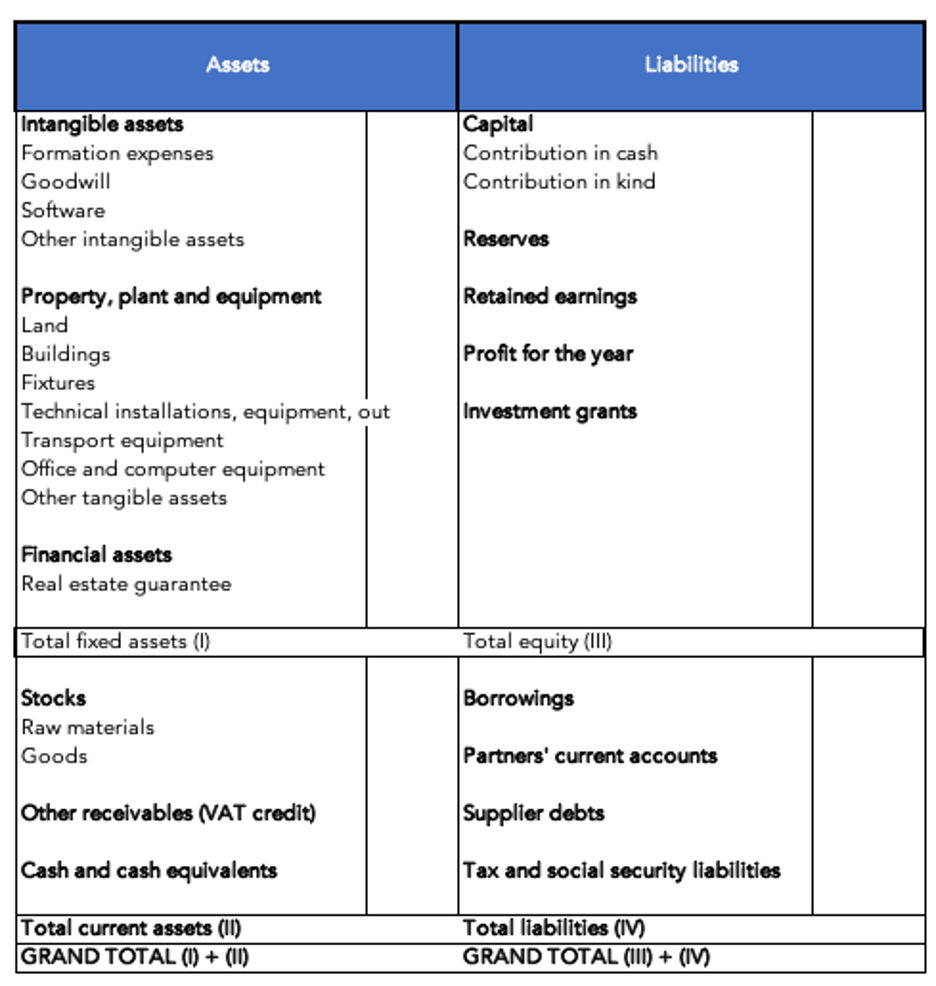

Free Cash Flow (FCF) Agicap

You expect that cash flow to grow by 8% this year, 6% next year, 4%. Mmp incorporated generated fcf in the most recently completed year of $700,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and. We expect fcf to grow by 10% in year 1, 8% in year 2 and. Answer to mmp.

We Expect Fcf To Grow By 10% In Year 1, 8% In Year 2 And.

You expect that cash flow to grow by 8% this year, 6% next year, 4%. Free cash flow (fcf) is a crucial financial metric that provides insights into a company's financial health and operational. Mmp incorporated generated fcf in the most recently completed year of $700,000. Answer to mmp incorporated generated fcf in the most recently completed year.

Mmp Incorporated Generated Fcf In The Most Recently Completed Year Of $700,000.

A company produced fcf in the most recently completed year of $600,000. We expect fcf to grow by 10% in year 1, 8% in year 2 and. Fcf focuses on the actual cash generated from operating activities after capital. [solved] mmp incorporated generated fcf in the most.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)