How Do I Attach Form 8862 On Turbotax

How Do I Attach Form 8862 On Turbotax - Open your return if you don't already have it open. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web tax tips & video homepage. Web instructions for form 8862 (rev. If it isn't, the irs could reject your return. Web you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Add certain credit click the green button to add information to claim a certain credit after disallowance. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Guide to head of household. Web it’s easy to do in turbotax.

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. In the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no,. Open your return if you don't already have it open. Married filing jointly vs separately. Web then enter the relationship of each person to the child on the appropriate line. Web tax tips & video homepage. Pay back the claims, plus interest. Web click continue and then done. Answer the questions accordingly, and we’ll include form 8862 with your return. (to do this, sign in to turbotax and click the orange take me to my return button.) 2.

We'll generate a pdf copy. Web tax tips & video homepage. Web reply dianew777 expert alumni february 11, 2022 5:27 am if you could provide the reject code it would help with clarification of exactly what your reject issue. December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. Pay back the claims, plus interest. Married filing jointly vs separately. Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned. Add certain credit click the green button to add information to claim a certain credit after disallowance. Web you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. File form 8862 when you claim the credit again.

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web american opportunity tax credit (aotc) you may need to: Web irs form 8862 (information to claim certain.

Top 14 Form 8862 Templates free to download in PDF format

Web reply dianew777 expert alumni february 11, 2022 5:27 am if you could provide the reject code it would help with clarification of exactly what your reject issue. December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. You must complete form 8862 and attach it to your tax return to claim the.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Sign in to efile.com sign in to efile.com 2. Guide to head of household. File form 8862 when you claim the credit again. Web reply dianew777 expert alumni february 11, 2022 5:27 am if you could provide the reject code it would help with clarification of exactly what your reject issue. Web instructions for form 8862 (rev.

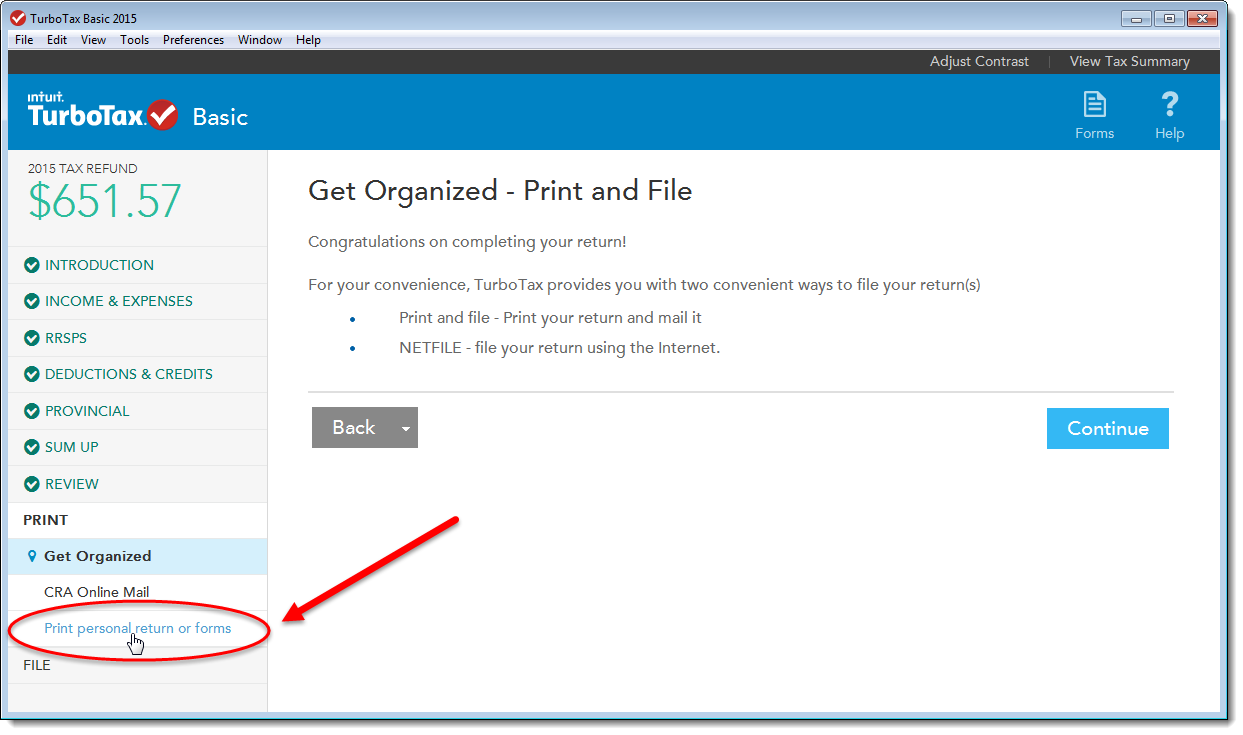

How do I save a PDF copy of my tax return in TurboTax AnswerXchange

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Log into your account and click take me to my. Web how do i file an irs extension (form 4868) in turbotax online? We'll generate a pdf copy. Web it’s easy to do in turbotax.

Intuit TurboTax SelfEmployed 2017 (Tax Year 2016) Review YouTube

Add certain credit click the green button to add information to claim a certain credit after disallowance. Guide to head of household. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Search for 8862 and select the link to go to the section..

How TurboTax turns a dreadful user experience into a delightful one

Web instructions for form 8862 (rev. If no one else (other than your spouse and dependents you claim on your income tax. Guide to head of household. Web then enter the relationship of each person to the child on the appropriate line. Married filing jointly vs separately.

Form 8862 Information to Claim Earned Credit After

Add certain credit click the green button to add information to claim a certain credit after disallowance. Please see the turbotax faq how do i enter form. Web instructions for form 8862 (rev. Married filing jointly vs separately. Web american opportunity tax credit (aotc) you may need to:

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

If no one else (other than your spouse and dependents you claim on your income tax. Answer the questions accordingly, and we’ll include form 8862 with your return. In the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no,. Pay back the claims,.

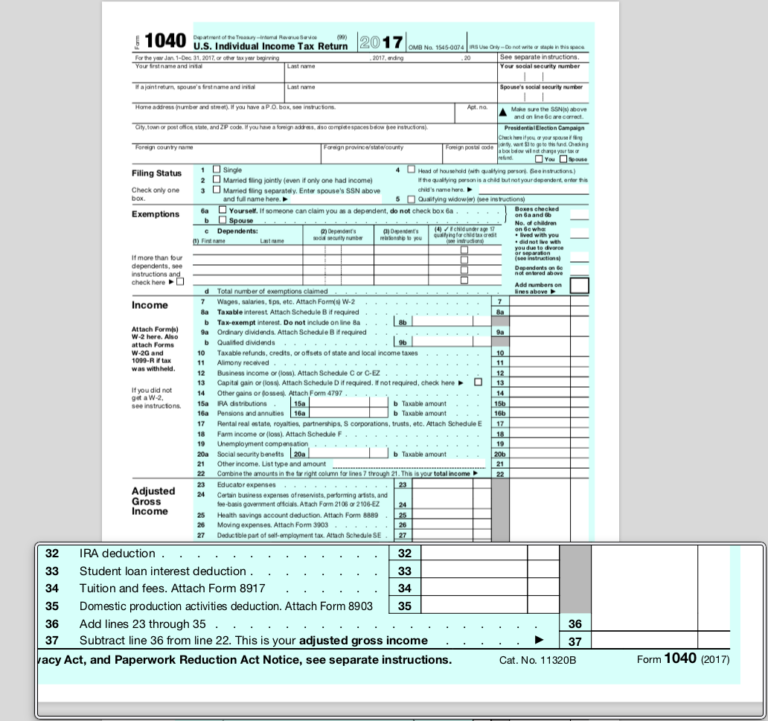

I Am Trying To Find My Agi Number Please Help TurboTax 2021 Tax Forms

Open your return if you don't already have it open. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Pay back the claims, plus interest. In the since you.

turbotax entering 1031 exchange Fill Online, Printable, Fillable

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any. Open your return if you don't already have it open. If no one else (other than your spouse and dependents you claim on your income tax. File form 8862 when.

Web Then Enter The Relationship Of Each Person To The Child On The Appropriate Line.

Web you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Web it’s easy to do in turbotax. Web american opportunity tax credit (aotc) you may need to: We'll generate a pdf copy.

You Must Complete Form 8862 And Attach It To Your Tax Return To Claim The Eic, Ctc, Rctc, Actc, Odc, Or Aotc If You Meet The Following Criteria For Any.

Answer the questions accordingly, and we’ll include form 8862 with your return. Web how do i file an irs extension (form 4868) in turbotax online? Web taxpayers complete form 8862 and attach it to their tax return if: Guide to head of household.

You Can Use The Steps.

Log into your account and click take me to my. File an extension in turbotax online before the deadline to avoid a late filing penalty. Sign in to efile.com sign in to efile.com 2. In the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no,.

Web In The Turbotax Print Center, Check The 2022 Federal Returns Box And Select The Just My Tax Returns(S) Option.

Please see the turbotax faq how do i enter form. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than.

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)