How Do I Fill Out Form 8812

How Do I Fill Out Form 8812 - Web form 8812 is for the additional child tax credit. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to. Or form 1040nr, line 7c; How do i claim the qualified business income d. Web internal revenue service 2022 instructions for schedule 8812 credits for qualifying children and other dependents use schedule 8812 (form 1040) to figure your child tax. Web schedule 8812 is automatically generated in taxslayer pro as needed depending on the answers to due diligence questions about the dependents, the amount of earned income,. Sign it in a few clicks draw. You can respond online send us your documents using the documentation. They must under the age of 17 by the end of the calendar tax year. Web solved • by turbotax • 3264 • updated january 25, 2023.

Get ready for tax season deadlines by completing any required tax forms today. Insert photos, crosses, check and text boxes, if needed. Complete, edit or print tax forms instantly. Follow the steps in the schedule 8812 instructions to figure: Web form 8812 (2002) page 2 instructions purpose of form use form 8812 to figure your additional child tax credit. Web mail both the form 15110 and form 1040 (schedule 8812) in the envelope provided. They must under the age of 17 by the end of the calendar tax year. Web internal revenue service 2022 instructions for schedule 8812 credits for qualifying children and other dependents use schedule 8812 (form 1040) to figure your child tax. Our experts can get your taxes done right. If you have at least one qualifying child, you can claim a credit of up to 15% of your earned income in excess of.

They must live with you for. Web form 8812 (2002) page 2 instructions purpose of form use form 8812 to figure your additional child tax credit. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Or form 1040nr, line 7c; Web community discussions taxes get your taxes done still need to file? That amount would be listed on line 18 (b) of your form 1040. Insert graphics, crosses, check and text boxes, if you want. Web form 8812 is for the additional child tax credit. You can respond online send us your documents using the documentation. They must under the age of 17 by the end of the calendar tax year.

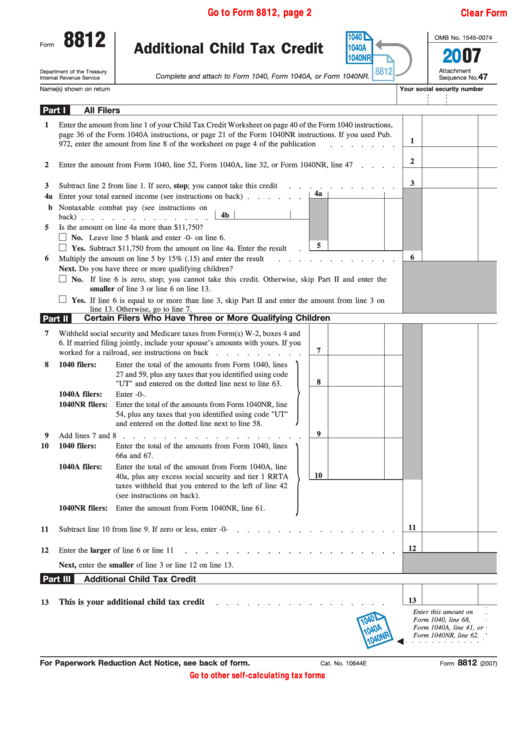

Fillable Form 8812 Additional Child Tax Credit printable pdf download

You can respond online send us your documents using the documentation. Web form 8812 is for the additional child tax credit. Taxable earned income paperwork reduction act notice. Or form 1040nr, line 7c; Try it for free now!

Form 8812Additional Child Tax Credit

Ad access irs tax forms. Web schedule 8812 is automatically generated in taxslayer pro as needed depending on the answers to due diligence questions about the dependents, the amount of earned income,. Taxable earned income paperwork reduction act notice. Web community discussions taxes get your taxes done still need to file? Insert graphics, crosses, check and text boxes, if you.

Irs Child Tax Credit Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Web mail both the form 15110 and form 1040 (schedule 8812) in the envelope provided. How do i enter a 1099. How do i claim the qualified business income d. Web sign in (4.6/5 | 291,310 reviews) view all what is form 1065, u.s.

Top 8 Form 8812 Templates free to download in PDF format

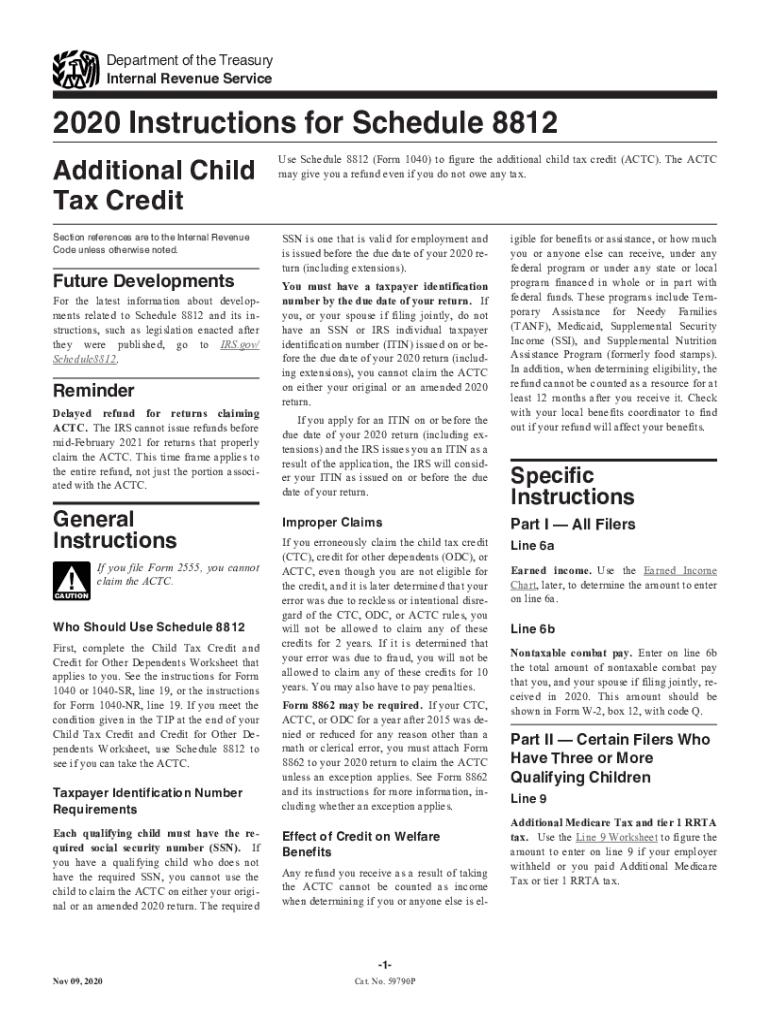

Caution who should use schedule 8812 first, complete the child tax credit and credit for other. If you have at least one qualifying child, you can claim a credit of up to 15% of your earned income in excess of. Web form 8812 (2002) page 2 instructions purpose of form use form 8812 to figure your additional child tax credit..

How To Read Tax Return

They must be a u.s. Edit your 8812 instructions child tax credit online type text, add images, blackout confidential details, add comments, highlights and more. Get ready for tax season deadlines by completing any required tax forms today. Caution who should use schedule 8812 first, complete the child tax credit and credit for other. Web sign in (4.6/5 | 291,310.

Irs 8812 Instructions Fill Out and Sign Printable PDF Template signNow

Ad access irs tax forms. Web form 8812 (2002) page 2 instructions purpose of form use form 8812 to figure your additional child tax credit. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Get started > shaniced24 returning member.

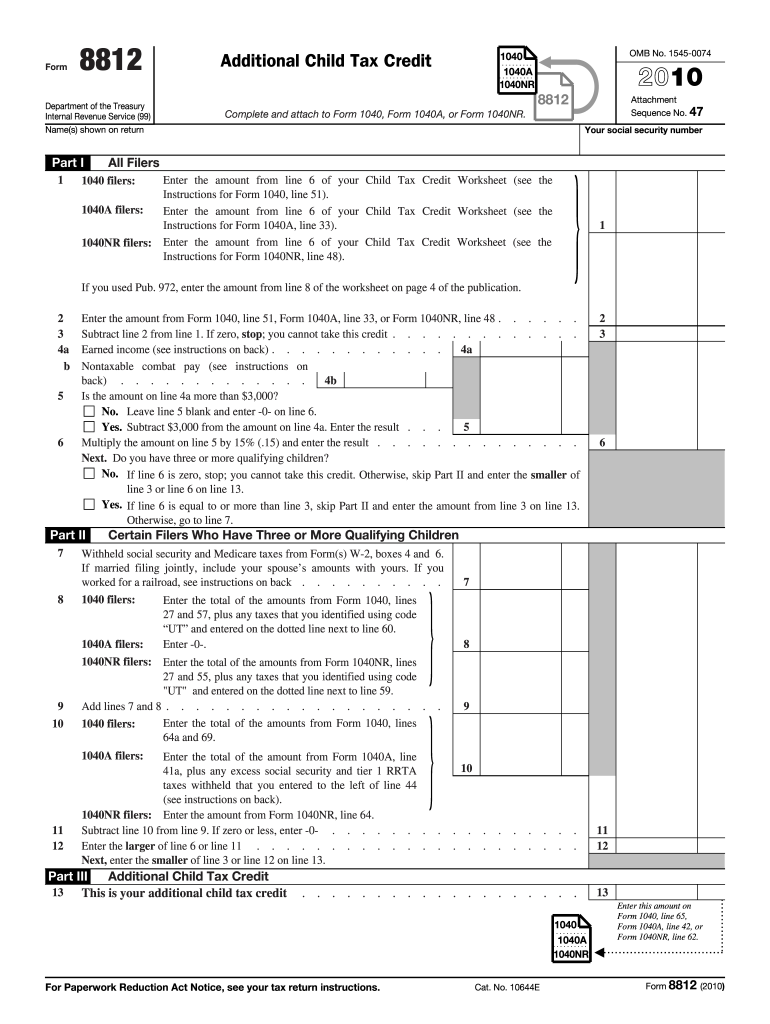

IRS 1040 Schedule 8812 Instructions 2012 Fill out Tax Template Online

Web you must have three or more qualifying children. If you have at least one qualifying child, you can claim a credit of up to 15% of your earned income in excess of. How do i enter a 1099. Web general instructions if you file form 2555, you cannot ! Get started > shaniced24 returning member.

2010 Form IRS 8812 Fill Online, Printable, Fillable, Blank pdfFiller

They must be a u.s. Web form 8812 is for the additional child tax credit. Complete, edit or print tax forms instantly. Web sign in (4.6/5 | 291,310 reviews) view all what is form 1065, u.s. Taxable earned income paperwork reduction act notice.

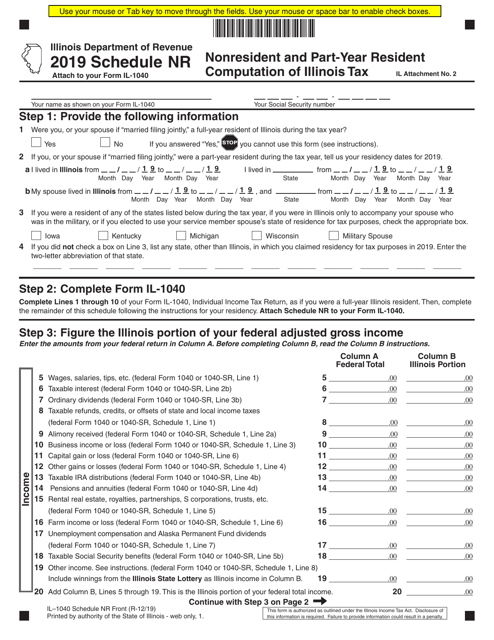

Form IL1040 Schedule NR Download Fillable PDF or Fill Online

Complete, edit or print tax forms instantly. That amount would be listed on line 18 (b) of your form 1040. They must live with you for. Web form 8812 is for the additional child tax credit. Sign it in a few clicks draw.

[서식예 36] 건물철거 및 대지인도청구의 소 샘플, 양식 다운로드

Web form 8812 (2002) page 2 instructions purpose of form use form 8812 to figure your additional child tax credit. How do i enter a 1099. Taxable earned income paperwork reduction act notice. Web use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040, line 6c; That amount would be.

Web Use Part I Of Schedule 8812 To Document That Any Child For Whom You Entered An Itin On Form 1040, Line 6C;

Try it for free now! Insert photos, crosses, check and text boxes, if needed. Web solved • by turbotax • 3264 • updated january 25, 2023. Insert graphics, crosses, check and text boxes, if you want.

Complete, Edit Or Print Tax Forms Instantly.

Sign it in a few clicks draw. Follow the steps in the schedule 8812 instructions to figure: I suggest you look on that line and see if you have an. Web schedule 8812 is automatically generated in taxslayer pro as needed depending on the answers to due diligence questions about the dependents, the amount of earned income,.

Web Sign In (4.6/5 | 291,310 Reviews) View All What Is Form 1065, U.s.

Web you must have three or more qualifying children. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to. That amount would be listed on line 18 (b) of your form 1040. Repeating fields will be filled.

Our Experts Can Get Your Taxes Done Right.

You can respond online send us your documents using the documentation. They must under the age of 17 by the end of the calendar tax year. They must be a u.s. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents.

![[서식예 36] 건물철거 및 대지인도청구의 소 샘플, 양식 다운로드](http://www.bizforms.co.kr/form_openpreview/form_88008_5.jpg)