How Do I Form An S Corp In Florida

How Do I Form An S Corp In Florida - Mail it to the division of corporations with the required payment. Ad find the right registered agent for your business' needs, we compared the best options. Start your corporation with us. Get started on yours today. Takes just 3 easy steps with swyft filings®. Form 2553 requires basic information such as: Web follow these five steps to start a florida llc and elect florida s corp designation: State taxes a florida s corporation might need to. Web steps for forming an llc and electing s corp status in florida. Most florida businesses elect s corporation status when filing.

Ad get access to the largest online library of legal forms for any state. Web best car insurance companies. There is a fee of. File the form 2553 with the irs. Ron desantis said black people learned beneficial skills as slaves. Web florida s corporation filing requirements 1. Ad start your florida incorporation today. Electing to be taxed as an s corporation can. Takes just 3 easy steps with swyft filings®. Web steps for forming an llc and electing s corp status in florida.

Ad get access to the largest online library of legal forms for any state. Electing to be taxed as an s corporation can. Takes just 3 easy steps with swyft filings®. Web an s corporation is simply a florida corporation that has elected a special tax status. Web up to $48 cash back forming an llc or c corporation before electing s corp status through the irs would be best. Ad protect your business from liabilities. National registered agent service all 50 us states & dc. Become a corporation in the state of florida. Get started on yours today. Web follow these five steps to start a florida llc and elect florida s corp designation:

Irs Ein Confirmation Letter Copy

Start your corporation with us. State taxes a florida s corporation might need to. Create a free legal form in minutes. Electing to be taxed as an s corporation can. We're ready when you are.

SCorporation What Is an SCorp and How to Form One mojafarma

Web follow these five steps to start a florida llc and elect florida s corp designation: Home of the $0 llc. Corporations (florida and foreign) florida. Web file online with a credit card. They're probably going to show that some of the folks that eventually.

W 9 Forms Printable 2019 Form Resume Examples G28B7lG1gE

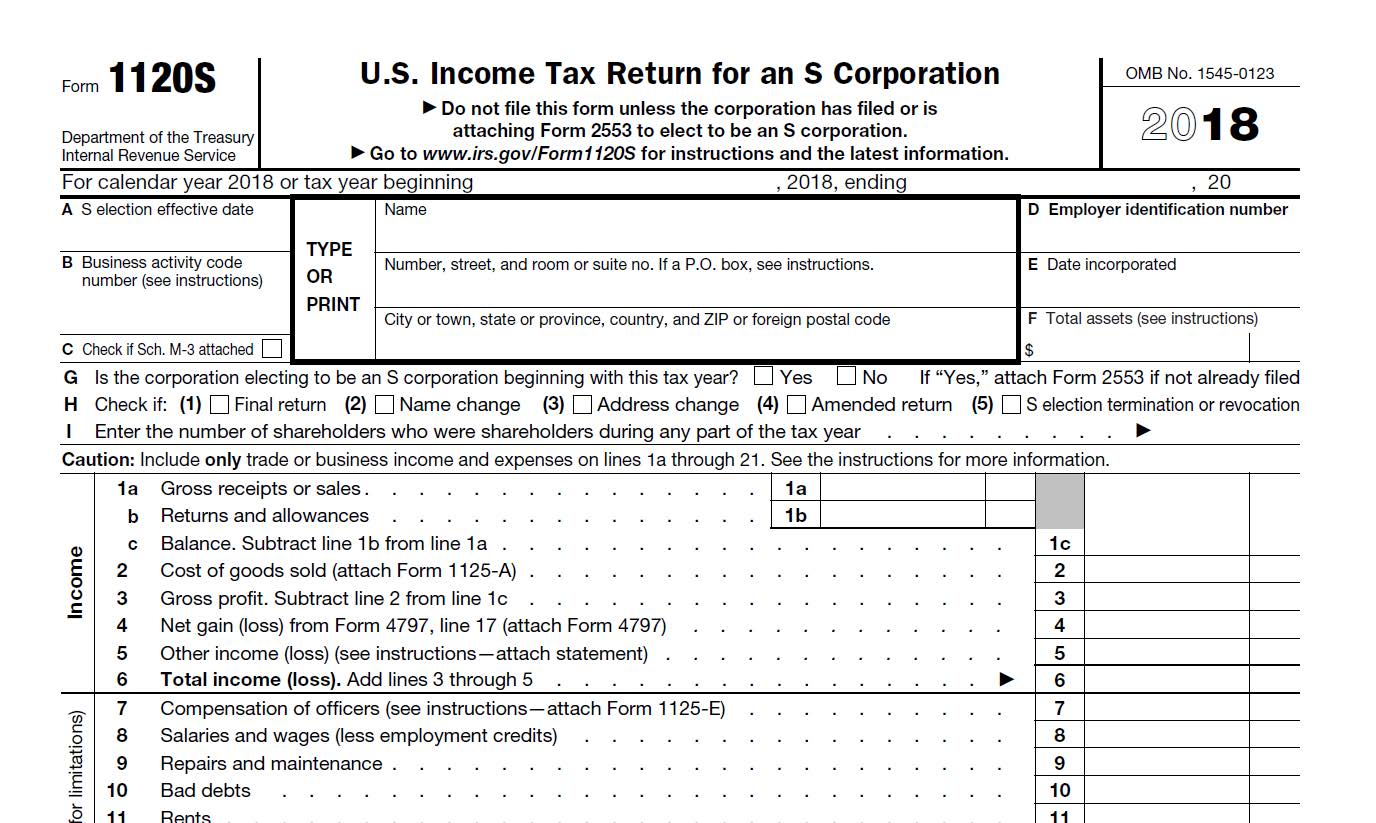

Federal taxes that florida s corporations must pay 2. Web for existing corporations, the form 2553 to elect s corporation status must be made by march 15 in order for the election to take effect that year. Order online and get your registered agent service instantly. Web florida s corporation filing requirements 1. Web best car insurance companies.

Best Form Editor Company Tax Return

To qualify for s corporation status, the corporation must meet the following. File an annual report due by may 1. See how easily you can file an s corp in florida with these s corp filing services What is an s corporation? Ad 3m+ customers have trusted us with their business formations.

1+ Florida Offer to Purchase Real Estate Form Free Download

Web you need form 255 3 to turn your corporation into an s classification. Mail it to the division of corporations with the required payment. Ad 3m+ customers have trusted us with their business formations. Partnership forms (general, florida limited. National registered agent service all 50 us states & dc.

Scorp form 1120s YouTube

Mail it to the division of corporations with the required payment. Research starting a business fyi: Create a free legal form in minutes. Our trusted & experienced business specialists provide personal customer support. Over 1,000,0000 filings since 2004, a+ bbb.

Everything to Know to Start an S Corp in Florida YouTube

State taxes a florida s corporation might need to. What is an s corporation? Web you subsequently make a federal election to be a s corporation. Takes just 3 easy steps with swyft filings®. Ad start your s corporation with confidence!

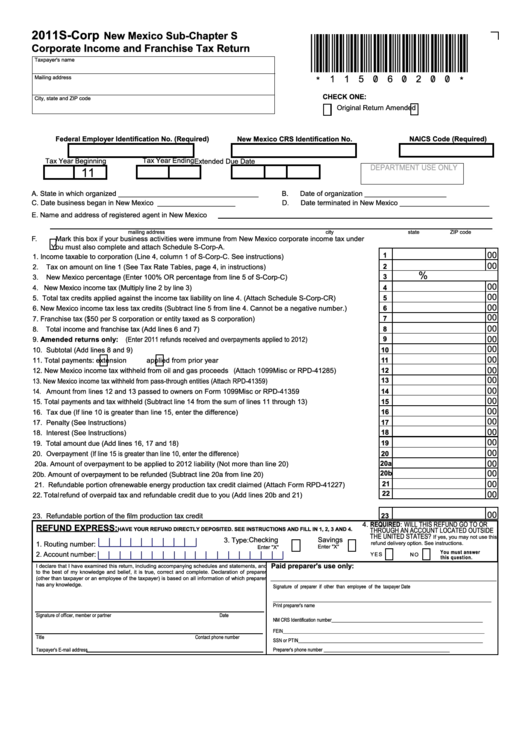

Form SCorp New Mexico SubChapter S Corporate And Franchise

Ad protect your business from liabilities. Federal taxes that florida s corporations must pay 2. Web × file an s corp today start an s corp let our experts file your business paperwork quickly and accurately, guaranteed! You can also use nolo's online corporation service, which will form a corporation. Ad get access to the largest online library of legal.

An SCorp Gift Charitable Solutions, LLC

Create a free legal form in minutes. Web file online with a credit card. Or complete the fillable pdf form using your computer. Real estate, family law, estate planning, business forms and power of attorney forms. Ad start your s corporation with confidence!

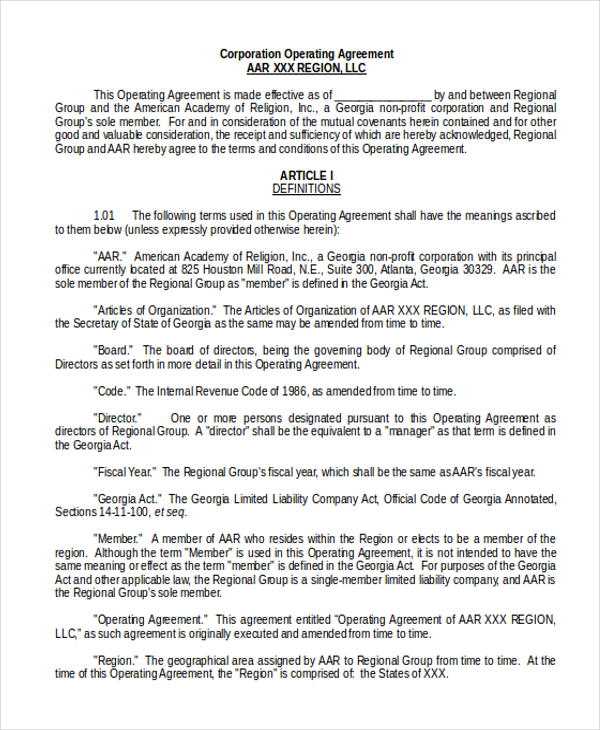

Best Templates Sample Operating Agreement Form 10+ Free Documents in

Web steps for forming an llc and electing s corp status in florida. We're ready when you are. An s corporation is not a. Corporations (florida and foreign) florida. Web × file an s corp today start an s corp let our experts file your business paperwork quickly and accurately, guaranteed!

We're Ready When You Are.

Web up to 25% cash back to form a corporation in florida, you need to take the steps set forth below. Ad protect your business from liabilities. Ad start your s corporation with confidence! Web florida s corporation filing requirements 1.

Real Estate, Family Law, Estate Planning, Business Forms And Power Of Attorney Forms.

Web follow these five steps to start a florida llc and elect florida s corp designation: To qualify for s corporation status, the corporation must meet the following. Limited liability company (florida and foreign) florida. Getting started with a florida business step 2:

Web You Need Form 255 3 To Turn Your Corporation Into An S Classification.

Web you subsequently make a federal election to be a s corporation. Start your corporation with us. Partnership forms (general, florida limited. What is an s corporation?

An S Corporation Is Not A.

File an annual report due by may 1. Ad get access to the largest online library of legal forms for any state. Address name employer identification number. Web in order to elect to be taxed as an s corporation, you need to first create a corporation or a limited liability company.