How To File Form 5329

How To File Form 5329 - Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Get form 5329 from a tax preparation office, a government agency, or you can simply download it online and open it on pdfelement. Web when and where to file. Web form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty. Complete, edit or print tax forms instantly. Ad register and subscribe now to work on your irs 5329 form & more fillable forms. Complete, edit or print tax forms instantly. Line 55 will be 0. Ad get ready for tax season deadlines by completing any required tax forms today. Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form.

Get form 5329 from a tax preparation office, a government agency, or you can simply download it online and open it on pdfelement. If you don’t have to file a. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. 9.5 ah xsl/xml page 1 of 9 draft ok. Ad register and subscribe now to work on your irs 5329 form & more fillable forms. Web form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty. Line 55 will be 0.

Line 55 will be 0. Ad get ready for tax season deadlines by completing any required tax forms today. If you don’t have to file a. Web for line 54, enter rc (reasonable cause) and the amount from line 52 on the dotted line next to line 54 and enter 0 on the actual line 54. Get form 5329 from a tax preparation office, a government agency, or you can simply download it online and open it on pdfelement. Web when and where to file. Iras, other qualified retirement plans,. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Use form 5329 to report additional taxes on iras, other qualified. Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form.

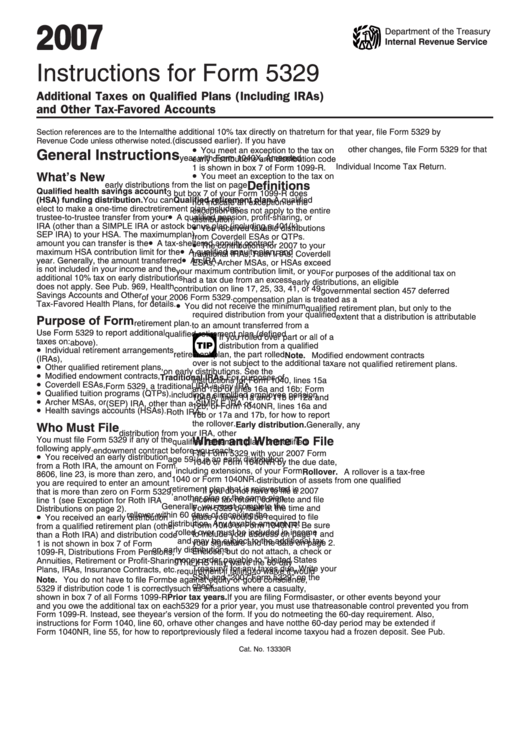

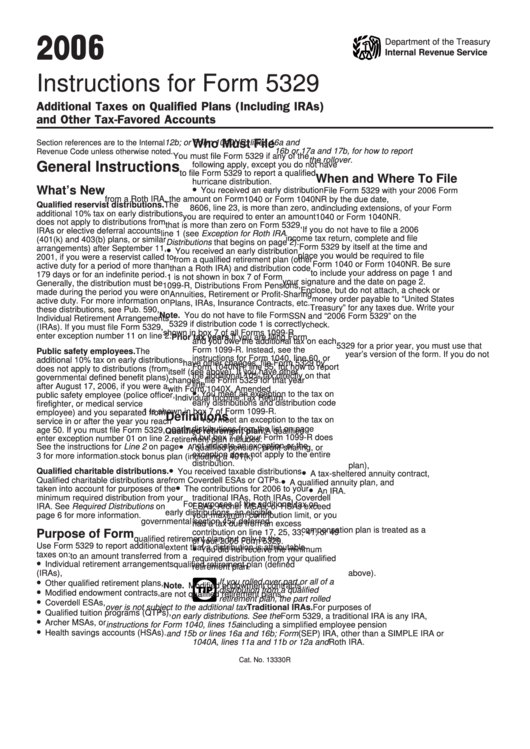

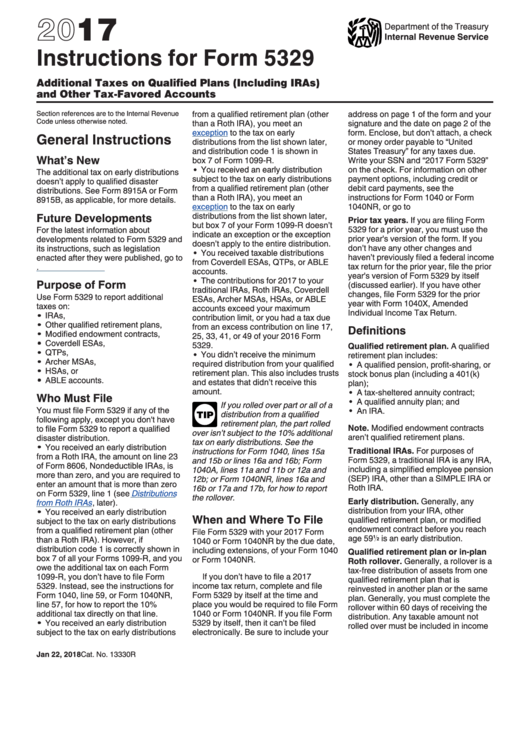

Instructions For Form 5329 Additional Taxes On Qualified Plans

Line 55 will be 0. Web form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty. Web for line 54, enter rc (reasonable cause) and the amount from line 52 on the dotted line next to line 54 and enter 0 on the actual line 54. Web when.

How to file form 2290 Electronically For the Tax Year 20212022 by Form

Line 55 will be 0. Web for line 54, enter rc (reasonable cause) and the amount from line 52 on the dotted line next to line 54 and enter 0 on the actual line 54. Get form 5329 from a tax preparation office, a government agency, or you can simply download it online and open it on pdfelement. Iras, other.

Top 19 Form 5329 Templates free to download in PDF format

Line 55 will be 0. Use form 5329 to report additional taxes on iras, other qualified. Web when and where to file. Web instructions for form 5329 userid: Ad get ready for tax season deadlines by completing any required tax forms today.

2020 Form IRS 8879PE Fill Online, Printable, Fillable, Blank pdfFiller

Web when and where to file. Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form. Line 55 will be 0. Ad register and subscribe now to work on your irs 5329 form & more fillable forms. Get form 5329 from a.

What is Tax Form 5329? Lively

Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form. Web for line 54, enter rc (reasonable cause) and the amount from line 52 on the dotted line next to line 54 and enter 0 on the actual line 54. Complete, edit.

Form 5329 Instructions & Exception Information for IRS Form 5329

Line 55 will be 0. Use form 5329 to report additional taxes on iras, other qualified. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Web when and where to file. 9.5 ah xsl/xml page 1 of 9 draft ok.

2009 Form 5329 Edit, Fill, Sign Online Handypdf

Web instructions for form 5329 userid: Line 55 will be 0. Ad get ready for tax season deadlines by completing any required tax forms today. 9.5 ah xsl/xml page 1 of 9 draft ok. Web when and where to file.

Form 5329 Additional Taxes on Qualified Plans Definition

9.5 ah xsl/xml page 1 of 9 draft ok. Web form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty. Web when and where to file. Complete, edit or print tax forms instantly. Web instructions for form 5329 userid:

1099R Coding Change

Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Ad get ready for tax season deadlines by completing any required tax forms today. Iras, other qualified retirement plans,. Complete, edit or print tax forms instantly. Use form 5329 to report additional taxes on iras, other qualified.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

9.5 ah xsl/xml page 1 of 9 draft ok. Use form 5329 to report additional taxes on iras, other qualified. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty. Get form 5329.

Web Form 5329 Is Used By Any Individual Who Has Established A Retirement Account, Annuity Or Retirement Bond.

Iras, other qualified retirement plans,. Use form 5329 to report additional taxes on iras, other qualified. Web when and where to file. Ad get ready for tax season deadlines by completing any required tax forms today.

9.5 Ah Xsl/Xml Page 1 Of 9 Draft Ok.

Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form. Web instructions for form 5329 userid: Web for line 54, enter rc (reasonable cause) and the amount from line 52 on the dotted line next to line 54 and enter 0 on the actual line 54. Web form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty.

If You Don’t Have To File A.

Ad register and subscribe now to work on your irs 5329 form & more fillable forms. Complete, edit or print tax forms instantly. Line 55 will be 0. Get form 5329 from a tax preparation office, a government agency, or you can simply download it online and open it on pdfelement.

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)