How To Fill Out Form 1116

How To Fill Out Form 1116 - Web form 8716 is used by partnerships, s corporations, and personal service corporations to elect under section 444(a) to have a tax year other than a required tax. Solved • by turbotax • 2533 • updated april 11, 2023 to see when form. Once you enter your income, you’ll be asked if it has been taxed outside the us, and. You do not have to complete form 1116 to take. If you make this election, you cannot carry back or carry over any unused foreign tax to or from this tax year. Web how to claim the foreign tax credit. File form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or. Find out if you qualify for the foreign tax credit. Web how to file form 1116 head over to our ways to file page and choose to either file with an advisor or file yourself. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116.

File form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or. Web turbotax help intuit where do i enter the foreign tax credit (form 1116) or deduction? Once you enter your income, you’ll be asked if it has been taxed outside the us, and. Web you must complete form 1116 in order to claim the foreign tax credit on your us tax return. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Web william baldwin senior contributor nov 9, 2021,11:41am est listen to article share to facebook share to twitter share to linkedin an explanation of the weird form. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. If you make this election, you cannot carry back or carry over any unused foreign tax to or from this tax year. Web form 8716 is used by partnerships, s corporations, and personal service corporations to elect under section 444(a) to have a tax year other than a required tax. However, you may qualify for an.

Web william baldwin senior contributor nov 9, 2021,11:41am est listen to article share to facebook share to twitter share to linkedin an explanation of the weird form. Web form 1116 instructions step one: If you make this election, you cannot carry back or carry over any unused foreign tax to or from this tax year. Web you elect this procedure for the tax year. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. File form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. You do not have to complete form 1116 to take. Register online and complete your tax. The form requests the information about the country your foreign taxes were paid in, the.

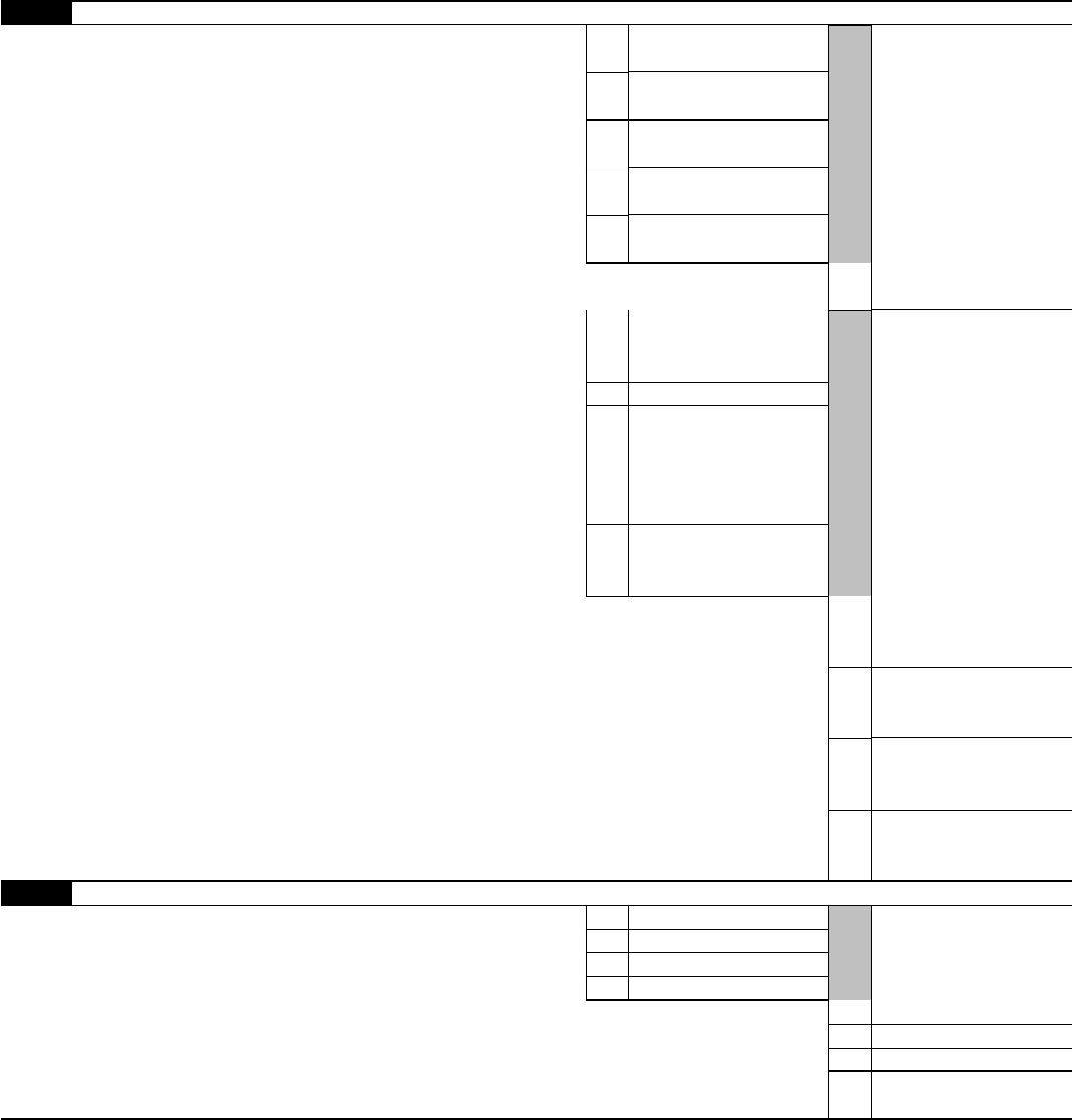

Form 1116 Edit, Fill, Sign Online Handypdf

Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; You must have incurred or paid a foreign tax liability. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year.

Form 1116 Edit, Fill, Sign Online Handypdf

Once you enter your income, you’ll be asked if it has been taxed outside the us, and. Web to choose the foreign tax credit you generally must complete form 1116 and attach it to your form 1040. You do not have to complete form 1116 to take. Complete, edit or print tax forms instantly. Web how to claim the foreign.

Form I580F Edit, Fill, Sign Online Handypdf

Web turbotax help intuit where do i enter the foreign tax credit (form 1116) or deduction? Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Web for the latest information about developments related to form 1116.

Filing Taxes While Working Abroad — Ambassador Year in China

If you make this election, you cannot carry back or carry over any unused foreign tax to or from this tax year. Web william baldwin senior contributor nov 9, 2021,11:41am est listen to article share to facebook share to twitter share to linkedin an explanation of the weird form. Web form 1116 instructions step one: Web for the latest information.

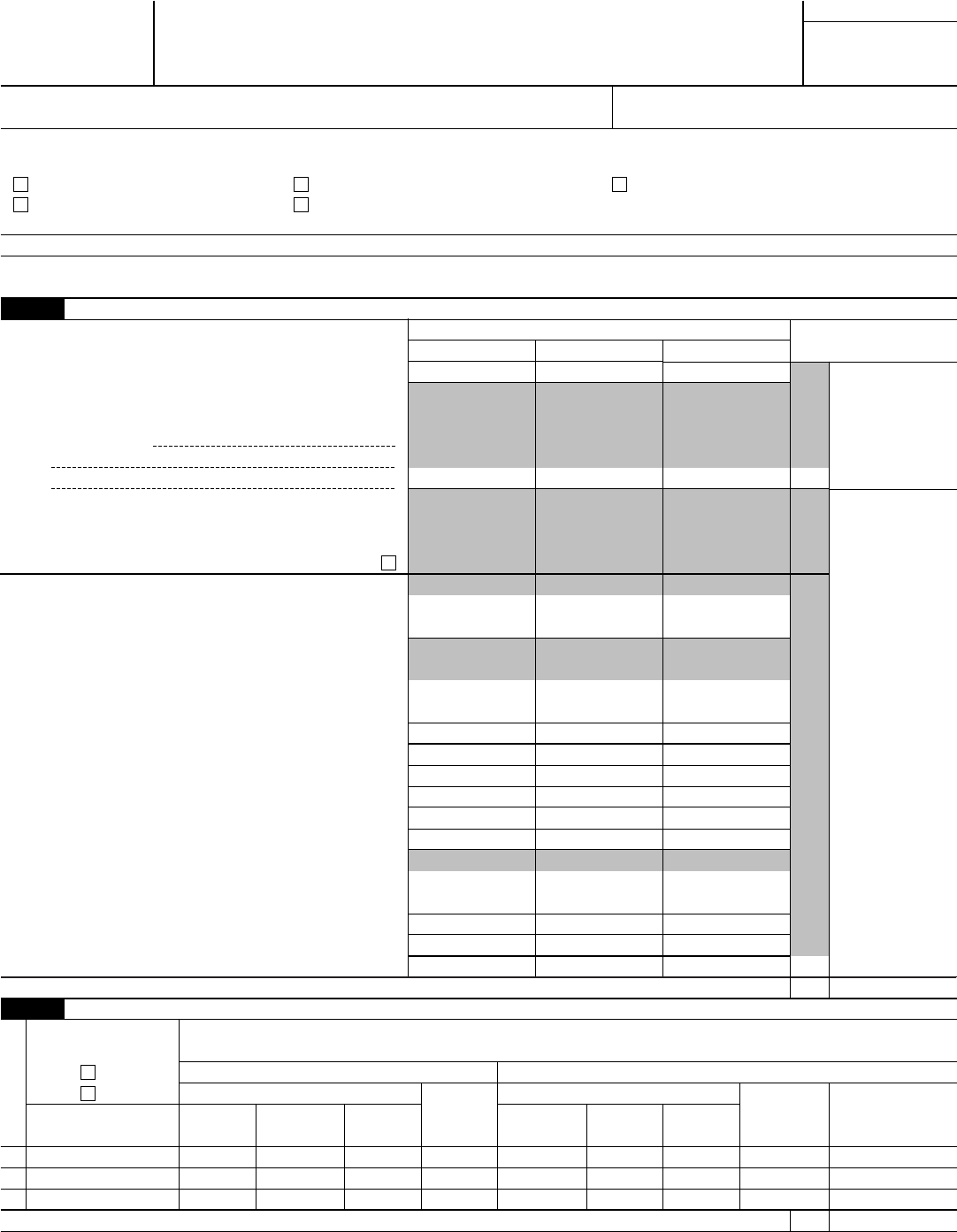

Fillable Form 1116 Foreign Tax Credit printable pdf download

File form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or. Web you elect this procedure for the tax year. Web to choose the foreign tax credit you generally must complete form 1116 and attach it to your form 1040. Web turbotax help intuit where do i.

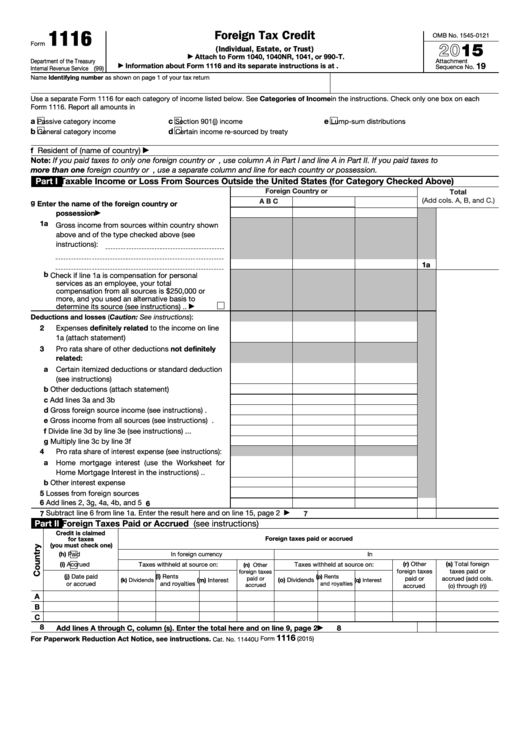

IRS Form 965 Schedule H Download Fillable PDF or Fill Online Amounts

The form requests the information about the country your foreign taxes were paid in, the. Web (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions. Complete, edit or print tax forms instantly. Web how to claim the foreign tax credit. File form 1116, foreign tax credit, to claim the foreign tax credit.

Fill Free fillable Form 1116 2019 Foreign Tax Credit PDF form

Web william baldwin senior contributor nov 9, 2021,11:41am est listen to article share to facebook share to twitter share to linkedin an explanation of the weird form. The form requests the information about the country your foreign taxes were paid in, the. You do not have to complete form 1116 to take. Web how to file form 1116 head over.

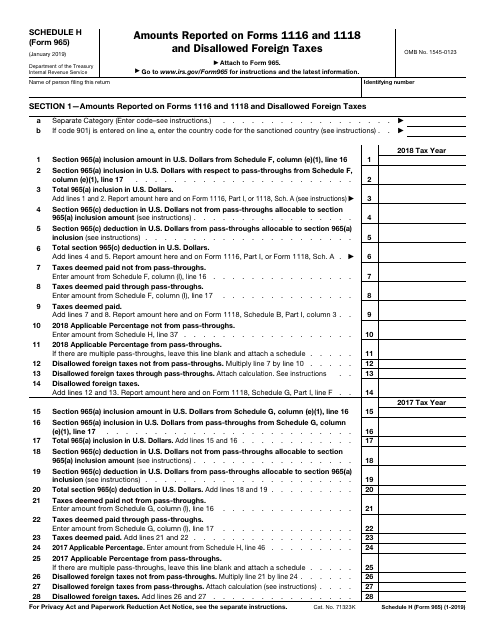

Form 1116 part 1 instructions

Web once signed in, select the “select income (s)” section in the navigation left of the page: Web when filling out a form 1116 explanation statement, you should always include the following personal details: Once you enter your income, you’ll be asked if it has been taxed outside the us, and. You must have incurred or paid a foreign tax.

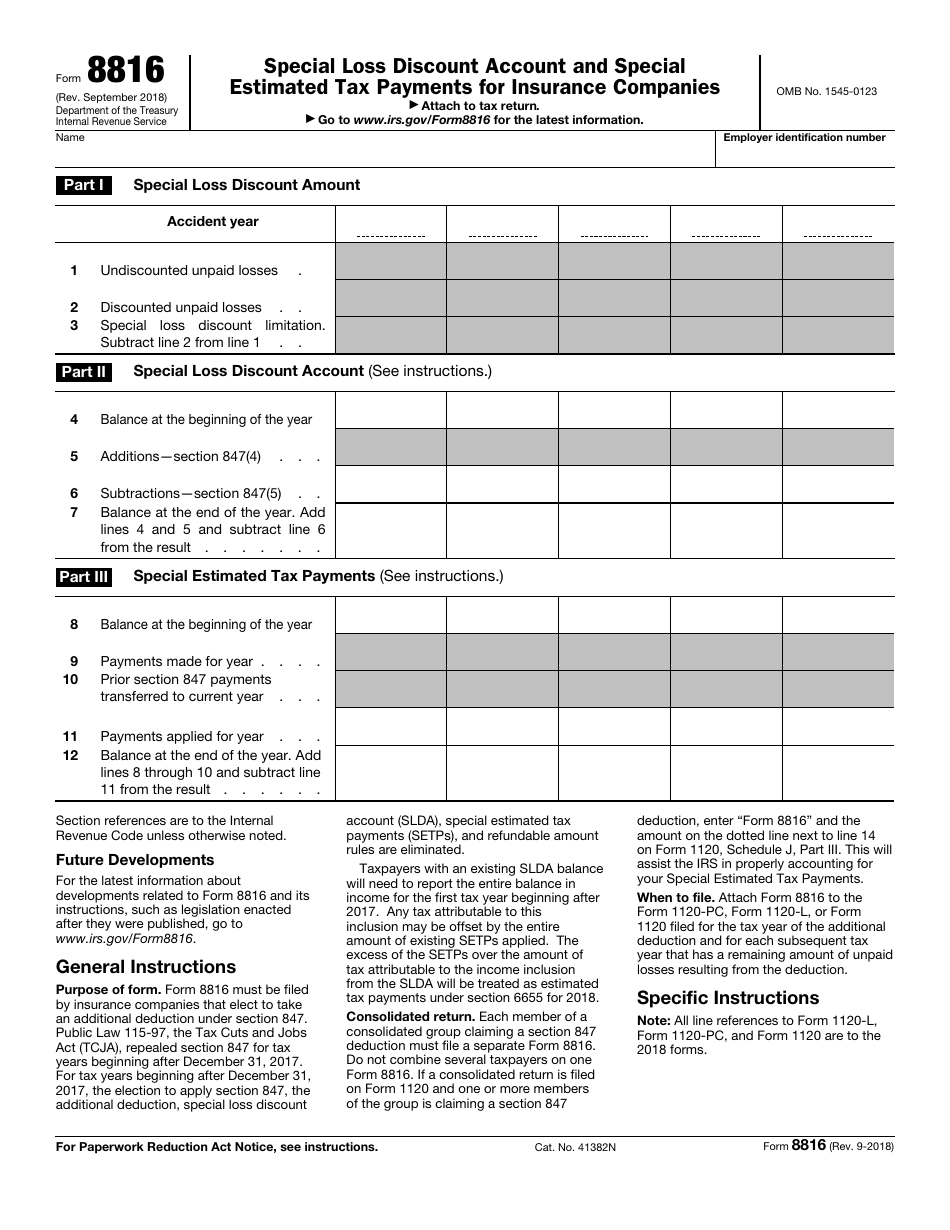

IRS Form 8816 Download Fillable PDF or Fill Online Special Loss

Solved • by turbotax • 2533 • updated april 11, 2023 to see when form. You must have incurred or paid a foreign tax liability. Web how to claim the foreign tax credit. Web william baldwin senior contributor nov 9, 2021,11:41am est listen to article share to facebook share to twitter share to linkedin an explanation of the weird form..

How to fill out form 1116 foreign tax credit Australian manuals

Web form 8716 is used by partnerships, s corporations, and personal service corporations to elect under section 444(a) to have a tax year other than a required tax. Complete, edit or print tax forms instantly. Web you elect this procedure for the tax year. Web turbotax help intuit where do i enter the foreign tax credit (form 1116) or deduction?.

Register Online And Complete Your Tax.

Web form 1116 instructions step one: You must have incurred or paid a foreign tax liability. Solved • by turbotax • 2533 • updated april 11, 2023 to see when form. Complete, edit or print tax forms instantly.

Web Form 8716 Is Used By Partnerships, S Corporations, And Personal Service Corporations To Elect Under Section 444(A) To Have A Tax Year Other Than A Required Tax.

The form requests the information about the country your foreign taxes were paid in, the. Find out if you qualify for the foreign tax credit. Web when filling out a form 1116 explanation statement, you should always include the following personal details: Web to choose the foreign tax credit you generally must complete form 1116 and attach it to your form 1040.

Once You Enter Your Income, You’ll Be Asked If It Has Been Taxed Outside The Us, And.

Web turbotax help intuit where do i enter the foreign tax credit (form 1116) or deduction? Web william baldwin senior contributor nov 9, 2021,11:41am est listen to article share to facebook share to twitter share to linkedin an explanation of the weird form. Web how to file form 1116 head over to our ways to file page and choose to either file with an advisor or file yourself. Web (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate instructions.

Web A Form 1116 Does Not Have To Be Completed If The Total Creditable Foreign Taxes Are Not More Than $300 ($600 If Married Filing A Joint Return) And Other Conditions Are Met;

Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Get ready for tax season deadlines by completing any required tax forms today. You do not have to complete form 1116 to take. Web you elect this procedure for the tax year.