How To Fill Out Form 941 For Employee Retention Credit

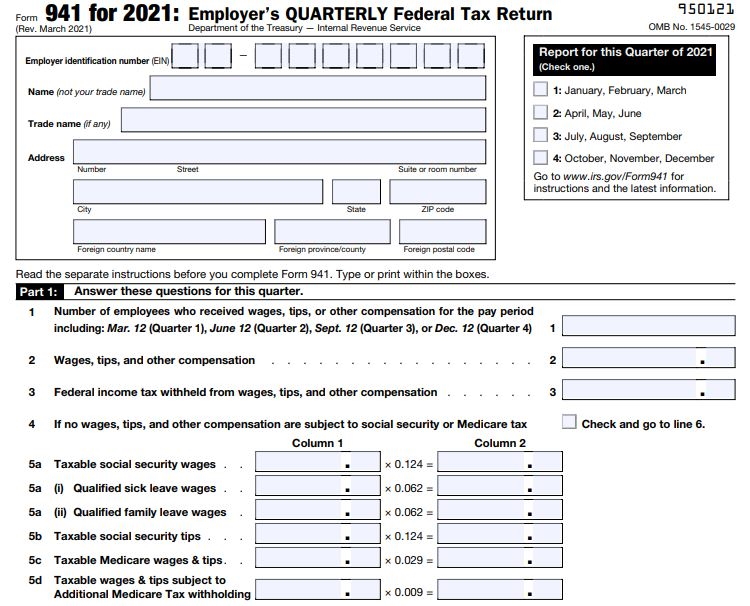

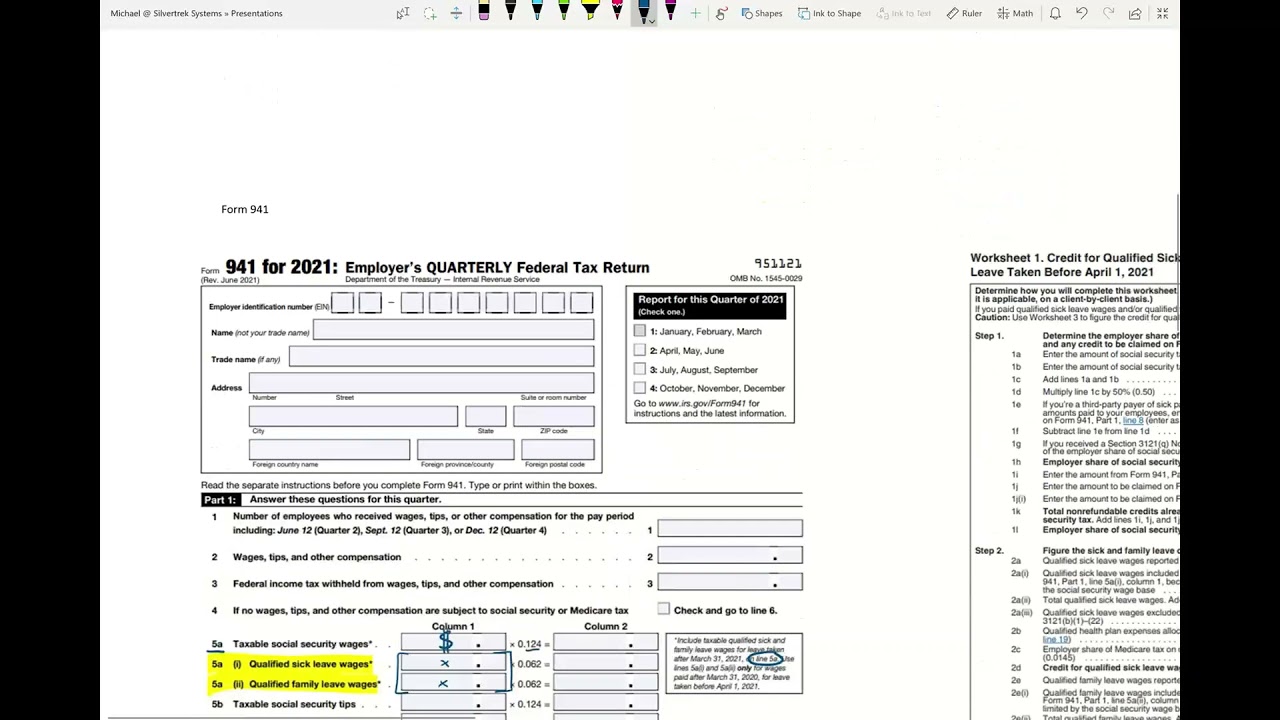

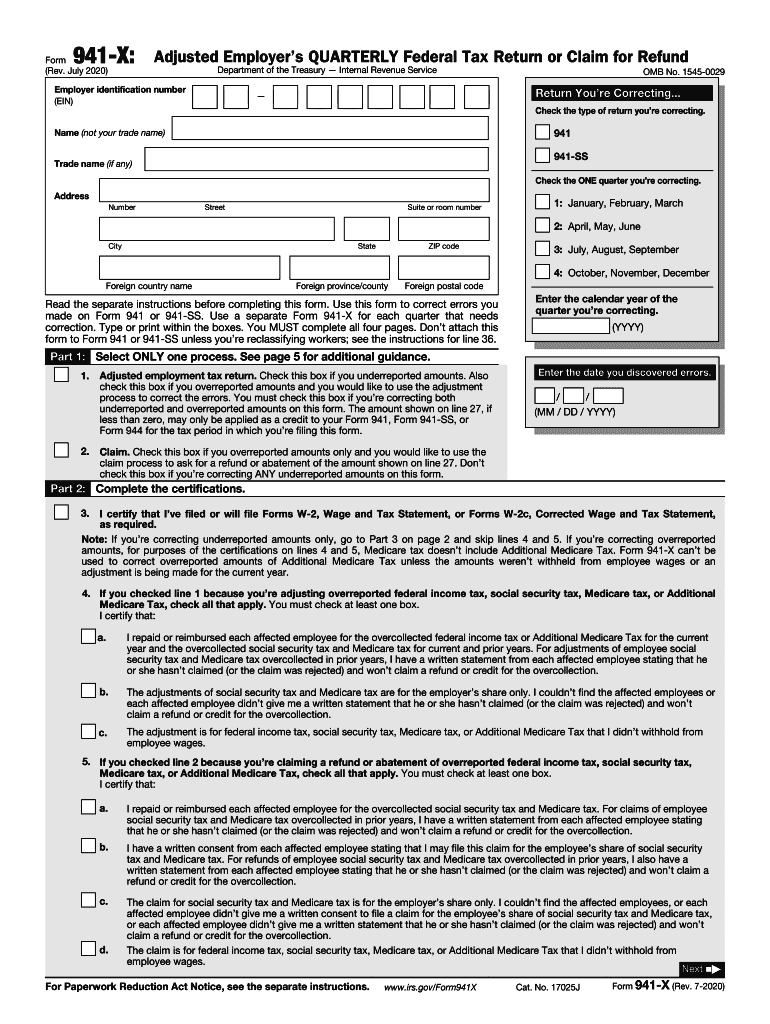

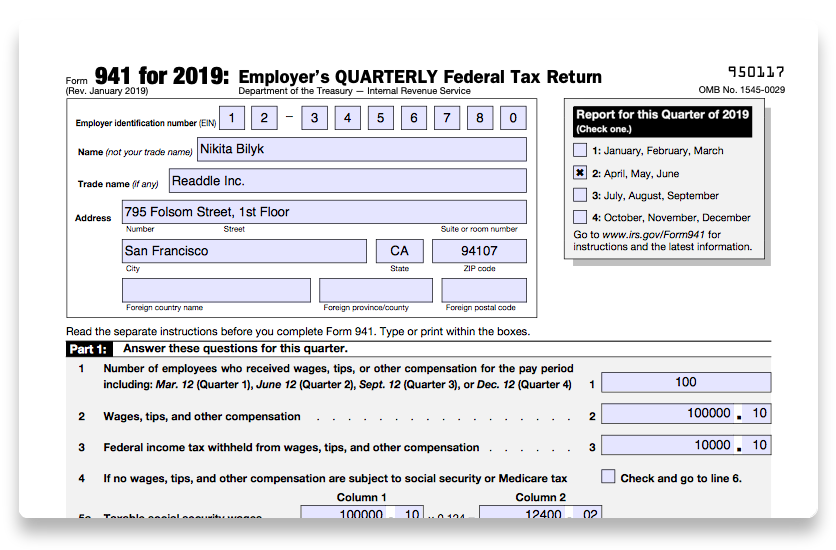

How To Fill Out Form 941 For Employee Retention Credit - Web if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any corrections on form 941‐x to amounts used to figure this credit, you'll need to refigure the amount of this credit using worksheet 4. Assess your qualified wages for each year. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction Ad stentam is the nations leading tax technology firm. Find which payroll quarters in 2020 and 2021 your association was qualified for. Web the employer's employee retention credit on form 941, line 16, month 3, or, if a semiweekly schedule depositor, on schedule b (form 941) for the applicable day or days in december (month 3) for the fourth quarter of 2021. Determine if you had a qualifying closure. To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1 that it references is on the last page of the form 941 instructions. Ad there is no cost to you until you receive the funds from the irs.

Determine if you had a qualifying closure. Ad there is no cost to you until you receive the funds from the irs. Find which payroll quarters in 2020 and 2021 your association was qualified for. Web do it yourself. Companies qualify to get up to $26,000 per employee. Web the employer's employee retention credit on form 941, line 16, month 3, or, if a semiweekly schedule depositor, on schedule b (form 941) for the applicable day or days in december (month 3) for the fourth quarter of 2021. Ad stentam is the nations leading tax technology firm. Calculate the erc for your business. Work with an experienced professional. See if you do in 2 min

See if you do in 2 min Work with an experienced professional. Determine if you had a qualifying closure. Please remember, this article was written as a general guide, and is not meant to replace consulting with tax experts. Web if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any corrections on form 941‐x to amounts used to figure this credit, you'll need to refigure the amount of this credit using worksheet 4. Calculate the erc for your business. Check to see if you qualify. To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1 that it references is on the last page of the form 941 instructions. Assess your qualified wages for each year. Web do it yourself.

Easy Instructions to Prepare Form 941

Utilize the worksheet to calculate the tax credit. Ad stentam is the nations leading tax technology firm. See if you do in 2 min Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction Claim your ercs with confidence today.

How to Fill Out 941X for Employee Retention Credit? by Employee

Ad there is no cost to you until you receive the funds from the irs. Ad get tax credit directly from the irs with our streamlined erc services. Web the employer's employee retention credit on form 941, line 16, month 3, or, if a semiweekly schedule depositor, on schedule b (form 941) for the applicable day or days in december.

How to Fill out IRS Form 941 Nina's Soap

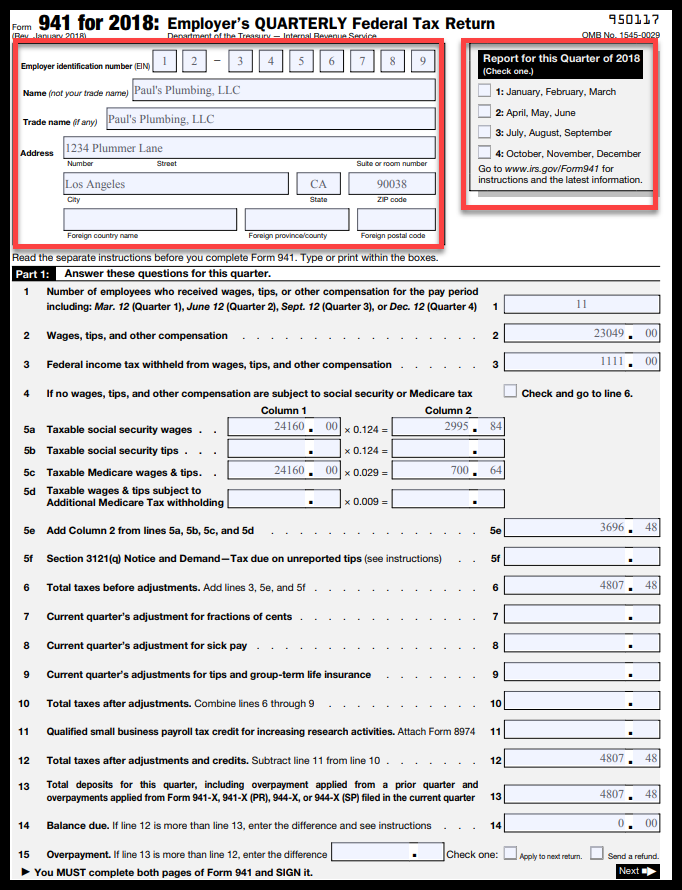

Web do it yourself. Check part 1, box 2 b. Companies qualify to get up to $26,000 per employee. Web irs form 941 is the form you regularly file quarterly with your payroll. Complete the company information on each page, the “return you’re correcting” information in the upper right corner and enter the date you discovered the errors.

Updated 941 and Employee Retention Credit in Vista YouTube

See if you do in 2 min Web do it yourself. Check part 1, box 2 b. Check to see if you qualify. Complete the company information on each page, the “return you’re correcting” information in the upper right corner and enter the date you discovered the errors.

Form Bavar 2018 941 for 2018 Employer's QUARTERLY

Determine if you had a qualifying closure. Check to see if you qualify. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Get the maximum tax benefit for your business with our assistance. To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1 that it.

Employee Retention Credit Form MPLOYME

To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1 that it references is on the last page of the form 941 instructions. Ad we take the confusion out of erc funding and specialize in working with small businesses. Utilize the worksheet to calculate the tax credit. Claim your ercs with confidence today. Ad there.

How To Fill Out Form 941 X For Employee Retention Credit

Fill in the required details on the page header, such as the ein number, quarter, company name, and year. To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1 that it references is on the last page of the form 941 instructions. Check part 1, box 2 b. Ad get tax credit directly from the.

941 X Form Fill Out and Sign Printable PDF Template signNow

Ad stentam is the nations leading tax technology firm. Up to $26,000 per employee. Get the maximum tax benefit for your business with our assistance. Ad there is no cost to you until you receive the funds from the irs. To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1 that it references is on.

10 Form Irs 10 10 Secrets About 10 Form Irs 10 That Has Never Been

Calculate the erc for your business. Determine if you had a qualifying closure. Find which payroll quarters in 2020 and 2021 your association was qualified for. Web do it yourself. Web if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any corrections on form 941‐x to amounts.

How To Fill Out Form 941 X For Employee Retention Credit In 2020

See if you do in 2 min Web do it yourself. Claim your ercs with confidence today. Web if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any corrections on form 941‐x to amounts used to figure this credit, you'll need to refigure the amount of this.

Up To $26,000 Per Employee.

Ad we take the confusion out of erc funding and specialize in working with small businesses. To claim the employee retention credit, utilize line 11c in form 941, and worksheet 1 that it references is on the last page of the form 941 instructions. Ad get tax credit directly from the irs with our streamlined erc services. Web if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and you make any corrections on form 941‐x to amounts used to figure this credit, you'll need to refigure the amount of this credit using worksheet 4.

Ad There Is No Cost To You Until You Receive The Funds From The Irs.

Claim your ercs with confidence today. Web irs form 941 is the form you regularly file quarterly with your payroll. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction Please remember, this article was written as a general guide, and is not meant to replace consulting with tax experts.

Get The Maximum Tax Benefit For Your Business With Our Assistance.

Check part 1, box 2 b. Web the employer's employee retention credit on form 941, line 16, month 3, or, if a semiweekly schedule depositor, on schedule b (form 941) for the applicable day or days in december (month 3) for the fourth quarter of 2021. Complete the company information on each page, the “return you’re correcting” information in the upper right corner and enter the date you discovered the errors. Check to see if you qualify.

Determine If You Had A Qualifying Closure.

Work with an experienced professional. Find which payroll quarters in 2020 and 2021 your association was qualified for. Utilize the worksheet to calculate the tax credit. Fill in the required details on the page header, such as the ein number, quarter, company name, and year.

:max_bytes(150000):strip_icc()/scan0001-57aa87625f9b58974a2c7f97.jpg)