How To Fill Out W-9 Form For Only Fans

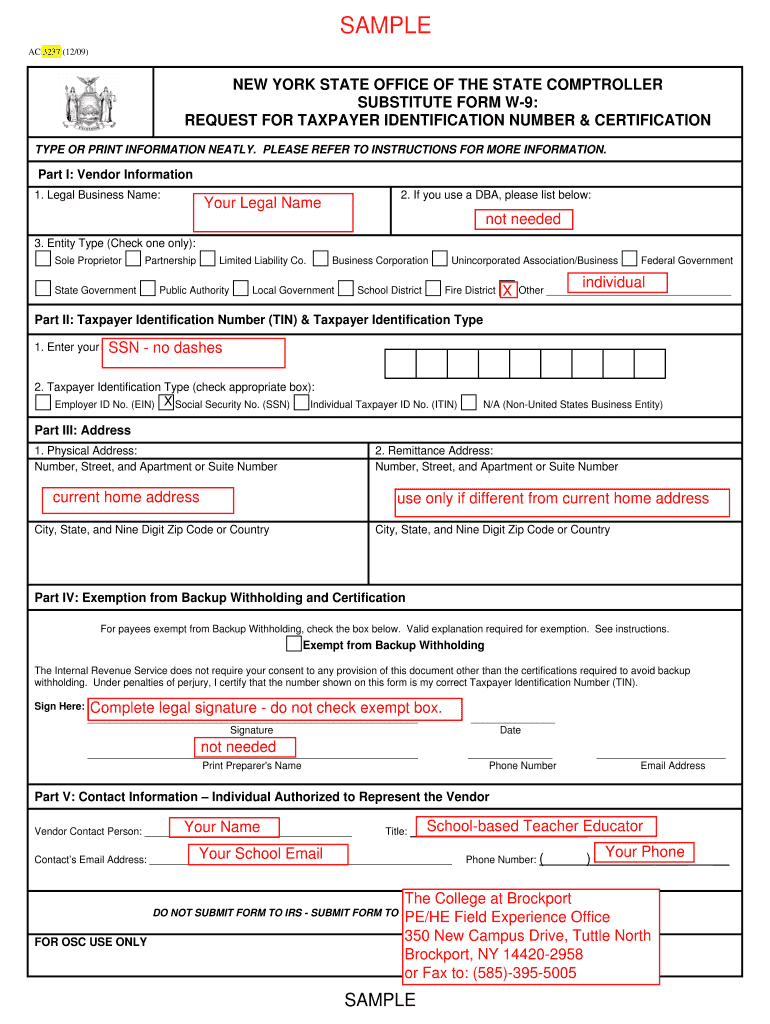

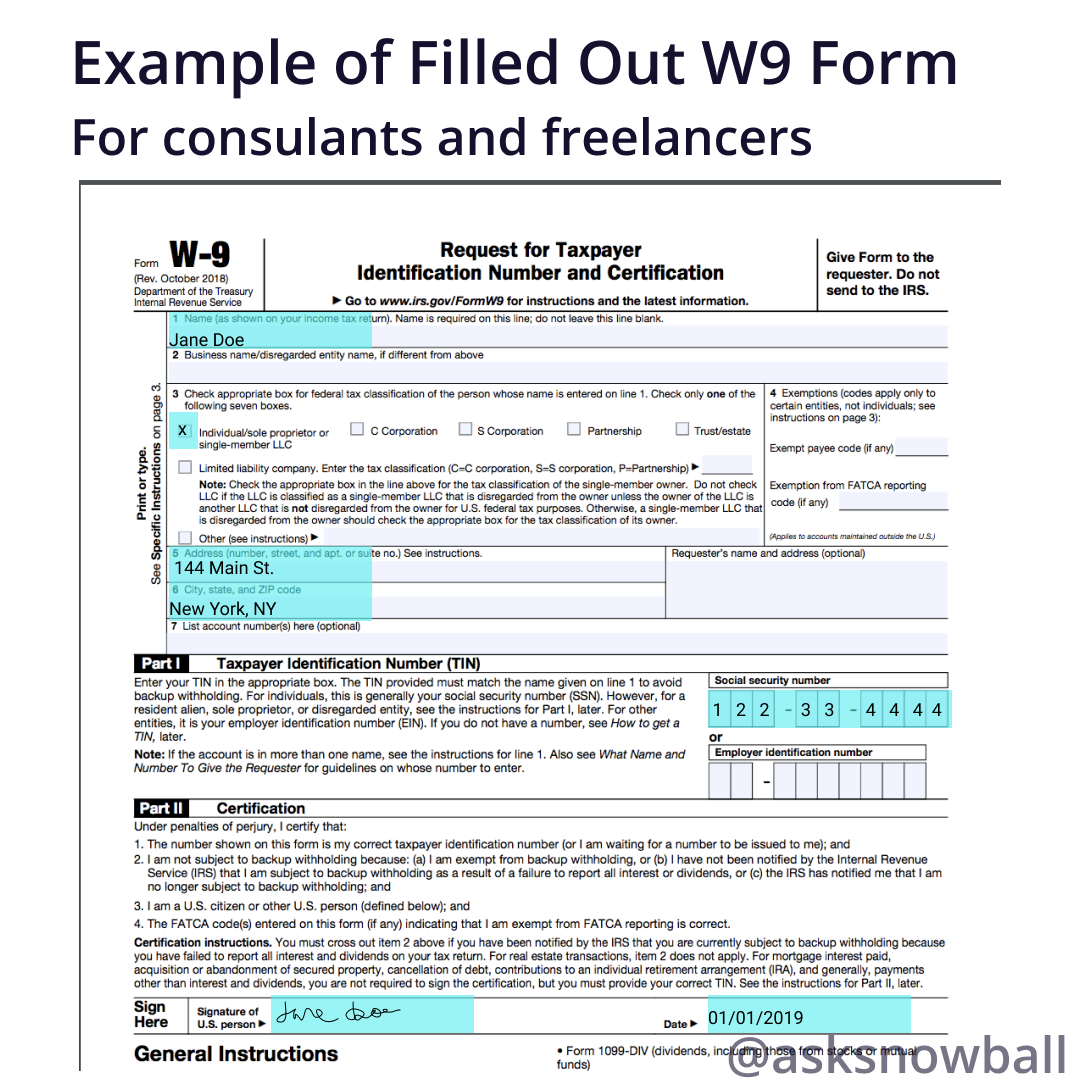

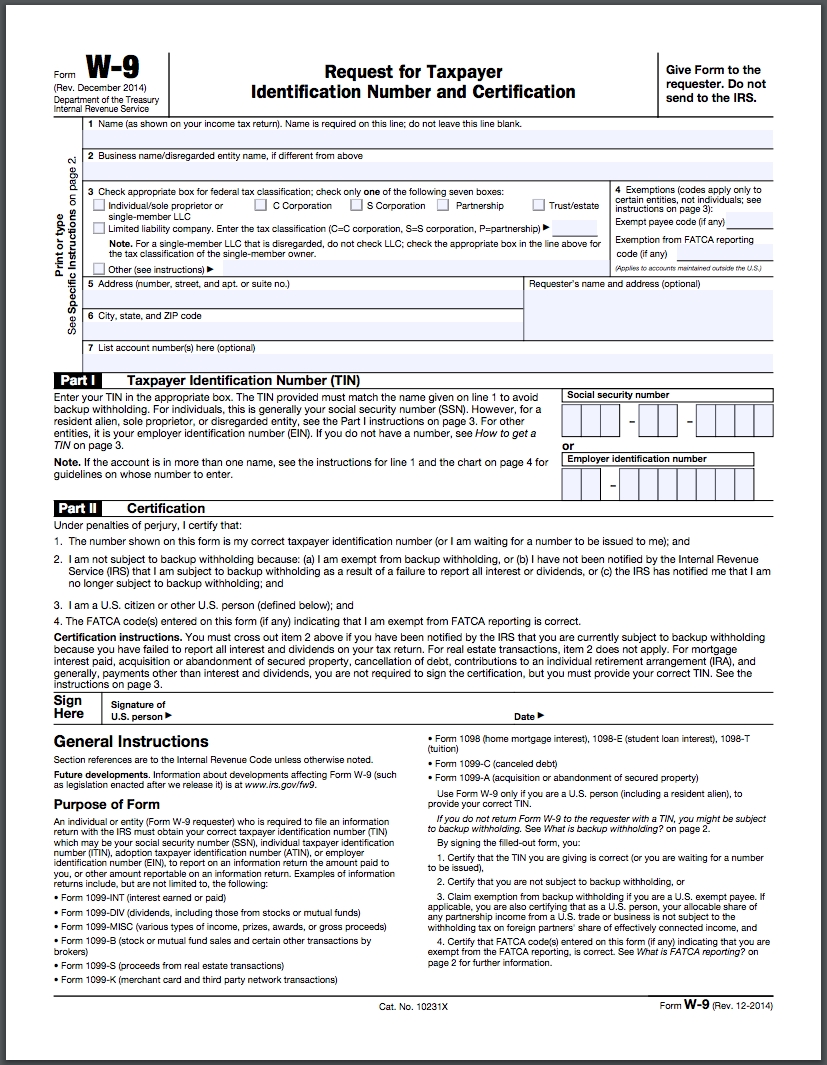

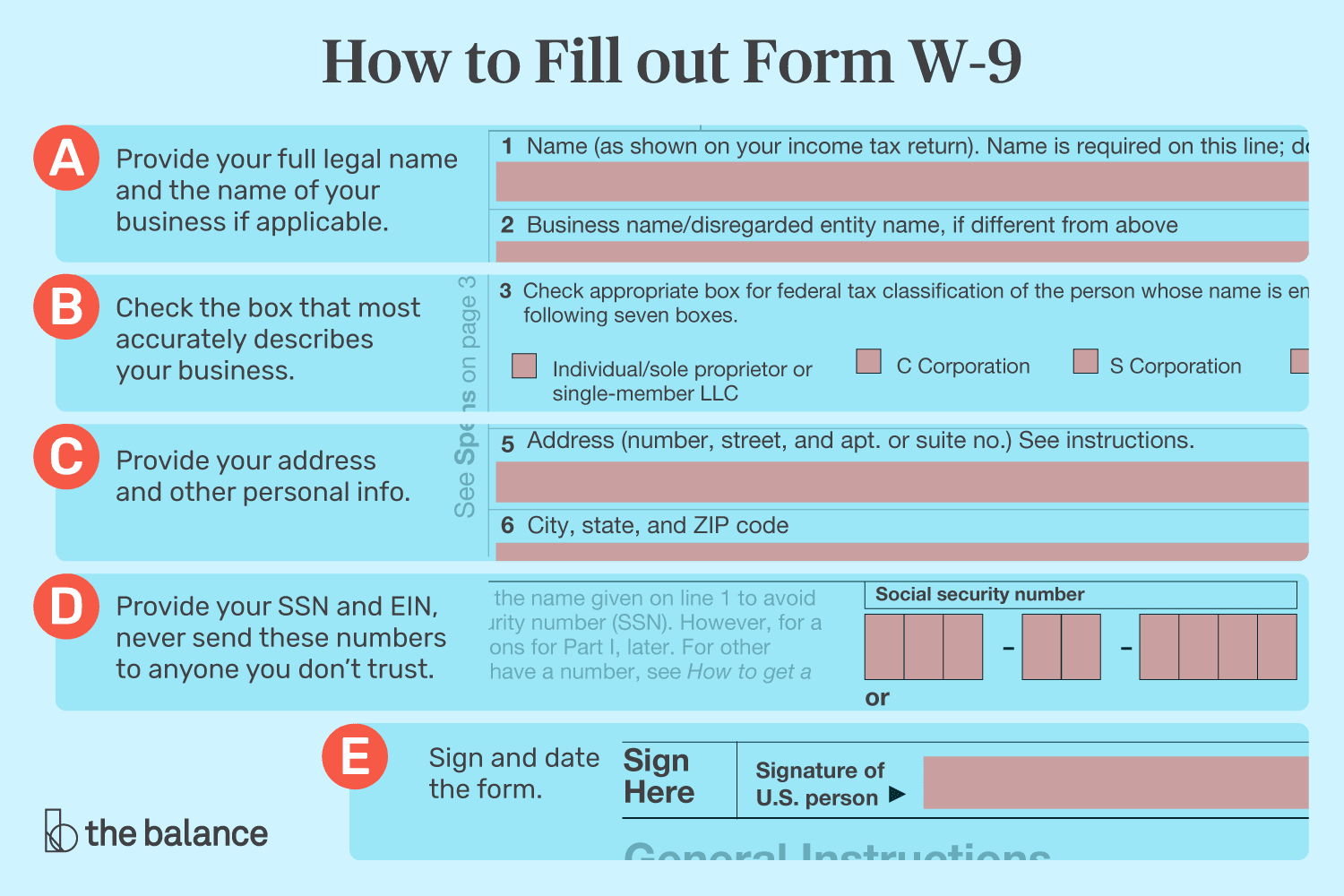

How To Fill Out W-9 Form For Only Fans - We just go to google. Web to fill out the onlyfans w9 form, you will need to provide your legal name, address, and social security number or other taxpayer identification number. Web to fill out the form, creators must provide their full legal name, mailing address, and social security number or individual taxpayer identification number. Web you need to fill it out with your full name, address and ssn, sign the certification in part ii. Jotform offers a convenient and easy option that makes this possible. If you are running a sole proprietorship you would enter your name. Download and print the w9 form you can find the w9 form on the irs website. Line 2 is optional and can be left blank if you don’t have a dba or llc. Web this is a federal employer identification number. On line 3, check the box for.

Line 2 is optional and can be left blank if you don’t have a dba or llc. Next, go back to the top and fill in your name or business. Download and print a copy of the form so you can fill it out manually. When i go to submit it says there is a validation error. Web you need to fill it out with your full name, address and ssn, sign the certification in part ii. Jotform offers a convenient and easy option that makes this possible. You will be paid for your work by the owner of the website and they. Web i do this to inform! You are required to have one if your business has employees, but anyone running a business has the option of. Web help filling out w9 form for onlyfans.

You will be paid for your work by the owner of the website and they. Web to fill out the form, creators must provide their full legal name, mailing address, and social security number or individual taxpayer identification number. I'm currently trying to fill out a w9 form for an onlyfans account. Line 2 is optional and can be left blank if you don’t have a dba or llc. Web help filling out w9 form for onlyfans. You are required to have one if your business has employees, but anyone running a business has the option of. Next, go back to the top and fill in your name or business. Web i do this to inform! If you are running a sole proprietorship you would enter your name. Download and print the w9 form you can find the w9 form on the irs website.

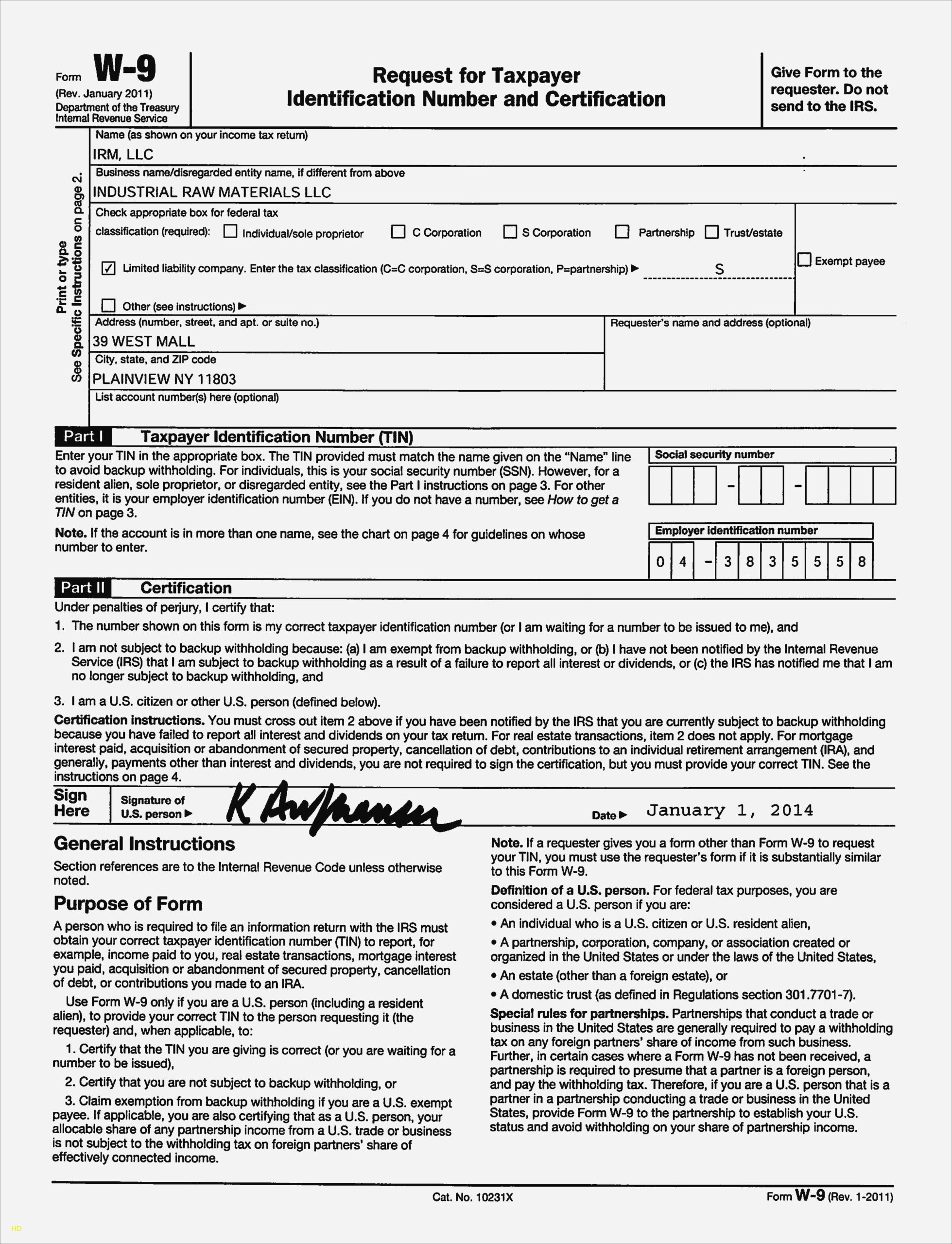

W9 Sample Fill Out and Sign Printable PDF Template signNow

I'm currently trying to fill out a w9 form for an onlyfans account. Line 2 is optional and can be left blank if you don’t have a dba or llc. If you’re an onlyfans creator, you may have been asked to fill. When i go to submit it says there is a validation error. Download and print the w9 form.

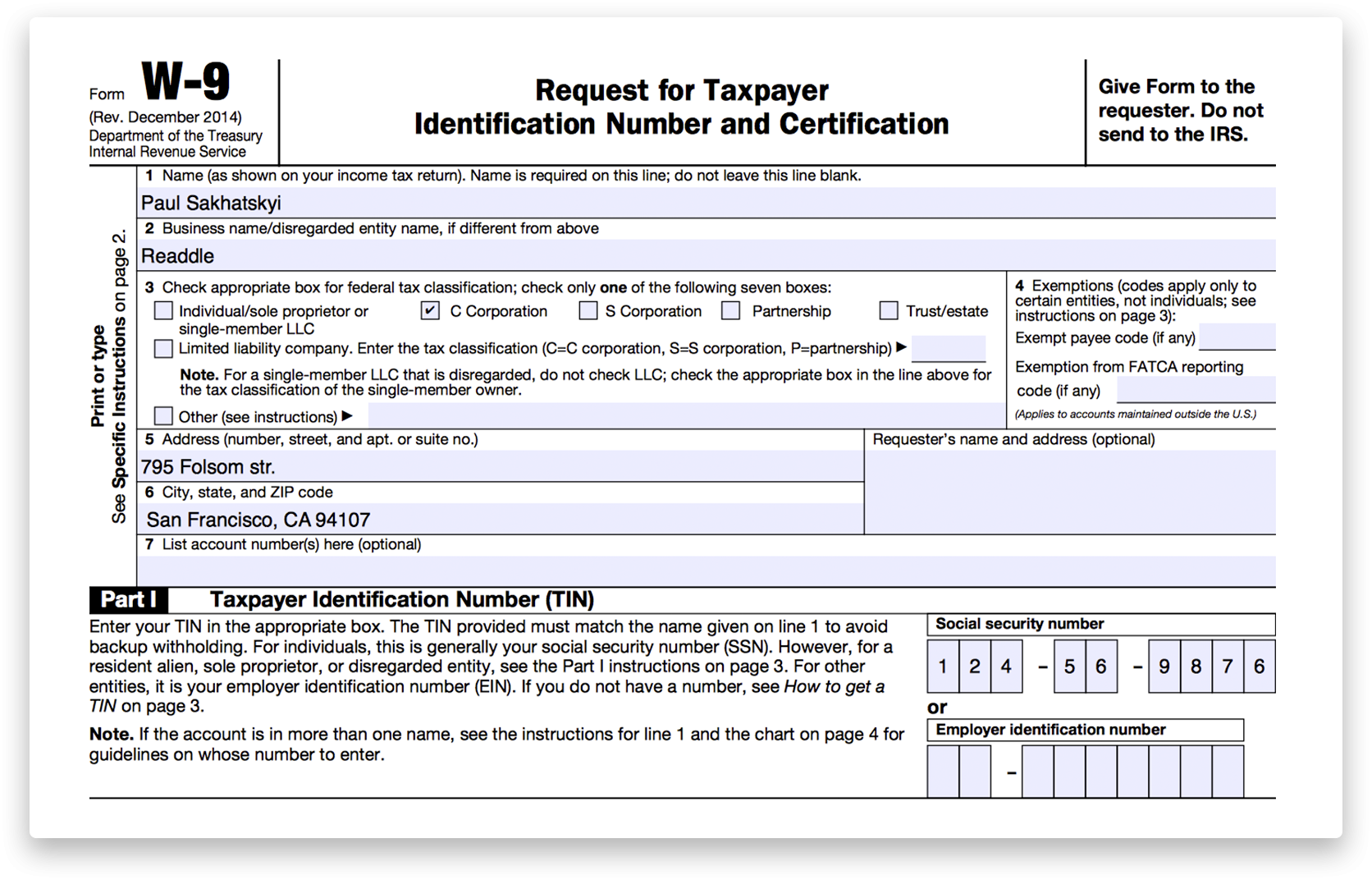

How To Fill Out And Sign Your W9 Form Online within Online Fillable W

Web help filling out w9 form for onlyfans. Web to fill out the onlyfans w9 form, you will need to provide your legal name, address, and social security number or other taxpayer identification number. Web i do this to inform! I'm currently attempting to fill out a w9 form for an onlyfans account. Jotform offers a convenient and easy option.

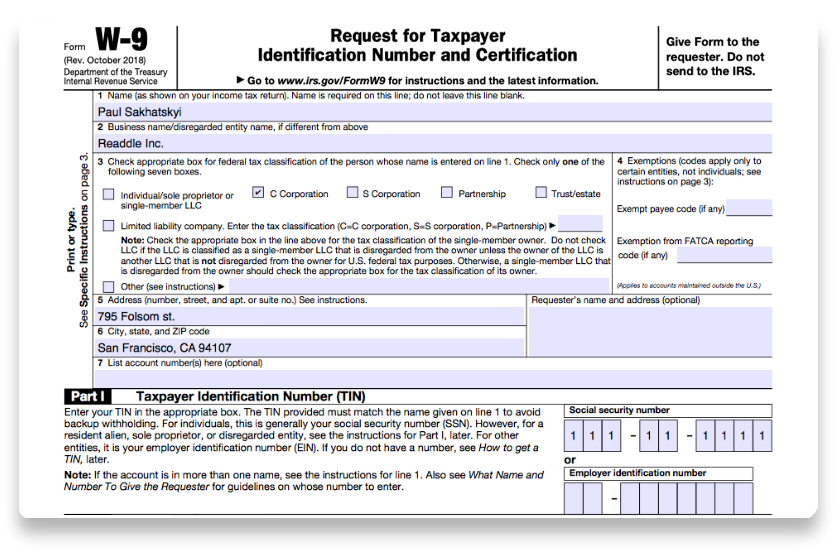

How to Fill out a W9 2019

Download and print a copy of the form so you can fill it out manually. Web to fill out the onlyfans w9 form, you will need to provide your legal name, address, and social security number or other taxpayer identification number. Any supplier, contractor, or small business owner who receives. Start by adding your full legal name on line 1..

What Is a W9 Tax Form? H&R Block

Web you need to fill it out with your full name, address and ssn, sign the certification in part ii. Download and print the w9 form you can find the w9 form on the irs website. When i go to submit it says there is a validation error. Web this is a federal employer identification number. Line 2 is optional.

W 9 Form 2020 Printable Free Blank Calendar Template Printable

Jotform offers a convenient and easy option that makes this possible. Web help filling out w9 form for onlyfans. You will also need to. Web to fill out the form, creators must provide their full legal name, mailing address, and social security number or individual taxpayer identification number. Line 2 is optional and can be left blank if you don’t.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

Web i do this to inform! I'm currently trying to fill out a w9 form for an onlyfans account. You will be paid for your work by the owner of the website and they. You are required to have one if your business has employees, but anyone running a business has the option of. Web help with w9 form for.

Pick Blank W 9 Printable Form Template Calendar Printables Free Blank

Web help filling out w9 form for onlyfans. Web this is a federal employer identification number. Start by adding your full legal name on line 1. You are required to have one if your business has employees, but anyone running a business has the option of. On line 3, check the box for.

Sample W 9 Form Example Calendar Printable

You will also need to. Web this is a federal employer identification number. I'm currently attempting to fill out a w9 form for an onlyfans account. You are required to have one if your business has employees, but anyone running a business has the option of. When i go to submit it says there is a validation error.

W9 Form Fill Out Free

If you’re an onlyfans creator, you may have been asked to fill. Web to fill out the onlyfans w9 form, you will need to provide your legal name, address, and social security number or other taxpayer identification number. You will be paid for your work by the owner of the website and they. Download and print a copy of the.

How to fill out IRS Form W9 20202021 PDF Expert

Any supplier, contractor, or small business owner who receives. Next, go back to the top and fill in your name or business. I'm currently attempting to fill out a w9 form for an onlyfans account. Download and print a copy of the form so you can fill it out manually. I'm currently trying to fill out a w9 form for.

You Are Required To Have One If Your Business Has Employees, But Anyone Running A Business Has The Option Of.

Web to fill out the onlyfans w9 form, you will need to provide your legal name, address, and social security number or other taxpayer identification number. Any supplier, contractor, or small business owner who receives. We just go to google. Web help filling out w9 form for onlyfans.

Next, Go Back To The Top And Fill In Your Name Or Business.

You will also need to. On line 3, check the box for. Download and print a copy of the form so you can fill it out manually. Start by adding your full legal name on line 1.

Web This Is A Federal Employer Identification Number.

Line 2 is optional and can be left blank if you don’t have a dba or llc. Download and print the w9 form you can find the w9 form on the irs website. Web i do this to inform! You will be paid for your work by the owner of the website and they.

I'm Currently Attempting To Fill Out A W9 Form For An Onlyfans Account.

If you’re an onlyfans creator, you may have been asked to fill. When i go to submit it says there is a validation error. If you are running a sole proprietorship you would enter your name. Login to your only fans account and go to your profile page.