How To Form A Trust In Florida

How To Form A Trust In Florida - Easily customize your living trust. Web up to 25% cash back to make a living trust in florida, you: According to § 736.0402 , to create a trust, the grantor needs to select a trustee and beneficiary and list their assets. Web to put your house in a trust in florida, the property owner must convey the house to the trust using a deed. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web legalzoom can help you create a florida living trust online quickly and easily. Grantor (you), beneficiary (heir/heiress), and trustee (executor). Ron desantis said black people learned beneficial skills as slaves. There are three roles you have to include in your living trust document: Web in order to open a trust account, a valid florida trust agreement must be effectuated.

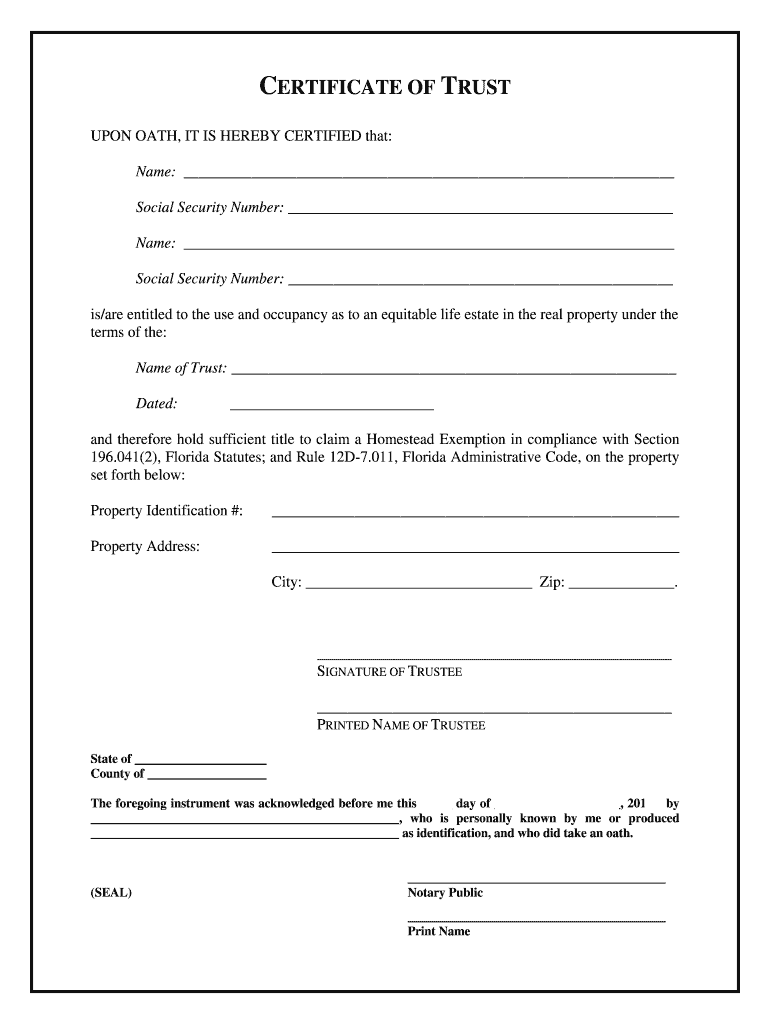

If all heirs sign waivers. Web this notice of trust is found in florida trust code 736.05055. Choose whether to make an individual or shared trust. Web up to 25% cash back to make a living trust in florida, you: According to § 736.0402 , to create a trust, the grantor needs to select a trustee and beneficiary and list their assets. Fl certificate of trust & more fillable forms, register and subscribe now! Fill out a simple questionnaire to get started. They're probably going to show that some of the folks that eventually. Decide what property to include in the trust. Grantor (you), beneficiary (heir/heiress), and trustee (executor).

Web this notice of trust is found in florida trust code 736.05055. Web on june 13, 2014, governor scott signed the florida family trust company act, creating f.s. Web the first step in how to put your home in a trust in florida is to create one. Web to put your house in a trust in florida, the property owner must convey the house to the trust using a deed. Edit, sign and save fl certificate of trust form. Ad create a living trust to seamlessly transfer your property or assets to a beneficiary. Web july 31, 2023. Web ap photo/phil sears, file. Easily customize your living trust. Grantor (you), beneficiary (heir/heiress), and trustee (executor).

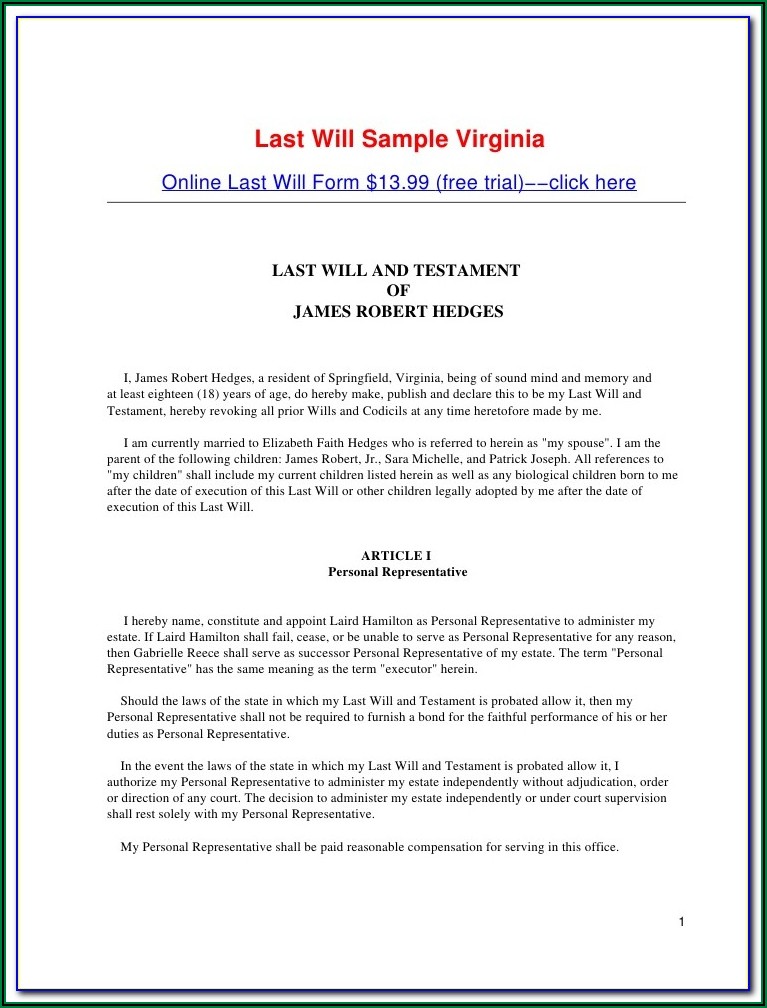

Florida Irrevocable Trust Execution Formalities Form Resume

Save time and money by creating and downloading any legally binding agreement in minutes. A quitclaim deed is the preferred type of deed for this. Web on june 13, 2014, governor scott signed the florida family trust company act, creating f.s. Therefore, the main steps to creating a functioning trust account in florida are as. Web to put your house.

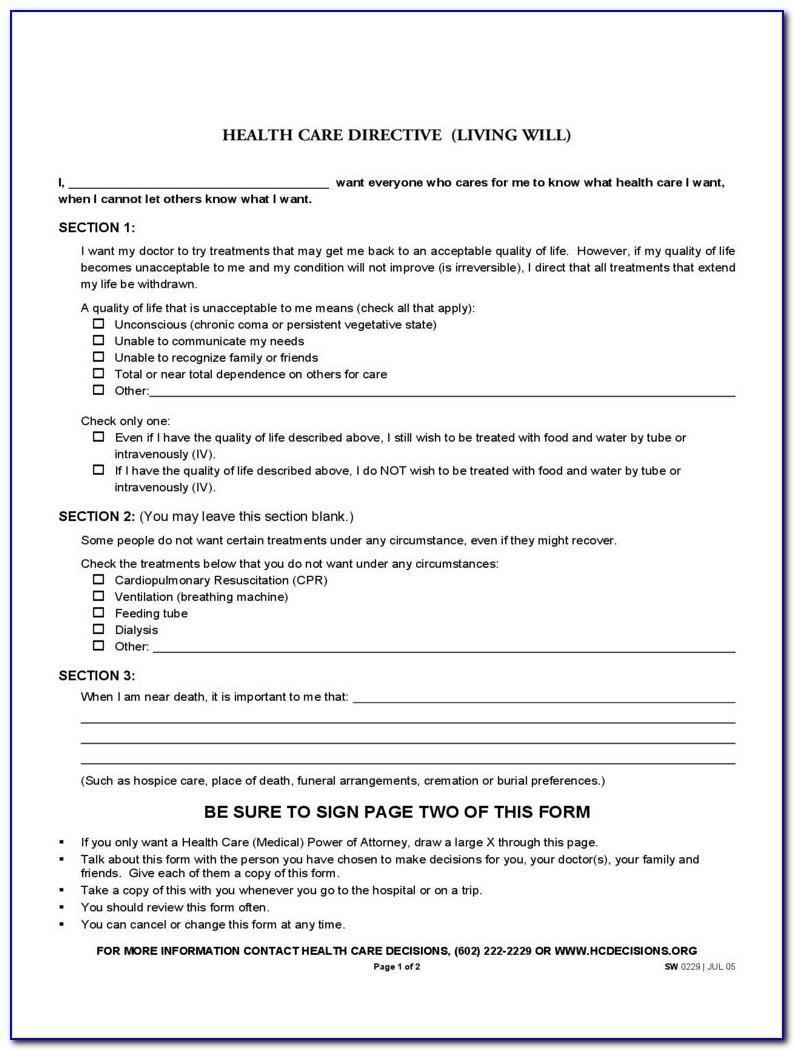

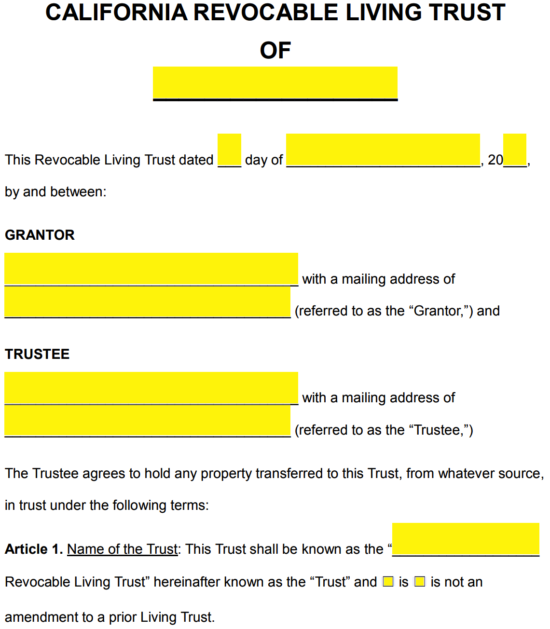

Florida Revocable Living Trust Form Free

Fill out a simple questionnaire to get started. On a blank sheet of paper, write the word “amendment” and then describe the changes that you want to make to your trust. Ad answer simple questions to make a living trust on any device in minutes. Web on june 13, 2014, governor scott signed the florida family trust company act, creating.

Certificate of Trust Form Fill Out and Sign Printable PDF Template

Web july 31, 2023. Grantor (you), beneficiary (heir/heiress), and trustee (executor). There are three roles you have to include in your living trust document: Web this notice of trust is found in florida trust code 736.05055. Fill out a simple questionnaire to get started.

Florida Spendthrift Trust Form Universal Network

According to § 736.0402 , to create a trust, the grantor needs to select a trustee and beneficiary and list their assets. Web states basing their taxing jurisdiction on the residence of the trustee, or the place of administration, will afford the best opportunity for planning, since changing trustees to those residing in florida, moving tangible and intangible personal property.

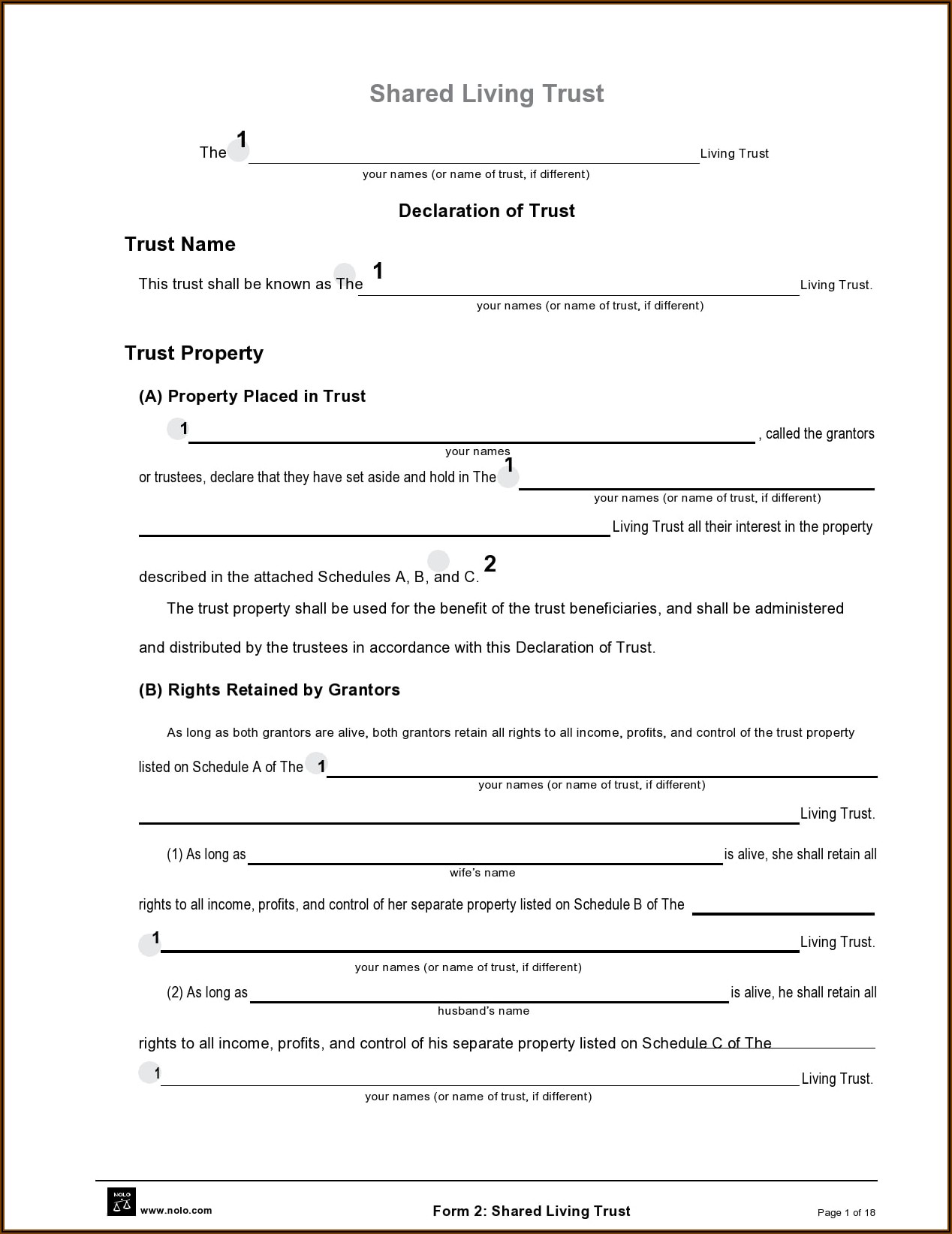

Free Florida Revocable Living Trust Form PDF Word eForms Free

Web states basing their taxing jurisdiction on the residence of the trustee, or the place of administration, will afford the best opportunity for planning, since changing trustees to those residing in florida, moving tangible and intangible personal property to florida, and assuring that books and records of the trust are kept in florida can be. Easily customize your living trust..

Irrevocable Trust Template Florida Template 1 Resume Examples

According to § 736.0402 , to create a trust, the grantor needs to select a trustee and beneficiary and list their assets. The act, which becomes effective october 1, 2015, governs. They're probably going to show that some of the folks that eventually. Web create your amendment. Therefore, the main steps to creating a functioning trust account in florida are.

Florida Irrevocable Trust Execution Formalities Form Resume

If all heirs sign waivers. Fill out a simple questionnaire to get started. Legalzoom will review your answer. Ad answer simple questions to make a living trust on any device in minutes. Web florida trust litigation refers to legal disputes that arise involving trusts in the state of florida.

Free California Revocable Living Trust Form PDF Word eForms

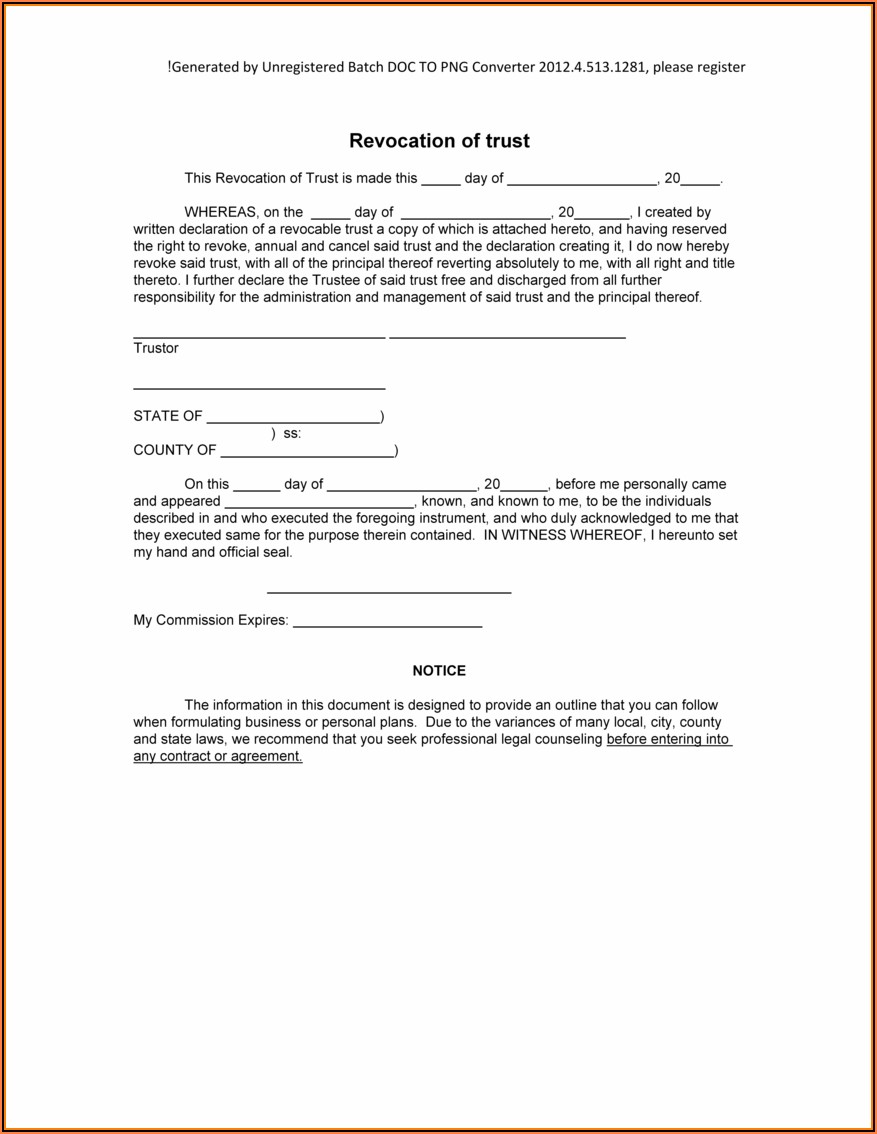

To do so, you’ll first need to choose which type of trust is optimal for you and your family. Web create your amendment. Therefore, the main steps to creating a functioning trust account in florida are as. On a blank sheet of paper, write the word “amendment” and then describe the changes that you want to make to your trust..

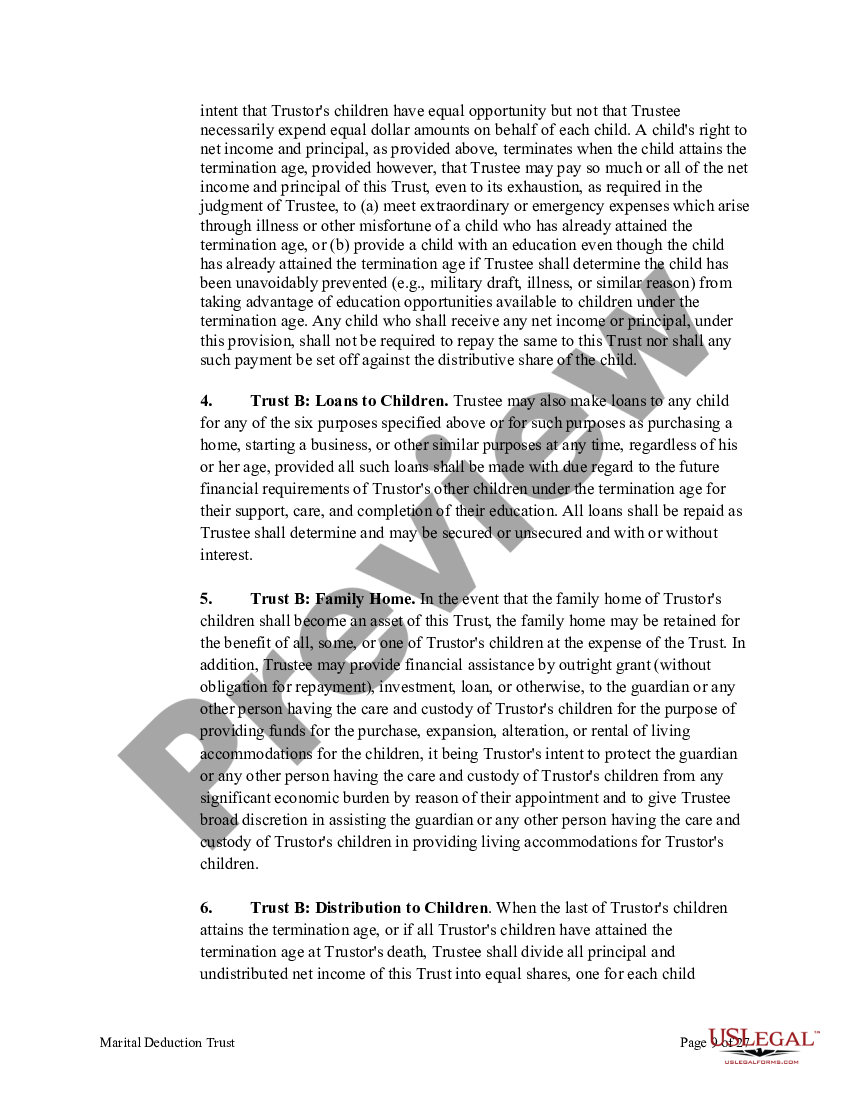

Florida Marital Deduction Trust Trust A and Bypass Trust B Marital

Decide what property to include in the trust. Save time and money by creating and downloading any legally binding agreement in minutes. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according.

Example Trust Amendment Form Form Resume Examples Wk9y6a0vY3

Web florida trust litigation refers to legal disputes that arise involving trusts in the state of florida. Therefore, the main steps to creating a functioning trust account in florida are as. Web legalzoom can help you create a florida living trust online quickly and easily. Ron desantis said black people learned beneficial skills as slaves. Web create your amendment.

There Are Three Roles You Have To Include In Your Living Trust Document:

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) The act, which becomes effective october 1, 2015, governs. Web to put your house in a trust in florida, the property owner must convey the house to the trust using a deed. Web guide for transferring real property into a living trust.

They're Probably Going To Show That Some Of The Folks That Eventually.

Web ap photo/phil sears, file. Web create your amendment. Web florida trust litigation refers to legal disputes that arise involving trusts in the state of florida. Web how to make a living trust in florida.

Easily Customize Your Living Trust.

Web july 31, 2023. Web in order to open a trust account, a valid florida trust agreement must be effectuated. You see, when one has a revocable trust, and they die, that revocable trust may have to pay: To do so, you’ll first need to choose which type of trust is optimal for you and your family.

Web Legalzoom Can Help You Create A Florida Living Trust Online Quickly And Easily.

Grantor (you), beneficiary (heir/heiress), and trustee (executor). Ad create a living trust to seamlessly transfer your property or assets to a beneficiary. Decide what property to include in the trust. According to § 736.0402 , to create a trust, the grantor needs to select a trustee and beneficiary and list their assets.