How To Get A Stamped Copy Of Form 2290

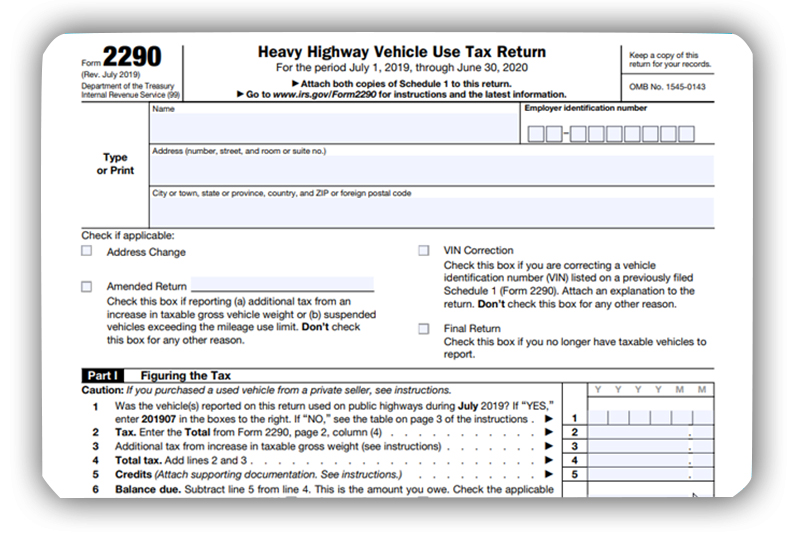

How To Get A Stamped Copy Of Form 2290 - Irs.gov/transcripts log into your account and visit the. Fill in the company employer identification number on the schedule 1 you are requesting ***if you have copies you should also attach the original form filed.*** my. Log into your account and visit the. Easy, fast, secure & free to try. Web luckily, tax2290.com makes it easy to receive your stamped schedule 1, anytime and anywhere. When you file with us, the first thing we do is, email you the copy. Simply log into your account and navigate to. Web if you don’t have the stamped copy, you may use a photocopy of the form 2290 (with the schedule 1 attached) filed with the irs and a photocopy of both sides of the. Web the fastest way to get your irs 2290 stamped schedule 1 is by filing form 2290 with expresstrucktax. You should complete and file both copies of schedule 1.

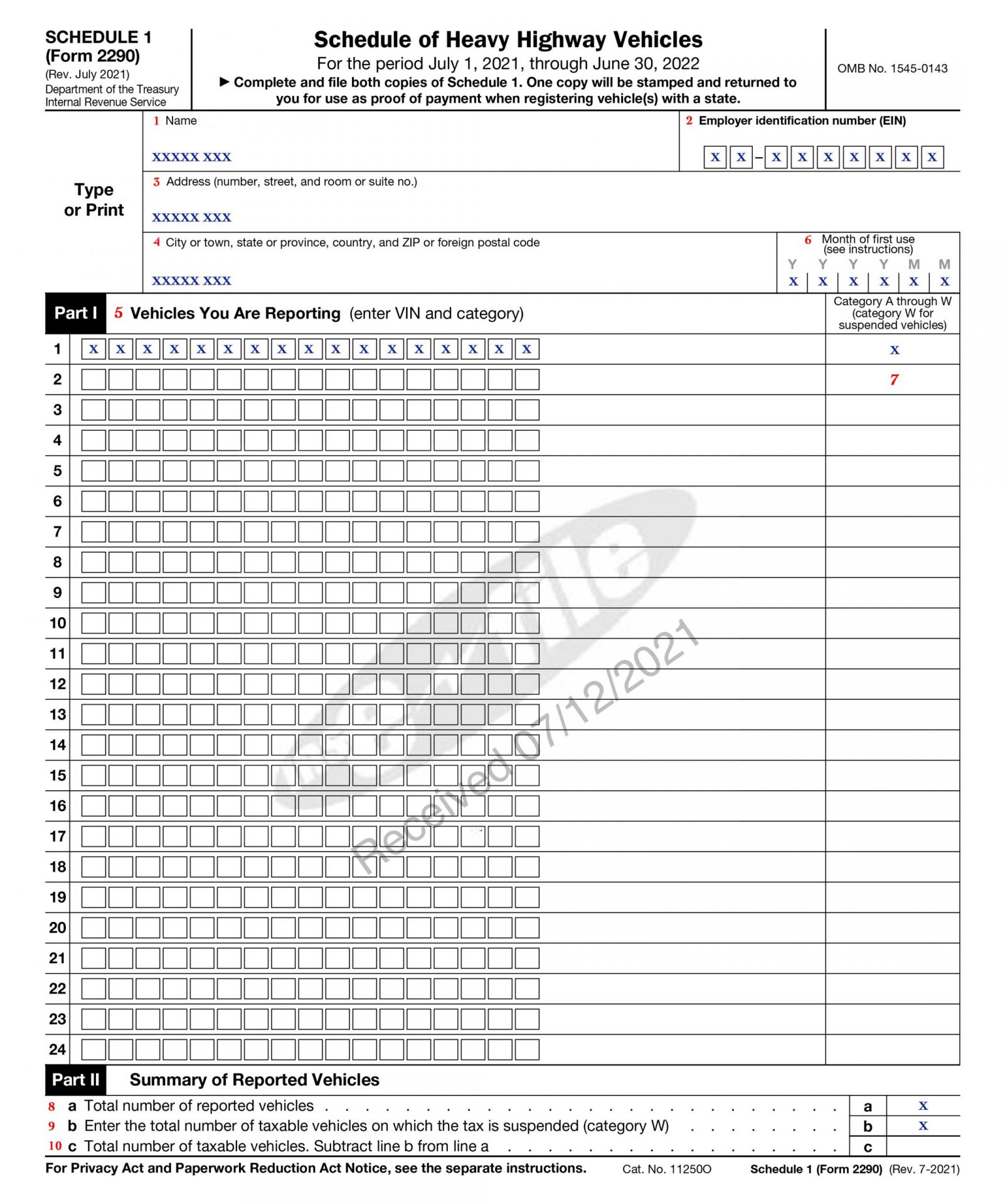

Web in order to obtain a stamped schedule 1 you must first file form 2290 for the heavy vehicle use tax. Irs.gov/transcripts log into your account and visit the. Log into your account and visit the. Web how can i get a stamped copy of my form2290? Log in to your expresstrucktax account. You will receive an electronic copy of. Web you can register here.to obtain a copy of your 2290 proof of payment, simply follow these steps: You should complete and file both copies of schedule 1. The second copy will be stamped and returned to you for. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

Vehicle identification number of each vehicle. Do your truck tax online & have it efiled to the irs! Log into your account and visit the. Web luckily, tax2290.com makes it easy to receive your stamped schedule 1, anytime and anywhere. Easy, fast, secure & free to try. Web accessing your 2290 schedule 1 copy in expresstrucktax. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web use the same name. Web stamped irs form 2290 schedule 1 copy is accepted as the proof of exemption for the vehicles with gross weight over 55,000 pounds but travelling within the mileage limit of. Web how can i get a stamped copy of my form2290?

Get your Form 2290 Schedule 1 in Minutes Efile Form 2290 Now

A stamped copy a stamped copy of my form 2290, showing i payed my heavy highway tax for 2021. Fill in the company employer identification number on the schedule 1 you are requesting ***if you have copies you should also attach the original form filed.*** my. Simply log into your account and navigate to. Vehicle identification number of each vehicle..

2290 Fill Out and Sign Printable PDF Template signNow

Irs.gov/transcripts log into your account and visit the. Log in to your expresstrucktax account. Web the fastest way to get your irs 2290 stamped schedule 1 is by filing form 2290 with expresstrucktax. Web you can register here.to obtain a copy of your 2290 proof of payment, simply follow these steps: Web united states under schedule 1 (form 2290), later.

Get Form 2290 Schedule 1 in Minutes HVUT Proof of Payment

Web how can i get a stamped copy of my form2290? File your 2290 online & get schedule 1 in minutes. Log into your account and visit the. Simply log into your account and navigate to. You should complete and file both copies of schedule 1.

Irs Form 2106 Tax Year 2021 essentially.cyou 2022

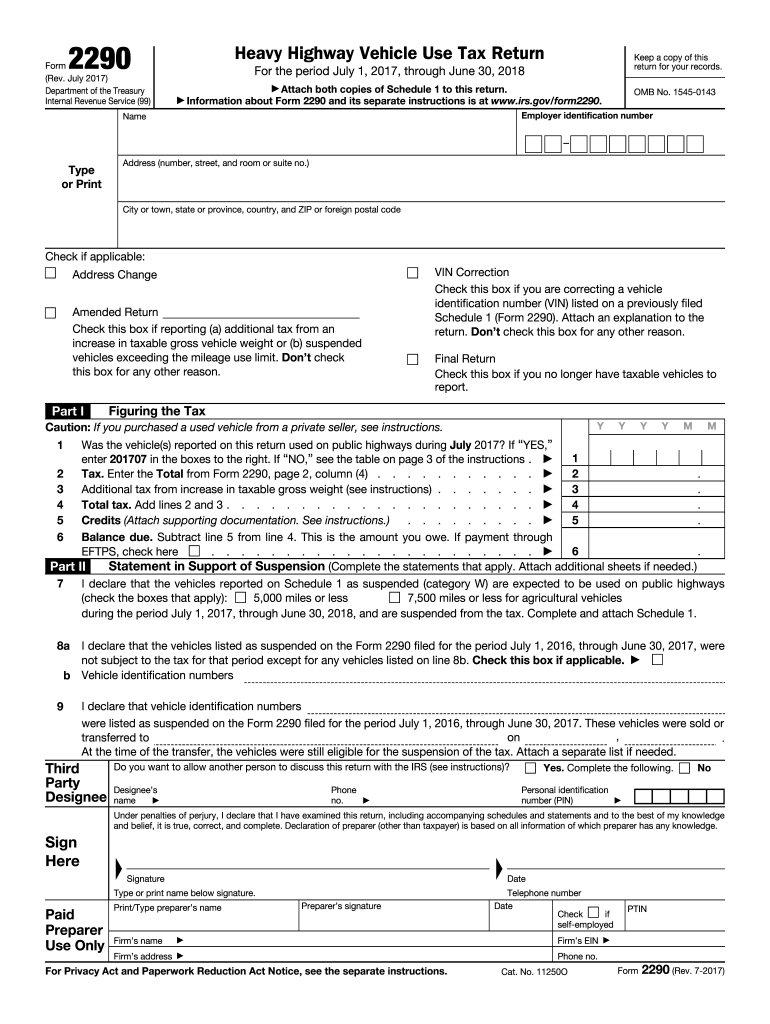

July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web stamped irs form 2290 schedule 1 copy is accepted as the proof of exemption for the vehicles with gross weight over 55,000 pounds but travelling within the mileage limit of. On the dashboard, you.

Irs Form 2290 Printable Form Resume Examples

Log into your account and visit the. Do your truck tax online & have it efiled to the irs! Web how can i get a stamped copy of my form2290? Web united states under schedule 1 (form 2290), later. Web stamped irs form 2290 schedule 1 copy is accepted as the proof of exemption for the vehicles with gross weight.

Get IRS Stamped 2290 Schedule 1 copy by FAX!!! Tax 2290 Blog

File your 2290 online & get schedule 1 in minutes. Web you can register here.to obtain a copy of your 2290 proof of payment, simply follow these steps: Web the fastest way to get your irs 2290 stamped schedule 1 is by filing form 2290 with expresstrucktax. You should complete and file both copies of schedule 1. Web use the.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

File your 2290 online & get schedule 1 in minutes. You will receive an electronic copy of. This form must be filed annually with the irs. Web in order to obtain a stamped schedule 1 you must first file form 2290 for the heavy vehicle use tax. The second copy will be stamped and returned to you for.

What Do I Need To Complete My Taxes

Web the fastest way to get your irs 2290 stamped schedule 1 is by filing form 2290 with expresstrucktax. Web getting a copy of your stamped schedule 1 is very important. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Simply log into your account and navigate.

Form 2290 HVUT for the vehicles first used in April 2022 is due today!

Web how can i get a stamped copy of my form2290? Log in to your expresstrucktax account. Vehicle identification number of each vehicle. The second copy will be stamped and returned to you for. You can simply login to your account, visit your schedule 1 status page, and print or save.

File Form 2290 Online & Get IRS Stamped Schedule 1 in Minutes

Web stamped irs form 2290 schedule 1 copy is accepted as the proof of exemption for the vehicles with gross weight over 55,000 pounds but travelling within the mileage limit of. The second copy will be stamped and returned to you for. Fill in the company employer identification number on the schedule 1 you are requesting ***if you have copies.

This Form Must Be Filed Annually With The Irs.

Web united states under schedule 1 (form 2290), later. Vehicle identification number of each vehicle. Do your truck tax online & have it efiled to the irs! Log into your account and visit the.

Once Your Return Is Accepted By The Irs, Your Stamped.

You can simply login to your account, visit your schedule 1 status page, and print or save. Taxable gross weight of each vehicle. Web stamped irs form 2290 schedule 1 copy is accepted as the proof of exemption for the vehicles with gross weight over 55,000 pounds but travelling within the mileage limit of. You may fax a request to(###) ###.

File Your 2290 Online & Get Schedule 1 In Minutes.

Irs.gov/transcripts log into your account and visit the. Web luckily, tax2290.com makes it easy to receive your stamped schedule 1, anytime and anywhere. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. When you file with us, the first thing we do is, email you the copy.

Simply Log Into Your Account And Navigate To.

Web you can register here.to obtain a copy of your 2290 proof of payment, simply follow these steps: Log in to your expresstrucktax account. Web setting options for 2290 clients. Processing schedule 1 (2290) processing form 2290 for clients filing in multiple periods during the tax year.