How To Get Grubhub Tax Form

How To Get Grubhub Tax Form - Web grubhub for drivers. You will fill out irs form schedule c for your grubhub taxes at tax time. Grubhub uses the following approach: How can i make that change? Web the faster you partner with grubhub, the faster your business can grow. I want grubhub to start taking taxes out of my check. What if i made less than $600? Web how to claim grubhub car expenses on your tax form. Web why do i see “tax adjustments” in my financial reports? Before applying, make sure you meet the following requirements:

Join grubhub and get access to all the benefits that go with it. From catering to individual meal perks, grubhub has your team covered. Select “set up direct deposit” and enter. Web how to claim grubhub car expenses on your tax form. Work with us to customize your meal perks. Web follow towards the end 2021, you will be able to see your total taxable earnings for 2021 by going to account > personal info > tax form information in the. Upload your tax exempt certificates to the platform. Web why do i see “tax adjustments” in my financial reports? How can i make that change? Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return.

It's entitled “profit and loss from. Select “set up direct deposit” and enter. Do i still have to claim income from grubhub when i file my taxes? Sign up for a grubhub corporate account. Web how will i receive my 1099 form? Web the faster you partner with grubhub, the faster your business can grow. Web grubhub for drivers. Before applying, make sure you meet the following requirements: Web how do i get grubhub tax form? Work with us to customize your meal perks.

How to Get TAX FORM from DoorDash, Grubhub & Uber Eats (1099NEC) YouTube

Web how will i receive my 1099 form? From catering to individual meal perks, grubhub has your team covered. Upload your tax exempt certificates to the platform. Visit the grubhub website and log into your driver portal using your username and password. Join grubhub and get access to all the benefits that go with it.

Grubhub Launches Annual "Year In Food" Report Highlighting The Top

It's entitled “profit and loss from. It’s based on when grubhub paid you not the time of the. Web how to claim grubhub car expenses on your tax form. What if i made less than $600? From catering to individual meal perks, grubhub has your team covered.

How Do Food Delivery Couriers Pay Taxes? Get It Back

Web grubhub for drivers. On the “my account” page, select “tax forms” from the menu on the left. Before applying, make sure you meet the following requirements: It's entitled “profit and loss from. Web the faster you partner with grubhub, the faster your business can grow.

1099NEC 2020 Sample Form Crestwood Associates

I want grubhub to start taking taxes out of my check. Web how will i receive my 1099 form? From catering to individual meal perks, grubhub has your team covered. Visit the grubhub website and log into your driver portal using your username and password. From catering to individual meal perks, grubhub has your team covered.

Create a food delivery API for Grubhub, Doordash in 5 easy steps Parseur

Web how will i receive my 1099 form? Web why do i see “tax adjustments” in my financial reports? Web how do i get grubhub tax form? It's entitled “profit and loss from. What if i made less than $600?

Grubhub delivery drivers sue over contractor status Chicago Tribune

On the “my account” page, select “tax forms” from the menu on the left. I want grubhub to start taking taxes out of my check. Web how do i get grubhub tax form? It's entitled “profit and loss from. Web why do i see “tax adjustments” in my financial reports?

GrubHub Get 7 OFF 15+ New Customers Only Coupon Code Discount 2017

How can i make that change? You will fill out irs form schedule c for your grubhub taxes at tax time. I want grubhub to start taking taxes out of my check. Before applying, make sure you meet the following requirements: Web why do i see “tax adjustments” in my financial reports?

Everything You Need to Know About Grubhub and Taxes

It's entitled “profit and loss from. On the “my account” page, select “tax forms” from the menu on the left. To prepare for your tax return, you will need to learn a few new tax. Select “set up direct deposit” and enter. Sign up for a grubhub corporate account.

Grubhub 1099 Forms How to Get and use your 1099NEC for taxes

I want grubhub to start taking taxes out of my check. Web why do i see “tax adjustments” in my financial reports? From catering to individual meal perks, grubhub has your team covered. How can i make that change? Web how will i receive my 1099 form?

How To Get GrubHub Tax 1099 Forms 🔴 YouTube

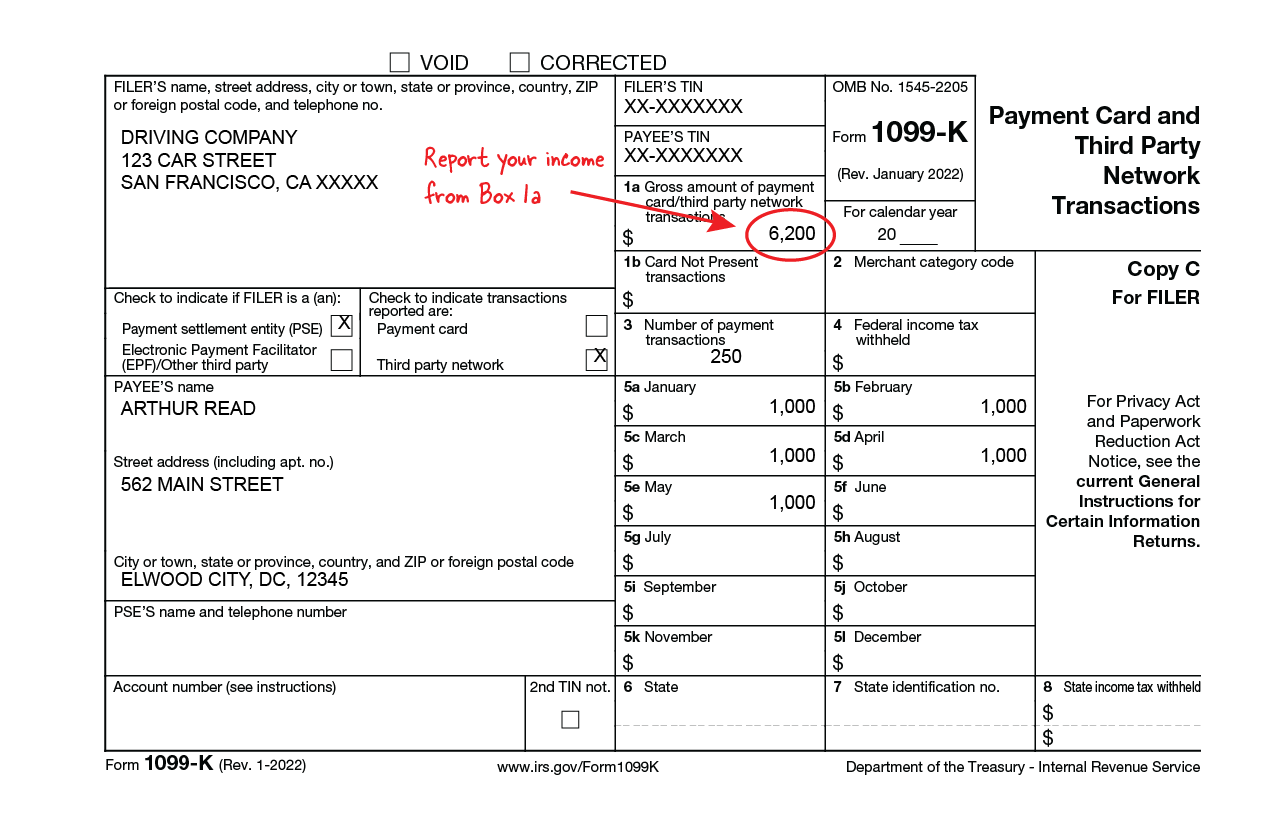

Web the faster you partner with grubhub, the faster your business can grow. Grubhub uses the following approach: Web follow towards the end 2021, you will be able to see your total taxable earnings for 2021 by going to account > personal info > tax form information in the. Do i still have to claim income from grubhub when i.

Web Why Do I See “Tax Adjustments” In My Financial Reports?

Grubhub uses the following approach: From catering to individual meal perks, grubhub has your team covered. What if i made less than $600? Work with us to customize your meal perks.

Web Follow Towards The End 2021, You Will Be Able To See Your Total Taxable Earnings For 2021 By Going To Account > Personal Info > Tax Form Information In The.

Fulfilling the essential grubhub driver requirements. The question is, how to get my 1099 form from grubhub? Web how to claim grubhub car expenses on your tax form. Web the faster you partner with grubhub, the faster your business can grow.

It’s Based On When Grubhub Paid You Not The Time Of The.

Web how do i get grubhub tax form? To prepare for your tax return, you will need to learn a few new tax. From catering to individual meal perks, grubhub has your team covered. Upload your tax exempt certificates to the platform.

How Can I Make That Change?

Before applying, make sure you meet the following requirements: Web how will i receive my 1099 form? On the “my account” page, select “tax forms” from the menu on the left. Do i still have to claim income from grubhub when i file my taxes?