How To Read A Form 990

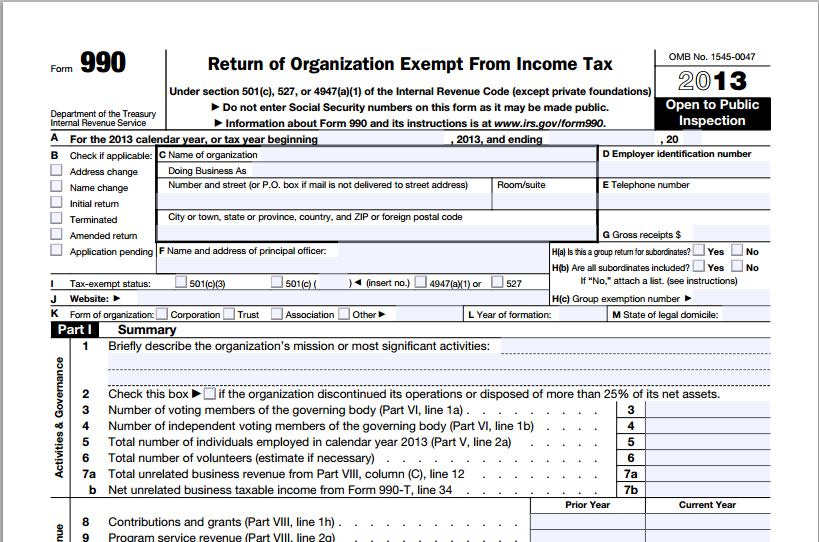

How To Read A Form 990 - Web form 990 can be found at : Web how to read a form 990 for a nonprofit. Unlike your personal tax return, anyone can request a copy of your form 990 from the irs or search for your filing several online databases. Web fundamental to your examination of a form 990 is to make sure you are looking at the form 990 that you set out to look at. Check out the total assets (part 1, 20). Web a form 990 lists key information about an organization, including its governing body, purpose, and resources. And when they know how to read a 990, they can find out a lot about your organization. Watchdog organizations, large donors, and grantmakers regularly use your. Examine many of the same research resources as you would for other companies This is an important figure to.

Web the form starts with the fiscal year and indicates the type of return, as well as the website and year of formation. And when they know how to read a 990, they can find out a lot about your organization. Web form 990 can be found at : Web fundamental to your examination of a form 990 is to make sure you are looking at the form 990 that you set out to look at. Watchdog organizations, large donors, and grantmakers regularly use your. Breakdown of a 990 form; This amount is the total amount that the. Web by the charity cfo | may 2, 2022. Web how to read a form 990. Observe the contributions made or grants and similar amounts paid.

Breakdown of a 990 form; Watchdog organizations, large donors, and grantmakers regularly use your. Web a form 990 lists key information about an organization, including its governing body, purpose, and resources. Every year most charities must file a 990 tax return with the irs. And when they know how to read a 990, they can find out a lot about your organization. Web how to read a form 990 for a nonprofit. Check out the fair market value of assets. Unlike your personal tax return, anyone can request a copy of your form 990 from the irs or search for your filing several online databases. Web updated may 25, 2023. And they require disclosure on whether the organization is abiding by best practices.

What Is A 990 N E Postcard hassuttelia

Observe the contributions made or grants and similar amounts paid. And when they know how to read a 990, they can find out a lot about your organization. Check out the fair market value of assets. Unlike your personal tax return, anyone can request a copy of your form 990 from the irs or search for your filing several online.

Blog 1 Tips on How to Read Form 990

This amount is the total amount that the. This includes all cash, investments, grants and pledges, land, buildings and property, investments and more. These forms contain a wealth of information about charities, but like most tax forms, they can be a bear to digest. Web how to read a form 990. This is an important figure to.

Form 990 or 990EZ (Sch E) Schools (2015) Free Download

Web the form starts with the fiscal year and indicates the type of return, as well as the website and year of formation. Web by the charity cfo | may 2, 2022. And they require disclosure on whether the organization is abiding by best practices. They reveal how the organization uses its resources to accomplish its mission. For some charities.

IRS Form 990PF 2019 Printable & Fillable Sample in PDF

Web a form 990 lists key information about an organization, including its governing body, purpose, and resources. By looking at the address information in the box (item c), you learn the name and address of the filer. Breakdown of a 990 form; Web how to read a form 990 for a nonprofit. This is an important figure to.

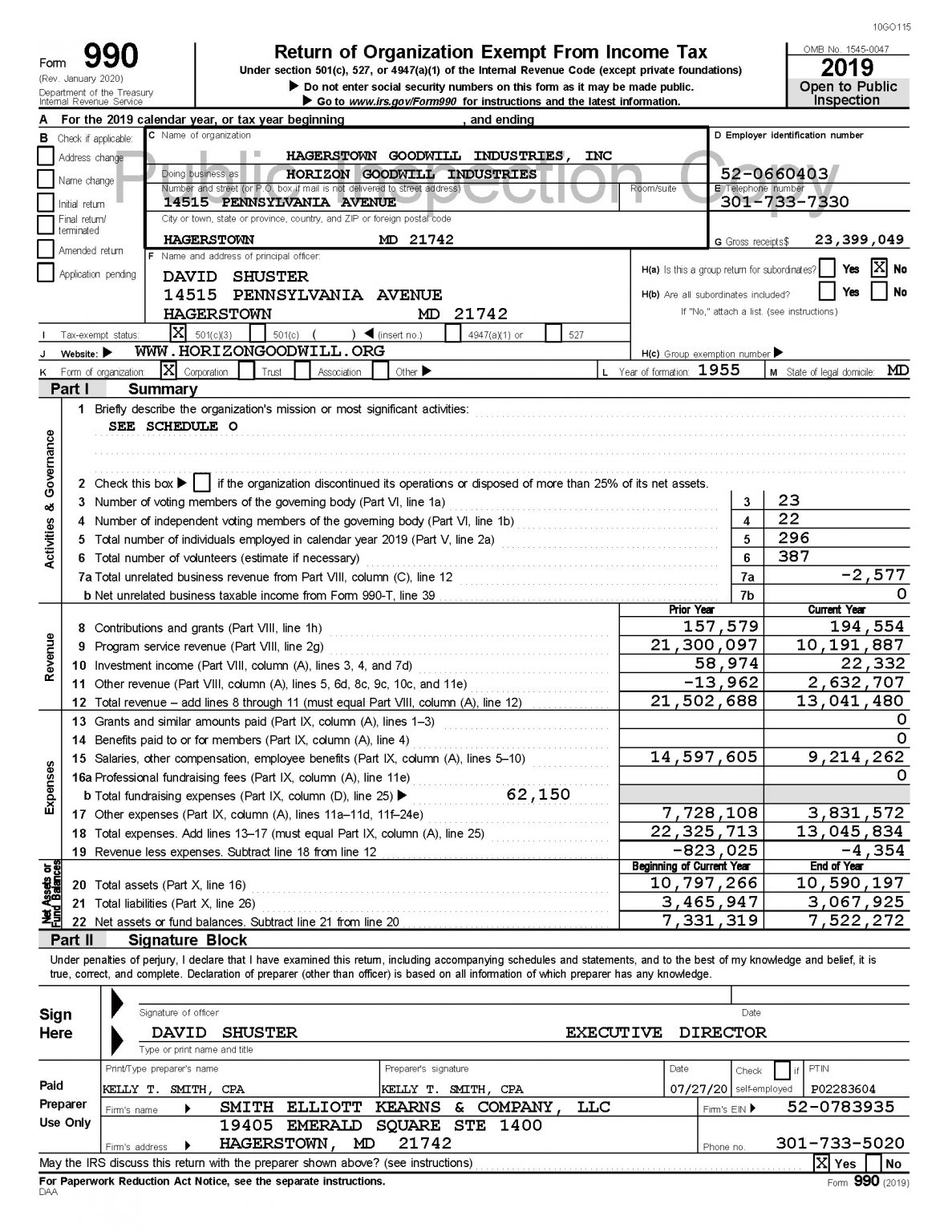

Download Form 990 2017 2018 2019 Horizon Goodwill Industries

And when they know how to read a 990, they can find out a lot about your organization. Web how to read a form 990 for a nonprofit. Examine many of the same research resources as you would for other companies Check out total assets for the end of year. Web the form starts with the fiscal year and indicates.

Chemjobber The 2017 ACS Form 990

And when they know how to read a 990, they can find out a lot about your organization. Web updated may 25, 2023. Check out the total assets (part 1, 20). Web the form starts with the fiscal year and indicates the type of return, as well as the website and year of formation. Web how to read a form.

Blog 1 Tips on How to Read Form 990

By looking at the address information in the box (item c), you learn the name and address of the filer. Check out the fair market value of assets. Part 1 includes activities & governance includes overview information: For some charities these forms can be. Observe the contributions made or grants and similar amounts paid.

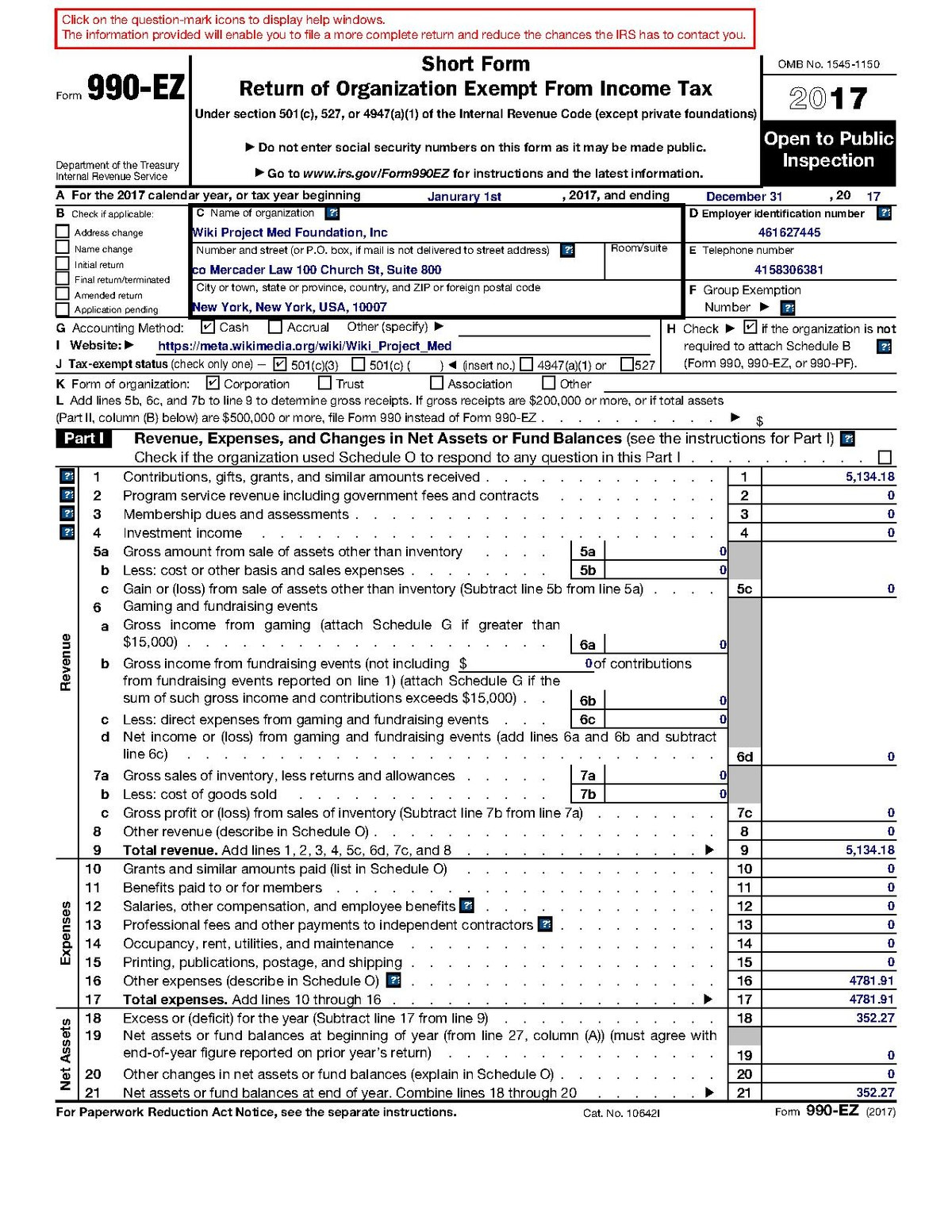

File 2017 Form 990 EZ Pdf Wikimedia Commons 2021 Tax Forms 1040 Printable

This is an important figure to. Examine many of the same research resources as you would for other companies And they require disclosure on whether the organization is abiding by best practices. Web updated may 25, 2023. Web how to read a form 990.

Form 990EZ for nonprofits updated Accounting Today

Part 1 includes activities & governance includes overview information: Web updated may 25, 2023. Examine many of the same research resources as you would for other companies Web a form 990 lists key information about an organization, including its governing body, purpose, and resources. For some charities these forms can be.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Web updated may 25, 2023. Web fundamental to your examination of a form 990 is to make sure you are looking at the form 990 that you set out to look at. Check out the total assets (part 1, 20). Observe the contributions made or grants and similar amounts paid. Web how to read a form 990.

Web 7 Tips For Reading The Form 990 1.

Web by the charity cfo | may 2, 2022. They reveal how the organization uses its resources to accomplish its mission. Web how to read a charity 990 tax form. This includes all cash, investments, grants and pledges, land, buildings and property, investments and more.

Web Form 990 Can Be Found At :

Web how to read a form 990. Observe the contributions made or grants and similar amounts paid. By looking at the address information in the box (item c), you learn the name and address of the filer. Part 1 includes activities & governance includes overview information:

And They Require Disclosure On Whether The Organization Is Abiding By Best Practices.

Web fundamental to your examination of a form 990 is to make sure you are looking at the form 990 that you set out to look at. This is an important figure to. Web how to read a form 990 for a nonprofit. Breakdown of a 990 form;

And When They Know How To Read A 990, They Can Find Out A Lot About Your Organization.

Web a form 990 lists key information about an organization, including its governing body, purpose, and resources. Watchdog organizations, large donors, and grantmakers regularly use your. Every year most charities must file a 990 tax return with the irs. Unlike your personal tax return, anyone can request a copy of your form 990 from the irs or search for your filing several online databases.