How To Report Third Party Sick Pay On Form 941

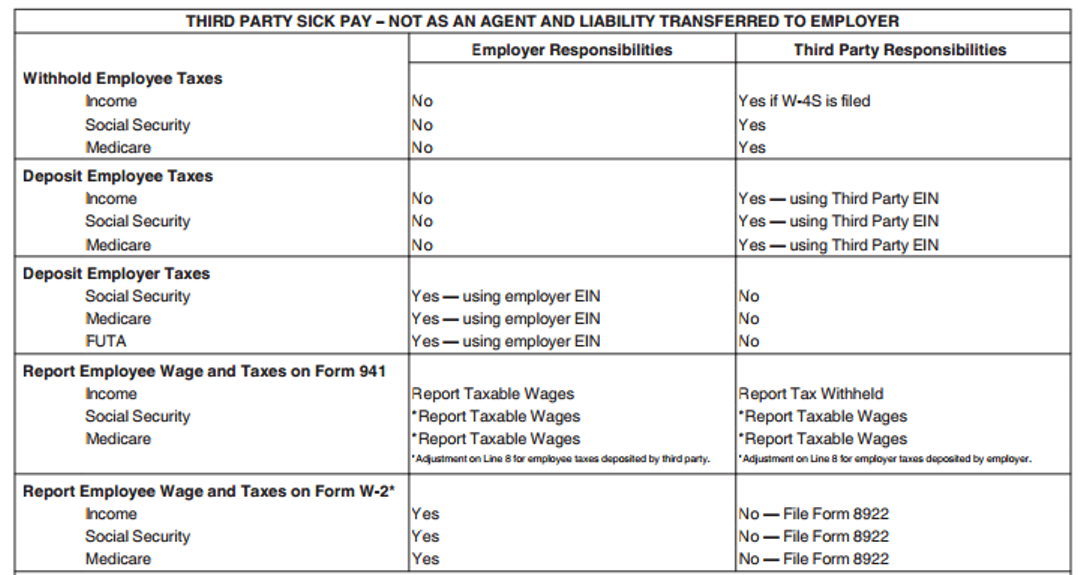

How To Report Third Party Sick Pay On Form 941 - Follow steps in related article below, how to print 941 and schedule b forms; This info is required by the irs for reporting purposes. Web use form 941 to report: You will need to report both the employer and the employee parts for. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. On line 8, manually enter the amount for the employee. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Official site | smart tools. Use this form to reconcile. Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941.

Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Follow steps in related article below, how to print 941 and schedule b forms; Web to report third party sick pay on 941 form: Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. This info is required by the irs for reporting purposes. Official site | smart tools. Use this form to reconcile. Web use form 941 to report: You will need to report both the employer and the employee parts for.

Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. This info is required by the irs for reporting purposes. Official site | smart tools. On line 8, manually enter the amount for the employee. Web to report third party sick pay on 941 form: You will need to report both the employer and the employee parts for. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Use this form to reconcile. Follow steps in related article below, how to print 941 and schedule b forms; Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941.

Third Party Sick Payment Notification Example NWOCA Fiscal Services

Use this form to reconcile. Follow steps in related article below, how to print 941 and schedule b forms; Web use form 941 to report: Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Web to report.

Sick Leave Form Template Fill Out and Sign Printable PDF Template

Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941. You will need to report both the employer and the employee parts for. Use this form to reconcile. On line 8, manually enter the amount for the employee. Official site | smart tools.

Third Party Sick Pay W2 slidesharetrick

Use this form to reconcile. Official site | smart tools. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Report both the employer and employee shares of social security and medicare taxes for sick pay on lines.

Third Party Sick Pay W2 slidesharetrick

Web to report third party sick pay on 941 form: Web use form 941 to report: You will need to report both the employer and the employee parts for. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share.

Third Party Sick Pay slidesharetrick

Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941. This info is required by the irs for reporting purposes. Web to report third party sick pay on 941 form: You will need to report both the employer and the employee parts for. Web qualified sick.

Is Third Party Sick Pay Taxable PEO Guide (2022)

Web to report third party sick pay on 941 form: Follow steps in related article below, how to print 941 and schedule b forms; Use this form to reconcile. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share.

Is Third Party Sick Pay Taxable PEO Guide

Use this form to reconcile. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Official site | smart tools. Web use form 941 to report: Web to report third party sick pay on 941 form:

Is Third Party Sick Pay Taxable PEO Guide (2022)

You will need to report both the employer and the employee parts for. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Use this form to reconcile. Web qualified sick leave wages and qualified family leave wages.

How to account for Third Party Sick Pay on W2 and 941 tax forms for

Official site | smart tools. You will need to report both the employer and the employee parts for. Use this form to reconcile. Web to report third party sick pay on 941 form: Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject.

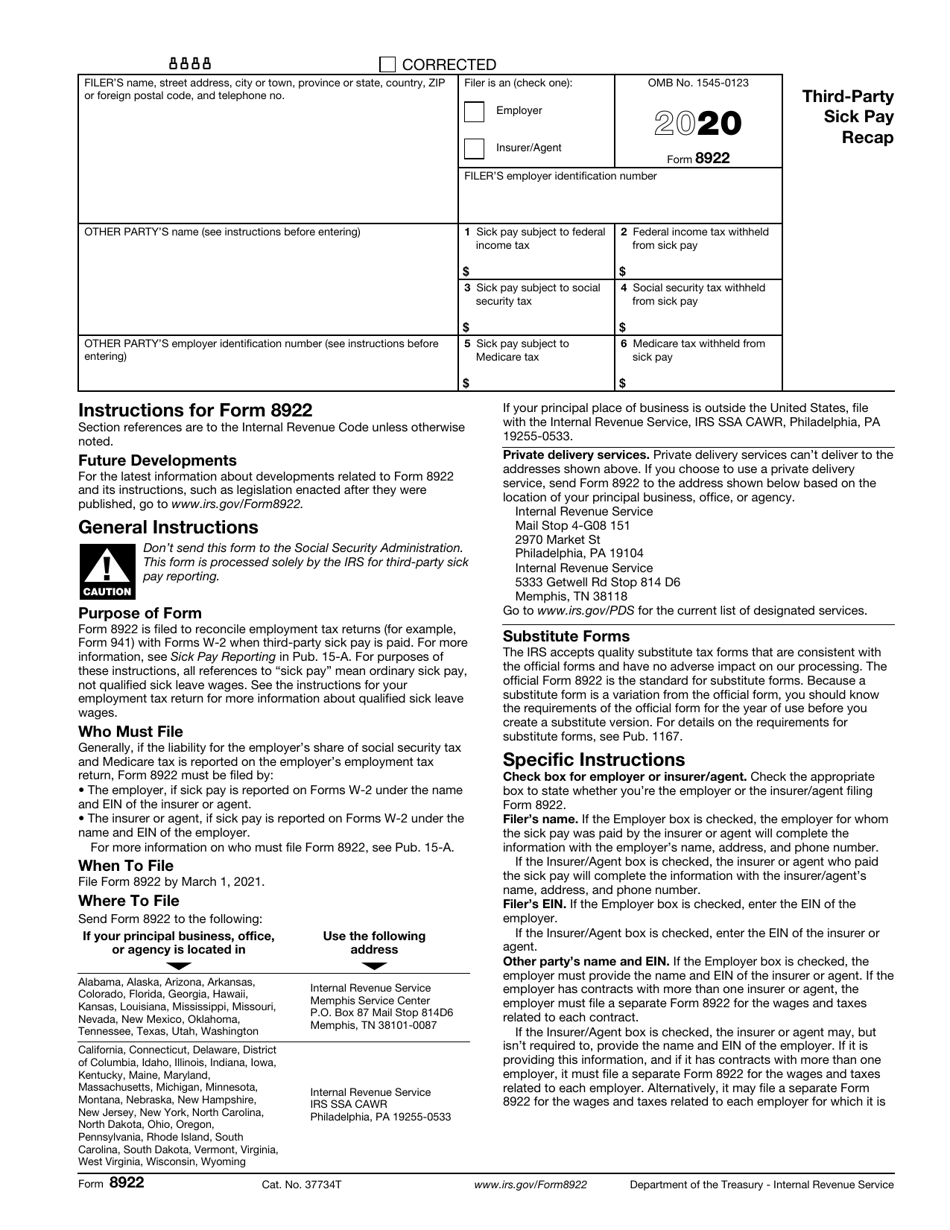

IRS Form 8922 Download Fillable PDF or Fill Online ThirdParty Sick Pay

Follow steps in related article below, how to print 941 and schedule b forms; Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before.

Web To Report Third Party Sick Pay On 941 Form:

You will need to report both the employer and the employee parts for. This info is required by the irs for reporting purposes. On line 8, manually enter the amount for the employee. Follow steps in related article below, how to print 941 and schedule b forms;

Web Qualified Sick Leave Wages And Qualified Family Leave Wages Paid In 2023 For Leave Taken After March 31, 2020, And Before April 1, 2021, Aren't Subject To The Employer Share Of.

Report both the employer and employee shares of social security and medicare taxes for sick pay on lines 6b and 7b of form 941. Use this form to reconcile. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of. Official site | smart tools.