Il 941 Form

Il 941 Form - Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. You’ll need to withhold illinois income taxes and pay those taxes on your employee’s salaries if you’re the owner of a small business. Web about form 941, employer's quarterly federal tax return. Web this form must be filed electronically. Pay the employer's portion of social security or medicare tax. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. Web mailing addresses for forms 941. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. This form is required to be filed electronically. Employers use form 941 to:

Web mailing addresses for forms 941. This form is required to be filed electronically. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Filing online is quick and easy! March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. Web this form must be filed electronically. You’ll need to withhold illinois income taxes and pay those taxes on your employee’s salaries if you’re the owner of a small business. Employers use form 941 to: Pay the employer's portion of social security or medicare tax.

This form is required to be filed electronically. Pay the employer's portion of social security or medicare tax. You’ll need to withhold illinois income taxes and pay those taxes on your employee’s salaries if you’re the owner of a small business. Web about form 941, employer's quarterly federal tax return. Filing online is quick and easy! Web this form must be filed electronically. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Employers use form 941 to: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina.

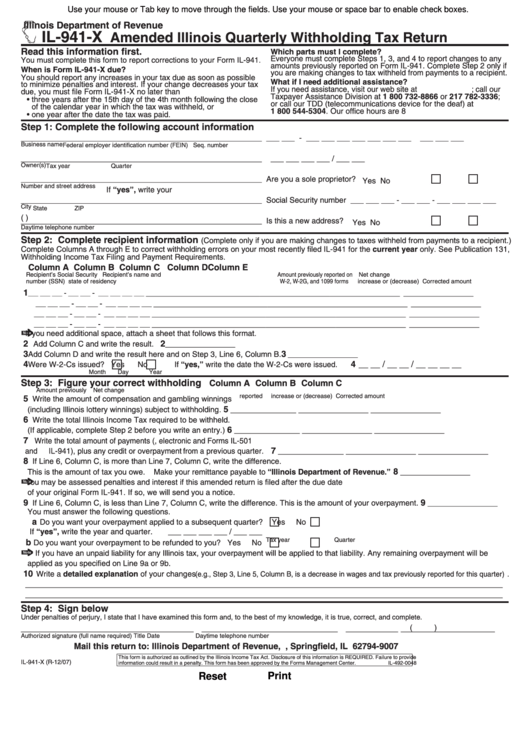

2016 Form IL DoR IL941X Fill Online, Printable, Fillable, Blank

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. Web this form must be filed electronically. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. This form is required to be filed electronically. Web about form 941, employer's.

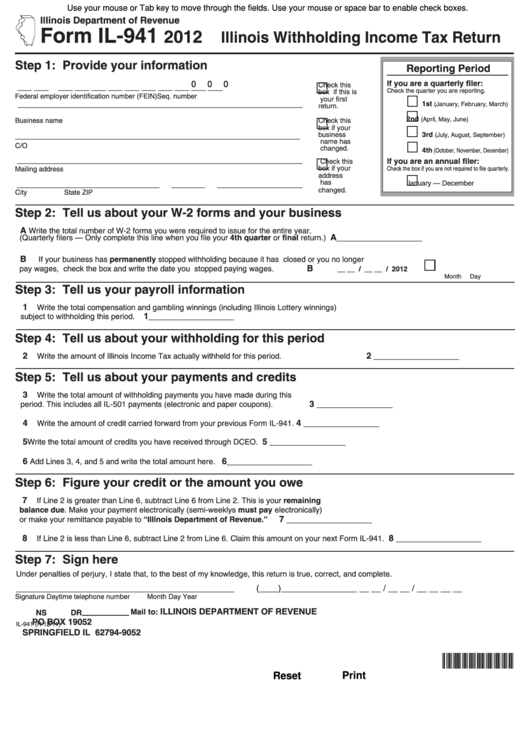

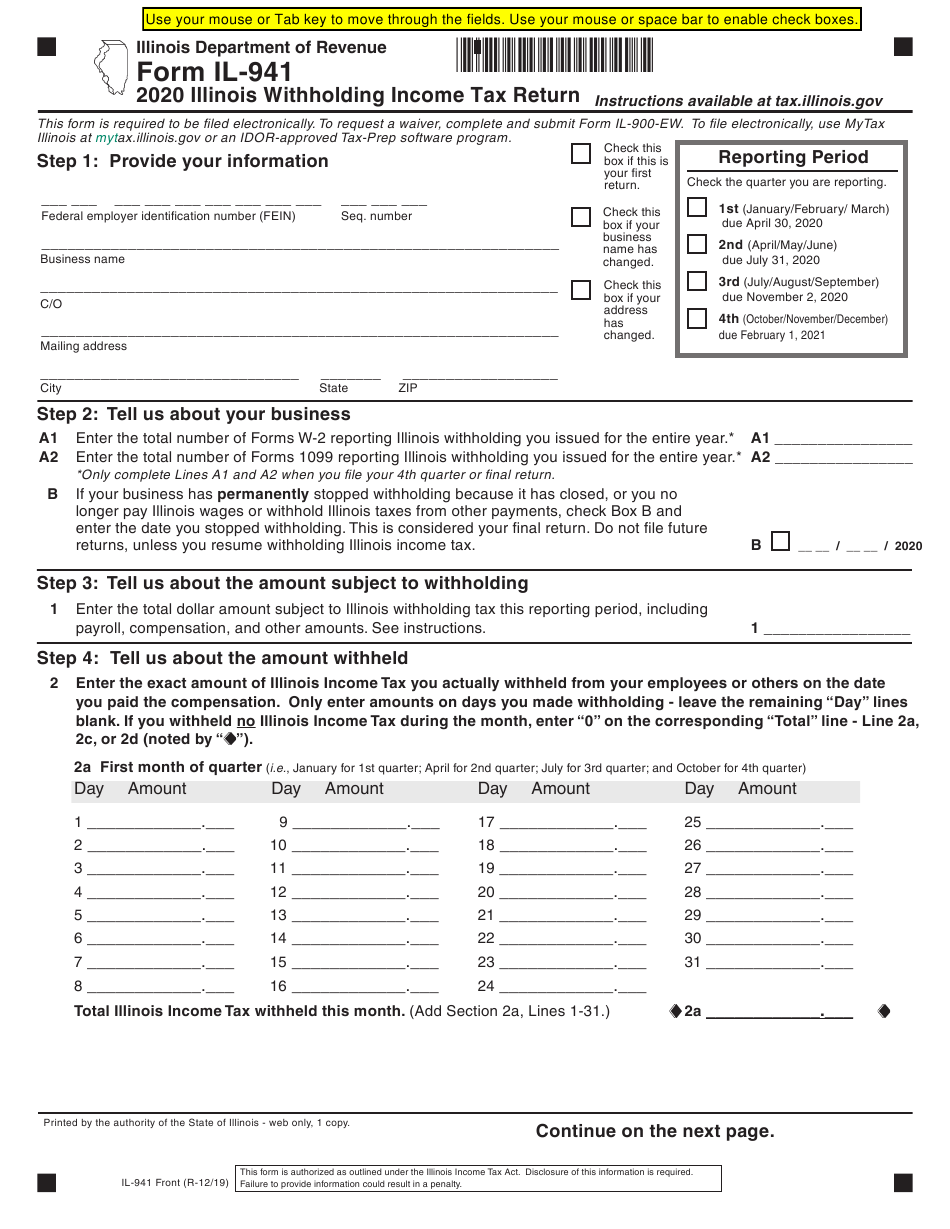

Fillable Form Il941 Illinois Withholding Tax Return 2012

Web about form 941, employer's quarterly federal tax return. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Pay the employer's portion of social security or medicare tax. Employers use form 941 to: Filing online is quick and easy!

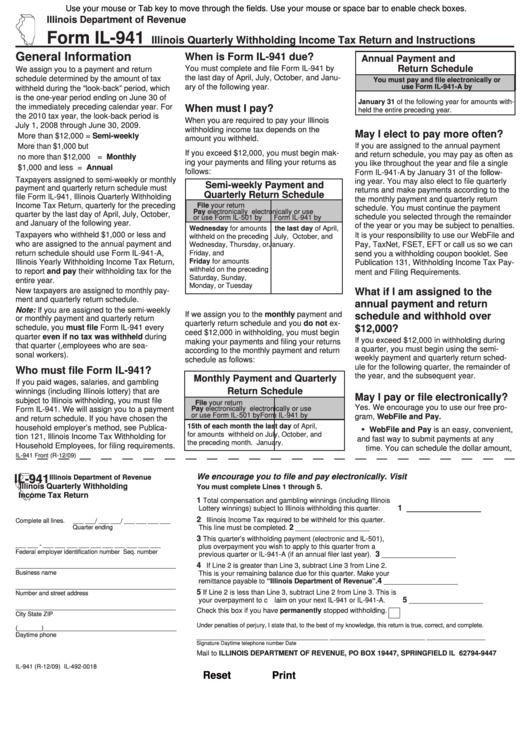

Form Il941 Illinois Quarterly Withholding Tax Return 2004

Web this form must be filed electronically. Web about form 941, employer's quarterly federal tax return. This form is required to be filed electronically. Pay the employer's portion of social security or medicare tax. Employers use form 941 to:

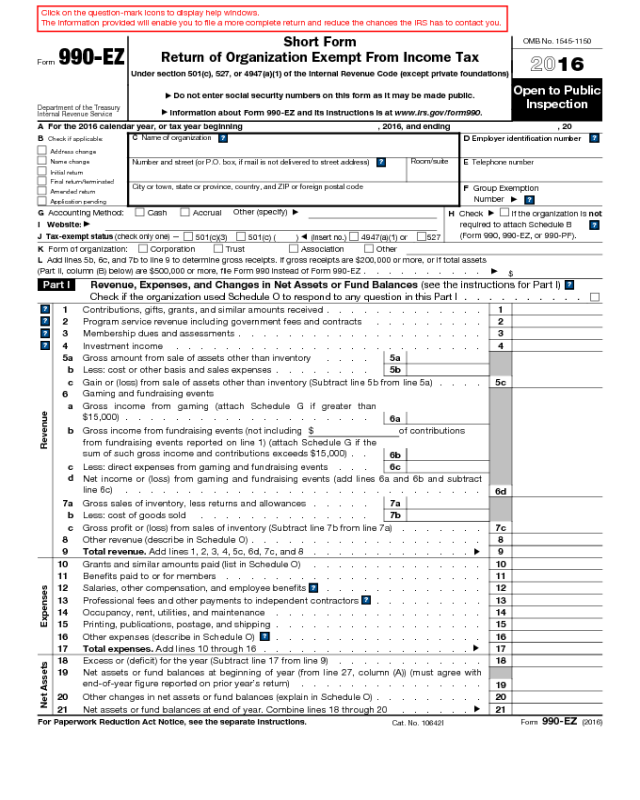

Irs Form 941 Instructions 2016

Web mailing addresses for forms 941. Web this form must be filed electronically. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Employers use form 941 to: Pay the employer's portion of social security or medicare tax.

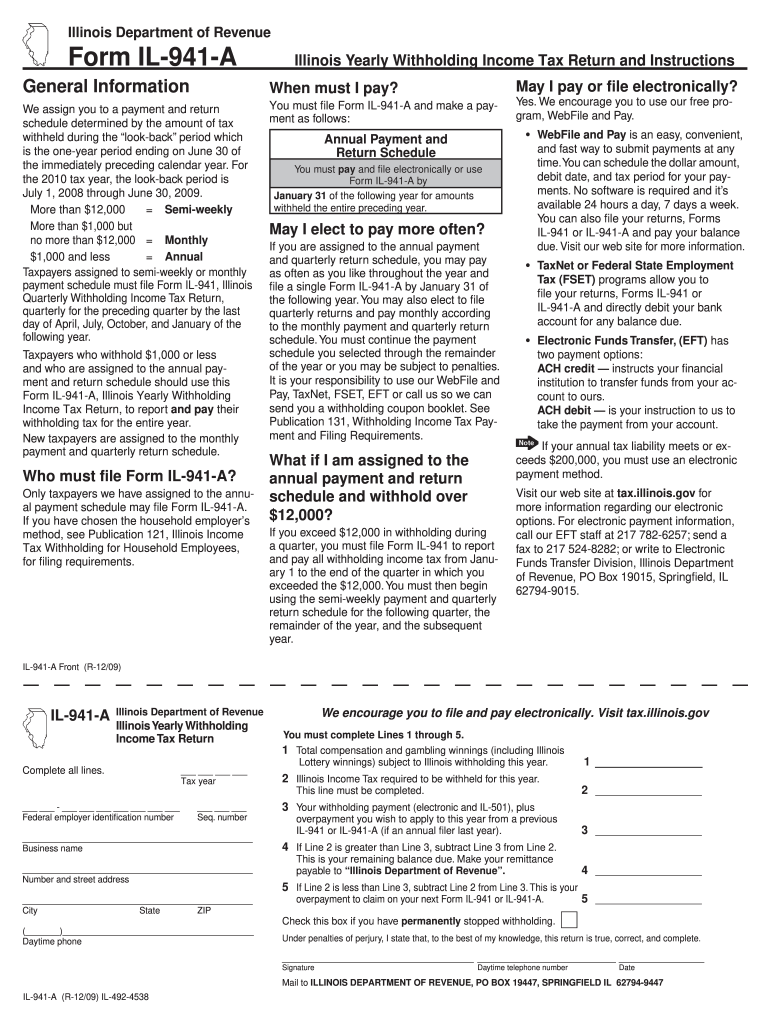

20092022 Form IL DoR IL941A Fill Online, Printable, Fillable, Blank

Filing online is quick and easy! You’ll need to withhold illinois income taxes and pay those taxes on your employee’s salaries if you’re the owner of a small business. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. Employers use form 941.

2021 Illinois Withholding Form 2022 W4 Form

Web this form must be filed electronically. This form is required to be filed electronically. Pay the employer's portion of social security or medicare tax. You’ll need to withhold illinois income taxes and pay those taxes on your employee’s salaries if you’re the owner of a small business. Employers use form 941 to:

Fillable Form Il941X Amended Illinois Quarterly Withholding Tax

Pay the employer's portion of social security or medicare tax. Web mailing addresses for forms 941. This form is required to be filed electronically. Web about form 941, employer's quarterly federal tax return. Employers use form 941 to:

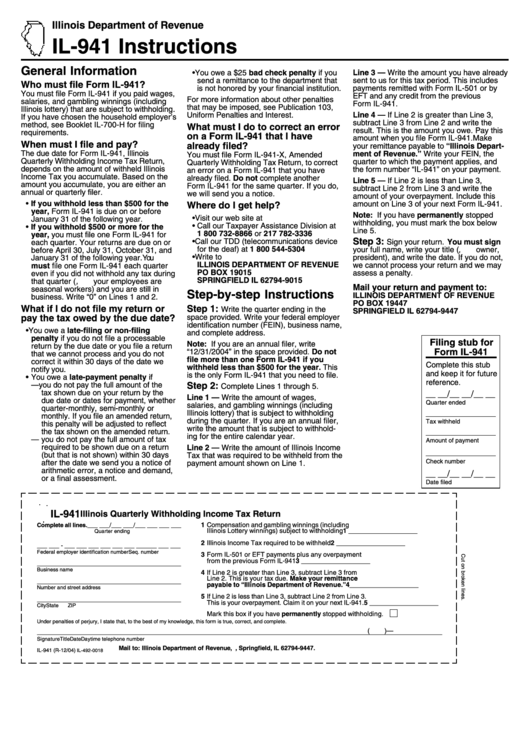

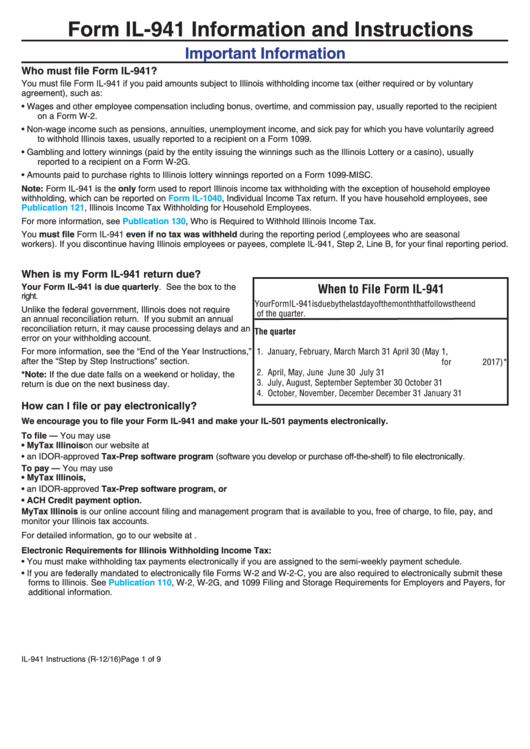

Form Il941 Information And Instructions 2016 printable pdf download

Web mailing addresses for forms 941. Filing online is quick and easy! Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. Web this form must be filed electronically. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue.

Form Il941 Illinois Quarterly Withholding Tax Return And

This form is required to be filed electronically. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. Employers use form 941 to: Web about.

[Solved] Form 941 for 2021 Employer's QUARTERLY Federal Tax Return

Pay the employer's portion of social security or medicare tax. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. You’ll need to withhold illinois.

Web About Form 941, Employer's Quarterly Federal Tax Return.

This form is required to be filed electronically. Pay the employer's portion of social security or medicare tax. Employers use form 941 to: Report income taxes, social security tax, or medicare tax withheld from employee's paychecks.

Filing Online Is Quick And Easy!

You’ll need to withhold illinois income taxes and pay those taxes on your employee’s salaries if you’re the owner of a small business. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. Web this form must be filed electronically. Web mailing addresses for forms 941.