Illinois Chapter 7 Income Limits

Illinois Chapter 7 Income Limits - Introduction to general financial requirements (a) 130 cmr 520.000 describes the rules governing financial eligibility for masshealth. Filing $70,000.00 of earnings will result in $3,344.96 of your earnings being taxed as state tax (calculation based on 2023 illinois. Web updated january 5, 2022 table of contents what are the illinois bankruptcy exemptions, and why are they important in a chapter 7 bankruptcy? We provide helpful tips and resources to help you file chapter 7 bankruptcy in your state without a lawyer. Web it’s the analysis that determines whether you’re eligible for relief under chapter 7 bankruptcy based on your monthly income. Web when looking at expenses, those who make more than the median household income may still qualify for chapter 7 if the means test reveals they don’t have enough disposable income to pay 25% of their. If you fail the means test, you cannot file a chapter 7 bankruptcy. This marginal tax rate means that your immediate additional income. For example, if you are filing on september 15th, include all income. It’s called the bankruptcy means test because it calculates whether.

For example, if you are filing on september 15th, include all income. If you expect to owe $500 or more on april 15th, you must pay your income tax to illinois. 7 provides a greater amount of debt relief, income limits and other conditions are placed on who is eligible to use this type of bankruptcy. Web the following are the chapter 7 income limits for illinois households as of august 2021: Introduction to general financial requirements (a) 130 cmr 520.000 describes the rules governing financial eligibility for masshealth. Add up all of your income from the last full 6 months. Web filing $70,000.00 of earnings will result in $5,355.00 being taxed for fica purposes. Previously, the tax rate was raised from 3% to 5% in early 2011 as part of a statewide plan to reduce deficits. Web updated january 5, 2022 table of contents what are the illinois bankruptcy exemptions, and why are they important in a chapter 7 bankruptcy? Filing $70,000.00 of earnings will result in $3,344.96 of your earnings being taxed as state tax (calculation based on 2023 illinois.

Add $9,000 for each household member exceeding four; Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. Previously, the tax rate was raised from 3% to 5% in early 2011 as part of a statewide plan to reduce deficits. Monthly maximum of 3% of applicable monthly income, except no such limit. Add up all of your income from the last full 6 months. Your average tax rate is 25.0% and your marginal tax rate is 34.6%. Does illinois allow the use of federal bankruptcy exemptions? Web filing $70,000.00 of earnings will result in $5,355.00 being taxed for fica purposes. If you passed, thats great you likely qualify for chapter 7 bankruptcy in illinois. We provide helpful tips and resources to help you file chapter 7 bankruptcy in your state without a lawyer.

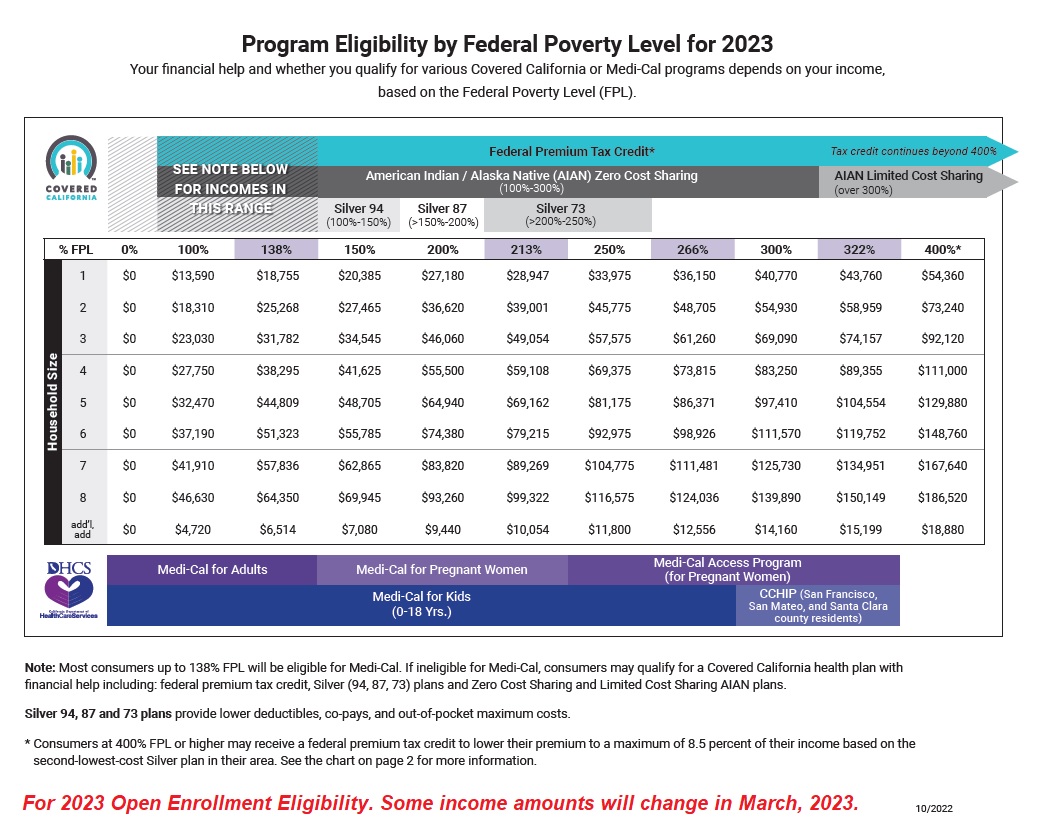

2023 Covered California Chart Explained YouTube

Web the following are the chapter 7 income limits for illinois households as of august 2021: Monthly maximum of 3% of applicable monthly income, except no such limit. This marginal tax rate means that your immediate additional income. We provide helpful tips and resources to help you file chapter 7 bankruptcy in your state without a lawyer. Add $9,000 for.

Illinois Medicaid Archives Medicaid Nerd

Written by attorney andrea wimmer. Web in a nutshell filing for bankruptcy doesn’t have to be scary and confusing. (see illinois exemptions) the trustee sells the assets and pays you, the debtor, any. Web the following are the chapter 7 income limits for illinois households as of august 2021: If your household income is above the state median, you can.

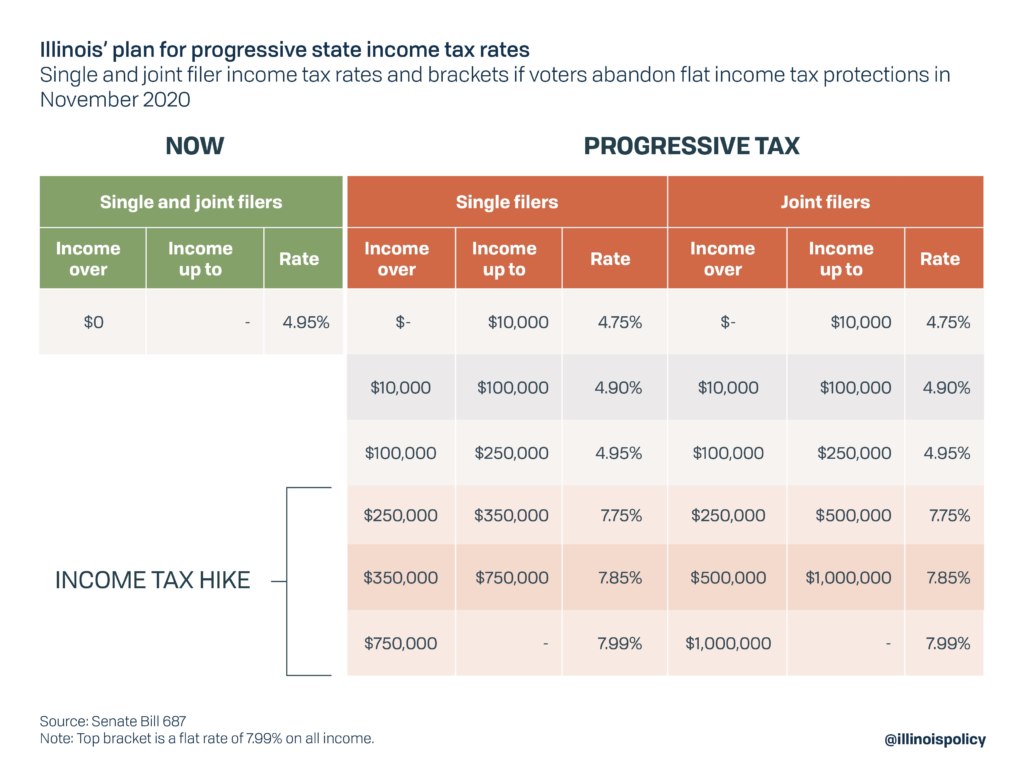

Illinois’ latest progressive tax ad Seven things every Illinoisan

If your household income is above the state median, you can still qualify for chapter 7 bankruptcy based on your disposable income. Add $9,000 for each household member exceeding four; If you expect to owe $500 or more on april 15th, you must pay your income tax to illinois. (see illinois exemptions) the trustee sells the assets and pays you,.

30+ Chapter 7 Limits 2022 AemiliaKhiara

(see illinois exemptions) the trustee sells the assets and pays you, the debtor, any. If you passed, thats great you likely qualify for chapter 7 bankruptcy in illinois. For individuals, there are two main types of bankruptcies that can be filed: We provide helpful tips and resources to help you file chapter 7 bankruptcy in your state without a lawyer..

Colorado Means Test Ascend Blog

Web filing $70,000.00 of earnings will result in $5,355.00 being taxed for fica purposes. Monthly maximum of 3% of applicable monthly income, except no such limit. (see illinois exemptions) the trustee sells the assets and pays you, the debtor, any. Web it’s the analysis that determines whether you’re eligible for relief under chapter 7 bankruptcy based on your monthly income..

With voters set to decide on progressive tax, Illinois wealth

Web filing $70,000.00 of earnings will result in $5,355.00 being taxed for fica purposes. Web the illinois income tax was lowered from 5% to 3.75% in 2015. Chapter 7 cases are also referred to as liquidation cases, while chapter 13. Filing $70,000.00 of earnings will result in $3,344.96 of your earnings being taxed as state tax (calculation based on 2023.

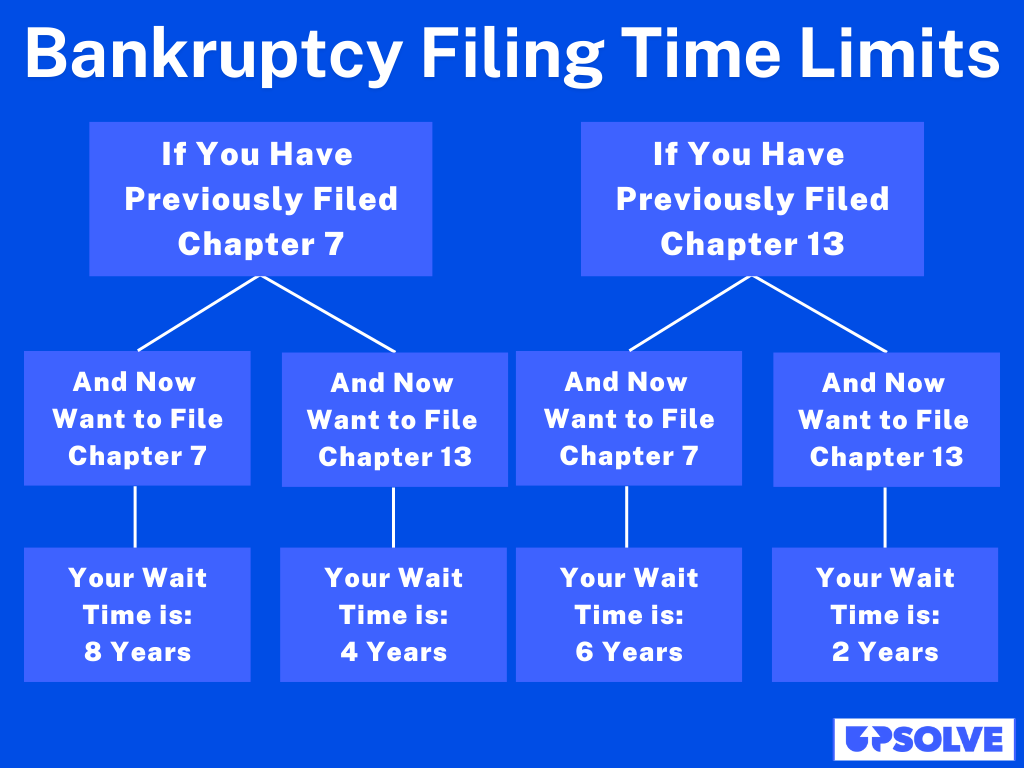

How Often Can I File Bankruptcy? Upsolve

The “means test” is the method used to determine if you qualify to file ch. Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. Written by attorney andrea wimmer. Introduction to general financial requirements (a) 130 cmr 520.000 describes the rules governing financial eligibility for masshealth..

Limits for Chapter 7 Bankruptcies Bruner Wright P.A.

Web updated january 5, 2022 table of contents what are the illinois bankruptcy exemptions, and why are they important in a chapter 7 bankruptcy? For example, if you are filing on september 15th, include all income. Web in a nutshell filing for bankruptcy doesn’t have to be scary and confusing. If you passed, thats great you likely qualify for chapter.

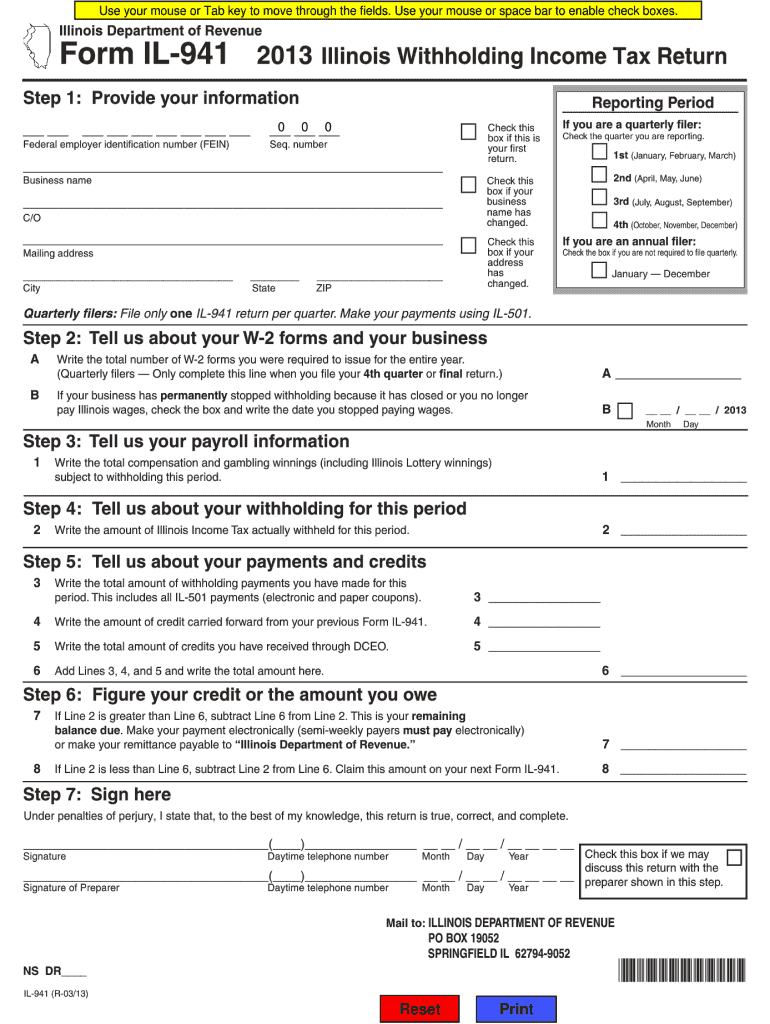

Illinois with Holding Tax Return Wikiform Fill Out and Sign

Web if the leftover income is too high, you fail the means test. Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. The means test qualification in illinois is based on your household size, income, and location. Please take a look at the table below to.

Why Are Your Children Suddenly MediCal in Covered California?

Web the following are the chapter 7 income limits for illinois households as of august 2021: Web when looking at expenses, those who make more than the median household income may still qualify for chapter 7 if the means test reveals they don’t have enough disposable income to pay 25% of their. Web if you make $75,000 a year living.

Updated May 10, 2023 Table Of Contents How To File Bankruptcy In Illinois For Free Illinois.

We provide helpful tips and resources to help you file chapter 7 bankruptcy in your state without a lawyer. Chapter 7 cases are also referred to as liquidation cases, while chapter 13. Please take a look at the table below to see if you may fall below the median income limit for filing chapter 7 based on your income. Web if the leftover income is too high, you fail the means test.

Filing $70,000.00 Of Earnings Will Result In $3,344.96 Of Your Earnings Being Taxed As State Tax (Calculation Based On 2023 Illinois.

Add up all of your income from the last full 6 months. That means that your net pay will be $56,282 per year, or $4,690 per month. Web the illinois income tax was lowered from 5% to 3.75% in 2015. Web the following are the chapter 7 income limits for illinois households as of august 2021:

Web In A Nutshell Filing For Bankruptcy Doesn’t Have To Be Scary And Confusing.

The means test qualification in illinois is based on your household size, income, and location. Introduction to general financial requirements (a) 130 cmr 520.000 describes the rules governing financial eligibility for masshealth. Web filing $70,000.00 of earnings will result in $5,355.00 being taxed for fica purposes. (see illinois exemptions) the trustee sells the assets and pays you, the debtor, any.

You Probably Just Did The Math In Your Head.

Web the following are the chapter 7 income limits for illinois households as of august 2021: This marginal tax rate means that your immediate additional income. Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. For individuals, there are two main types of bankruptcies that can be filed: