Illinois Property Tax Rebate Form

Illinois Property Tax Rebate Form - Web alternatively, click here to download and print the refund application form. Taxpayers who filed 2021 form il. Web illinois residents who paid state property taxes last year on their primary 2020 residence are eligible for the rebate if their adjusted gross income on their 2021. How do i get the money? Ad download or email il ged transcript & more fillable forms, register and subscribe now! Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. Web what is the property tax rebate? Web the illinois property tax and income tax rebates are not taxable by illinois and do not have to be reported on your illinois tax return. The property tax rebate was created by public act 102‐0700 and is equal to the lesser of the property tax credit you could qualify for 2020. If you didn't receive a refund or if you were given a paper check.

Ad download or email il ged transcript & more fillable forms, register and subscribe now! An illinois resident, have paid property taxes in illinois in 2020. Please use the link below to download 2022. If you have difficulty with any of the three steps listed above, you may contact our office or call us at. Upload, modify or create forms. Web the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real estate tax) you paid on your principal residence. Web what is the property tax rebate? Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. Web the illinois property tax and income tax rebates are not taxable by illinois and do not have to be reported on your illinois tax return. Web the 2022 illinois property tax rebate is equal to the property tax credit claimed on your 2021 illinois tax return, up to a maximum of $300.

To qualify for the property tax rebate, you must be: Ad download or email il ged transcript & more fillable forms, register and subscribe now! Web illinois residents who paid state property taxes last year on their primary 2020 residence are eligible for the rebate if their adjusted gross income on their 2021. If you didn't receive a refund or if you were given a paper check. Upload, modify or create forms. Web the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real estate tax) you paid on your principal residence. Web the 2022 illinois property tax rebate is equal to the property tax credit claimed on your 2021 illinois tax return, up to a maximum of $300. Web the illinois property tax and income tax rebates are not taxable by illinois and do not have to be reported on your illinois tax return. Taxpayers who filed 2021 form il. Web illinois — property tax rebate form download this form print this form it appears you don't have a pdf plugin for this browser.

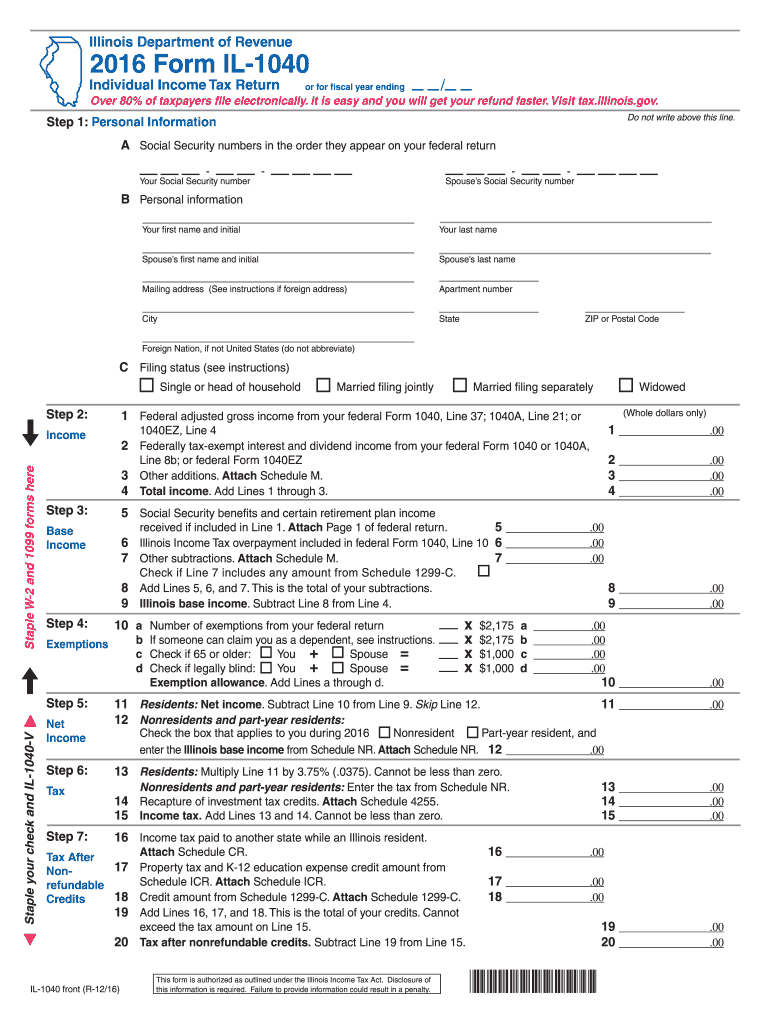

2016 Il 1040 Fill Out and Sign Printable PDF Template signNow

Web alternatively, click here to download and print the refund application form. Web filing help for requesting individual income tax rebate and property tax rebate by law, monday, october 17, 2022, was the last day to submit information to receive the illinois. If you didn't receive a refund or if you were given a paper check. Web illinois — property.

Illinois Tax Rebate 2022 When Is My Check Coming?

Upload, modify or create forms. Web the 2022 illinois property tax rebate is equal to the property tax credit claimed on your 2021 illinois tax return, up to a maximum of $300. To qualify for the property tax rebate, you must be: If you have difficulty with any of the three steps listed above, you may contact our office or.

Illinois' and Property Tax Rebate How to Know If You're Eligible

Web the illinois property tax and income tax rebates are not taxable by illinois and do not have to be reported on your illinois tax return. An illinois resident, have paid property taxes in illinois in 2020. How do i get the money? Taxpayers who filed 2021 form il. The property tax rebate was created by public act 102‐0700 and.

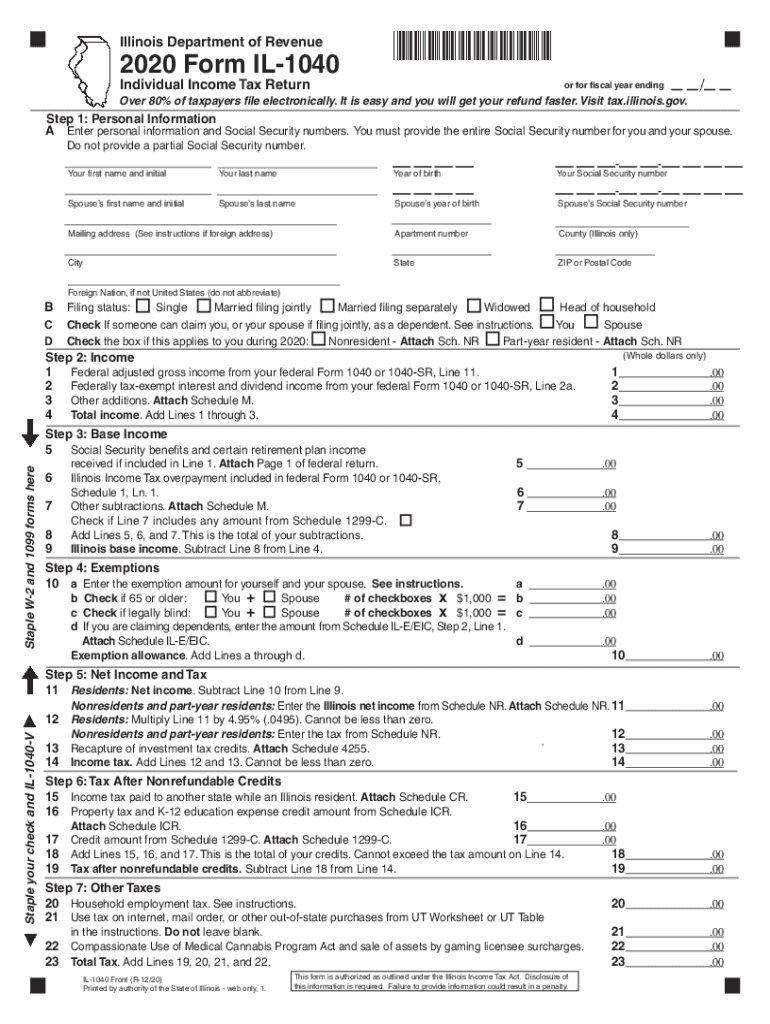

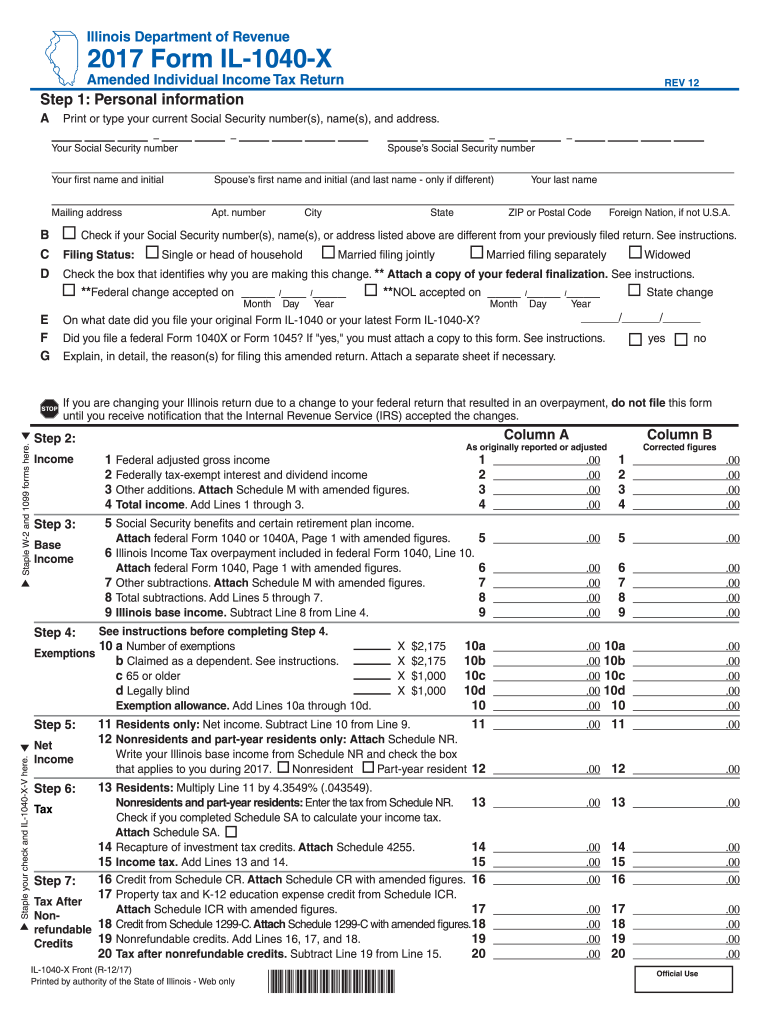

Illinois Form IL 1040 X Amended Individual Tax Fill Out and

Please use the link below to download 2022. Taxpayers who filed 2021 form il. If you didn't receive a refund or if you were given a paper check. Web the 2022 illinois property tax rebate is equal to the property tax credit claimed on your 2021 illinois tax return, up to a maximum of $300. Try it for free now!

2021 Illinois Property Tax Rebate Printable Rebate Form

An illinois resident, have paid property taxes in illinois in 2020. Upload, modify or create forms. Try it for free now! How do i get the money? If you didn't receive a refund or if you were given a paper check.

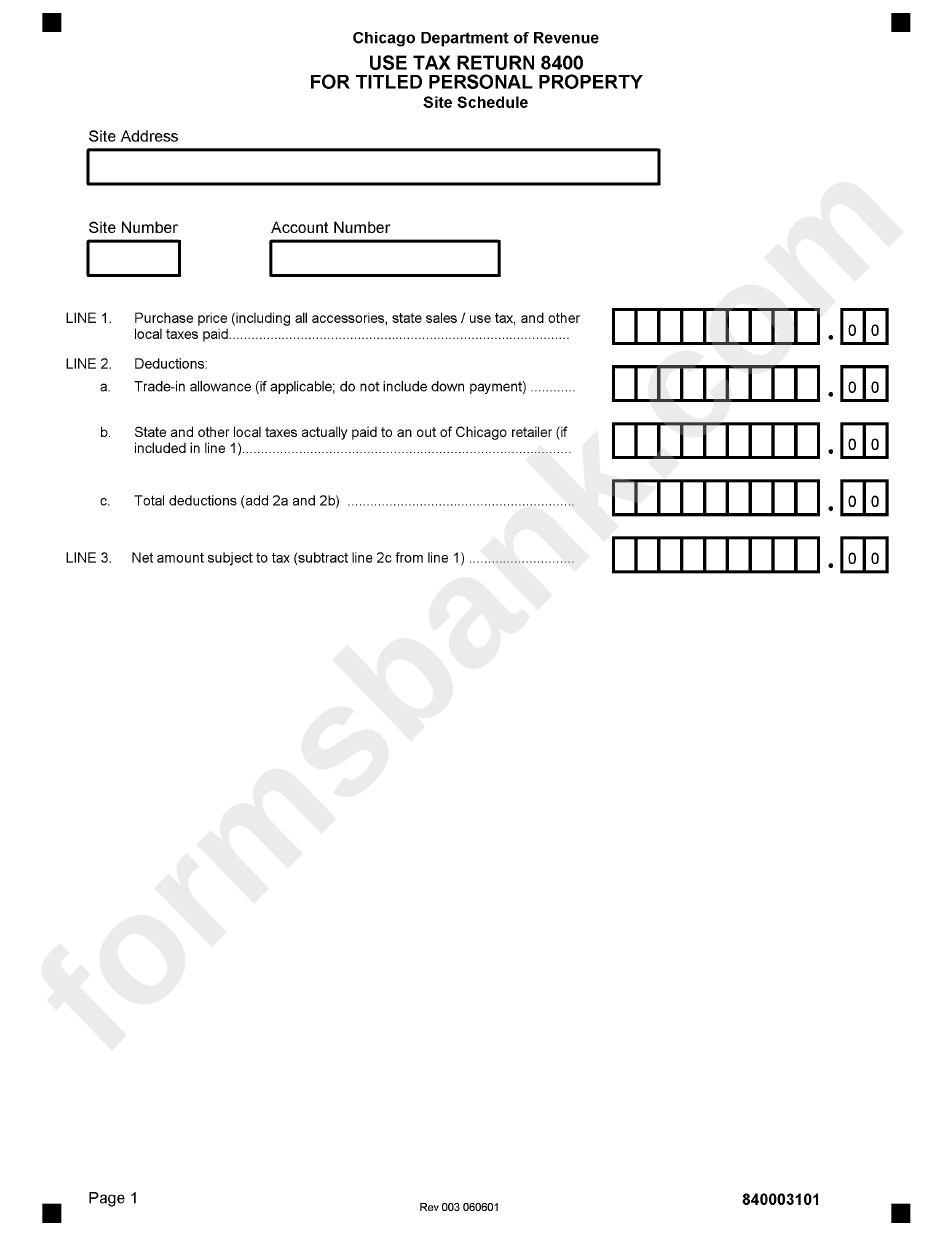

Use Tax Return Form 8400 For Titled Personal Property printable pdf

Web who qualifies for the property tax rebate? Web illinois residents who paid state property taxes last year on their primary 2020 residence are eligible for the rebate if their adjusted gross income on their 2021. Web the 2022 illinois property tax rebate is equal to the property tax credit claimed on your 2021 illinois tax return, up to a.

Illinois Property Tax Rebate How Much You Could Get and How to Know If

To qualify for the property tax rebate, you must be: Ad download or email il ged transcript & more fillable forms, register and subscribe now! Taxpayers eligible for both rebates will receive one. Web filing help for requesting individual income tax rebate and property tax rebate by law, monday, october 17, 2022, was the last day to submit information to.

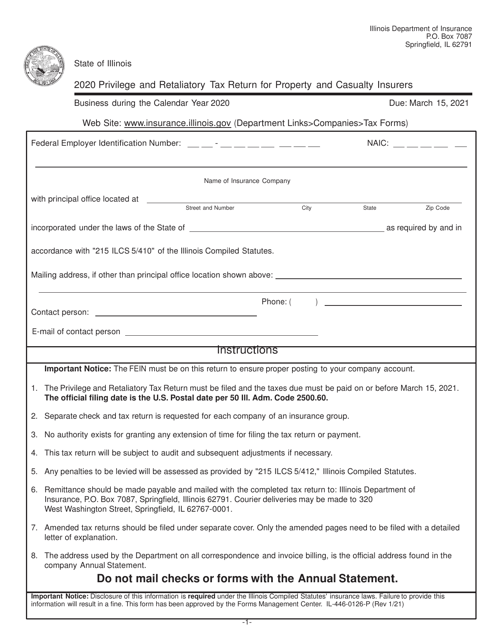

Form IL4460126P Download Printable PDF or Fill Online Privilege and

Web illinois residents who paid state property taxes last year on their primary 2020 residence are eligible for the rebate if their adjusted gross income on their 2021. An illinois resident, have paid property taxes in illinois in 2020. Taxpayers eligible for both rebates will receive one. If you have difficulty with any of the three steps listed above, you.

How Does Illinois’s Property Tax Rebate Work?

Try it for free now! Web who qualifies for the property tax rebate? Web illinois residents who paid state property taxes last year on their primary 2020 residence are eligible for the rebate if their adjusted gross income on their 2021. To qualify for the property tax rebate, you must be: Taxpayers eligible for both rebates will receive one.

Il 1040X Instructions 2017 Fill Out and Sign Printable PDF Template

Web illinois — property tax rebate form download this form print this form it appears you don't have a pdf plugin for this browser. An illinois resident, have paid property taxes in illinois in 2020. Web filing help for requesting individual income tax rebate and property tax rebate by law, monday, october 17, 2022, was the last day to submit.

The Property Tax Rebate Was Created By Public Act 102‐0700 And Is Equal To The Lesser Of The Property Tax Credit You Could Qualify For 2020.

Web alternatively, click here to download and print the refund application form. Upload, modify or create forms. Taxpayers eligible for both rebates will receive one. Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their.

Please Use The Link Below To Download 2022.

Web illinois — property tax rebate form download this form print this form it appears you don't have a pdf plugin for this browser. Web the 2022 illinois property tax rebate is equal to the property tax credit claimed on your 2021 illinois tax return, up to a maximum of $300. If you didn't receive a refund or if you were given a paper check. Web the rebate payments, which will take at least eight weeks to be issued in total, will be sent automatically to illinois residents who filed 2021 state income taxes.

To Qualify For The Property Tax Rebate, You Must Be:

Try it for free now! Web illinois residents who paid state property taxes last year on their primary 2020 residence are eligible for the rebate if their adjusted gross income on their 2021. Web the illinois property tax credit is a credit on your individual income tax return equal to 5 percent of illinois property tax (real estate tax) you paid on your principal residence. If you have difficulty with any of the three steps listed above, you may contact our office or call us at.

Web Filing Help For Requesting Individual Income Tax Rebate And Property Tax Rebate By Law, Monday, October 17, 2022, Was The Last Day To Submit Information To Receive The Illinois.

Web the illinois property tax and income tax rebates are not taxable by illinois and do not have to be reported on your illinois tax return. Taxpayers who filed 2021 form il. How do i get the money? Web who qualifies for the property tax rebate?