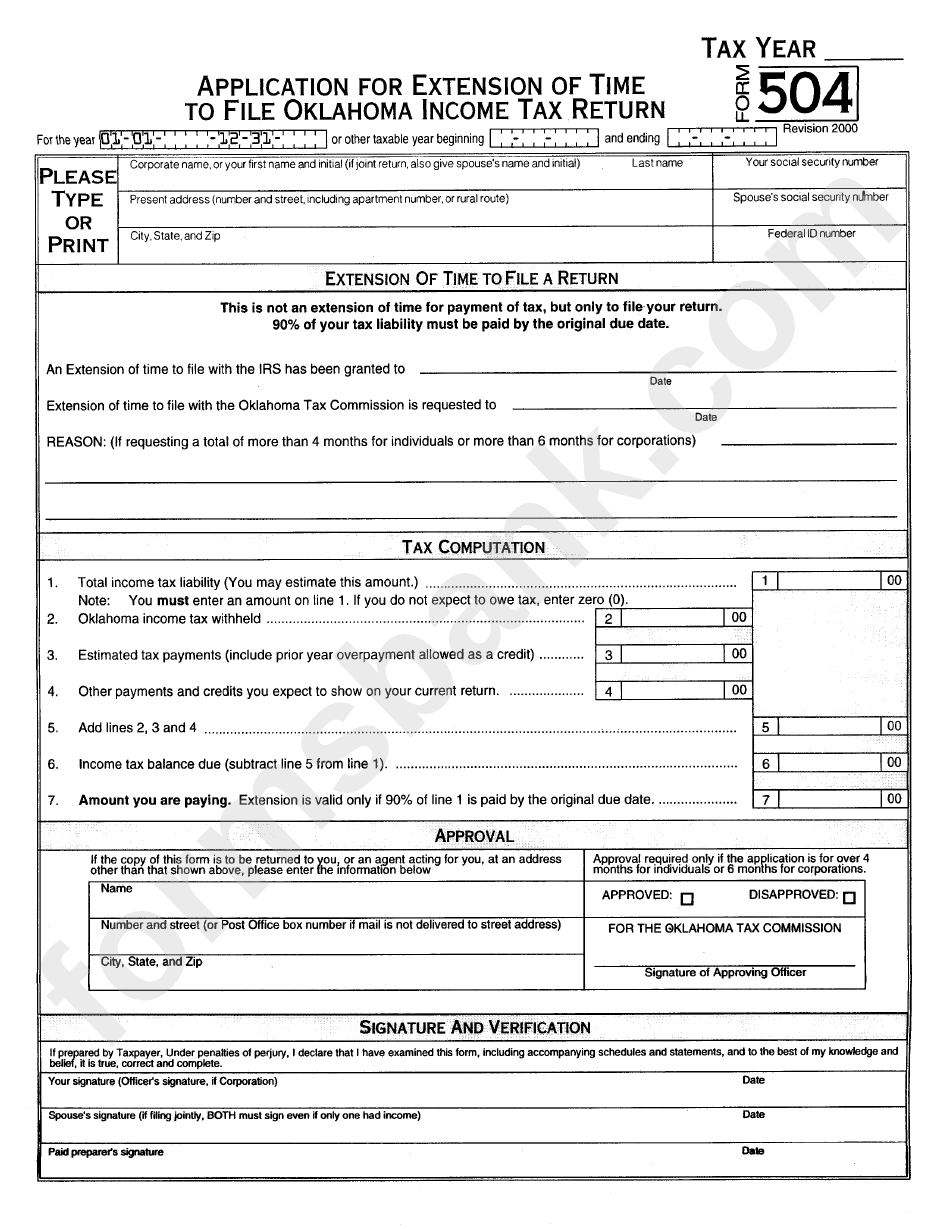

Illinois Tax Extension Form

Illinois Tax Extension Form - An extension payment can also be made. Corporation income and replacement tax return. Head over to the federal income tax forms page to get any forms you need for completing your federal income tax. Web illinois personal tax extensions are automatic, which means there is no application to submit. Before viewing these documents you may need to download adobe acrobat reader. Complete, edit or print tax forms instantly. Edit, sign and print tax forms on any device with signnow. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. 2023 estimated income tax payments for individuals. Web automatic filing extensions, proof of timely mailing of form 4768 to the irs will be accepted.

Sign up for a mytax illinois account; 2023 estimated income tax payments for individuals. Web tax forms documents are in adobe acrobat portable document format (pdf). An extension payment can also be made. Extension of time to file illinois form 700 an illinois. Before viewing these documents you may need to download adobe acrobat reader. Go to service provided by department of revenue go to agency. Web extension payments view information on extension payments for individual income tax (sole proprietorships). Web print or download 76 illinois income tax forms for free from the illinois department of revenue. Complete, edit or print tax forms instantly.

Go to service provided by department of revenue go to agency. Web illinois personal tax extensions are automatic, which means there is no application to submit. Web print or download 76 illinois income tax forms for free from the illinois department of revenue. Sign up for a mytax illinois account; Head over to the federal income tax forms page to get any forms you need for completing your federal income tax. Extension of time to file illinois form 700 an illinois. Edit, sign and print tax forms on any device with signnow. Web automatic filing extensions, proof of timely mailing of form 4768 to the irs will be accepted. Corporation income and replacement tax return. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and.

Illinois Tax Brief The Policy Circle

Web 1 2 3 next printed all of your illinois income tax forms? Corporation income and replacement tax return. Web extension payments view information on extension payments for individual income tax (sole proprietorships). Head over to the federal income tax forms page to get any forms you need for completing your federal income tax. An extension payment can also be.

File 1120 Extension Online Corporate Tax Extension Form for 2020

An extension payment can also be made. Web automatic filing extensions, proof of timely mailing of form 4768 to the irs will be accepted. Complete, edit or print tax forms instantly. Head over to the federal income tax forms page to get any forms you need for completing your federal income tax. Before viewing these documents you may need to.

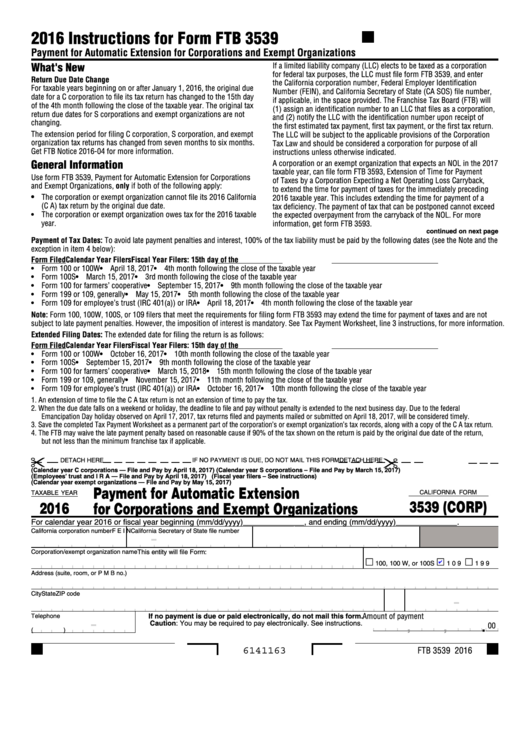

2016 tax extension form corporations dialockq

Web print or download 76 illinois income tax forms for free from the illinois department of revenue. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Go to service provided by department of revenue go to agency. Web extension payments view information on extension payments for individual income tax (sole.

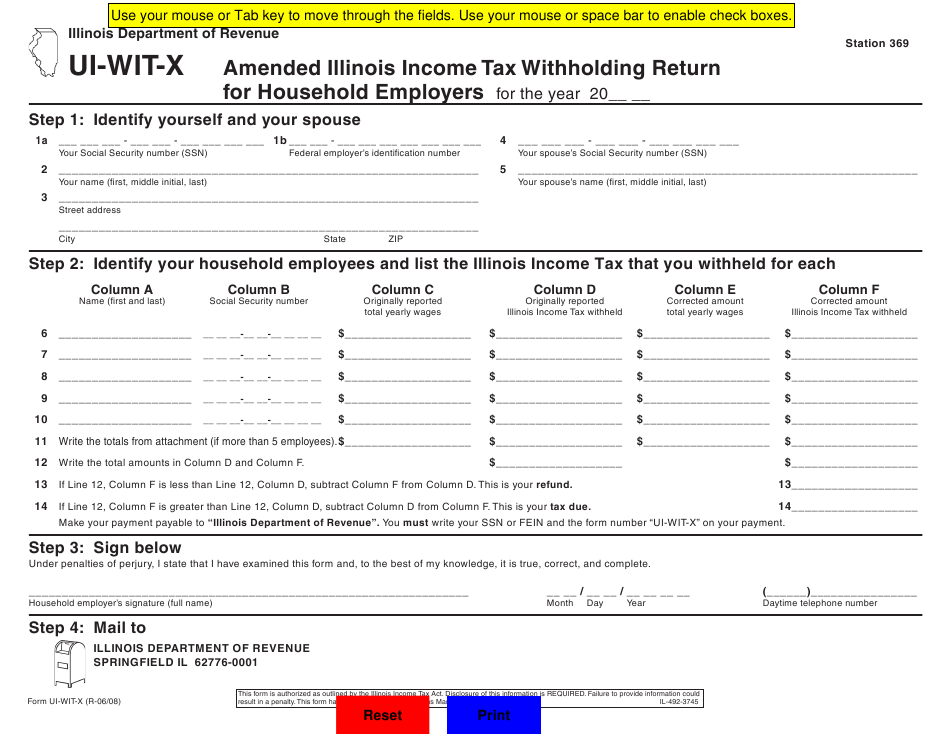

Illinois Tax Withholding Forms 2022 W4 Form

Corporation income and replacement tax return. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web automatic filing extensions, proof of timely mailing of form 4768 to the irs will be accepted. Extension of time to file illinois form 700 an illinois. Edit, sign and print tax forms on any.

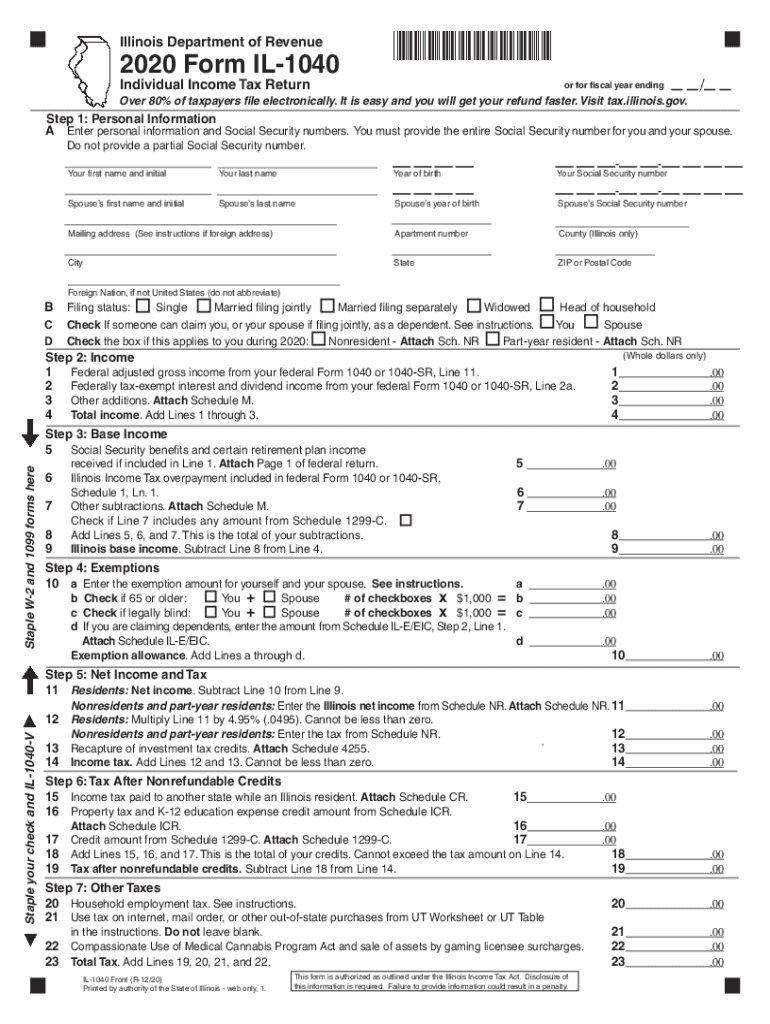

Illinois Form IL 1040 X Amended Individual Tax Fill Out and

Complete, edit or print tax forms instantly. Sign up for a mytax illinois account; Web extension payments view information on extension payments for individual income tax (sole proprietorships). Check on the status of your refund; Edit, sign and print tax forms on any device with signnow.

Form IL1040X Download Fillable PDF or Fill Online Amended Individual

Extension of time to file illinois form 700 an illinois. Web 1 2 3 next printed all of your illinois income tax forms? Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Edit, sign and print tax forms on any device with signnow. Web illinois personal tax extensions are automatic,.

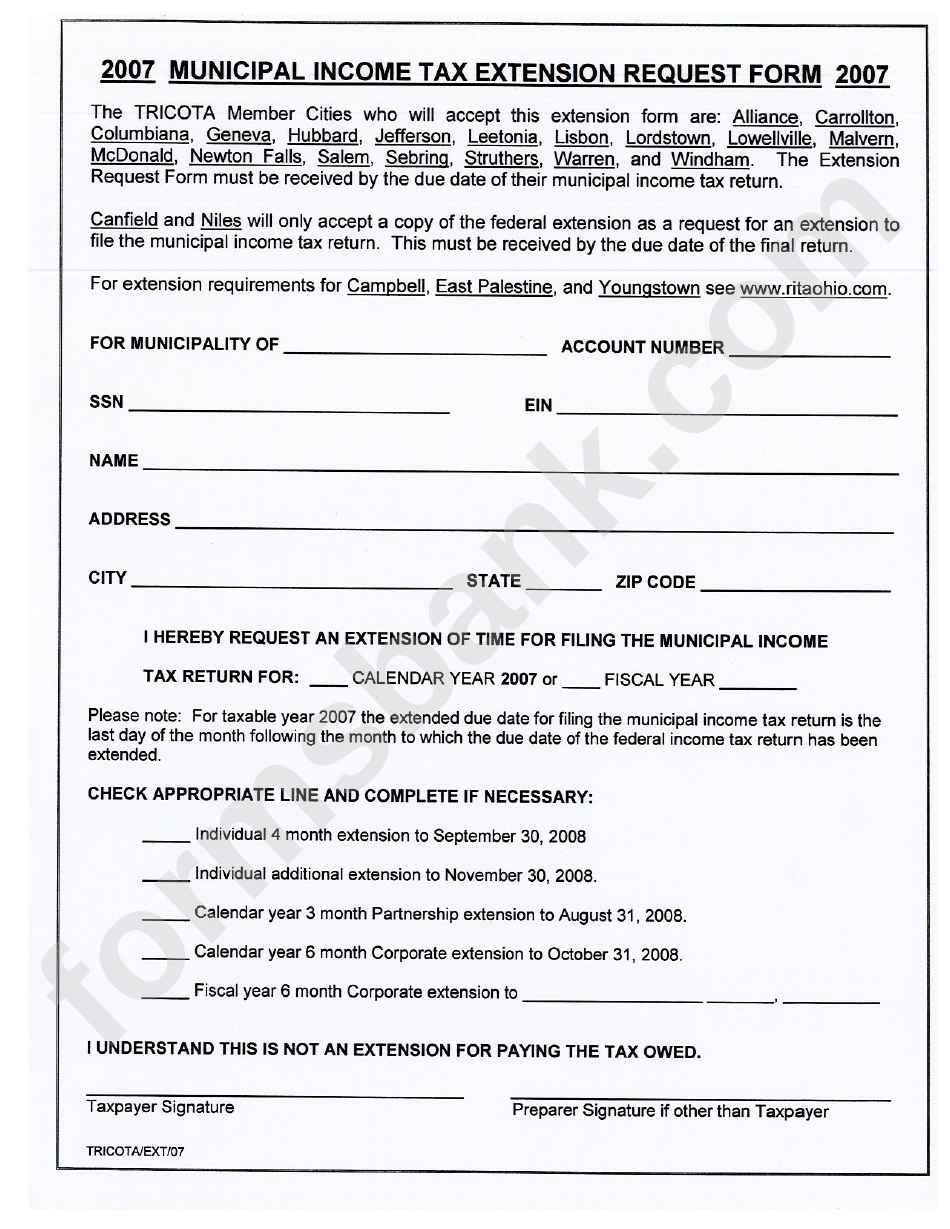

Form 504 Application For Extension Of Time To File Oklahoma

Edit, sign and print tax forms on any device with signnow. Corporation income and replacement tax return. Web extension payments view information on extension payments for individual income tax (sole proprietorships). Complete, edit or print tax forms instantly. An extension payment can also be made.

Illinois Dept Of Revenue Forms Fill Out and Sign Printable PDF

Web automatic filing extensions, proof of timely mailing of form 4768 to the irs will be accepted. Web extension payments view information on extension payments for individual income tax (sole proprietorships). Web print or download 76 illinois income tax forms for free from the illinois department of revenue. Before viewing these documents you may need to download adobe acrobat reader..

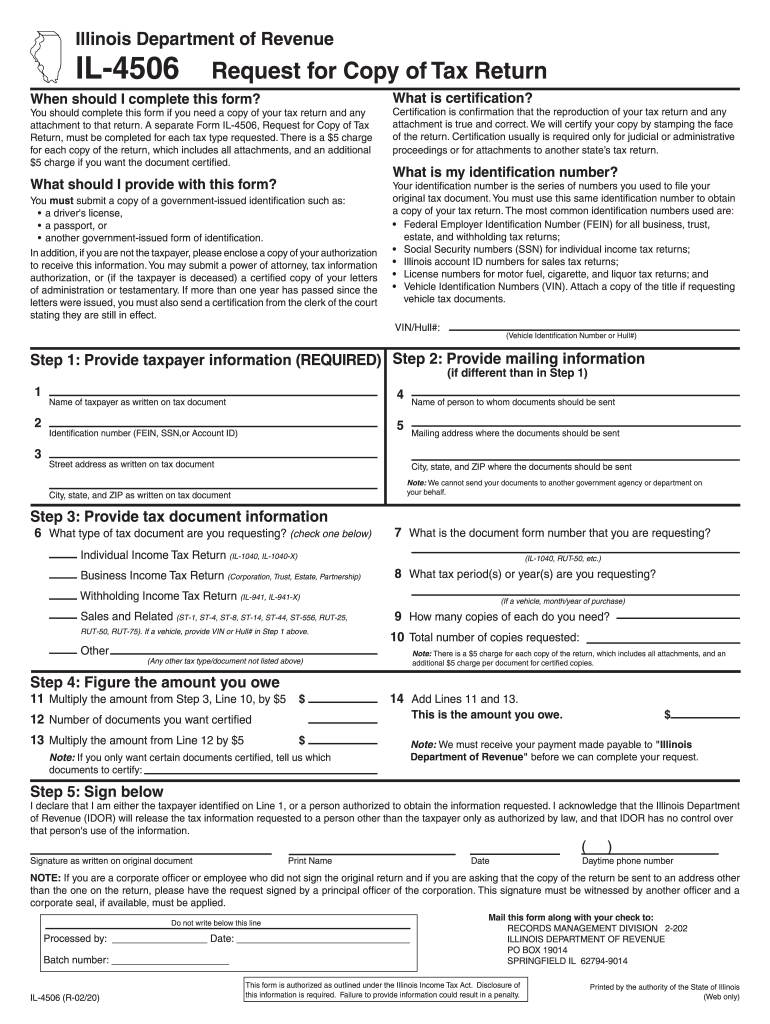

Municipal Tax Extension Request Form 2007 printable pdf download

Head over to the federal income tax forms page to get any forms you need for completing your federal income tax. Sign up for a mytax illinois account; Extension of time to file illinois form 700 an illinois. 2023 estimated income tax payments for individuals. Web 1 2 3 next printed all of your illinois income tax forms?

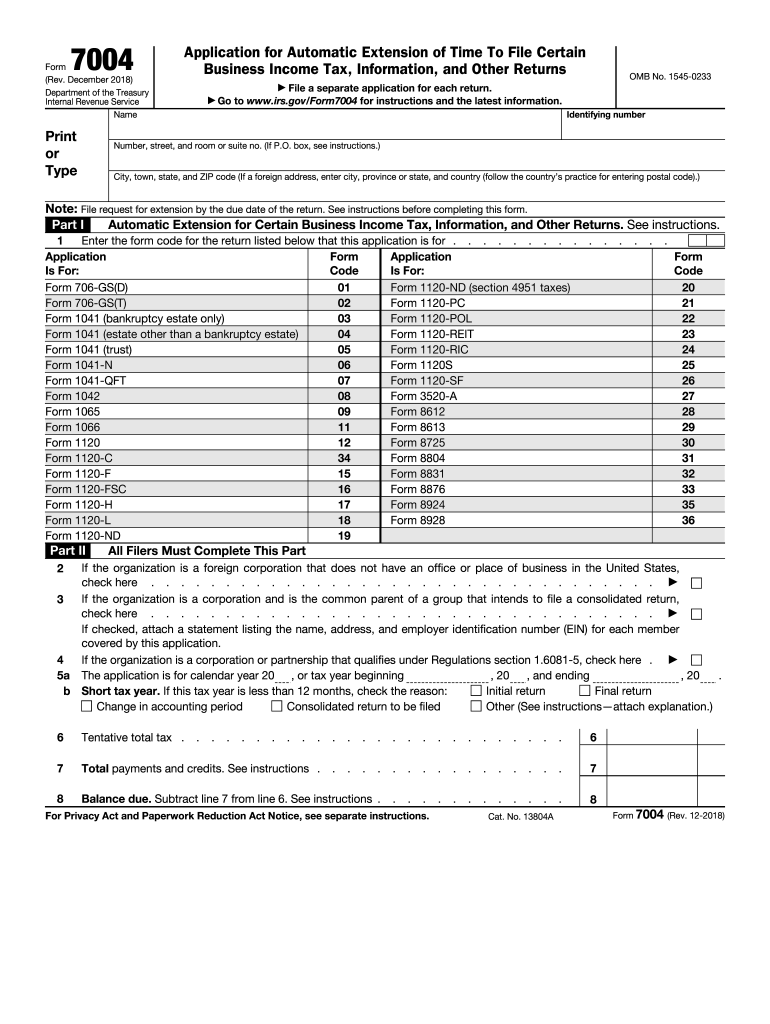

IRS 7004 2018 Fill and Sign Printable Template Online US Legal Forms

Web print or download 76 illinois income tax forms for free from the illinois department of revenue. Web tax forms documents are in adobe acrobat portable document format (pdf). Extension of time to file illinois form 700 an illinois. Corporation income and replacement tax return. Web extension payments view information on extension payments for individual income tax (sole proprietorships).

Complete, Edit Or Print Tax Forms Instantly.

Web illinois personal tax extensions are automatic, which means there is no application to submit. Edit, sign and print tax forms on any device with signnow. Check on the status of your refund; Web print or download 76 illinois income tax forms for free from the illinois department of revenue.

Sign Up For A Mytax Illinois Account;

Extension of time to file illinois form 700 an illinois. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Head over to the federal income tax forms page to get any forms you need for completing your federal income tax. Web extension payments view information on extension payments for individual income tax (sole proprietorships).

Web Automatic Filing Extensions, Proof Of Timely Mailing Of Form 4768 To The Irs Will Be Accepted.

Before viewing these documents you may need to download adobe acrobat reader. Web 1 2 3 next printed all of your illinois income tax forms? Go to service provided by department of revenue go to agency. Corporation income and replacement tax return.

An Extension Payment Can Also Be Made.

2023 estimated income tax payments for individuals. Web tax forms documents are in adobe acrobat portable document format (pdf).