In Its First Taxable Year Platform Inc Generated

In Its First Taxable Year Platform Inc Generated - In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. To calculate platform's taxable income for its second year, we begin with. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. This results in a taxable income of $230,000. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity.

This results in a taxable income of $230,000. In its first taxable year, platform, inc. In its first taxable year, platform, inc. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. To calculate platform's taxable income for its second year, we begin with. In its first taxable year, platform, inc.

Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. To calculate platform's taxable income for its second year, we begin with. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity.

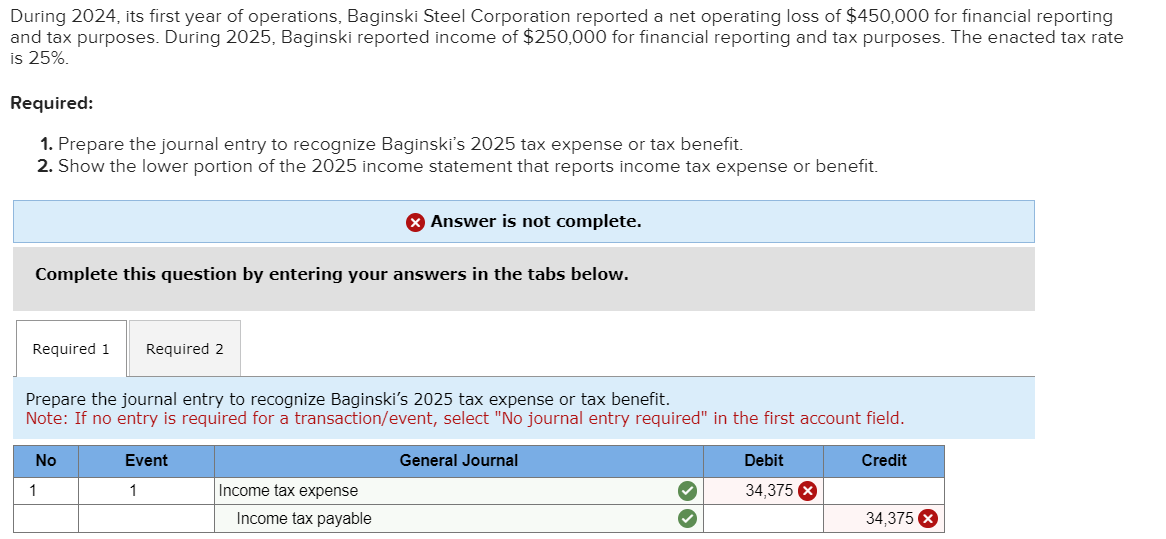

Solved During 2024 , its first year of operations, Baginski

In its first taxable year, platform, inc. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. This results in a taxable income of $230,000. To calculate platform's taxable income for its second year, we begin with.

SOLVED For its first year of operations, Tringali Corporation's

This results in a taxable income of $230,000. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. In its second year, platform generated $350,000 operating income and made a $20,000.

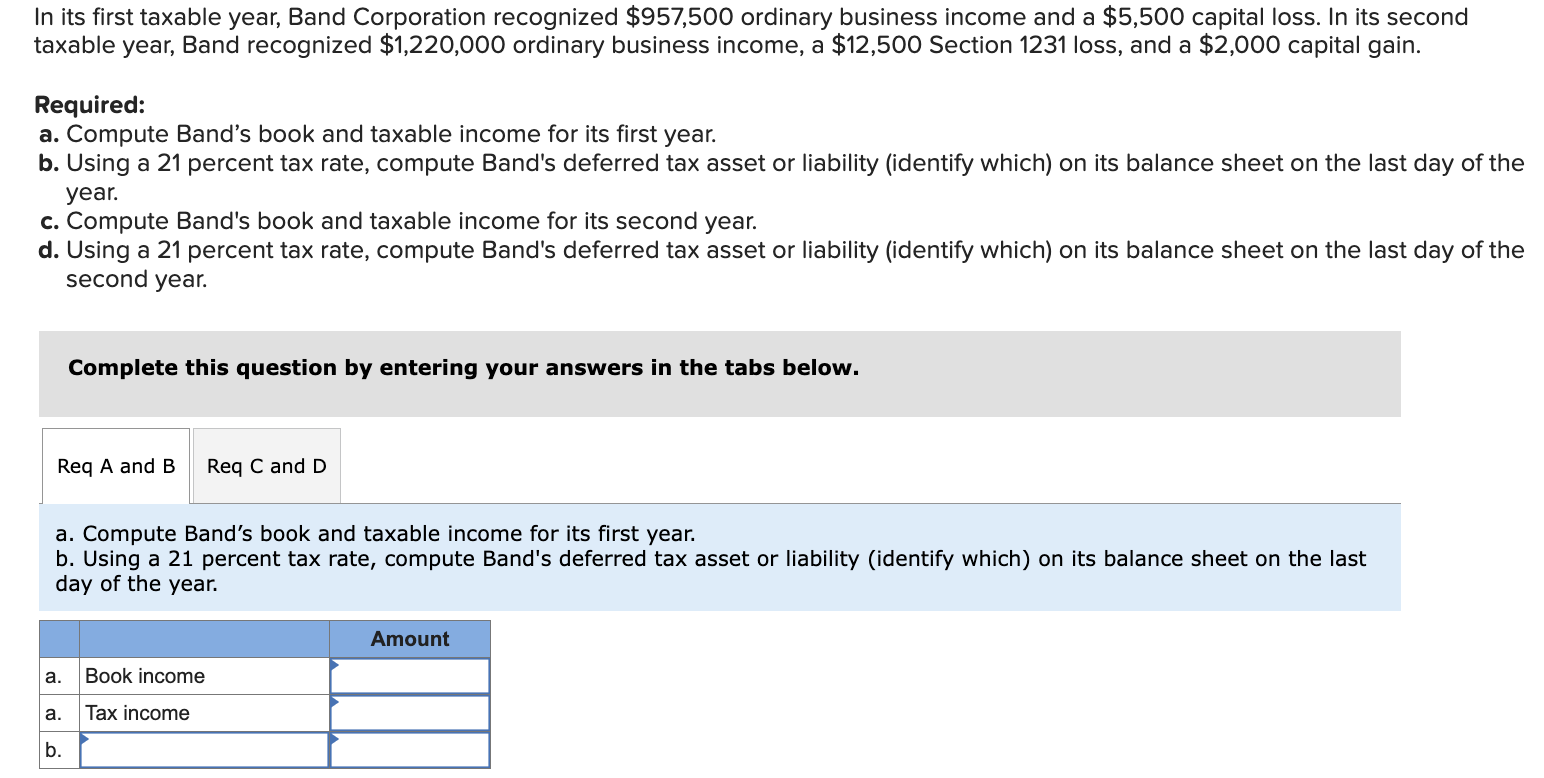

Solved In its first taxable year, Band Corporation

This results in a taxable income of $230,000. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash.

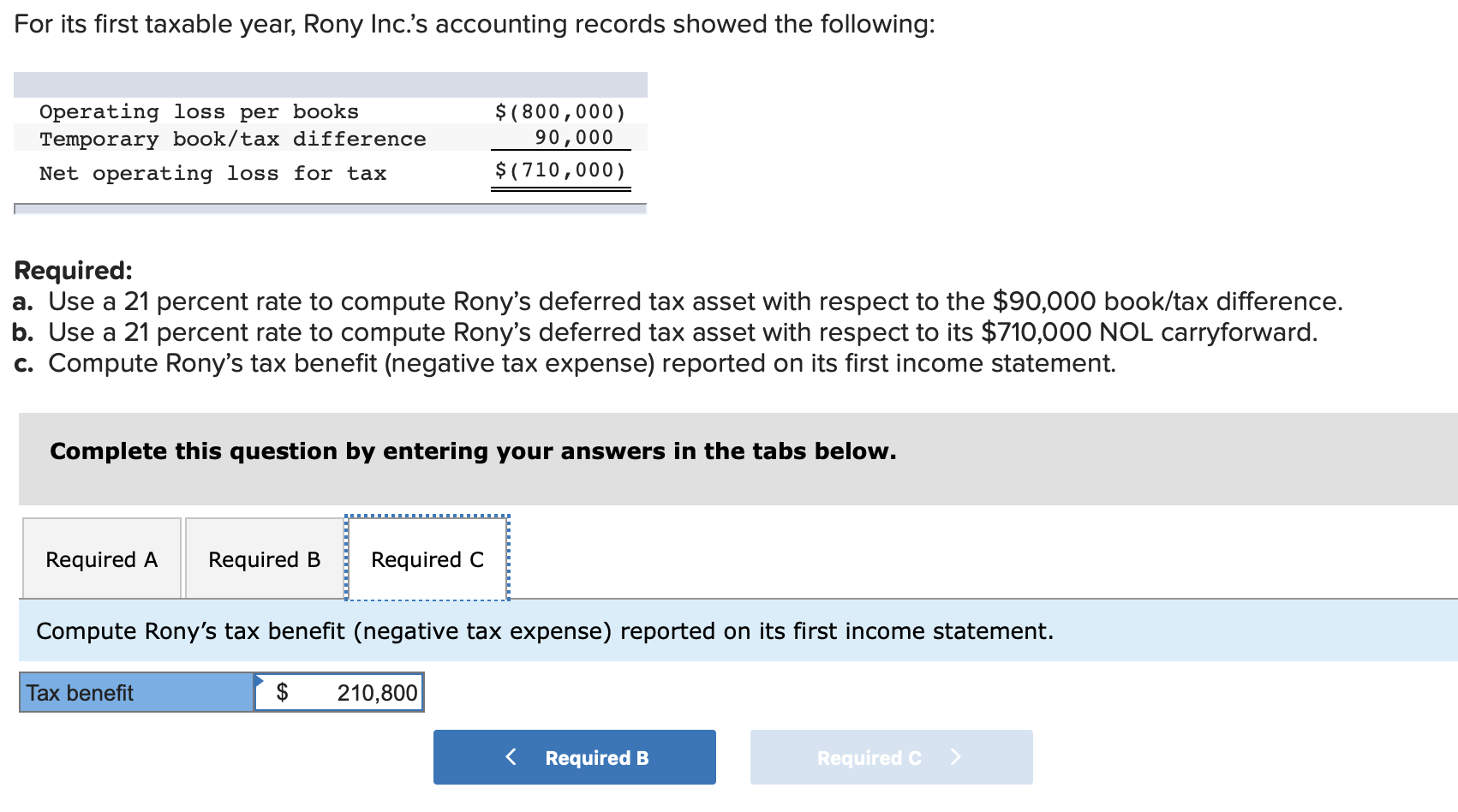

Solved For its first taxable year, Rony Inc.'s accounting

This results in a taxable income of $230,000. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform,.

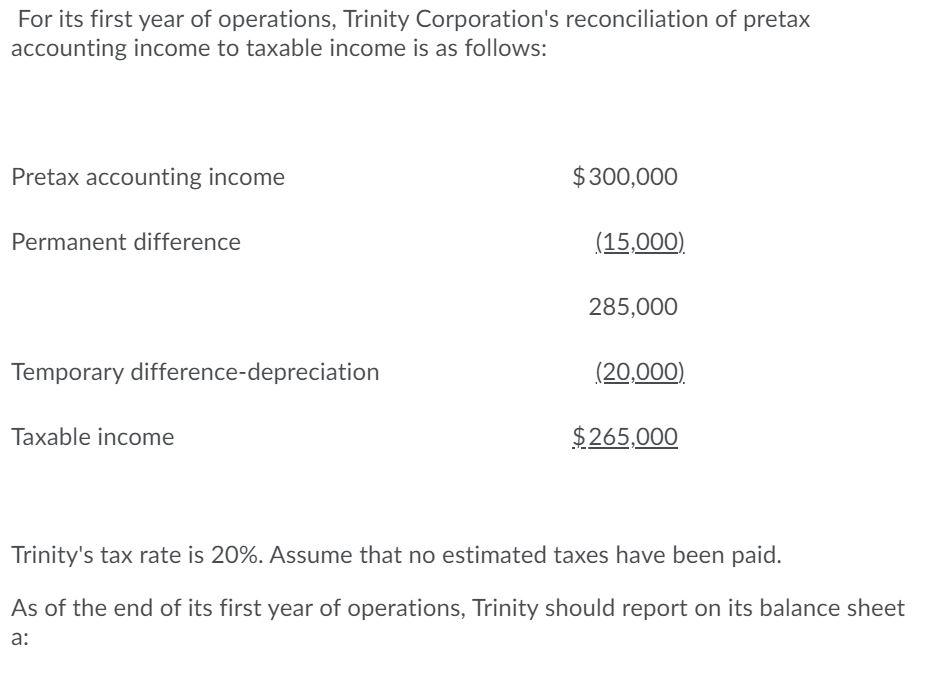

Solved For its first year of operations, Trinity

Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. This results in a taxable income of $230,000. In its first taxable year, platform, inc. To calculate platform's taxable income for its second year, we begin with. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000.

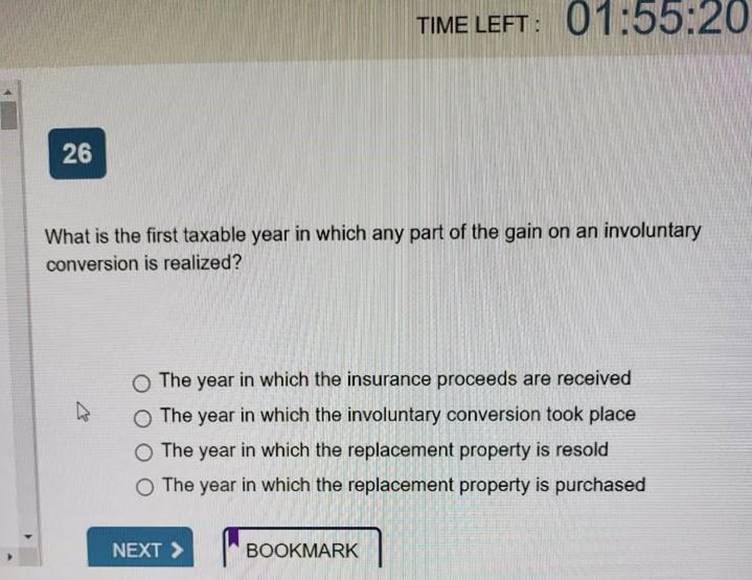

(Get Answer) TIME LEFT 015520 26 What is the first taxable year in

In its first taxable year, platform, inc. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a.

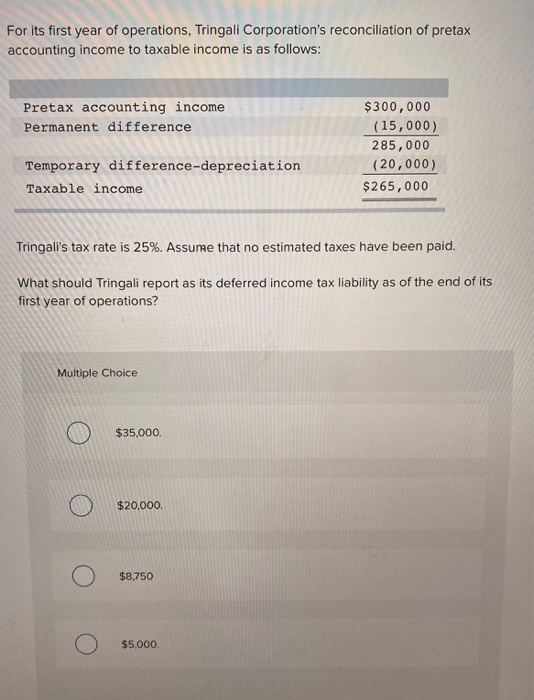

Solved For its first year of operations, Tringali

Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. This results in a taxable income of $230,000. In its first taxable year, platform, inc. In its first taxable year, platform, inc. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local.

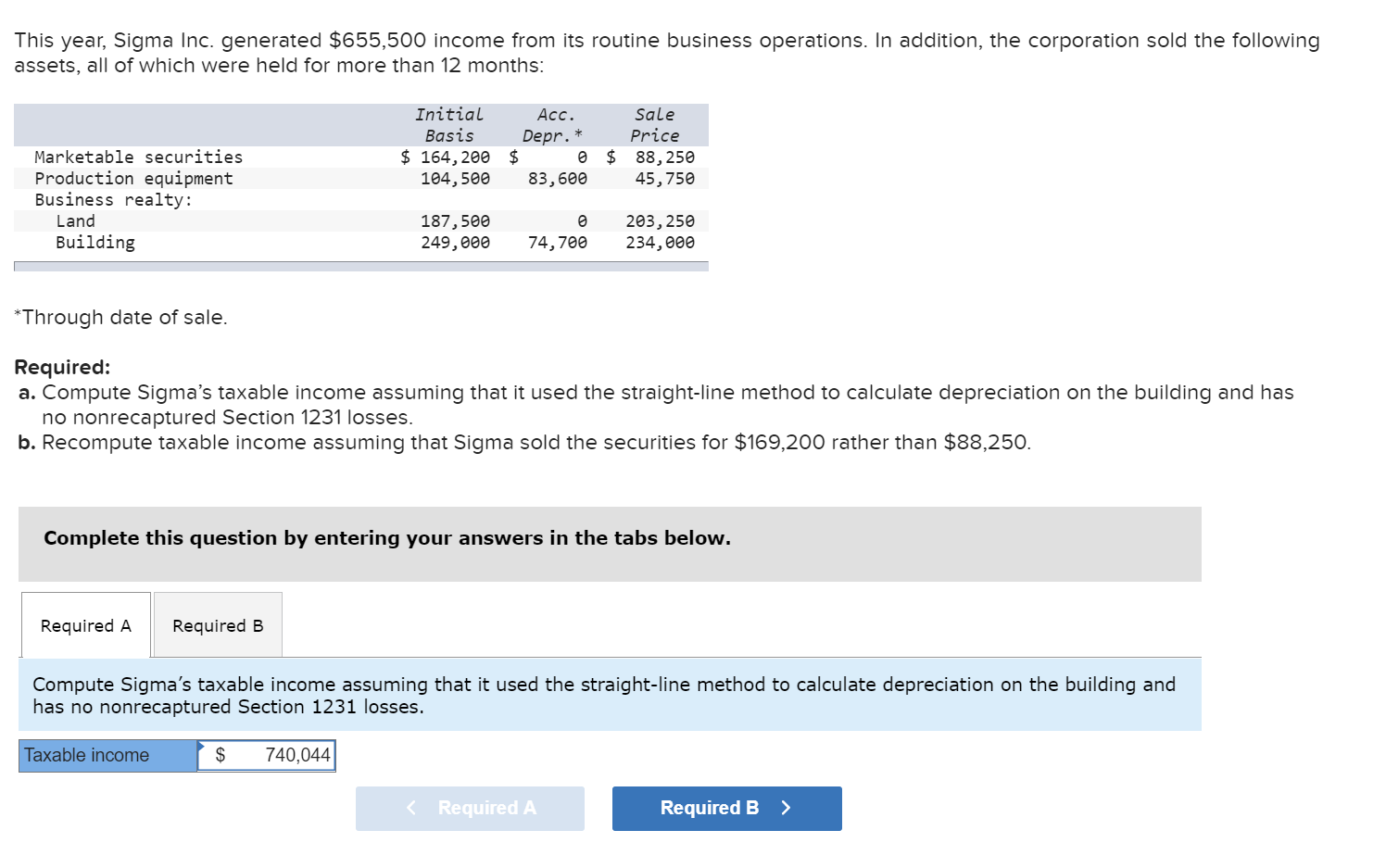

Solved This year, Sigma Inc. generated 655,500 from

In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc.

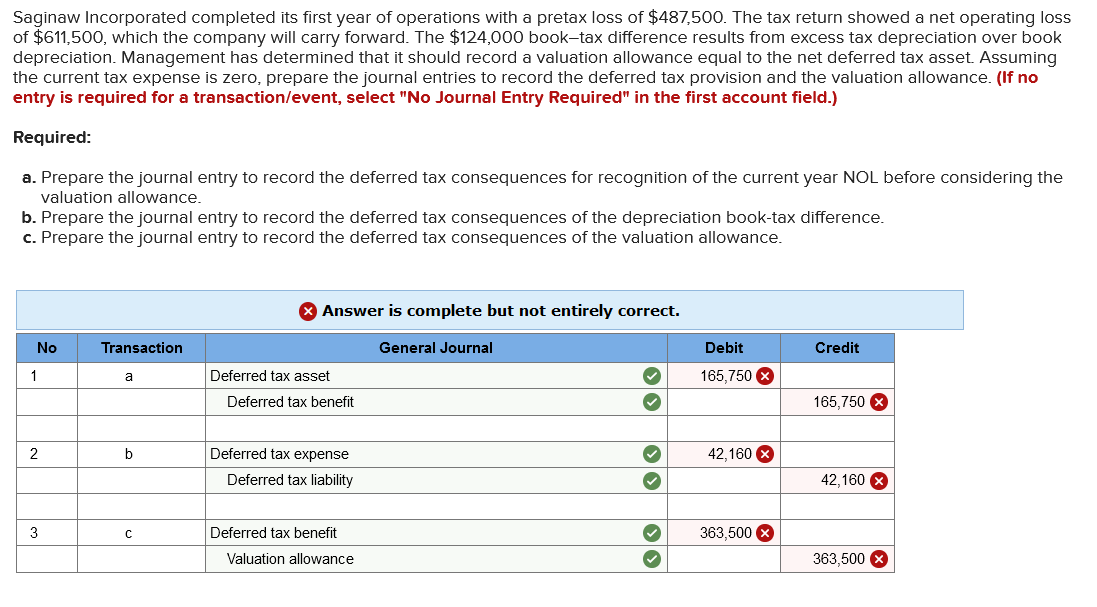

Solved Saginaw Incorporated completed its first year of

In its first taxable year, platform, inc. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. This results in a taxable income of.

Solved TimesRoman Publishing Company reports the following

In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation.

Generated A $100,000 Net Operating Loss And Made A $10,000 Cash Donation To A Local Charity.

In its first taxable year, platform, inc. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. This results in a taxable income of $230,000. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity.

In Its First Taxable Year, Platform, Inc.

Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. To calculate platform's taxable income for its second year, we begin with. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity.

In Its First Taxable Year, Platform, Incorporated Generated A $100,000 Net Operating Loss And Made A $10,000 Cash Donation To A Local Charity.

In its first taxable year, platform, inc.