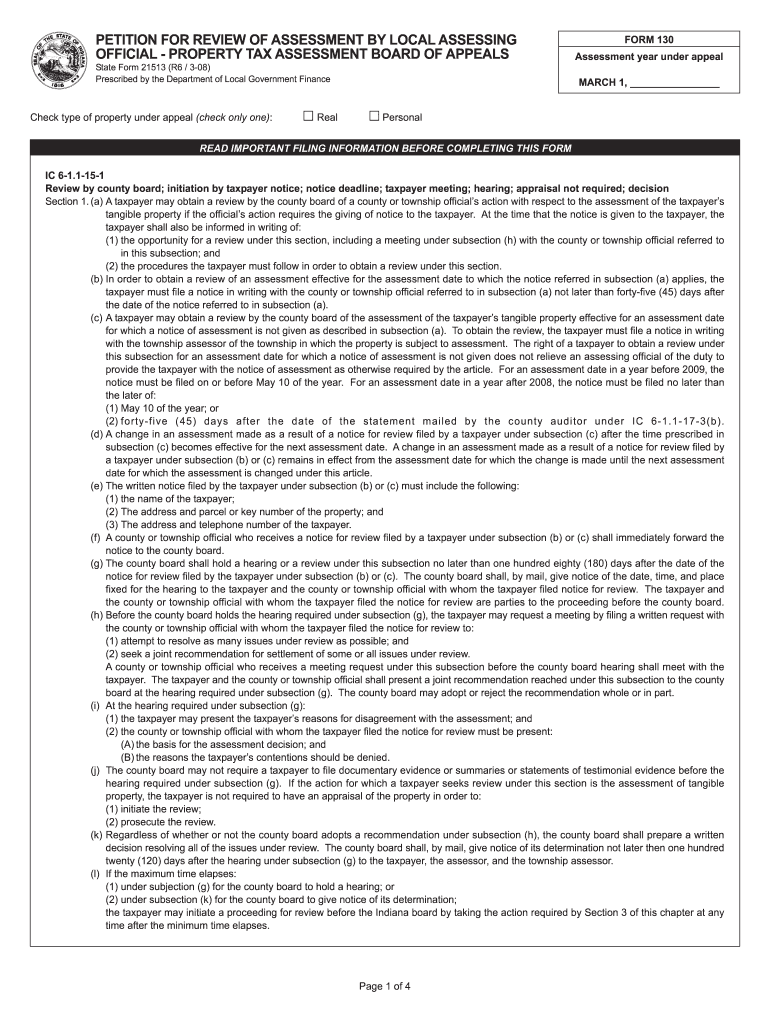

Indiana Property Tax Appeal Form 130

Indiana Property Tax Appeal Form 130 - Taxpayer files a property tax appeal with assessing official. Web to access all department of local government finance forms please visit the state forms online catalog available here. Complete power of attorney if necessary. Web there are several different types of appeals available to a taxpayer. The taxpayer must file a separate petition for each parcel. Ad download or email 2008 130 & more fillable forms, register and subscribe now! Appeals can be emailed to: Web a taxpayer may appeal an assessment by filing a form 130 with the assessing official. Web indiana law does not require a taxpayer to submit an appraisal of the subject property to appeal the assessment. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed.

Edit, sign and save in dlgf 130 form. Web there are several different types of appeals available to a taxpayer. Web taxpayer files a property tax appeal with assessing official. If you file a form 130, the. Taxpayer files a property tax appeal with assessing official. And 2) requires the assessing official. While the indiana tax court has held that an appraisal properly. Web the indiana department of revenue (dor) accepts written appeals up to 60 days from the date the proposed assessment or refund denial is issued. Web taxpayer files a property tax appeal with assessing official. The taxpayer must file a separate petition for each parcel.

Web to appeal an assessment notice, the taxpayer must file a form 130 with the county assessor within 45 days of the date the form 11 (notice of assessment) was mailed. Web to initiate an appeal of your assessment, you must file a form 130 taxpayer's notice to initiate an appeal (state form 53958) for each parcel. The appeal should detail the pertinent facts of why the assessed. Ad download or email 2008 130 & more fillable forms, register and subscribe now! Edit, sign and save in dlgf 130 form. And 2) requires the assessing official. If a property owner chooses to file an assessment. Appeals can be emailed to: While the indiana tax court has held that an appraisal properly. If you file a form 130, the.

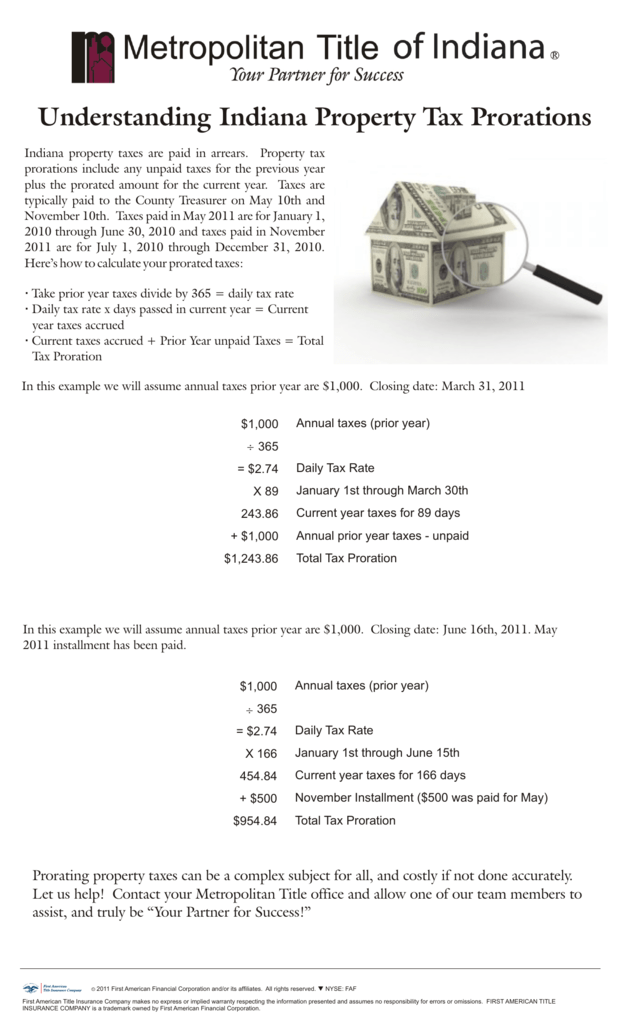

Understanding Indiana Property Tax Prorations

The appeal should detail the pertinent facts of why the assessed. If you file a form 130, the. Edit, sign and save in dlgf 130 form. The taxpayer must file a separate petition for each parcel. Petition to the state board of tax commissioners for review of assessment (pdf) form 132 petition for.

Fill Free fillable forms Jennings County Government

Appeals can be emailed to: Web to initiate an appeal of your assessment, you must file a form 130 taxpayer's notice to initiate an appeal (state form 53958) for each parcel. Web a taxpayer may appeal an assessment by filing a form 130 with the assessing official. Web form 130 assessment year under appeal. Web the deadline to file an.

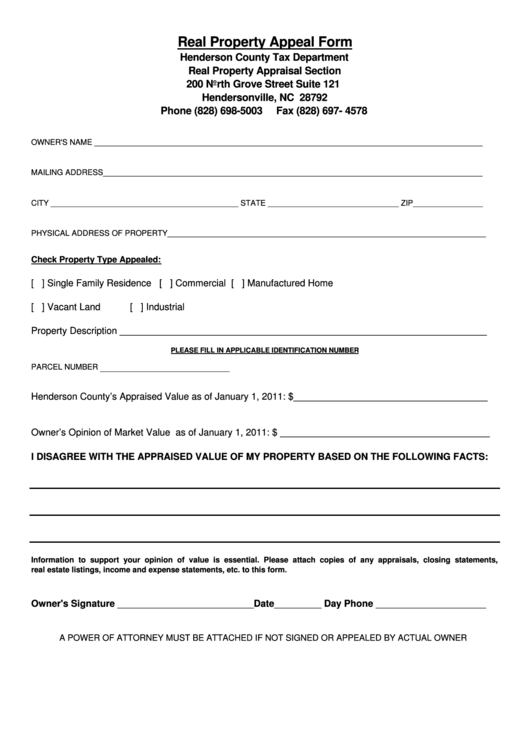

Real Property Appeal Form Henderson County Tax Department printable

Check the information needed to verify you have included the required. If you file a form 130, the. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Complete power of attorney if necessary. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed.

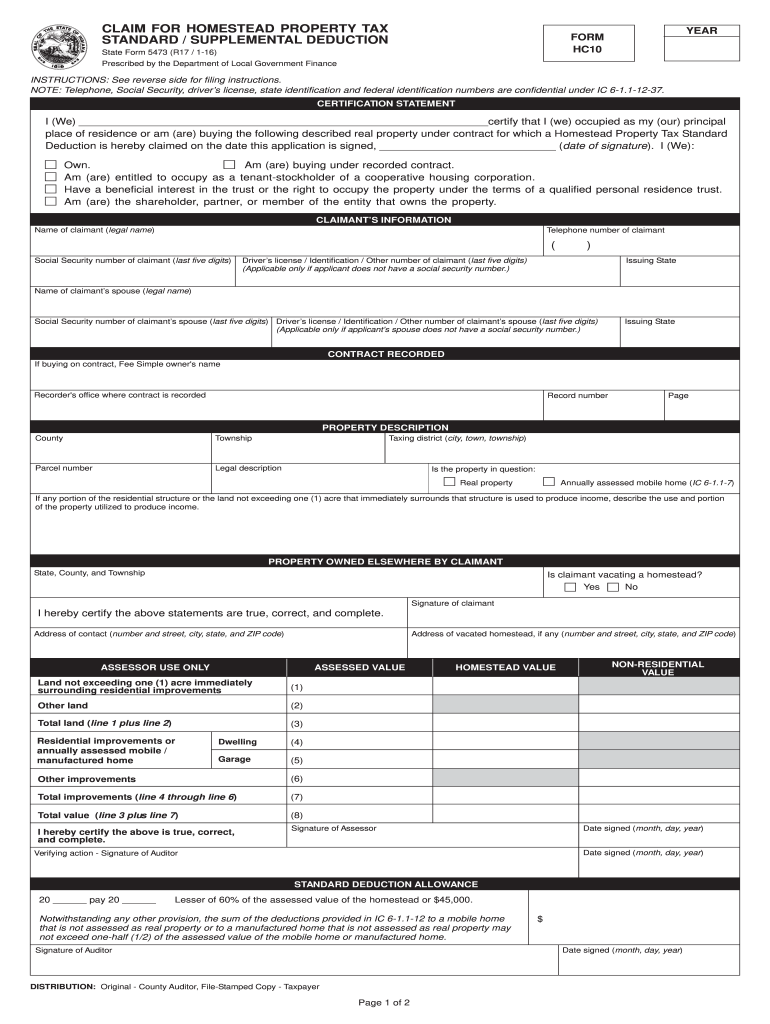

Indiana Homestead Exemption Form Fill Out and Sign Printable PDF

Web the indiana department of revenue (dor) accepts written appeals up to 60 days from the date the proposed assessment or refund denial is issued. Web a taxpayer may appeal an assessment by filing a form 130 with the assessing official. Web the deadline to file an appeal is june 15th, 2023. Edit, sign and save in dlgf 130 form..

How to Appeal Your Property Tax Assessment Clark Howard

Ad download or email 2008 130 & more fillable forms, register and subscribe now! The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Web within 30 days of the ptaboa mailing of its decision, the taxpayer, or township assessor, or a ptaboa member can file a petition to the state board of.

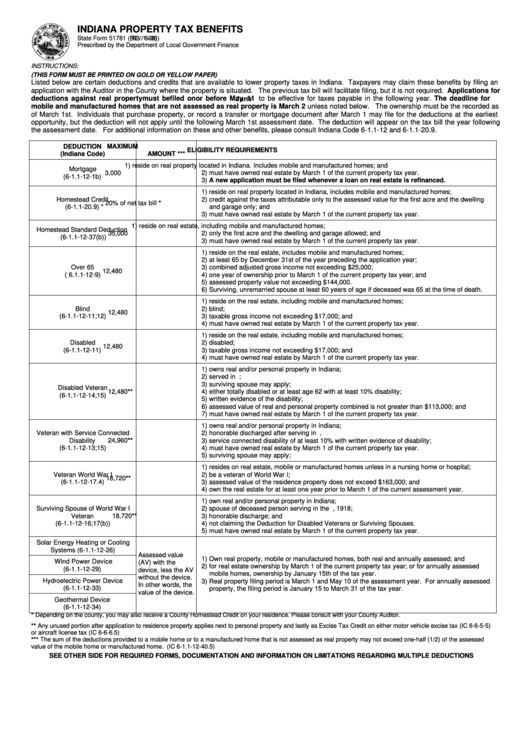

Indiana Property Tax Benefits Form printable pdf download

The taxpayer must file a separate petition for each parcel. Web a taxpayer may appeal an assessment by filing a form (“form 130”) with the assessing official. Web to initiate an appeal of your assessment, you must file a form 130 taxpayer's notice to initiate an appeal (state form 53958) for each parcel. Web every spring the county will send.

Form 130 Indiana Fill Out and Sign Printable PDF Template signNow

Edit, sign and save in dlgf 130 form. Web to appeal an assessment notice, the taxpayer must file a form 130 with the county assessor within 45 days of the date the form 11 (notice of assessment) was mailed. Web taxpayer files a property tax appeal with assessing official. Web there are several different types of appeals available to a.

How a Property Database Helps Commercial Property Tax Assessors Thrive

It appears you don't have a pdf plugin for this browser. Web form 130 assessment year under appeal. Check the information needed to verify you have included the required. The appeal should detail the pertinent facts of why the assessed. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed.

Morris County NJ Property Tax Appeal Form YouTube

Web a taxpayer may appeal an assessment by filing a form 130 with the assessing official. Appeals can be emailed to: Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Taxpayer's notice to initiate an appeal (pdf) form 131: Edit, sign and save in dlgf 130 form.

Appeal For Property Tax Fill Online, Printable, Fillable, Blank

Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Web taxpayer files a property tax appeal with assessing official. And 2) requires the assessing official. Web form 130 assessment year under appeal. If you file a form 130, the.

The Taxpayer Must Use The Form Prescribed By The Dlgf (Form 130) For Each Parcel Being Appealed.

Check the information needed to verify you have included the required. Appeals can be emailed to: Taxpayer's notice to initiate an appeal (pdf) form 131: The taxpayer must file a separate petition for each parcel.

And Requires The Assessing Official To.

Web a taxpayer may appeal an assessment by filing a form (“form 130”) with the assessing official. Taxpayer files a property tax appeal with assessing official. Ibtr = indiana board of tax review • ibtr is a state. Web every spring the county will send all property owners a form 11 notice of assessment. if the tax payer does not agree with the total assessed value as stated on the form, they.

Edit, Sign And Save In Dlgf 130 Form.

The appeal should detail the pertinent facts of why the assessed. It appears you don't have a pdf plugin for this browser. Web form 130 assessment year under appeal. If a property owner chooses to file an assessment.

And 2) Requires The Assessing Official.

Web to appeal an assessment notice, the taxpayer must file a form 130 with the county assessor within 45 days of the date the form 11 (notice of assessment) was mailed. Web a taxpayer may appeal an assessment by filing a form 130 with the assessing official. Web within 30 days of the ptaboa mailing of its decision, the taxpayer, or township assessor, or a ptaboa member can file a petition to the state board of tax commissioners for. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed.