Indiana W4 Printable

Indiana W4 Printable - Web follow the simple instructions below: Underpayment of indiana withholding filing register and file this tax online via. You can also download it, export it or print it out. Handy tips for filling out w 4 indiana. Print or type your full name, social. Intime allows you to file and pay your business taxes (including sales and withholding); Web submitting the indiana w4 printable with signnow will give better confidence that the output document will be legally binding and safeguarded. Register a new tax type and more. If line 1 is less than line 2,. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax.

Enter your indiana county of residence and count y of principal employment as of january 1 of the current year. Depending on the county in which you reside, you may have also have county tax withheld from your pay. If line 1 is less than line 2,. Web video instructions and help with filling out and completing indiana w4 printable form. Upload w2s, w2gs, and 1099rs; It is charged at a flat rate of 3.23% and, in addition, there is a county income tax where every county has its allocated tax rate. Read all the field labels carefully. You can download and print a. Web you may select any amount over $10.00 to be withheld from your annuity or pension payment. Overall, an employer is eligible to register for withholding tax if the business has:

Register a new tax type and more. You can download and print a. Depending on the county in which you reside, you may have also have county tax withheld from your pay. Web you may select any amount over $10.00 to be withheld from your annuity or pension payment. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web follow the simple instructions below: Overall, an employer is eligible to register for withholding tax if the business has: Start filling out the blanks according to the instructions: Web this forms part of indiana’s state payroll taxes every employee is liable to pay. Upload w2s, w2gs, and 1099rs;

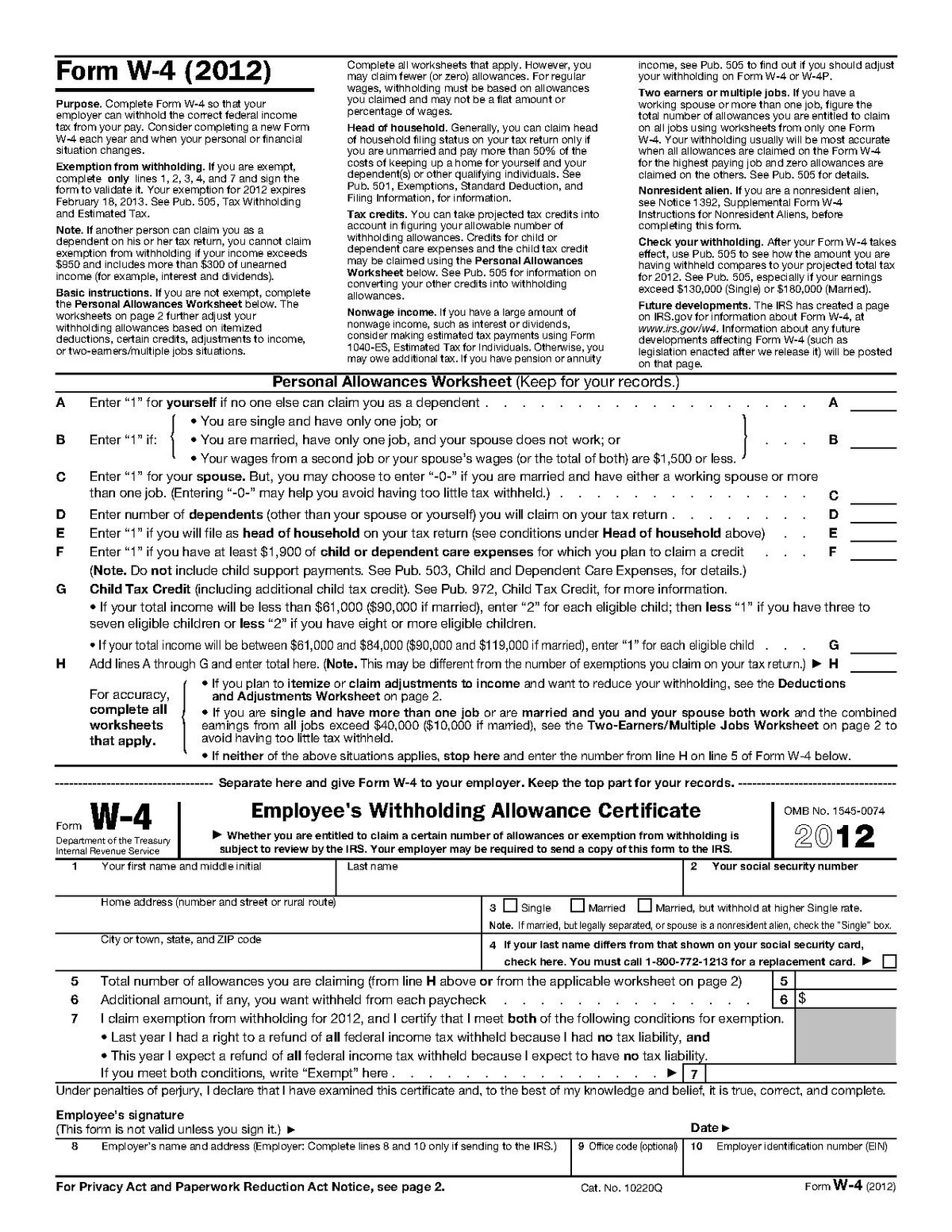

W4 Form 2022 Instructions

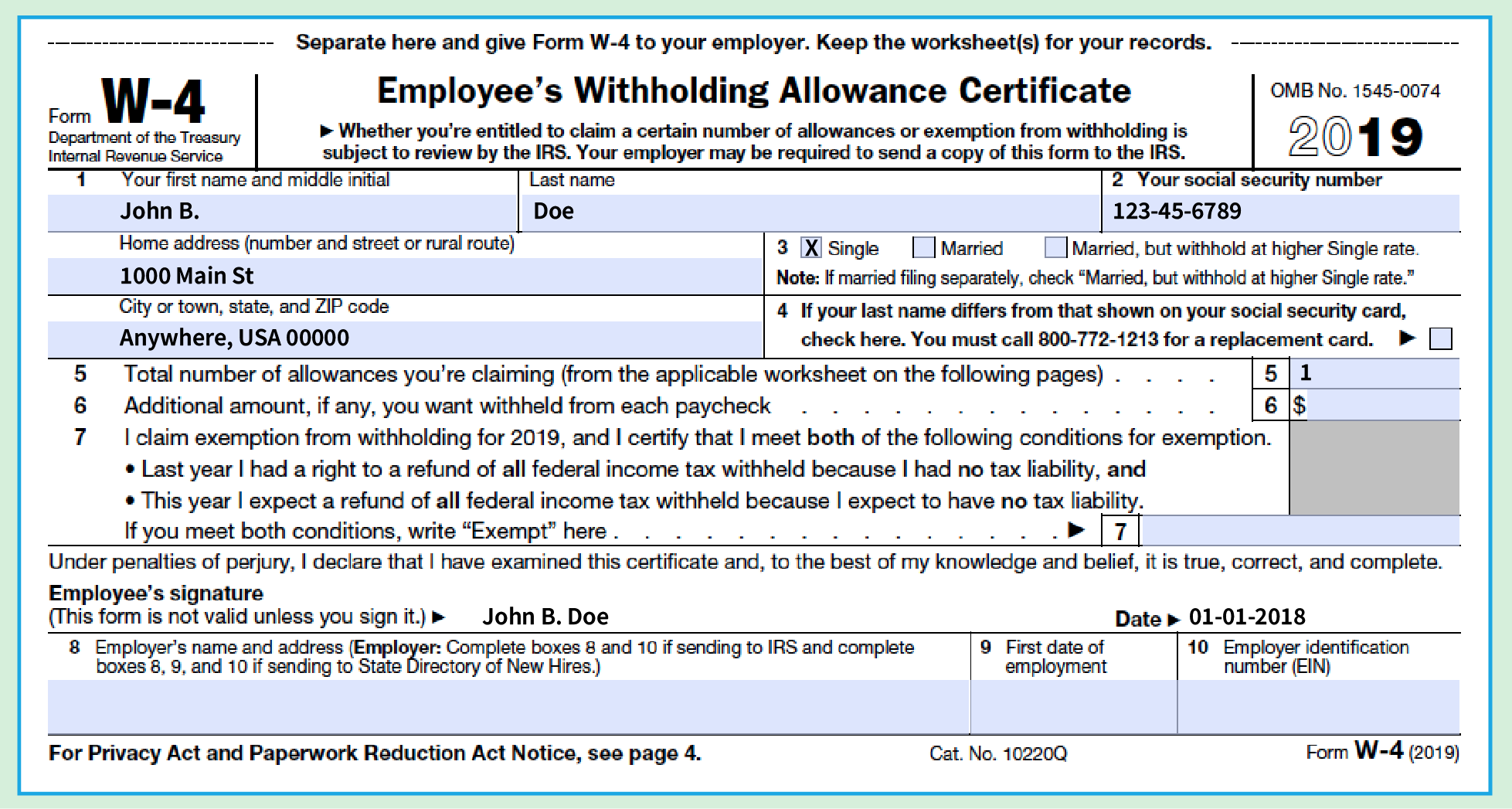

Print or type your full name, social security number or itin and home address. Web video instructions and help with filling out and completing indiana w4 printable form. You can download and print a. Print or type your full name, social. Edit your 2019 indiana state withholding form online.

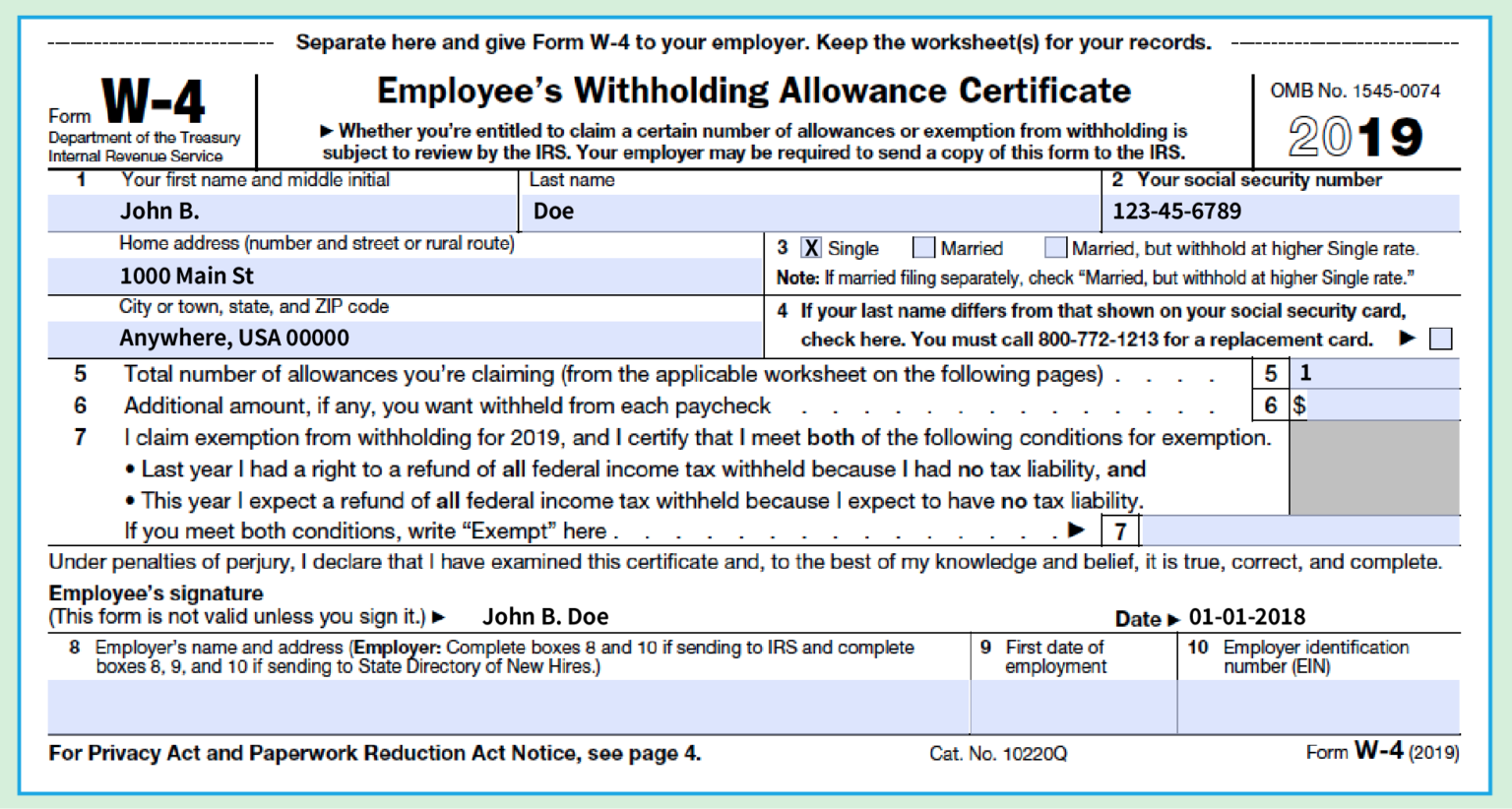

Sample Of W 4 2021 Filled Out 2022 W4 Form

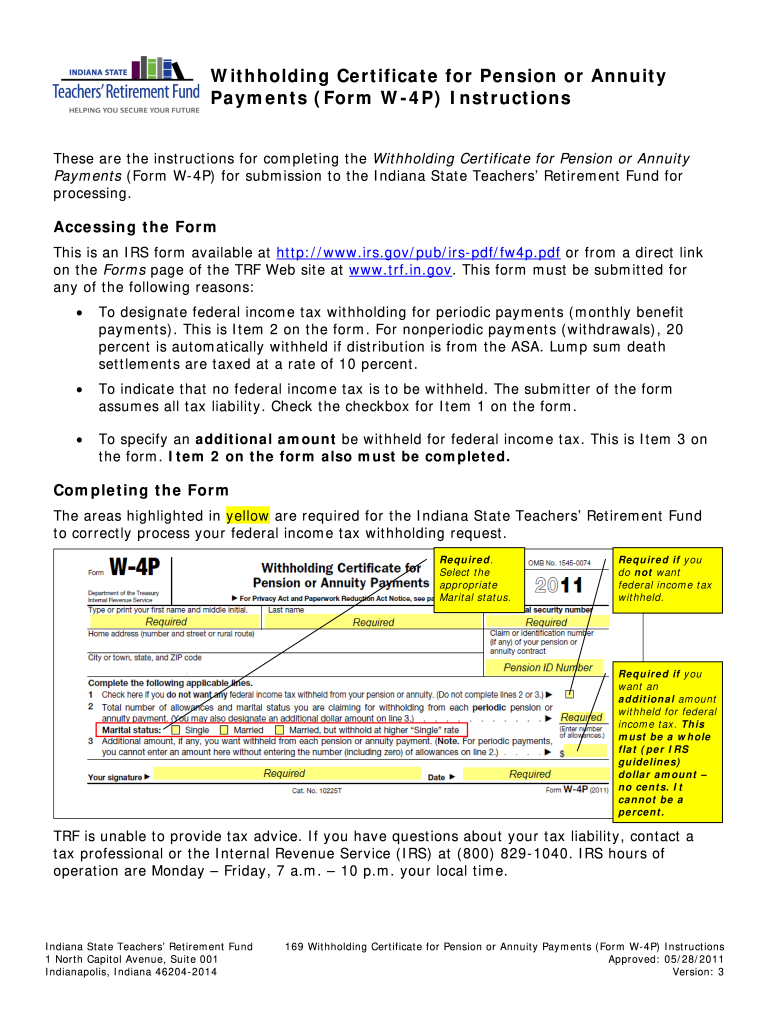

Web submitting the indiana w4 printable with signnow will give better confidence that the output document will be legally binding and safeguarded. Web you may select any amount over $10.00 to be withheld from your annuity or pension payment. Read all the field labels carefully. Handy tips for filling out w 4 indiana. Upload w2s, w2gs, and 1099rs;

Indiana W4 Fill Out and Sign Printable PDF Template signNow

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Read all the field labels carefully. It is charged at a flat rate of 3.23% and, in addition, there is a county income tax where every county has its allocated tax rate. Overall, an employer is eligible to.

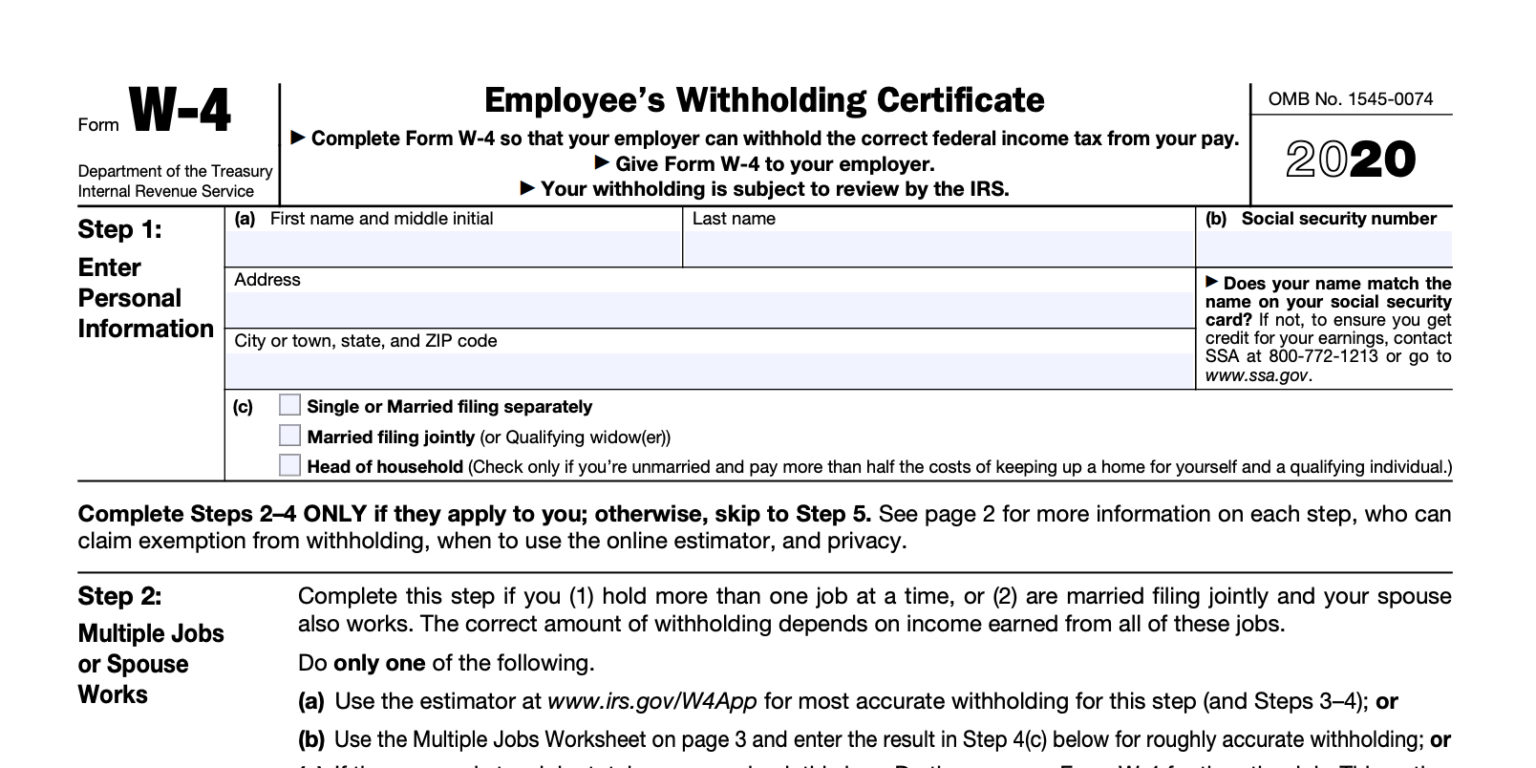

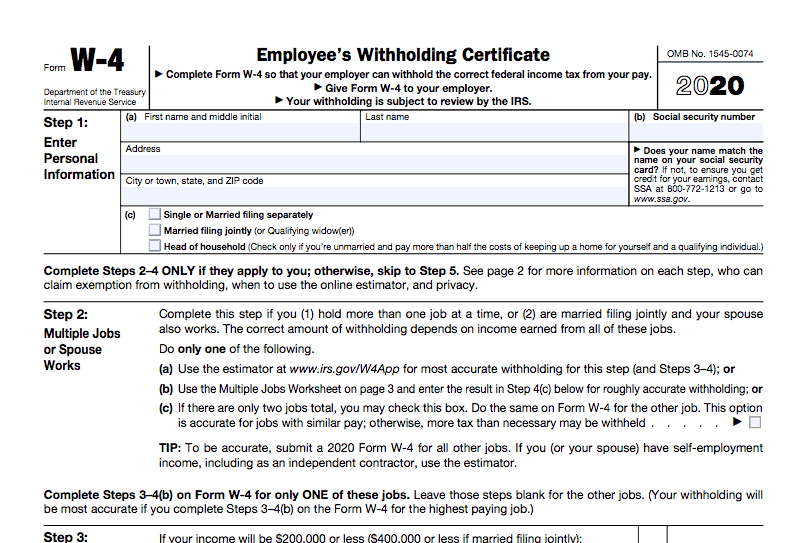

Build an Accurate W4 Form 2023

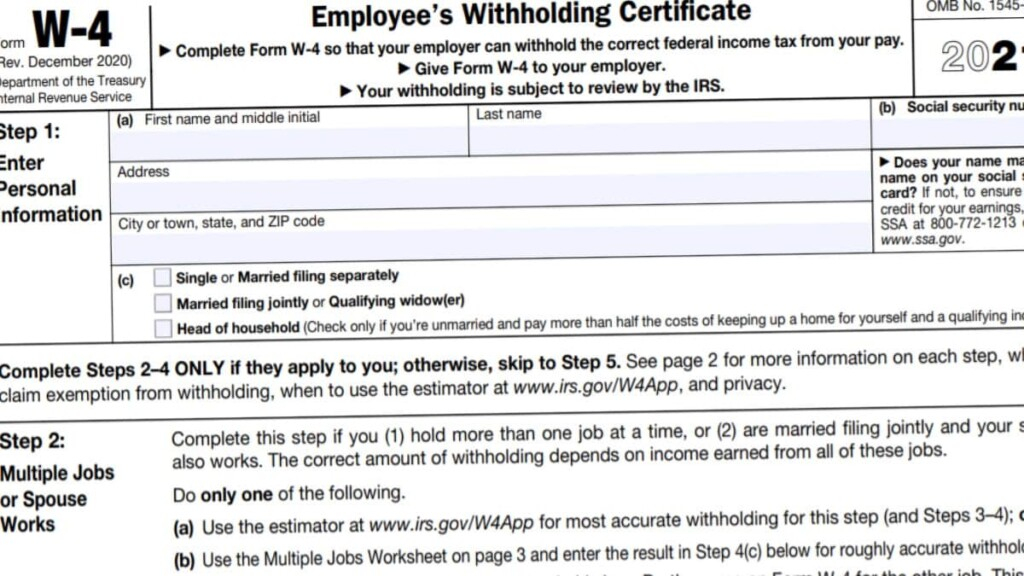

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Edit your 2019 indiana state withholding form online. If line 1 is less than line 2,. You can download and print a. Register a new tax type and more.

Federal W4 2022 W4 Form 2022 Printable

Web this forms part of indiana’s state payroll taxes every employee is liable to pay. Intime allows you to file and pay your business taxes (including sales and withholding); Web follow the simple instructions below: Web you may select any amount over $10.00 to be withheld from your annuity or pension payment. Web video instructions and help with filling out.

2022 Form W4 IRS Tax Forms W4 Form 2022 Printable

Web follow the simple instructions below: Print or type your full name, social. Overall, an employer is eligible to register for withholding tax if the business has: Web this forms part of indiana’s state payroll taxes every employee is liable to pay. Find a suitable template on the internet.

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

Edit your 2019 indiana state withholding form online. You can also download it, export it or print it out. Web 1 type or print your first name and middle initiallast name 2 your social security number home address (number and street or rural route). Upload w2s, w2gs, and 1099rs; Print or type your full name, social security number or itin.

Indiana W4 App

Web follow the simple instructions below: Start filling out the blanks according to the instructions: Intime allows you to file and pay your business taxes (including sales and withholding); Web submitting the indiana w4 printable with signnow will give better confidence that the output document will be legally binding and safeguarded. You can also download it, export it or print.

2022 Federal W4 Form To Print W4 Form 2022 Printable

Intime allows you to file and pay your business taxes (including sales and withholding); Web video instructions and help with filling out and completing indiana w4 printable form. You can also download it, export it or print it out. Find a suitable template on the internet. Edit your 2019 indiana state withholding form online.

IRS Form W4 2022 W4 Form 2022 Printable

Overall, an employer is eligible to register for withholding tax if the business has: Web follow the simple instructions below: Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Read all the field labels carefully. Print or type your full name, social security number or itin and.

Overall, An Employer Is Eligible To Register For Withholding Tax If The Business Has:

Web you may select any amount over $10.00 to be withheld from your annuity or pension payment. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Read all the field labels carefully. Edit your 2019 indiana state withholding form online.

Web Follow The Simple Instructions Below:

Web send wh 4 form 2019 via email, link, or fax. Depending on the county in which you reside, you may have also have county tax withheld from your pay. Start filling out the blanks according to the instructions: Enter your indiana county of residence and count y of principal employment as of january 1 of the current year.

Web This Forms Part Of Indiana’s State Payroll Taxes Every Employee Is Liable To Pay.

Find a suitable template on the internet. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Print or type your full name, social. Register a new tax type and more.

Web Indiana Withholding Tax Voucher Register And File This Tax Online Via Intime.

Intime allows you to file and pay your business taxes (including sales and withholding); Upload w2s, w2gs, and 1099rs; Web video instructions and help with filling out and completing indiana w4 printable form. You can download and print a.