Instructions For 8995 Form

Instructions For 8995 Form - What is the purpose of the irs form 8995, and when do you need to use it? Include the following schedules (their specific instructions are. 10 minutes watch video get the form! Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Web so, let's start with the basics. The qbi deduction will flow to line 10 of form. Web irs form 8995 instructions by forrest baumhover april 3, 2023 reading time: Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no. Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions.

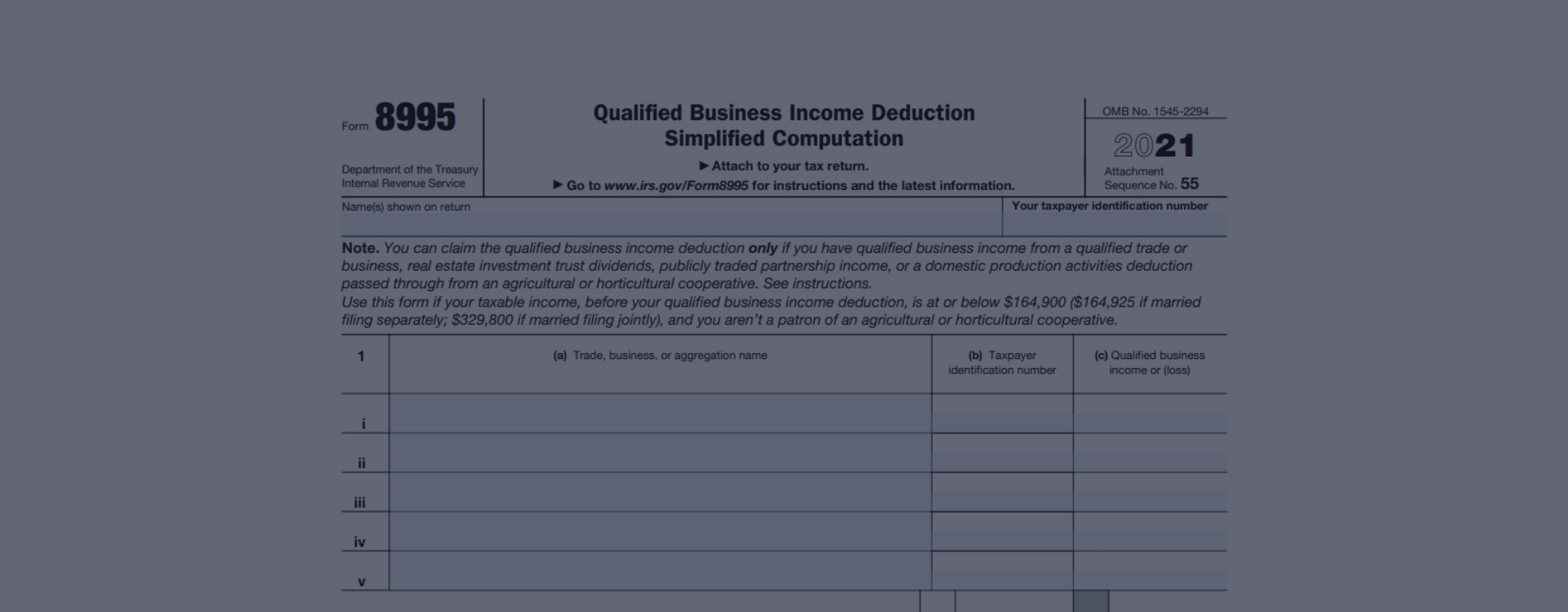

What is the purpose of the irs form 8995, and when do you need to use it? Web so, let's start with the basics. Web form 8995 is the simplified form and is used if all of the following are true: The qbi deduction will flow to line 10 of form. Web according to the irs: Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. Step by step instructions in 2018, the tax. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no.

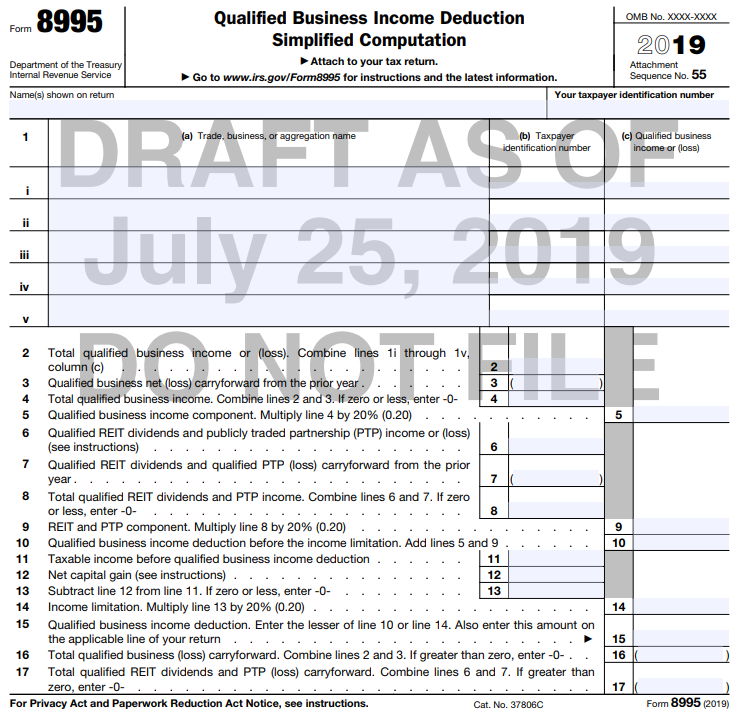

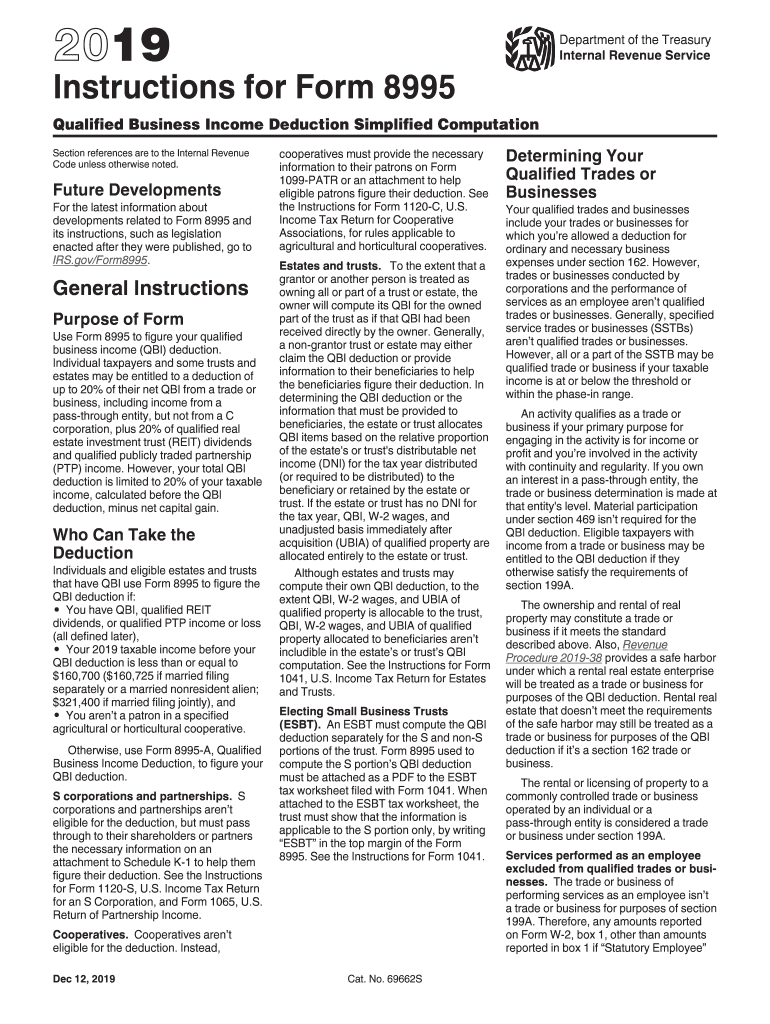

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no. This form calculates the qualified business income (qbi) deduction for. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Include the following schedules (their specific instructions are. What is the purpose of the irs form 8995, and when do you need to use it? Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise. Web irs form 8995 instructions by forrest baumhover april 3, 2023 reading time: Step by step instructions in 2018, the tax.

8995 Form 📝 Get IRS Form 8995 With Instructions Printable PDF Sample

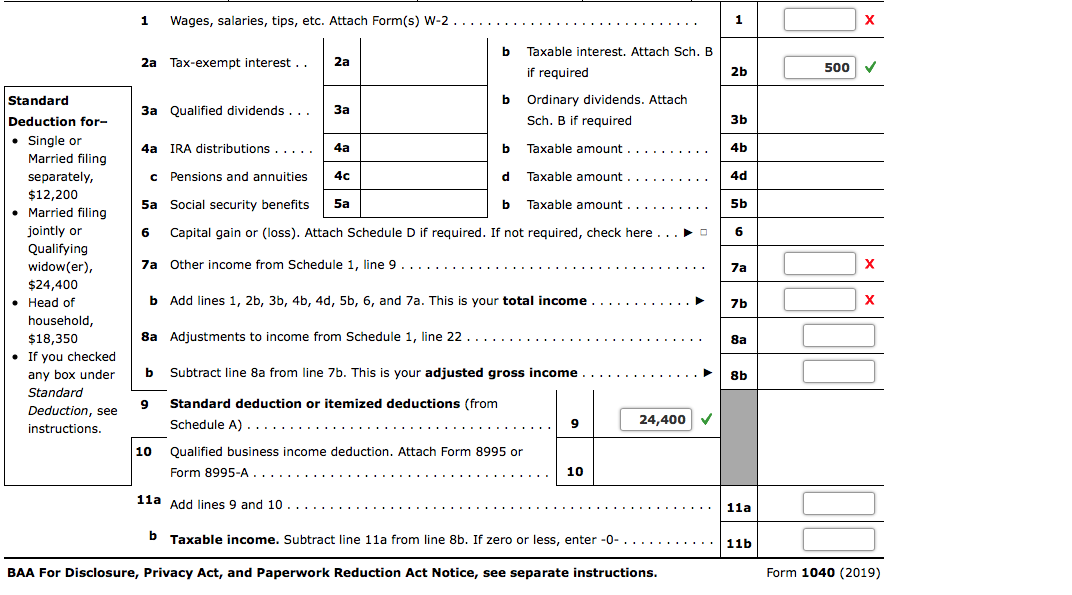

The qbi deduction will flow to line 10 of form. Web so, let's start with the basics. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Fear not, for i am. This form calculates the qualified business income (qbi) deduction for.

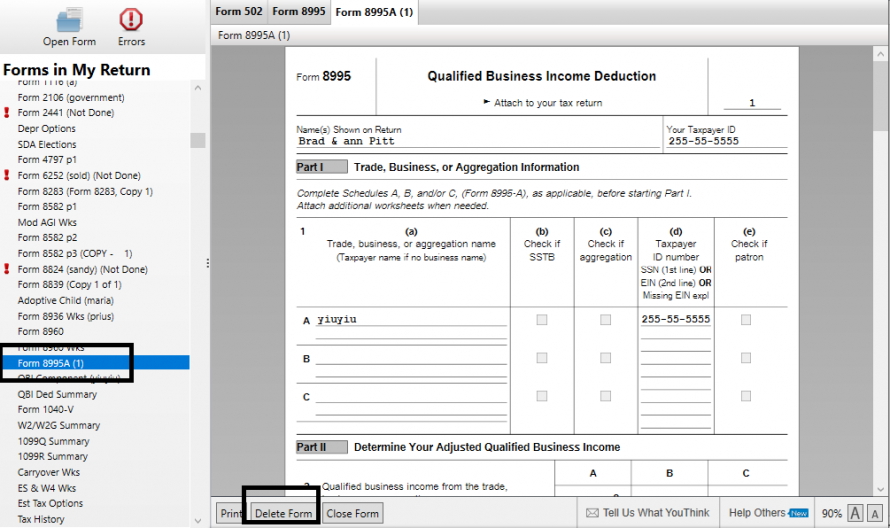

Note This problem is for the 2019 tax year. Alfred

Include the following schedules (their specific instructions are. Web so, let's start with the basics. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise. Web irs form 8995 instructions by forrest baumhover april 3, 2023.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Fear not, for i am. This form calculates the qualified business income (qbi) deduction for. Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. Web form 8995 is a newly created tax form used to.

Printable Form 8995 Blog 8995 Form Website

• if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form. The qbi deduction will flow to line 10 of form. This form calculates the qualified business income (qbi) deduction for. Web irs form 8995 instructions by forrest baumhover april 3, 2023 reading time:.

8995 Instructions 2022 2023 IRS Forms Zrivo

Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. This form calculates the qualified business income (qbi) deduction for. • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company.

Flowchart for partially preemptive scheduling technique with

• if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain.

Mason + Rich Blog NH’s CPA Blog

Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web 2022 irs form 8995 instructions 4 april.

Instructions for Form 8995 (2021) Internal Revenue Service

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Include the following schedules (their specific instructions are. Step by step instructions in 2018, the tax. Web so, let's start with the basics. Web irs form 8995 instructions by forrest baumhover april 3, 2023 reading time:

Ignoring IRS 8995 Instructions to Doublededuct Selfemployed Health

Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise. What is the purpose of the irs form 8995, and when do you need to use it? Web form 8995 is the simplified form and is used if all of the following are true: The qbi deduction will flow.

Instructions for Form 8995 Fill Out and Sign Printable PDF Template

Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). This form calculates the qualified business income (qbi).

Web Form 8995 Is The Simplified Form And Is Used If All Of The Following Are True:

What is the purpose of the irs form 8995, and when do you need to use it? 10 minutes watch video get the form! Web irs form 8995 instructions by forrest baumhover april 3, 2023 reading time: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).

The Individual Has Qualified Business Income (Qbi), Qualified Reit Dividends, Or Qualified Ptp.

Include the following schedules (their specific instructions are. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no. Web according to the irs: Fear not, for i am.

Web 2022 Irs Form 8995 Instructions 4 April 2023 Imagine Navigating Through A Maze Of Tax Regulations Only To Find Yourself Lost In A Sea Of Forms And Instructions.

The qbi deduction will flow to line 10 of form. Web so, let's start with the basics. Step by step instructions in 2018, the tax. • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form.

Web Instructions For Form 8995 Qualified Business Income Deduction Simplified Computation Section References Are To The Internal Revenue Code Unless Otherwise.

Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. This form calculates the qualified business income (qbi) deduction for.