Instructions For Form 8752

Instructions For Form 8752 - Go to www.irs.gov/form8752 for the latest. November 2013) application for voluntary classification settlement. If the entity's principal place of business or principal office or agency is located in. Web tax day has passed, and refunds are being processed! What is an 8752 form? The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Web according to the form 8752 instructions, partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net. Form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). Get everything done in minutes. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020.

November 2021) department of the treasury internal revenue service for use with form 8952 (rev. November 2013) application for voluntary classification settlement. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Web according to the form 8752 instructions, partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net. Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on how to file. I would not have filled it out the. Get ready for tax season deadlines by completing any required tax forms today. Get everything done in minutes. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Go to www.irs.gov/form8752 for the latest. Go to www.irs.gov/form8752 for the latest. Web form 8752 must be filed for each year the section 444 election is in effect, even if the required payment for the applicable election year is zero. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. November 2013) application for voluntary classification settlement. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. For your base year ending in. Get everything done in minutes. Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on how to file.

3.11.249 Processing Form 8752 Internal Revenue Service

Go to www.irs.gov/form8752 for the latest. Get everything done in minutes. Web according to the form 8752 instructions, partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net. Web form 8752 must be filed for each year the section 444 election is in effect, even if.

Taylor 8752 TempRite Single Use Manual Dishwasher 170 Degrees F Test

Get everything done in minutes. Form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). Ad complete irs tax forms online or print government tax documents. Web form 8752 must be filed for each year the section 444 election is in effect, even if the required payment.

3.13.222 BMF Entity Unpostable Correction Procedures Internal Revenue

Type, draw, or upload an image of your handwritten signature and place it where you need it. I would not have filled it out the. Web tax day has passed, and refunds are being processed! What is an 8752 form? Web mailing addresses for forms 8752.

Irs Form 8752 Instructions 2023 Fill online, Printable, Fillable Blank

If the entity's principal place of business or principal office or agency is located in. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Type, draw, or upload an image of your handwritten signature and place it where you need it. Web information about form 8752, required payment or refund under section 7519,.

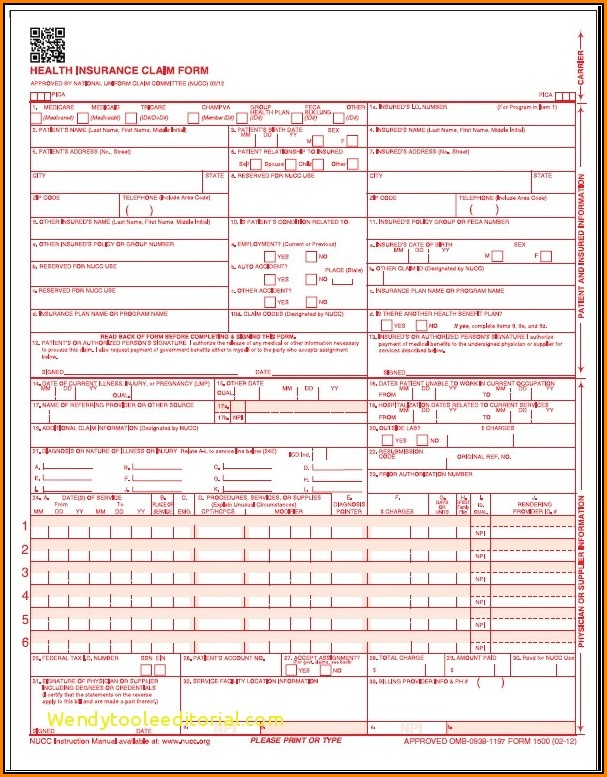

Hcfa 1500 Form Instructions Form Resume Examples mGM9Oo39DL

Ad complete irs tax forms online or print government tax documents. Web according to the form 8752 instructions, partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed.

Form 8752 Required Payment or Refund under Section 7519 (2015) Free

Get ready for tax season deadlines by completing any required tax forms today. Get everything done in minutes. November 2013) application for voluntary classification settlement. For applicable election years beginning in 2016, form 8752 must be filed and the required payment made on or before may 15, 2017. Web tax day has passed, and refunds are being processed!

Form 8752 Required Payment or Refund under Section 7519 (2015) Free

Ad complete irs tax forms online or print government tax documents. Web tax day has passed, and refunds are being processed! Web mailing addresses for forms 8752. Go to www.irs.gov/form8752 for the latest. For your base year ending in.

Form 8752 Required Payment or Refund under Section 7519 (2015) Free

Ad complete irs tax forms online or print government tax documents. If the entity's principal place of business or principal office or agency is located in. November 2013) application for voluntary classification settlement. Web according to the form 8752 instructions, partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain.

타일공사, 공사완료⑤ 샘플, 양식 다운로드

Web according to the form 8752 instructions, partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Ad complete irs tax forms.

Fill Free fillable IRS PDF forms

The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. For your base year ending in. Go to www.irs.gov/form8752 for the latest. See section 7519(c) for details. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020.

Form 8752 (Required Payment Or Refund Under Section 7519) Is A Federal Tax Form Designed And Processed By The Internal Revenue Service (Irs).

The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Web tax day has passed, and refunds are being processed! Web form 8752 must be filed for each year the section 444 election is in effect, even if the required payment for the applicable election year is zero. Push the get form or get form now button on the current page to.

See Section 7519(C) For Details.

What is an 8752 form? November 2013) application for voluntary classification settlement. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. I would not have filled it out the.

Web Per Irs Instructions, The 2019 Form 8752 (Required Payment Or Refund Under Section 7519) Must Be Mailed And The Required Payment Made By May 15, 2020.

Get everything done in minutes. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on how to file. For your base year ending in.

Web Start On Editing, Signing And Sharing Your Form 8752 Instructions Online Under The Guide Of These Easy Steps:

Ad complete irs tax forms online or print government tax documents. Type, draw, or upload an image of your handwritten signature and place it where you need it. For applicable election years beginning in 2016, form 8752 must be filed and the required payment made on or before may 15, 2017. If the entity's principal place of business or principal office or agency is located in.