Instructions Form 56

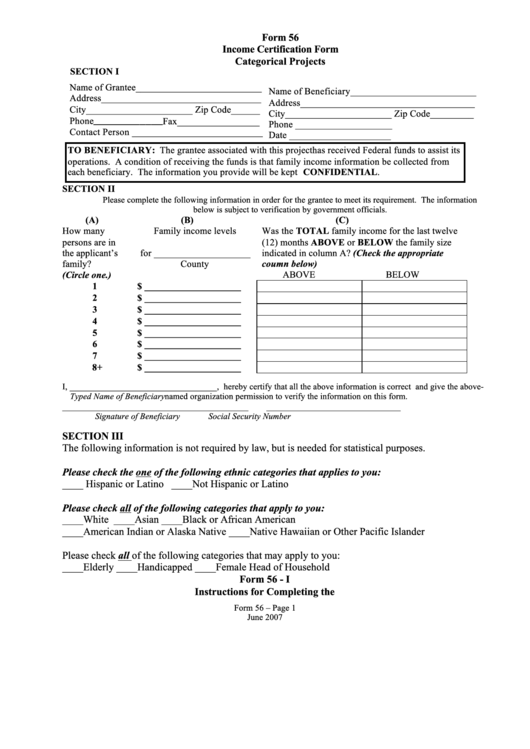

Instructions Form 56 - Web irs form 56, notice concerning fiduciary relationship, is used to notify the internal revenue service and state taxing authorities of either the initiation or termination of a. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. The instructions for filling out. Web 1 best answer. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Generally, you should file form 56 when you create (or terminate). In addition, it should be filed in every subsequent tax. Web the fiduciary or trustee is responsible for submitting form 56 directly to the irs in a timely manner after their fiduciary duties have been established. Web per irs instructions for form 56:

The instructions for filling out. You can file the notice concurrently with the return (form 56 is filed with the same internal revenue service center where the. Web form 56 omb no. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Web irs form 56, notice concerning fiduciary relationship, is used to notify the internal revenue service and state taxing authorities of either the initiation or termination of a. Web purpose of form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship. In addition, it should be filed in every subsequent tax. Web form 56 is filed by an individual that is going to act as the fiduciary for another taxpayers' estate. Sign online button or tick the preview image of the form. Web file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax returns.

Web general instructions purpose of form form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for. Web 1 best answer. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Generally, you should file form 56 when you create (or terminate). Web file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax returns. In this example, we look at form 56 filed by a daughter on behalf of. You can file the notice concurrently with the return (form 56 is filed with the same internal revenue service center where the. Web the fiduciary or trustee is responsible for submitting form 56 directly to the irs in a timely manner after their fiduciary duties have been established. Web how you can complete the editable form 56 on the internet: Web form 56 omb no.

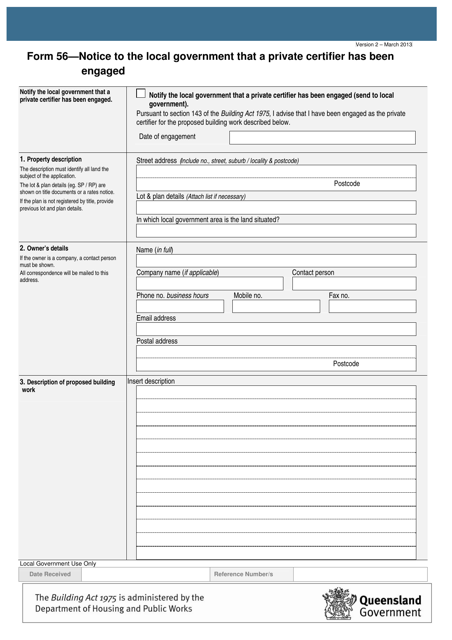

Form 56 Download Printable PDF or Fill Online Notice to the Local

Web the fiduciary or trustee is responsible for submitting form 56 directly to the irs in a timely manner after their fiduciary duties have been established. Web purpose of form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship. The instructions for.

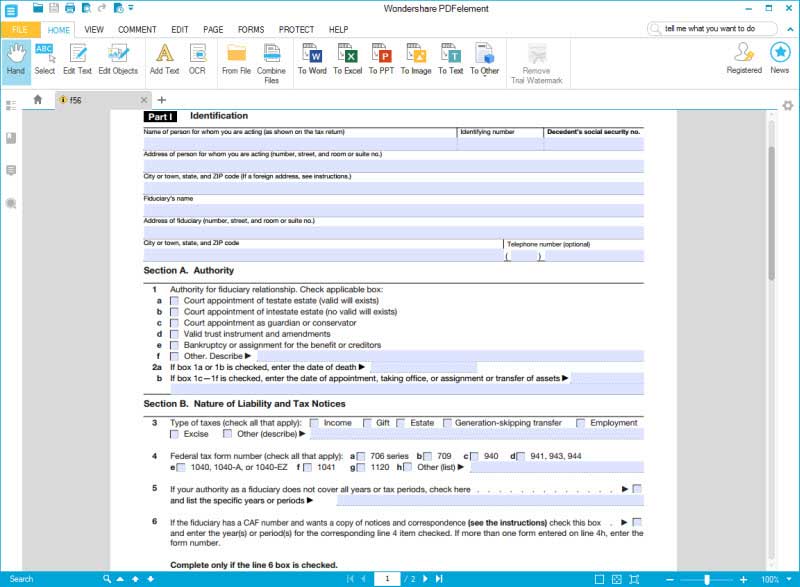

IRS Form 56 You can Fill it with the Best Form Filler Program

Web file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax returns. In addition, it should be filed in every subsequent tax. The instructions for filling out. Web how you can complete the editable form 56 on the internet: When and where to file notice of fiduciary relationship.

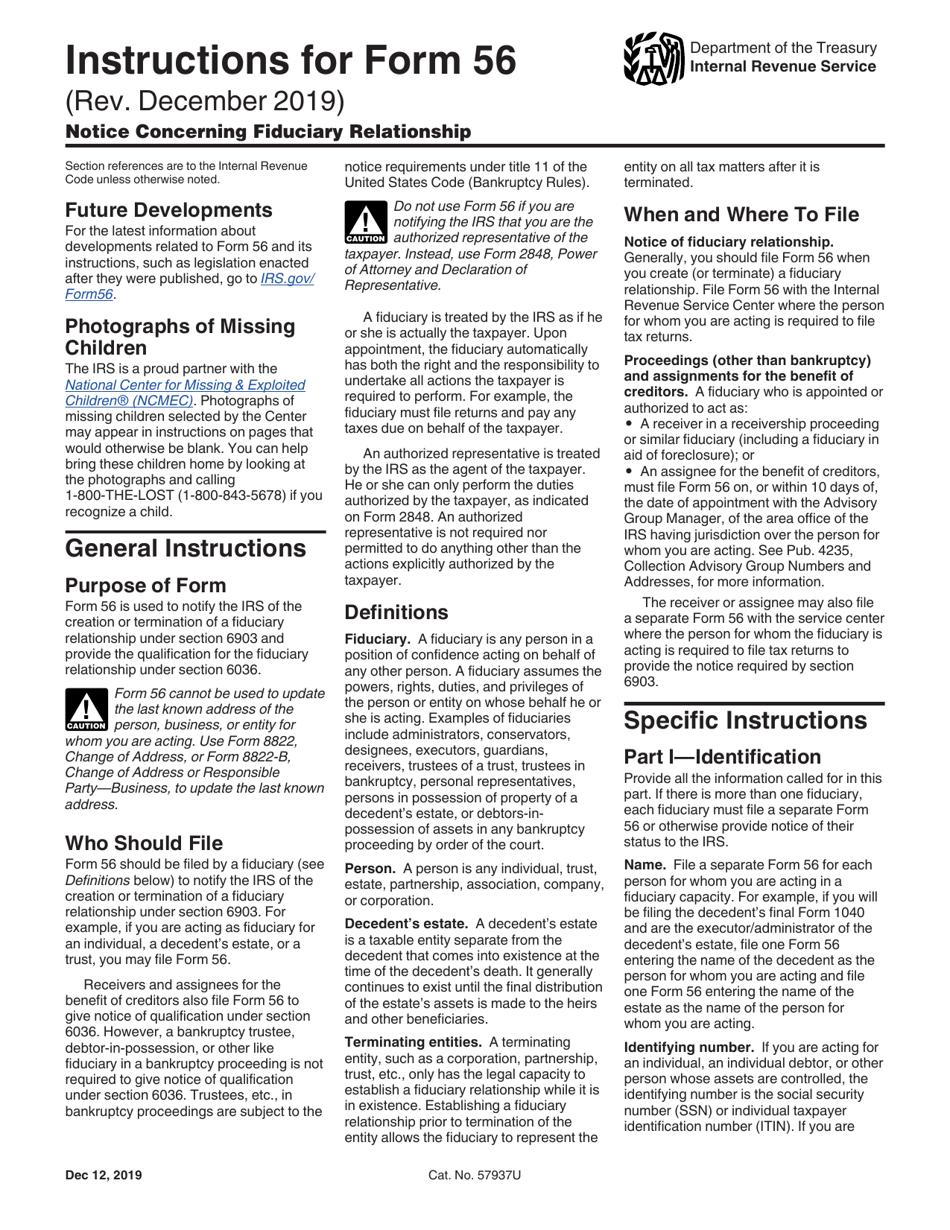

Download Instructions for IRS Form 56 Notice Concerning Fiduciary

Web general instructions purpose of form form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for. In this example, we look at form 56 filed by a daughter on behalf of. The instructions for filling out. Sign online button or tick the preview image of.

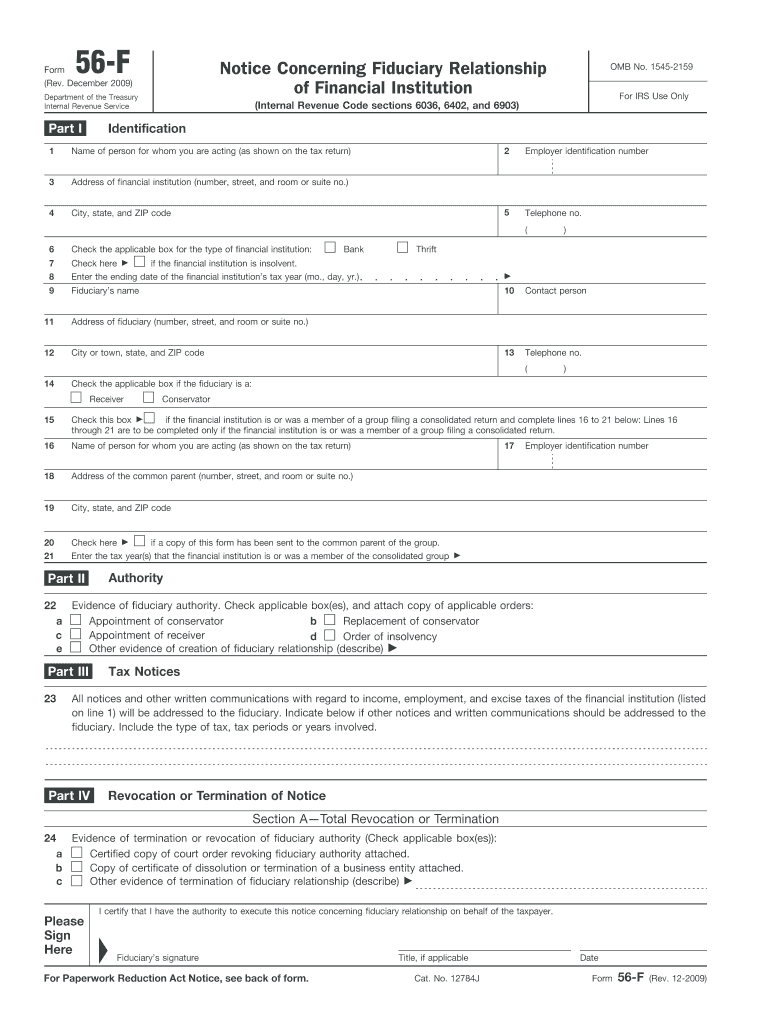

Form 56 F Fill Out and Sign Printable PDF Template signNow

You can file the notice concurrently with the return (form 56 is filed with the same internal revenue service center where the. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web how you can complete the editable form 56 on.

Instructions For Completing Form 2290 Form Resume Examples a6YnPoE2Bg

Sign online button or tick the preview image of the form. Web how you can complete the editable form 56 on the internet: In addition, it should be filed in every subsequent tax. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section.

Fill Free fillable Form 56 2011 Notice Concerning Fiduciary

When and where to file notice of fiduciary relationship. Web the fiduciary or trustee is responsible for submitting form 56 directly to the irs in a timely manner after their fiduciary duties have been established. In addition, it should be filed in every subsequent tax. In this example, we look at form 56 filed by a daughter on behalf of..

Form 56 Edit, Fill, Sign Online Handypdf

Web form 56 is filed by an individual that is going to act as the fiduciary for another taxpayers' estate. Web form 56 omb no. In addition, it should be filed in every subsequent tax. When and where to file notice of fiduciary relationship. Web irs form 56, notice concerning fiduciary relationship, is used to notify the internal revenue service.

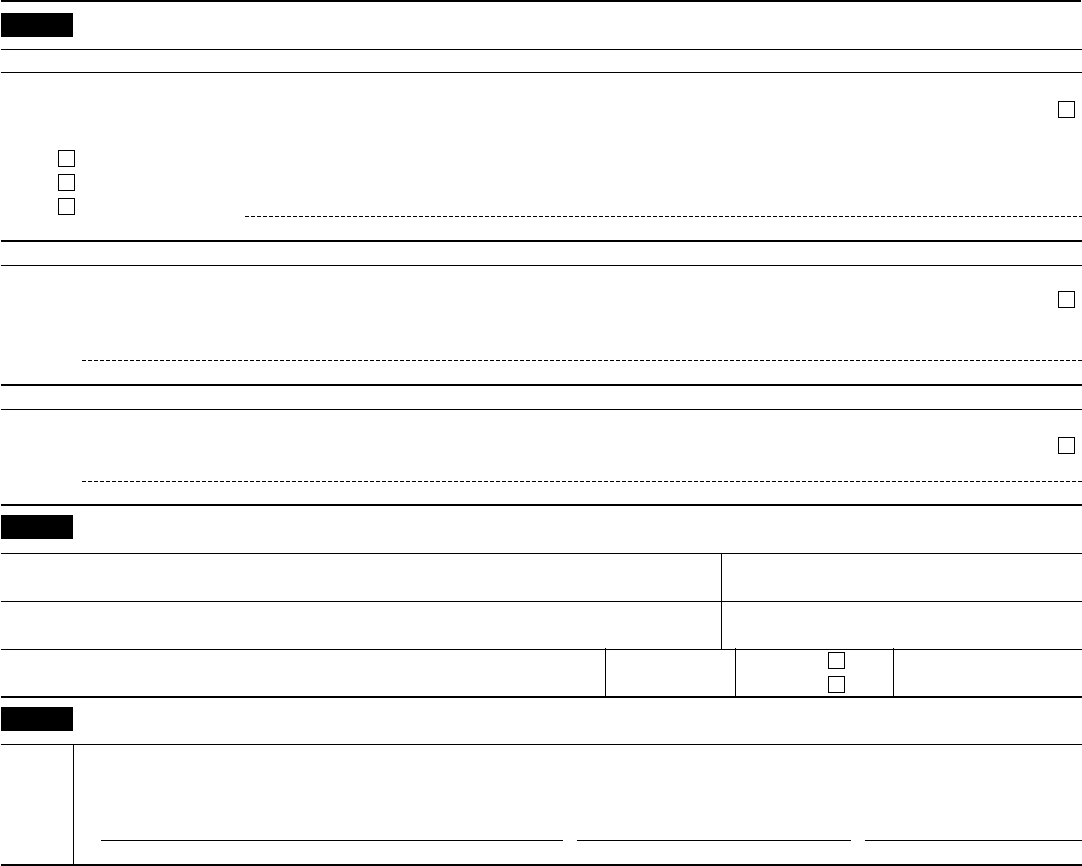

Form 56 Certification Form Categorical Projects printable pdf

Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web general instructions purpose of form form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for. Web.

Fillable Form 56 Notice Concerning Fiduciary Relationship printable

Web purpose of form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship. To get started on the form, utilize the fill camp; You can file the notice concurrently with the return (form 56 is filed with the same internal revenue service.

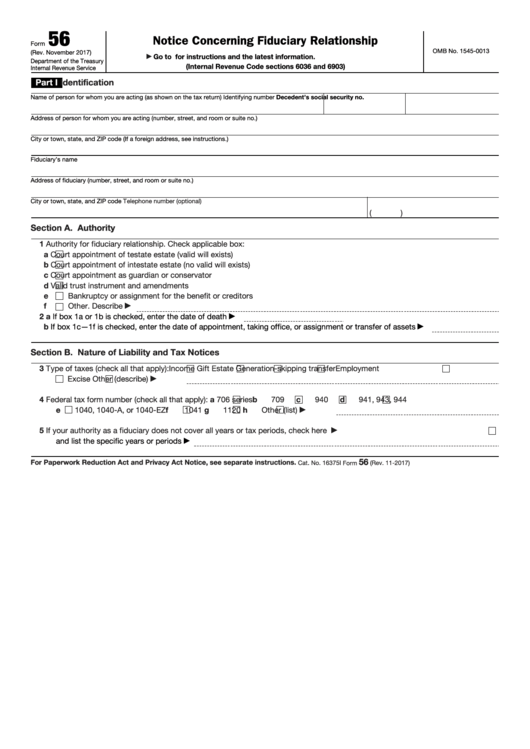

I.R.S. Form 56 General Instructions

Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Web irs form 56, notice concerning fiduciary relationship, is used to notify the internal revenue service and state taxing authorities of either the initiation or termination of a. Web the fiduciary or trustee is responsible for submitting.

The Instructions For Filling Out.

Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. You can file the notice concurrently with the return (form 56 is filed with the same internal revenue service center where the. Web the fiduciary or trustee is responsible for submitting form 56 directly to the irs in a timely manner after their fiduciary duties have been established.

In This Example, We Look At Form 56 Filed By A Daughter On Behalf Of.

Proceedings (other than bankruptcy) and. In addition, it should be filed in every subsequent tax. Web purpose of form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the.

Web Form 56 Should Be Filed By A Fiduciary (See Definitions Below) To Notify The Irs Of The Creation Or Termination Of A Fiduciary Relationship Under Section 6903.

Web per irs instructions for form 56: Web irs form 56, notice concerning fiduciary relationship, is used to notify the internal revenue service and state taxing authorities of either the initiation or termination of a. Sign online button or tick the preview image of the form. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

When And Where To File Notice Of Fiduciary Relationship.

Web 1 best answer. Web how you can complete the editable form 56 on the internet: Web file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax returns. Web general instructions purpose of form form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for.