Irs Form 4669

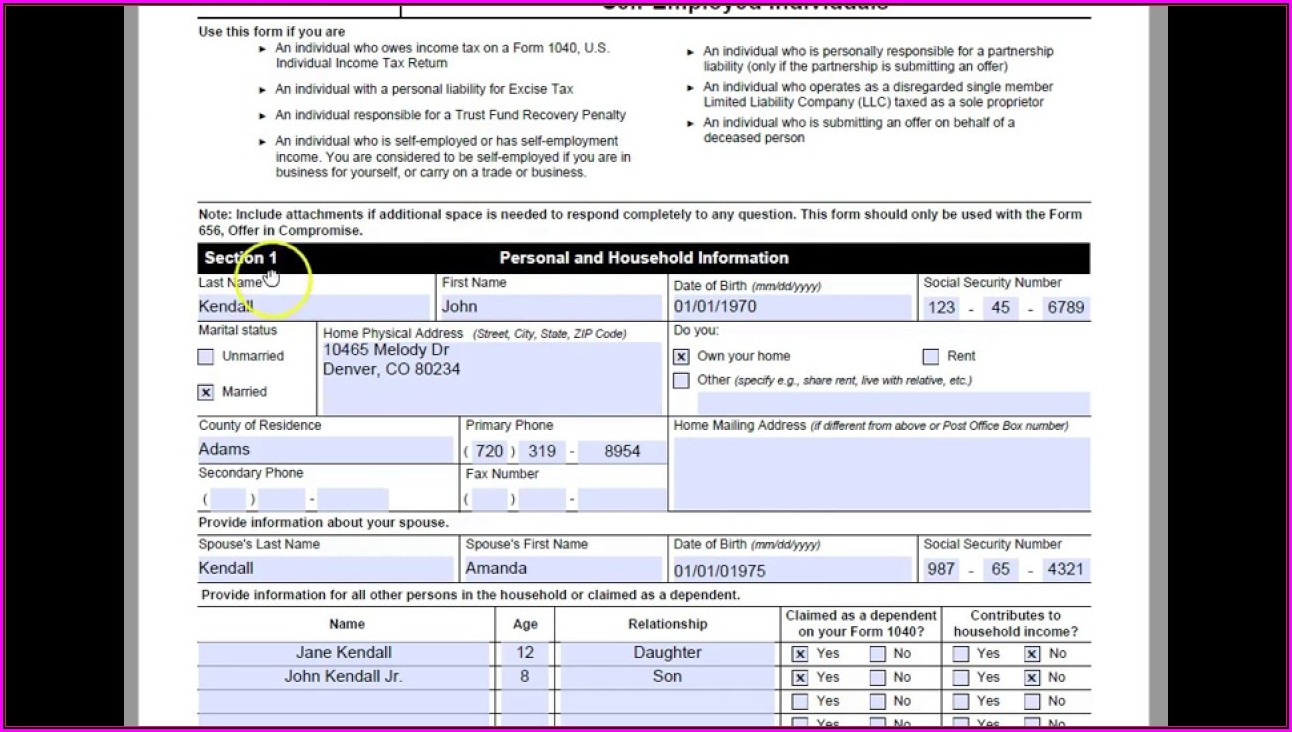

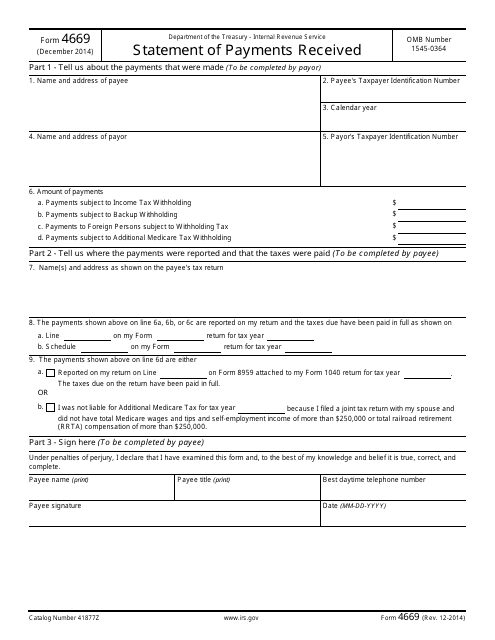

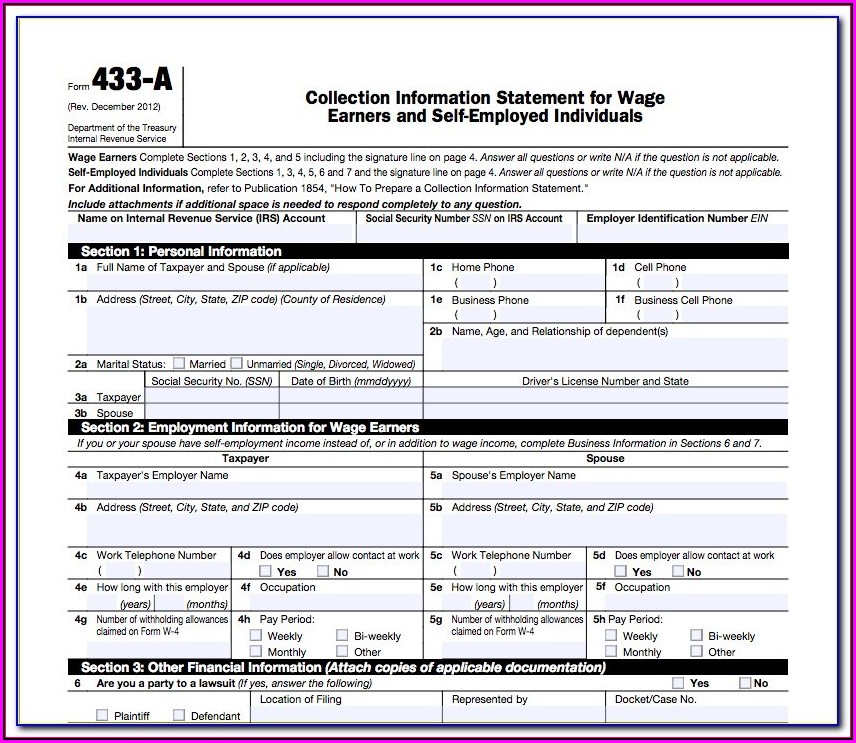

Irs Form 4669 - Individual tax return form 1040 instructions; While receipt of this form mitigates the employer’s liability for the failed withholding amounts, the employer may still be subject to penalties for having failed to withhold as required (sec. Web credit for backup withholding. Web form 4669, statement of payments received, is used for this certification. Your withholding is subject to review by the irs. Web this is the purpose of form 4669: Request for transcript of tax return The internal revenue code and regulations provide that a payor can be relieved of the payment of some taxes provided the payor can show that. Penalties or interest adjustments are not abated by these procedures. Web form 4670 is used to submit forms 4669, statement of payments received, to the irs.

Request for transcript of tax return The form includes spaces to list the amount of the payment, as well as the names of. Web form 4670 is used to submit forms 4669, statement of payments received, to the irs. Web credit for backup withholding. Form 4669 is used by payors in specific situations to request relief from payment of certain required taxes. It is a form that one files with the irs to declare any payment received on which income taxes, fica taxes, or other taxes were not withheld. These are the same forms used for requesting federal income tax withholding relief. Payee's taxpayer identification number 3. The internal revenue code and regulations provide that a payor can be relieved of the payment of some taxes provided the payor can show that. Individual tax return form 1040 instructions;

Payee's taxpayer identification number 3. Web this is the purpose of form 4669: Your withholding is subject to review by the irs. The form includes spaces to list the amount of the payment, as well as the names of. Web form 4670 is used to submit forms 4669, statement of payments received, to the irs. Individual tax return form 1040 instructions; It is the payee’s certification that the payments were reported and the tax paid. Request for transcript of tax return Penalties or interest adjustments are not abated by these procedures. If you did indeed report the income and pay the tax then there is absolutely no downside for you in completing your part of the form, signing it, and returning it to the housing authority and you’ll be helping out the housing.

File IRS 2290 Form Online for 20222023 Tax Period

Penalties or interest adjustments are not abated by these procedures. Payee's taxpayer identification number 3. Your withholding is subject to review by the irs. Web form 4670 is used to submit forms 4669, statement of payments received, to the irs. The form includes spaces to list the amount of the payment, as well as the names of.

LOGO

The form includes spaces to list the amount of the payment, as well as the names of. Web credit for backup withholding. Individual tax return form 1040 instructions; While receipt of this form mitigates the employer’s liability for the failed withholding amounts, the employer may still be subject to penalties for having failed to withhold as required (sec. Web form.

Irs Form W 9 Fillable Pdf Form Resume Examples yKVBjMRVMB

Request for transcript of tax return Individual tax return form 1040 instructions; Name and address of payee. Web form 4670 is used to submit forms 4669, statement of payments received, to the irs. The internal revenue code and regulations provide that a payor can be relieved of the payment of some taxes provided the payor can show that.

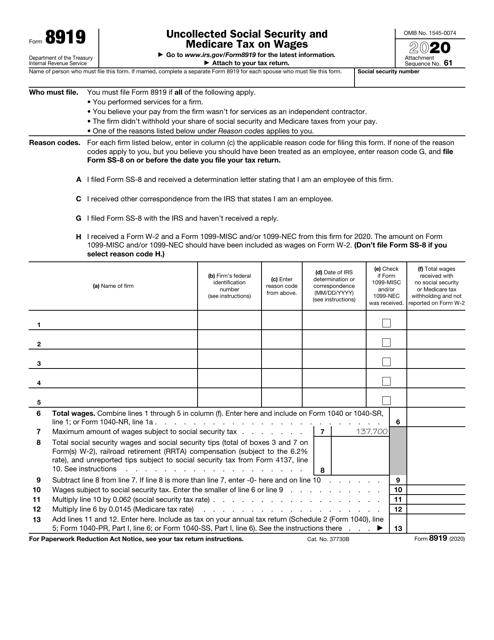

IRS Form 8919 Download Fillable PDF or Fill Online Uncollected Social

The internal revenue code and regulations provide that a payor can be relieved of the payment of some taxes provided the payor can show that. Payee's taxpayer identification number 3. Individual tax return form 1040 instructions; It is the payee’s certification that the payments were reported and the tax paid. It is a form that one files with the irs.

IRS Form 4669 Download Fillable PDF or Fill Online Statement of

Web credit for backup withholding. It is the payee’s certification that the payments were reported and the tax paid. Individual tax return form 1040 instructions; Web form 4670 is used to submit forms 4669, statement of payments received, to the irs. Request for transcript of tax return

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

The internal revenue code and regulations provide that a payor can be relieved of the payment of some taxes provided the payor can show that. Web this is the purpose of form 4669: Penalties or interest adjustments are not abated by these procedures. Web form 4669, statement of payments received, is used for this certification. Name and address of payee.

Form 4669 Statement of Payments Received (2014) Free Download

The form includes spaces to list the amount of the payment, as well as the names of. Name and address of payee. Web form 4669, statement of payments received, is used for this certification. Web this is the purpose of form 4669: Form 4669 is used by payors in specific situations to request relief from payment of certain required taxes.

Sample Fax Cover Sheet To Irs The Document Template

Web form 4670 is used to request relief from the employee additional medicare tax withholding obligation with the form 4669 attachments. Form 4669 is used by payors in specific situations to request relief from payment of certain required taxes. Individual tax return form 1040 instructions; These are the same forms used for requesting federal income tax withholding relief. Request for.

Form 4669 Statement of Payments Received (2014) Free Download

If you did indeed report the income and pay the tax then there is absolutely no downside for you in completing your part of the form, signing it, and returning it to the housing authority and you’ll be helping out the housing. While receipt of this form mitigates the employer’s liability for the failed withholding amounts, the employer may still.

IRS Form 4669 Statement of Payments Received

Web credit for backup withholding. These are the same forms used for requesting federal income tax withholding relief. It is a form that one files with the irs to declare any payment received on which income taxes, fica taxes, or other taxes were not withheld. The internal revenue code and regulations provide that a payor can be relieved of the.

Payee's Taxpayer Identification Number 3.

If you did indeed report the income and pay the tax then there is absolutely no downside for you in completing your part of the form, signing it, and returning it to the housing authority and you’ll be helping out the housing. It is a form that one files with the irs to declare any payment received on which income taxes, fica taxes, or other taxes were not withheld. Web credit for backup withholding. Your withholding is subject to review by the irs.

Web Form 4670 Is Used To Request Relief From The Employee Additional Medicare Tax Withholding Obligation With The Form 4669 Attachments.

Request for transcript of tax return Penalties or interest adjustments are not abated by these procedures. Individual tax return form 1040 instructions; Web form 4669, statement of payments received, is used for this certification.

The Form Includes Spaces To List The Amount Of The Payment, As Well As The Names Of.

While receipt of this form mitigates the employer’s liability for the failed withholding amounts, the employer may still be subject to penalties for having failed to withhold as required (sec. Web this is the purpose of form 4669: Name and address of payee. The internal revenue code and regulations provide that a payor can be relieved of the payment of some taxes provided the payor can show that.

These Are The Same Forms Used For Requesting Federal Income Tax Withholding Relief.

Form 4669 is used by payors in specific situations to request relief from payment of certain required taxes. Web form 4670 is used to submit forms 4669, statement of payments received, to the irs. It is the payee’s certification that the payments were reported and the tax paid.