Irs Form 4883C

Irs Form 4883C - They are concerned about your identity and want to confirm it before they process your return. Open turbotax sign in why sign in to support? Web why you received irs letter 4883c. What is the difference between letter 4883c and 5071c? What happens during the call? The irs fraud detection system flagged your tax return as a potential identity theft case. An irs representative directed you to use it. What can a taxpayer do if they get irs letter 4883c? Web what is irs letter 4883c? Web the irs sends letter 4883c when they have received your return but they need more information to process it.

They are concerned about your identity and want to confirm it before they process your return. Web the irs sends letter 4883c when they have received your return but they need more information to process it. Web why you received irs letter 4883c. What happens during the call? Or get an appointment at your local irs office. The information they seek is for you to verify your identity by personally appearing in their office. You received a 5447c letter and can verify your identity online. Web who must use the identity and tax return verification service. What can a taxpayer do if they get irs letter 4883c? Before your return can complete processing, you must prove that you are the legitimate owner of the social security number used.

Web the 4883c or 6330c letter; They are concerned about your identity and want to confirm it before they process your return. What is the difference between letter 4883c and 5071c? Or get an appointment at your local irs office. How many calls should a taxpayer make? What happens during the call? Web who must use the identity and tax return verification service. The irs fraud detection system flagged your tax return as a potential identity theft case. Before your return can complete processing, you must prove that you are the legitimate owner of the social security number used. What are some tips to remember?

Real Internal Revenue Service Letters & Notices

The irs fraud detection system flagged your tax return as a potential identity theft case. Keep in mind, you will only receive this communication via mail. Does the irs verify identity online? Web who must use the identity and tax return verification service. Get personalized help join the community

How To Write A Letter To Irs Sample Cover Letters Samples

If you received a 4883c letter or a 6330c letter, follow the instructions on the letter. Web who must use the identity and tax return verification service. The information they seek is for you to verify your identity by personally appearing in their office. Web the 4883c or 6330c letter; They are concerned about your identity and want to confirm.

Letter From Irs 2021 ULETRE

What are some tips to remember? Web why you received irs letter 4883c. What happens during the call? It’s basically a letter of request for you to contact the irs. Or get an appointment at your local irs office.

IRS Letter 4883C How To Use The IRS ID Verification Service

If you received a 4883c letter or a 6330c letter, follow the instructions on the letter. Try early in the day and put the phone on speaker so you can do something else while you wait. Open turbotax sign in why sign in to support? Before your return can complete processing, you must prove that you are the legitimate owner.

IRS Identity Fraud Filters Working Overtime Center for Agricultural

Before your return can complete processing, you must prove that you are the legitimate owner of the social security number used. Does the irs verify identity online? Web the irs sends letter 4883c when they have received your return but they need more information to process it. The irs fraud detection system flagged your tax return as a potential identity.

On Your Side Alert This IRS form is not a scam

The irs fraud detection system flagged your tax return as a potential identity theft case. Keep in mind, you will only receive this communication via mail. Or get an appointment at your local irs office. The irs sends this notice to request that you provide documentation to prove your identity. It’s basically a letter of request for you to contact.

¿Qué es la carta 4883C del IRS y qué debes hacer si la recibes?

What happens during the call? Does the irs verify identity online? Before your return can complete processing, you must prove that you are the legitimate owner of the social security number used. Web is a must you have to have the letter 4883c they sent to you via mail before calling the irs because they will ask for a control.

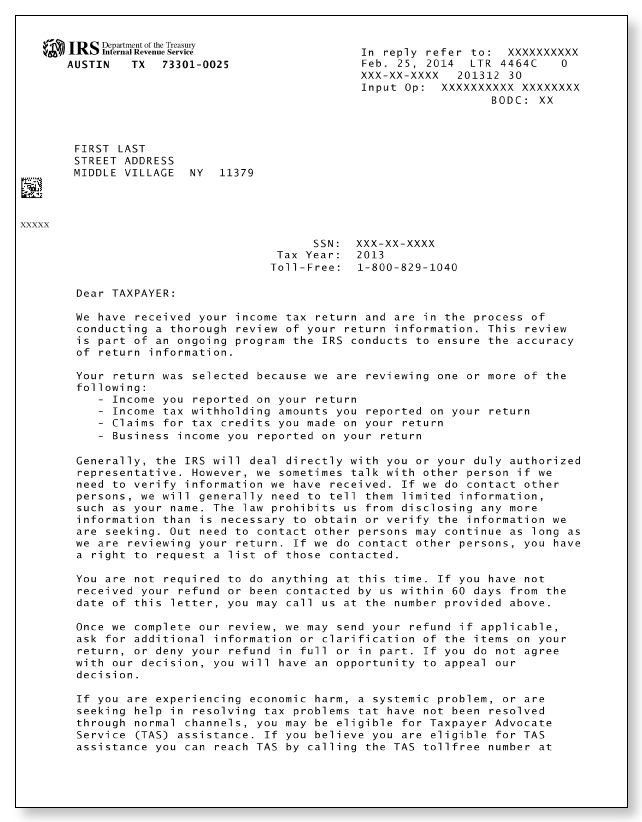

IRSLetter4464CSample1a Central Tax Services

Keep in mind, you will only receive this communication via mail. Is the website www.idverify.irs.gov fake? It’s basically a letter of request for you to contact the irs. What are some tips to remember? The irs fraud detection system flagged your tax return as a potential identity theft case.

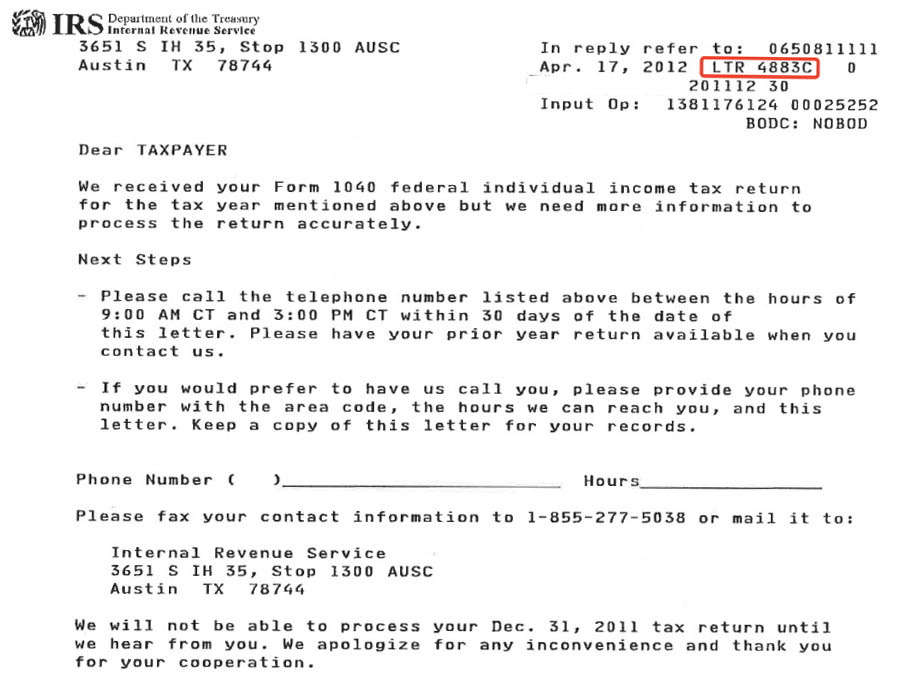

IRS LTR 4883C, Potential Identify Theft

Web who must use the identity and tax return verification service. Web what is irs letter 4883c? Web the irs sends letter 4883c when they have received your return but they need more information to process it. What happens during the call? They use letter 5071c to ask you to go online or call to verify your identity.

What to Do if You Receive the 4883c Letter from the IRS The Handy Tax Guy

Try early in the day and put the phone on speaker so you can do something else while you wait. Web what is irs letter 4883c? What happens during the call? The irs doesn’t communicate online or via email. Open turbotax sign in why sign in to support?

What Can A Taxpayer Do If They Get Irs Letter 4883C?

If you received a 4883c letter or a 6330c letter, follow the instructions on the letter. You received a 5447c letter and can verify your identity online. An irs representative directed you to use it. They are concerned about your identity and want to confirm it before they process your return.

Web Who Must Use The Identity And Tax Return Verification Service.

Does the irs verify identity online? Web what is irs letter 4883c? The information they seek is for you to verify your identity by personally appearing in their office. Web the irs sends letter 4883c when they have received your return but they need more information to process it.

Is The Website Www.idverify.irs.gov Fake?

Open turbotax sign in why sign in to support? Web the 4883c or 6330c letter; How many calls should a taxpayer make? What happens during the call?

Web Why You Received Irs Letter 4883C.

Keep in mind, you will only receive this communication via mail. Try early in the day and put the phone on speaker so you can do something else while you wait. Before your return can complete processing, you must prove that you are the legitimate owner of the social security number used. Get personalized help join the community