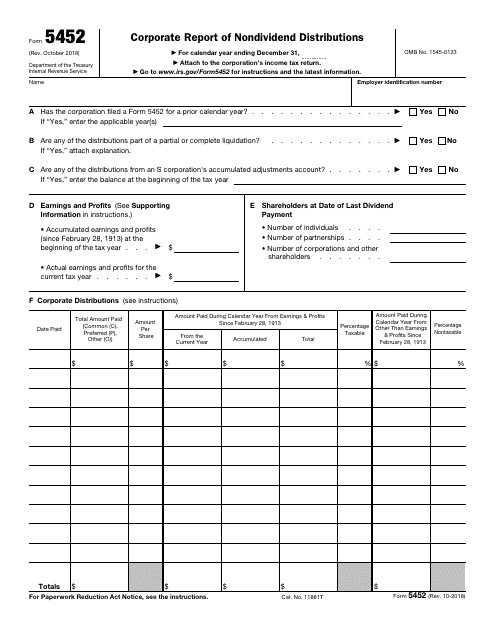

Irs Form 5452

Irs Form 5452 - You can print other federal tax forms here. Web form 5462 is used by corporations to report nondividend distributions to their shareholders under section 301, section 1368(c)(3), or section 1371(e). The form together with its supporting Web beginning accumulated earnings and profits. Corporations file form 5452, if they made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). Web file form 5452 if nondividend distributions were made to shareholders. Actual earnings and profits for the current tax year. Corporate report of nondividend distributions. Web complete form 5452 if the corporation made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). If the corporation is a member of a consolidated group, the parent corporation must file form 5452.

Corporations file form 5452, if they made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). Web file form 5452 if nondividend distributions were made to shareholders. If the corporation is a member of a consolidated group, the parent corporation must file form 5452. Form 5452, corporate report of nondividend distributions, is used to report nondividend distributions to shareholders. Web we last updated the corporate report of nondividend distributions in february 2023, so this is the latest version of form 5452, fully updated for tax year 2022. You need to complete form 5452 to document the correct amount of nontaxable dividends. If the corporation is a member of a consolidated group, the parent corporation must file form 5452. Corporate report of nondividend distributions. Web complete form 5452 if the corporation made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). Attach to the corporation’s income tax return.

Actual earnings and profits for the current tax year. Web beginning accumulated earnings and profits. The form together with its supporting Web complete form 5452 if the corporation made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). For calendar year ending december 31,. All corporations that have made nondividend distributions to their shareholders must file form 5452. Web form 5462 is used by corporations to report nondividend distributions to their shareholders under section 301, section 1368(c)(3), or section 1371(e). October 2018) department of the treasury internal revenue service. Corporations file form 5452, if they made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). A disagrees with the other.

Form 5452 Corporate Report of Nondividend Distributions (2006) Free

A calendar tax year corporation must file form 5452 with its income tax return for the tax year in which the nondividend distributions were made. Web the form breaks total distributions down into taxable and nontaxable categories. Form 5452, corporate report of nondividend distributions, is used to report nondividend distributions to shareholders. A disagrees with the other. Shareholders at date.

Form 5452 Corporate Report of Nondividend Distributions (2006) Free

You can print other federal tax forms here. For calendar year ending december 31,. Form 5452 requires the computation of e&p accumulated since february 28, 1913. Web the form breaks total distributions down into taxable and nontaxable categories. A, b, c, and d each own 2,500 shares of j corp., a c corporation real estate development company.

IRS Issues Updated New Form 5471 What's New?

All corporations that have made nondividend distributions to their shareholders must file form 5452. If the corporation is a member of a consolidated group, the parent corporation must file form 5452. Form 5452, corporate report of nondividend distributions, is used to report nondividend distributions to shareholders. Web we last updated the corporate report of nondividend distributions in february 2023, so.

Fill Free fillable Corporate Report of Nondividend Distributions Form

A disagrees with the other. Actual earnings and profits for the current tax year. Web file form 5452 if nondividend distributions were made to shareholders. If the corporation is a member of a consolidated group, the parent corporation must file form 5452. Corporate report of nondividend distributions.

IRS Form 5452 Download Fillable PDF or Fill Online Corporate Report of

A, b, c, and d each own 2,500 shares of j corp., a c corporation real estate development company. Web complete form 5452 if the corporation made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). Form 5452, corporate report of nondividend distributions, is used to report nondividend distributions to shareholders. All corporations that have made nondividend.

Form 5452 Corporate Report of Nondividend Distributions (2006) Free

A, b, c, and d each own 2,500 shares of j corp., a c corporation real estate development company. Web file form 5452 if nondividend distributions were made to shareholders. If the corporation is a member of a consolidated group, the parent corporation must file form 5452. Shareholders at date of last dividend payment: A disagrees with the other.

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

You need to complete form 5452 to document the correct amount of nontaxable dividends. The form together with its supporting A calendar tax year corporation must file form 5452 with its income tax return for the tax year in which the nondividend distributions were made. Web complete form 5452 if nondividend distributions are made to shareholders under section 301, section.

How To Fill Out Insolvency Worksheet 20202022 Fill and Sign

Web the corporation are required to file form 5452, corporate report of nondividend distributions, with their tax returns when filed with the internal revenue service (irs). A, b, c, and d each own 2,500 shares of j corp., a c corporation real estate development company. For calendar year ending december 31,. Form 5452 requires the computation of e&p accumulated since.

irs form 656 Fill Online, Printable, Fillable Blank

All corporations that have made nondividend distributions to their shareholders must file form 5452. If the corporation is a member of a consolidated group, the parent corporation must file form 5452. A, b, c, and d each own 2,500 shares of j corp., a c corporation real estate development company. Web complete form 5452 if nondividend distributions are made to.

Form 5452 Corporate Report of Nondividend Distributions (2006) Free

For calendar year ending december 31,. October 2018) department of the treasury internal revenue service. Form 5452 requires the computation of e&p accumulated since february 28, 1913. Web file form 5452 if nondividend distributions were made to shareholders. Web the form breaks total distributions down into taxable and nontaxable categories.

Web The Corporation Are Required To File Form 5452, Corporate Report Of Nondividend Distributions, With Their Tax Returns When Filed With The Internal Revenue Service (Irs).

A calendar tax year corporation must file form 5452 with its income tax return for the tax year in which the nondividend distributions were made. Web file form 5452 if nondividend distributions were made to shareholders. If the corporation is a member of a consolidated group, the parent corporation must file form 5452. For instructions and the latest information.

Web Beginning Accumulated Earnings And Profits.

Shareholders at date of last dividend payment: Corporations file form 5452, if they made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). Form 5452 requires the computation of e&p accumulated since february 28, 1913. Web the form breaks total distributions down into taxable and nontaxable categories.

A, B, C, And D Each Own 2,500 Shares Of J Corp., A C Corporation Real Estate Development Company.

If the corporation is a member of a consolidated group, the parent corporation must file form 5452. You need to complete form 5452 to document the correct amount of nontaxable dividends. October 2018) department of the treasury internal revenue service. Form 5452, corporate report of nondividend distributions, is used to report nondividend distributions to shareholders.

Web We Last Updated The Corporate Report Of Nondividend Distributions In February 2023, So This Is The Latest Version Of Form 5452, Fully Updated For Tax Year 2022.

A disagrees with the other. Web complete form 5452 if the corporation made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). Attach to the corporation’s income tax return. Actual earnings and profits for the current tax year.