Irs Form 568

Irs Form 568 - I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. A name control is established by the irs when the taxpayer requests an employer identification number (ein). Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. The llc is doing business in california. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. Web the generated ca form 568 will only have half of the reported values. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins. The llc is organized in another state or foreign country, but registered with the california sos. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc).

Web visit affordable care credit page for more information about filing a tax return with form 8962. Web application for irs individual taxpayer identification number. Web the generated ca form 568 will only have half of the reported values. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. You still have to file form 568 if the llc is registered in california. The llc isn't actively doing business in california, or; Llcs classified as a disregarded entity or partnership are required to file form 568 along with form 3522 with the franchise tax board of california. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins.

You still have to file form 568 if the llc is registered in california. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. The llc is doing business in california. If your total business income is $1000, you create two husband/wife llcs for federal taxes each with $500 income. Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). Web visit affordable care credit page for more information about filing a tax return with form 8962. The llc doesn't have a california source of income; The llc is organized in california.

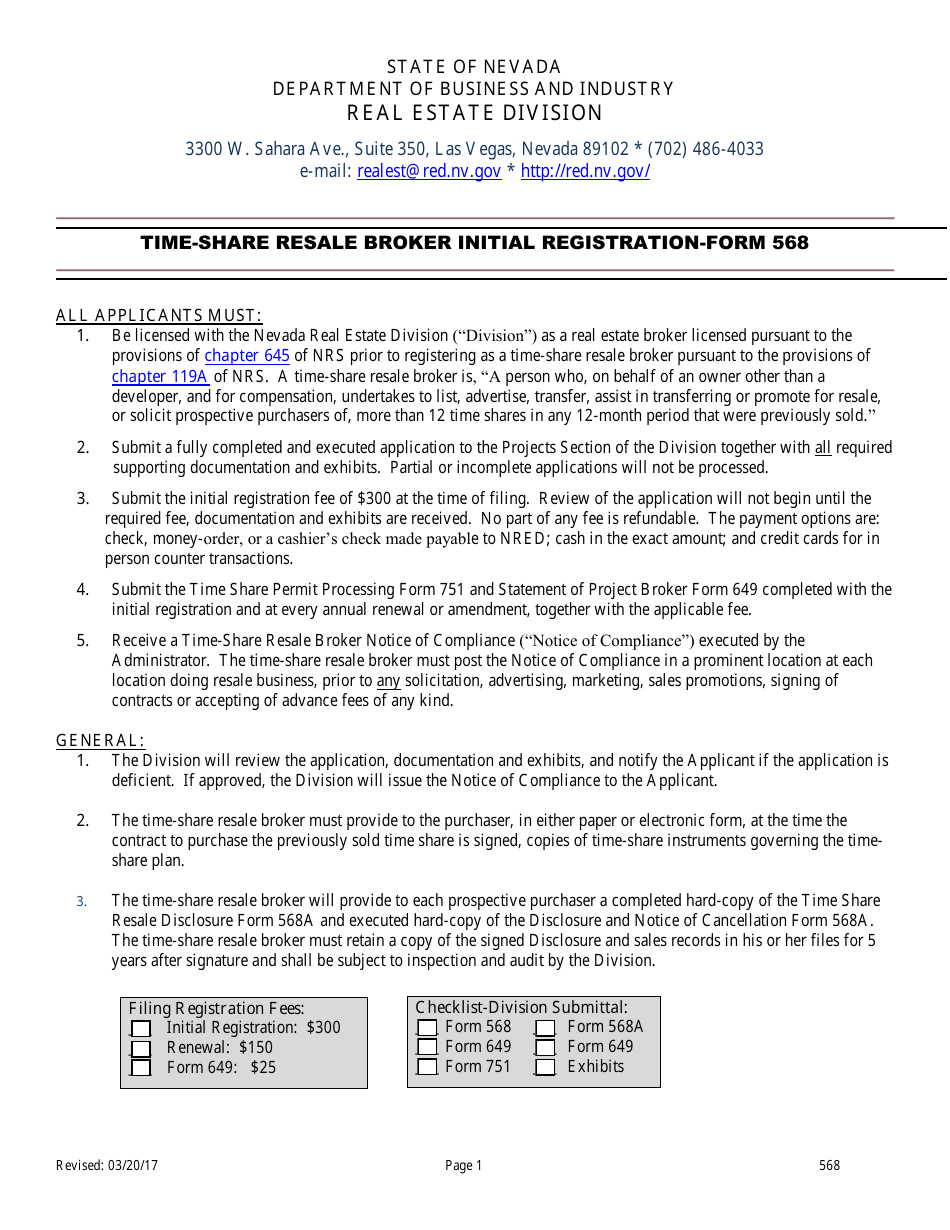

Form 568 Download Fillable PDF or Fill Online TimeShare Resale Broker

Web visit affordable care credit page for more information about filing a tax return with form 8962. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. You still have to file form 568 if the llc is registered in california. A name control is established by the irs when the.

3.11.213 Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC

Web visit affordable care credit page for more information about filing a tax return with form 8962. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real.

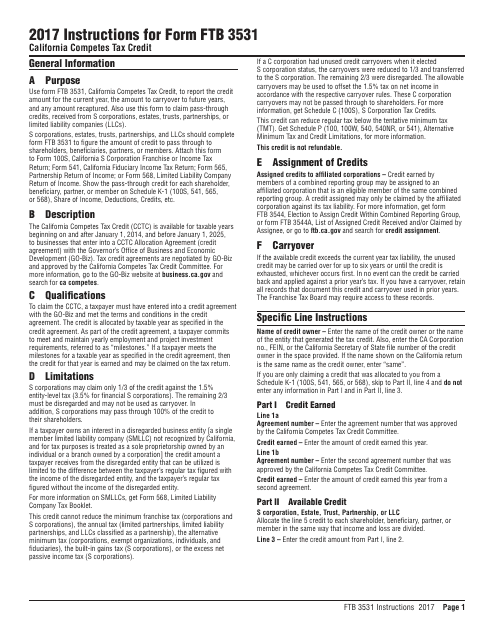

Instructions for Form Ftb 3531 California Competes Tax Credit

Web visit affordable care credit page for more information about filing a tax return with form 8962. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real.

Form 568 Instructions 2022 State And Local Taxes Zrivo

Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. But then turbo tax will generate only one ca 568 form with a business income of $500. The llc is organized in california. A name control is established by the irs when the taxpayer requests an employer identification.

Irs Form 2290 Printable Form Resume Examples

If your total business income is $1000, you create two husband/wife llcs for federal taxes each with $500 income. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue..

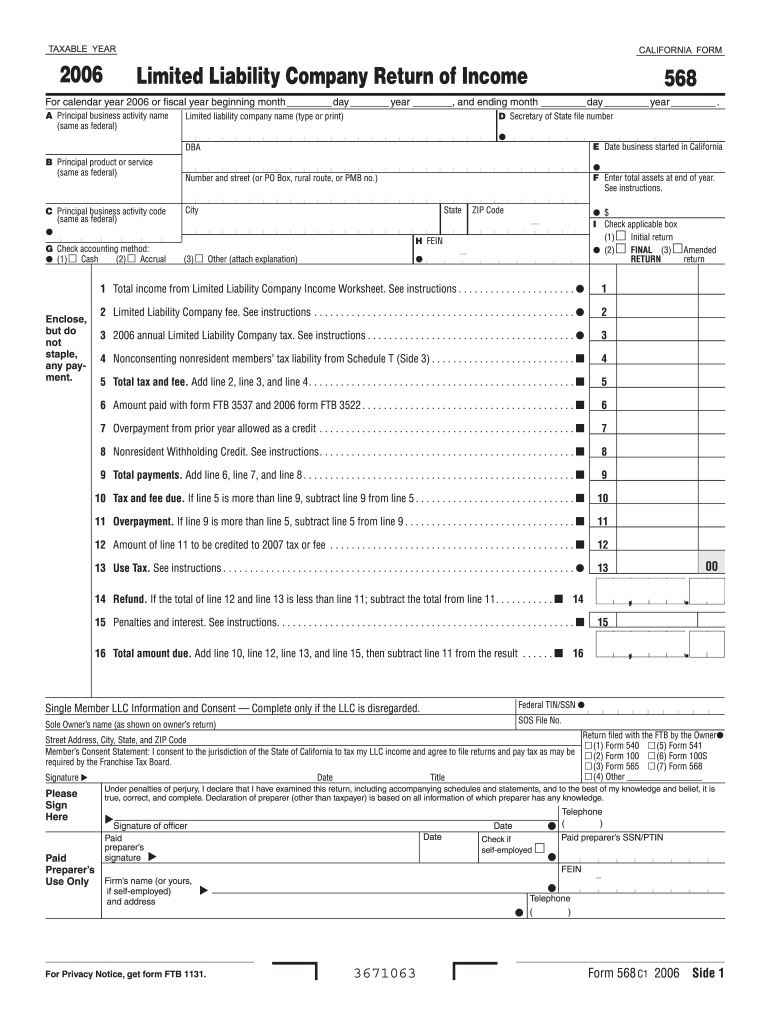

2006 Form CA FTB 568 Fill Online, Printable, Fillable, Blank PDFfiller

A name control is established by the irs when the taxpayer requests an employer identification number (ein). The llc is doing business in california. Web visit affordable care credit page for more information about filing a tax return with form 8962. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the.

File IRS 2290 Form Online for 20222023 Tax Period

If your total business income is $1000, you create two husband/wife llcs for federal taxes each with $500 income. Web application for irs individual taxpayer identification number. Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins. Web form 568 must.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

A name control is established by the irs when the taxpayer requests an employer identification number (ein). But then turbo tax will generate only one ca 568 form with a business income of $500. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: In general, for taxable.

Instructions For Form 568 Limited Liability Company Return Of

Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins. A name control is established by the irs when the taxpayer requests an employer identification number (ein). Web form 568 is the return of income that many limited liability companies (llc).

IRS Mileage Rate 2022 IRS TaxUni

The llc is organized in another state or foreign country, but registered with the california sos. Web visit affordable care credit page for more information about filing a tax return with form 8962. Web 2022 instructions for form 568, limited liability company return of income. The llc doesn't have a california source of income; The llc is organized in california.

The Llc Doesn't Have A California Source Of Income;

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. The llc is organized in another state or foreign country, but registered with the california sos.

A Name Control Is Established By The Irs When The Taxpayer Requests An Employer Identification Number (Ein).

If your total business income is $1000, you create two husband/wife llcs for federal taxes each with $500 income. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). The llc is organized in california. Web the generated ca form 568 will only have half of the reported values.

You Still Have To File Form 568 If The Llc Is Registered In California.

Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins. Web 2022 instructions for form 568, limited liability company return of income. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. The llc isn't actively doing business in california, or;

But Then Turbo Tax Will Generate Only One Ca 568 Form With A Business Income Of $500.

The llc is doing business in california. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. Llcs classified as a disregarded entity or partnership are required to file form 568 along with form 3522 with the franchise tax board of california.