Irs Form 982 Explained

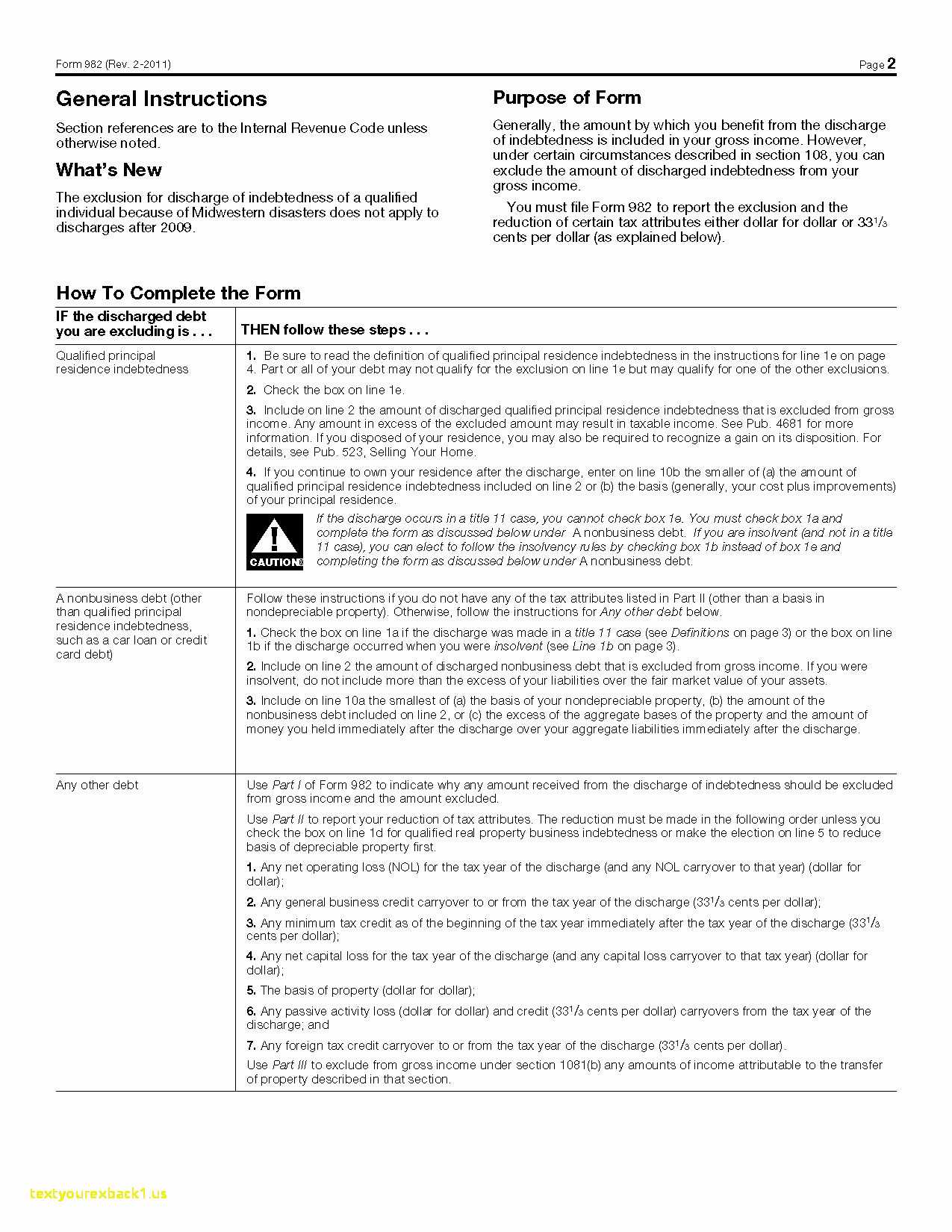

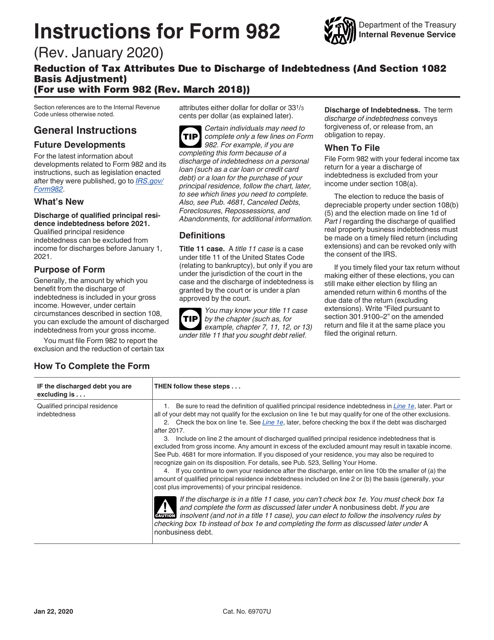

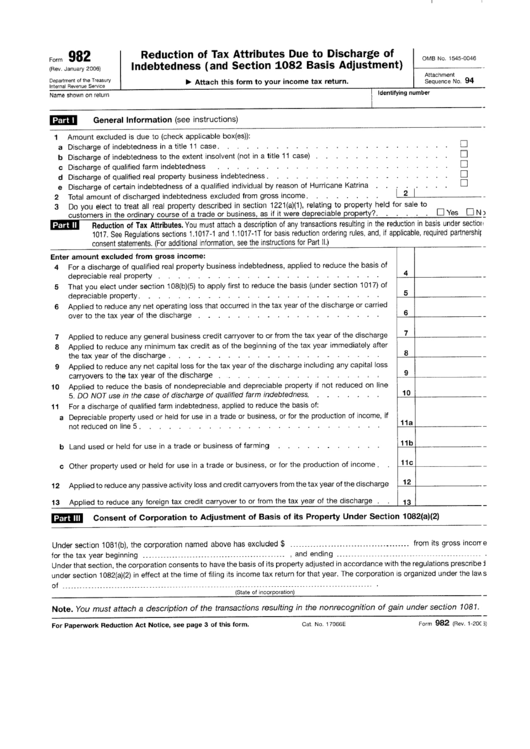

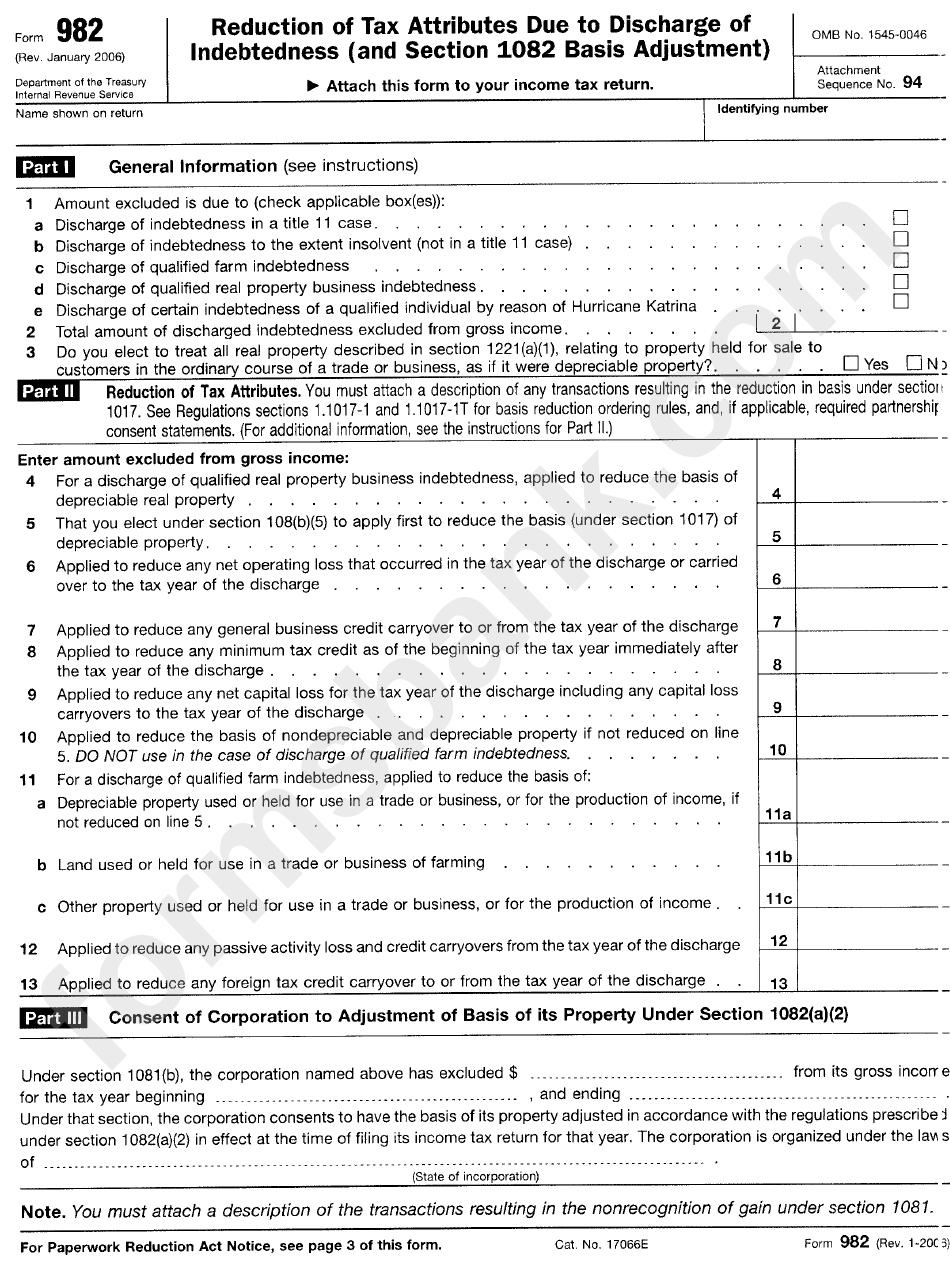

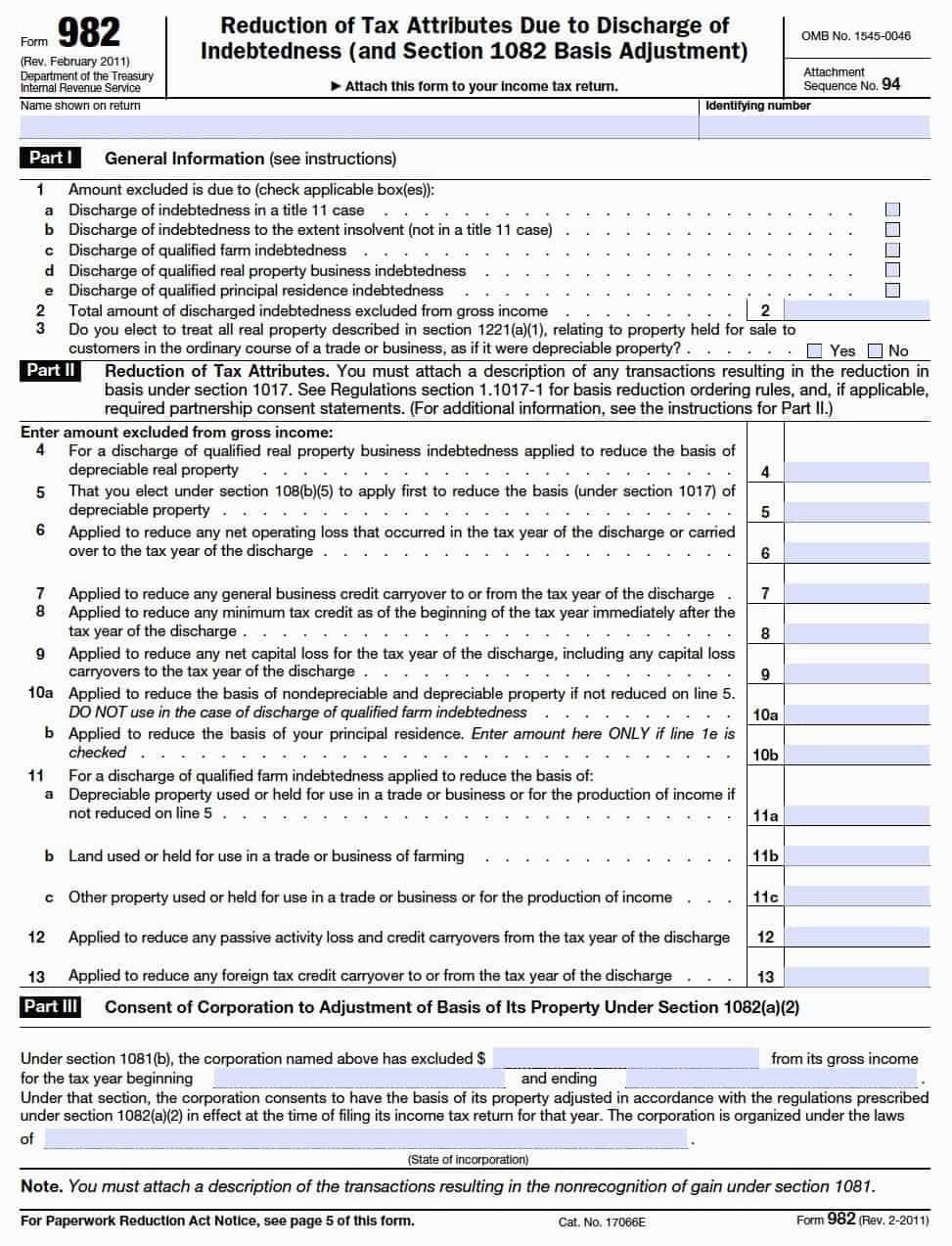

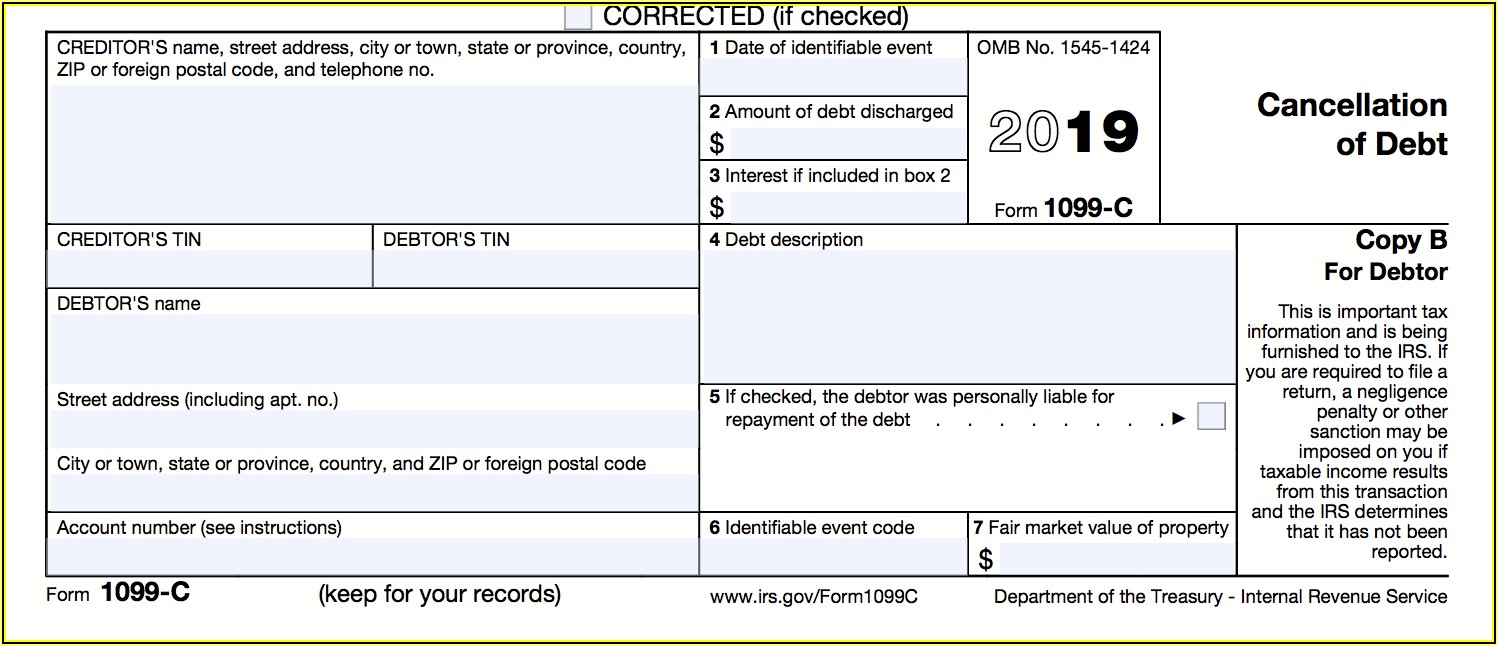

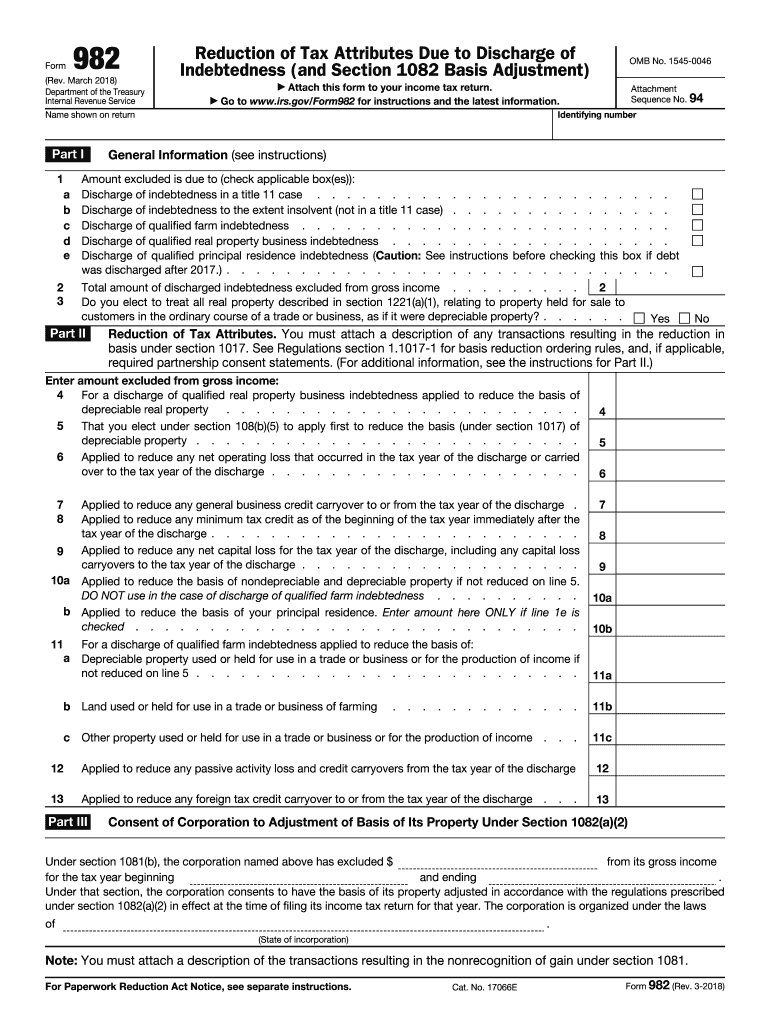

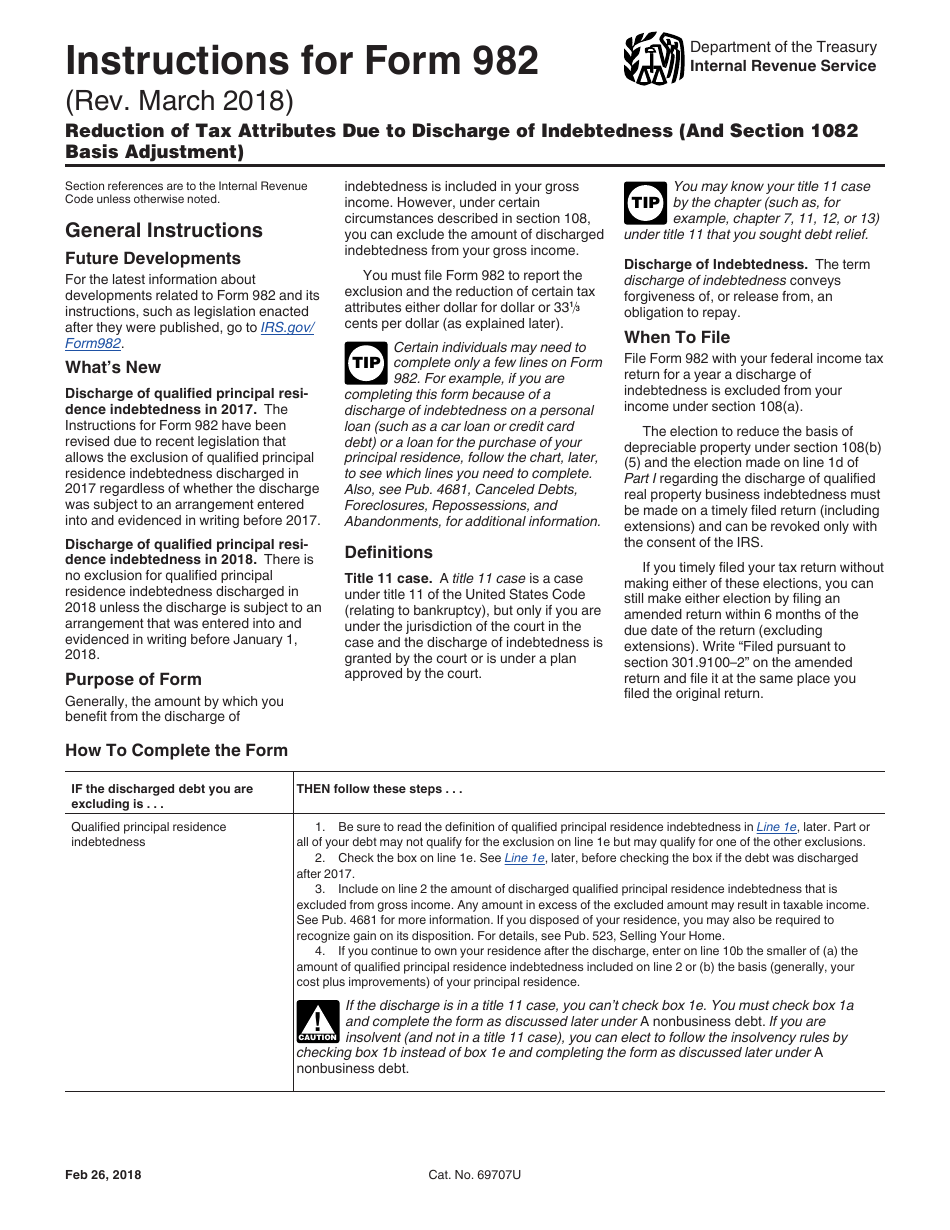

Irs Form 982 Explained - March 2018) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Web form 982 federal — reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) download this form print this form it appears you. Generally, the amount by which you benefit from the discharge of indebtedness is included in your gross income. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). This is because you received a benefit from. What is a discharge of qualified real property business indebtedness? Reduction of tax attributes due to discharge of indebtedness (and section 1082. Web check box 1e on form 982. Tax rules, the dollar value of canceled debt is included in gross inc. Qualified real property business indebtedness is indebtedness:

Attach form 982 to your federal income tax return for 2022 and check the. This is because you received a benefit from. Web the election is made by completing form 982 in accordance with its instructions. Reduction of tax attributes due to discharge of indebtedness (and section 1082. Web form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. That is assumed or incurred in. Tax rules, the dollar value of canceled debt is included in gross inc. We last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web form 982 federal — reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) download this form print this form it appears you.

Reduction of tax attributes due to discharge of indebtedness (and section 1082. Web form 982 federal — reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) download this form print this form it appears you. We last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Get ready for tax season deadlines by completing any required tax forms today. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Taxpayers who are not personally liable for. Web more about the federal form 982 corporate income tax ty 2022. Attach form 982 to your federal income tax return for 2022 and check the. See publication 4012, income tab, capital loss on foreclosure, on how to complete form 982.

Tax form 982 Insolvency Worksheet Along with 1099 form Utah

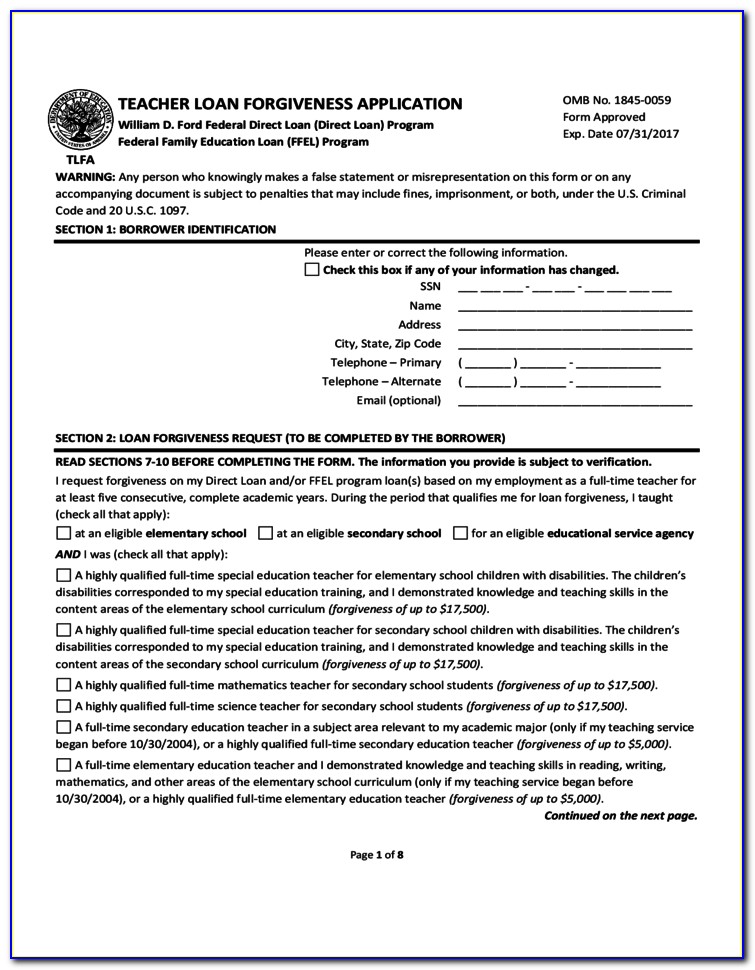

Get ready for tax season deadlines by completing any required tax forms today. Web to claim a canceled debt amount should be excluded from gross income, the taxpayer needs to complete irs form 982 and attach the completed form to their return. Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to.

Download Instructions for IRS Form 982 Reduction of Tax Attributes Due

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331⁄ 3 cents per dollar (as explained below). Web form 982 federal — reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) download this form print this form it appears you. Web more.

Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness

We last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Web more about the federal form 982 corporate income tax ty 2022. Complete, edit or print tax forms instantly. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents.

Irs Of Debt Form Form Resume Examples ojYqD0M9zl

Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Taxpayers who are not personally liable for. Web to claim a canceled debt amount should be excluded from gross income, the taxpayer needs to complete irs form 982 and attach the completed form to.

Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness

Web more about the federal form 982 corporate income tax ty 2022. This is because you received a benefit from. March 2018) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Taxpayers who are not personally liable for. What is a discharge of qualified real property business indebtedness?

Form 982 Instructions Reasons Why 9 Is Grad Amended Return —

Web check box 1e on form 982. Qualified real property business indebtedness is indebtedness: That is assumed or incurred in. Tax rules, the dollar value of canceled debt is included in gross inc. Attach form 982 to your federal income tax return for 2022 and check the.

Irs Debt Form 982 Form Resume Examples 86O7r9A5BR

Qualified real property business indebtedness is indebtedness: That is assumed or incurred in. Tax rules, the dollar value of canceled debt is included in gross inc. Attach form 982 to your federal income tax return for 2022 and check the. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for.

Irs Debt Form 982 Form Resume Examples MeVRkgq2Do

Complete, edit or print tax forms instantly. Reduction of tax attributes due to discharge of indebtedness (and section 1082. That is assumed or incurred in. Web to claim a canceled debt amount should be excluded from gross income, the taxpayer needs to complete irs form 982 and attach the completed form to their return. March 2018) department of the treasury.

Form 982 Fill Out and Sign Printable PDF Template signNow

Reduction of tax attributes due to discharge of indebtedness (and section 1082. Attach form 982 to your federal income tax return for 2022 and check the. Web form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. That is assumed or incurred in. Web form 982 (reduction of tax attributes due to discharge.

Download Instructions for IRS Form 982 Reduction of Tax Attributes Due

Web more about the federal form 982 corporate income tax ty 2022. Get ready for tax season deadlines by completing any required tax forms today. Web the election is made by completing form 982 in accordance with its instructions. We last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Tax rules, the dollar.

Generally, The Amount By Which You Benefit From The Discharge Of Indebtedness Is Included In Your Gross Income.

Tax rules, the dollar value of canceled debt is included in gross inc. March 2018) department of the treasury internal revenue service. Web form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Web form 982 federal — reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) download this form print this form it appears you.

See Publication 4012, Income Tab, Capital Loss On Foreclosure, On How To Complete Form 982.

What is a discharge of qualified real property business indebtedness? Get ready for tax season deadlines by completing any required tax forms today. Taxpayers who are not personally liable for. March 2018) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis.

Complete, Edit Or Print Tax Forms Instantly.

Web more about the federal form 982 corporate income tax ty 2022. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Reduction of tax attributes due to discharge of indebtedness (and section 1082. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later).

Attach Form 982 To Your Federal Income Tax Return For 2022 And Check The.

This is because you received a benefit from. Qualified real property business indebtedness is indebtedness: That is assumed or incurred in. Form 982 is used to determine, under certain.