Is There A Form 940 For 2021

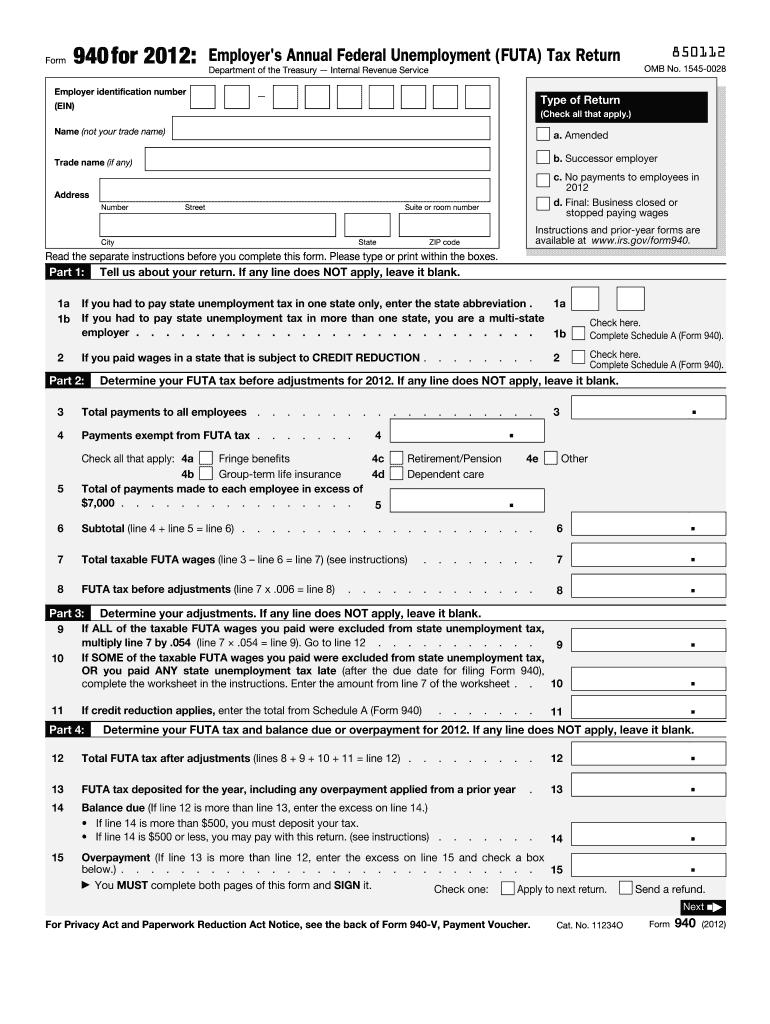

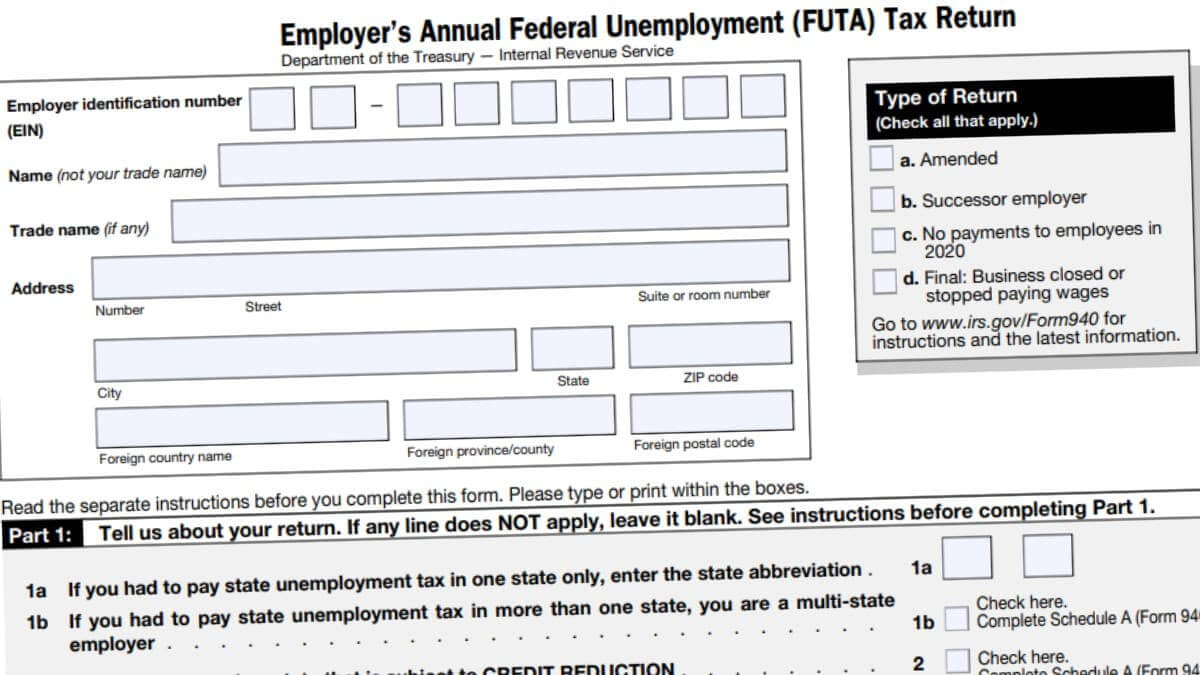

Is There A Form 940 For 2021 - Web get federal tax return forms and file by mail. Web instructions instructions for form 940 (2022) employer's annual federal unemployment (futa) tax return section references are to the internal revenue code unless. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Together with state unemployment tax systems, the futa tax provides. Are there penalties associated with form. Web form 940 is due january 31 (or the next business day if this date falls on a weekend or holiday). What information is required to file form 940 for 2022? Web form 940 is due on jan. Ad download or email irs 940 & more fillable forms, register and subscribe now!

Form 940 is due to the irs by january 31 of the following year, so the form would be due on january 31, 2022 for the 2021 tax year. Web finances and taxes. Web form 940 is a valuable and necessary document used by the irs to determine taxable futa wages from each business paying compensation to workers. Complete, edit or print tax forms instantly. Futa is different from fica as employees don’t contribute. Employers pay federal unemployment tax on the first $7,000 of each. This means that for 2021 tax returns, irs form 940 must be. Web instructions instructions for form 940 (2022) employer's annual federal unemployment (futa) tax return section references are to the internal revenue code unless. Web get federal tax return forms and file by mail. When is the 940 tax form due?

Web form 940 is due january 31 (or the next business day if this date falls on a weekend or holiday). As a small business, you’re required to file form 940 if either of the following is true: Web an employer's annual federal unemployment tax return, the irs’ form 940, is an annual form filed with the irs by businesses with one or more employees. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Web requirements for form 940. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. 31 each year for the previous year. Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. Futa is different from fica as employees don’t contribute.

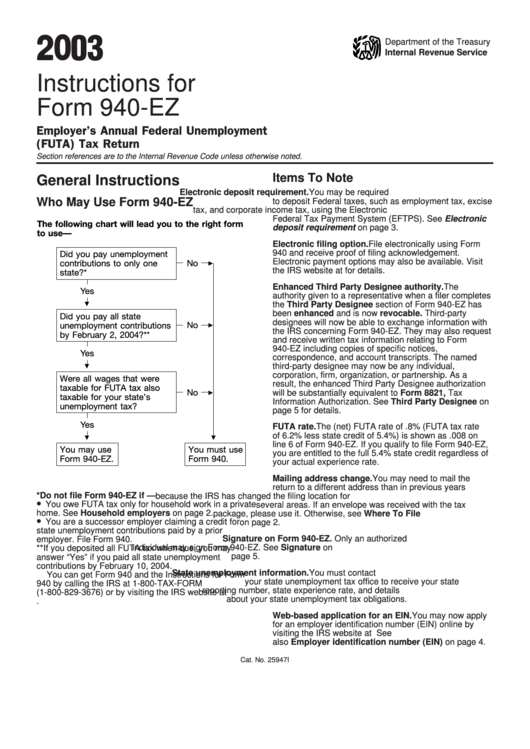

Instructions For Form 940Ez Employer'S Annual Federal Unemployment

Form 940 is due to the irs by january 31 of the following year, so the form would be due on january 31, 2022 for the 2021 tax year. Web under the general test, you're subject to futa tax on the wages you pay employees who aren't household or agricultural employees and must file form 940,. Complete, edit or print.

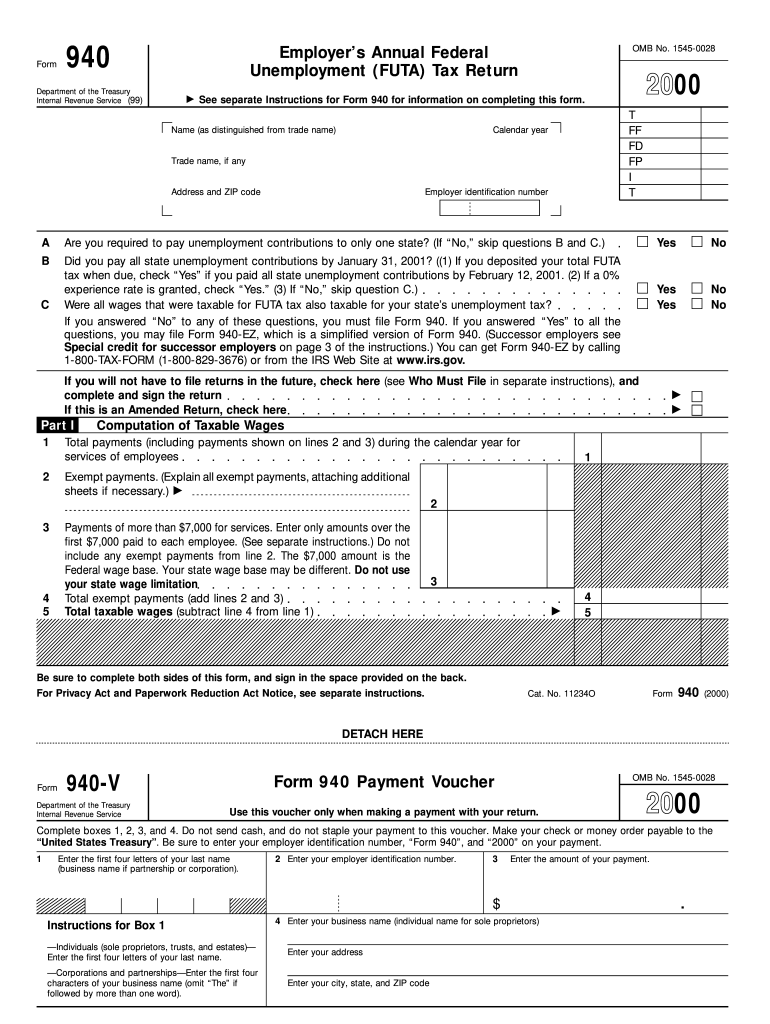

940 Form Fill Out and Sign Printable PDF Template signNow

Futa is different from fica as employees don’t contribute. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Are there penalties associated with form. Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. Web requirements for form 940.

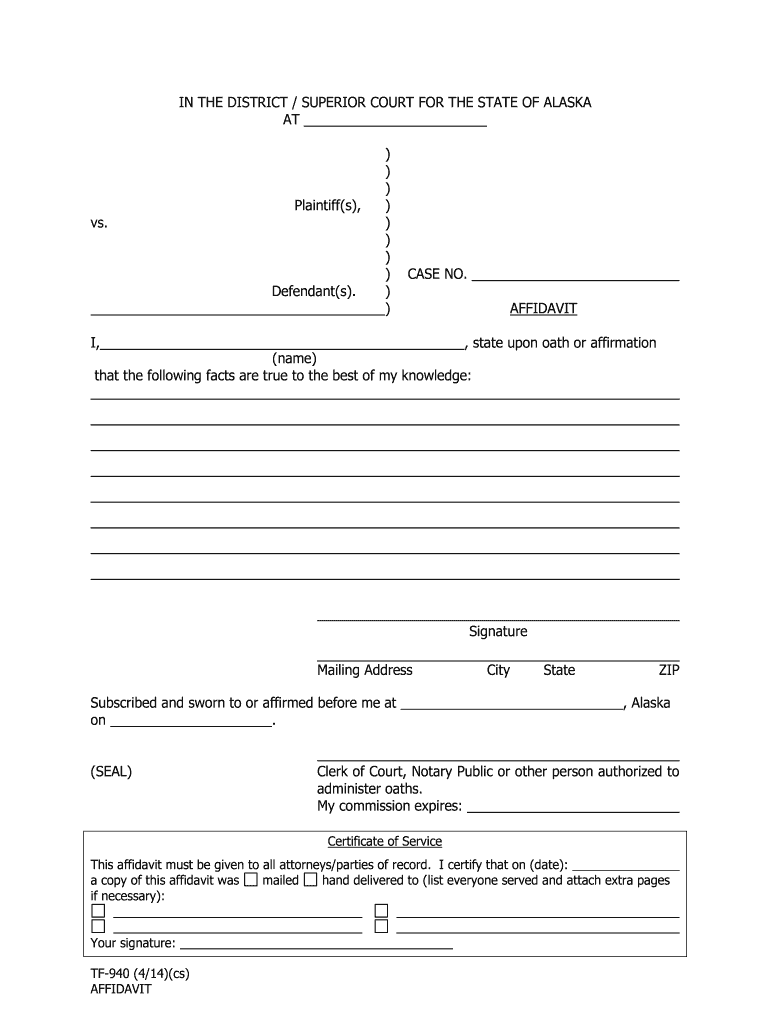

Tf 940 Fill Out and Sign Printable PDF Template signNow

Web under the general test, you're subject to futa tax on the wages you pay employees who aren't household or agricultural employees and must file form 940,. Web instructions instructions for form 940 (2022) employer's annual federal unemployment (futa) tax return section references are to the internal revenue code unless. Form 940 is due to the irs by january 31.

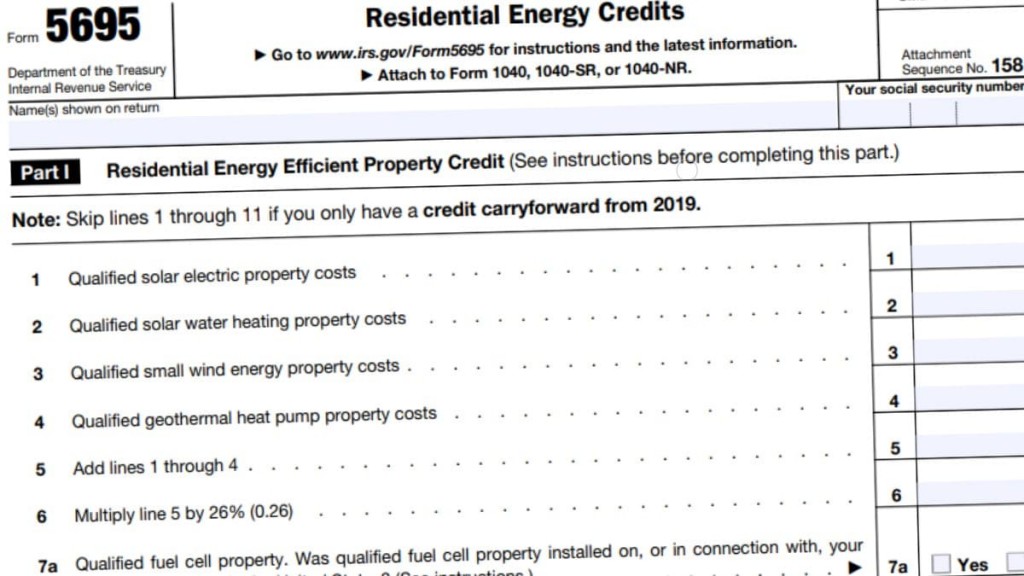

940 Form 2021 IRS Forms TaxUni

Web get federal tax return forms and file by mail. Web an employer's annual federal unemployment tax return, the irs’ form 940, is an annual form filed with the irs by businesses with one or more employees. Employers pay federal unemployment tax on the first $7,000 of each. Web form 940 is due on jan. Are there penalties associated with.

2020 Form IRS Instructions 940 Fill Online, Printable, Fillable, Blank

Ad get ready for tax season deadlines by completing any required tax forms today. Web form 940 reports federal unemployment taxes to the irs at the beginning of each year. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Web get federal tax return forms and file by mail..

IRS Instructions 940 2018 2019 Fillable and Editable PDF Template

Ad download or email irs 940 & more fillable forms, register and subscribe now! Web instructions instructions for form 940 (2022) employer's annual federal unemployment (futa) tax return section references are to the internal revenue code unless. Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. Web form.

940 Form 2021

Form 940 is due to the irs by january 31 of the following year, so the form would be due on january 31, 2022 for the 2021 tax year. Employers pay federal unemployment tax on the first $7,000 of each. Web form 940 reports federal unemployment taxes to the irs at the beginning of each year. Futa is different from.

Printable 940 Form 2021 Printable Form 2022

Web use form 940 to report your annual federal unemployment tax act (futa) tax. Ad get ready for tax season deadlines by completing any required tax forms today. Ad download or email irs 940 & more fillable forms, register and subscribe now! 31 each year for the previous year. Web form 940 is a tax return used to report a.

940 Form 2021

Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). Ad download or email irs 940 & more fillable forms, register and subscribe now! This means that for 2021 tax returns, irs form 940 must be. What information is required to file form 940 for 2022?.

Form 940 and Schedule A YouTube

Web under the general test, you're subject to futa tax on the wages you pay employees who aren't household or agricultural employees and must file form 940,. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Complete, edit or print tax.

Web Form 940 Is Due January 31 (Or The Next Business Day If This Date Falls On A Weekend Or Holiday).

When is the 940 tax form due? Complete, edit or print tax forms instantly. This means that for 2021 tax returns, irs form 940 must be. Web requirements for form 940.

Ad Download Or Email Irs 940 & More Fillable Forms, Register And Subscribe Now!

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Together with state unemployment tax systems, the futa tax provides. Web form 940 is a valuable and necessary document used by the irs to determine taxable futa wages from each business paying compensation to workers. Web form 940 is due on jan.

Web Use Form 940 To Report Your Annual Federal Unemployment Tax Act (Futa) Tax.

As a small business, you’re required to file form 940 if either of the following is true: Complete, edit or print tax forms instantly. 31 each year for the previous year. Form 940 is due to the irs by january 31 of the following year, so the form would be due on january 31, 2022 for the 2021 tax year.

What Information Is Required To File Form 940 For 2022?

Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. Web an employer's annual federal unemployment tax return, the irs’ form 940, is an annual form filed with the irs by businesses with one or more employees. Web monthly or semiweekly deposits may be required for taxes reported on form 941 (or form 944), and quarterly deposits may be required for taxes reported on form. Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa).