Kansas Homestead Tax Form

Kansas Homestead Tax Form - All hometead and food sales tax refunds are done electronically, county clerk's office does not have any. Complete, edit or print tax forms instantly. Web kansas homestead tax refund or safe senior refund. Complete, edit or print tax forms instantly. A new property tax refund for homeowners, 65 years of age or older with household income of $16,800. Web the current kansas homestead refund program is an entitlement for eligible taxpayers based upon their household income and their property tax liability that provides a refund. A homestead is the house, mobile or manufactured home, or other dwelling. Complete, edit or print tax forms instantly. File your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided. Web a homestead is the house, mobile or manufactured home, or other dwelling subject to property tax that you own and occupy as a residence.

Your refund percentage is based. Web a homestead is the house, mobile or manufactured home, or other dwelling subject to property tax that you own and occupy as a residence. Your refund percentage is based on your total household. Web the current kansas homestead refund program is an entitlement for eligible taxpayers based upon their household income and their property tax liability that provides a refund. The page numbers on instructions may not be consecutive. File your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided. All hometead and food sales tax refunds are done electronically, county clerk's office does not have any. Property tax relief claim (k. This form is for income earned in tax year 2022, with tax returns due in april. Web the kansas homestead refund act provides a refund to kansans who own their homes or pay rent and meet one of the following three requirements:

The page numbers on instructions may not be consecutive. File your state taxes online; Property tax relief claim (k. All hometead and food sales tax refunds are done electronically, county clerk's office does not have any. File your state taxes online; A new property tax refund for homeowners, 65 years of age or older with household income of $16,800. Your refund percentage is based on your total household. Web the current kansas homestead refund program is an entitlement for eligible taxpayers based upon their household income and their property tax liability that provides a refund. The homestead refund program offers a refund for homeowners who meet the. A homestead is the house, mobile or manufactured home, or other dwelling.

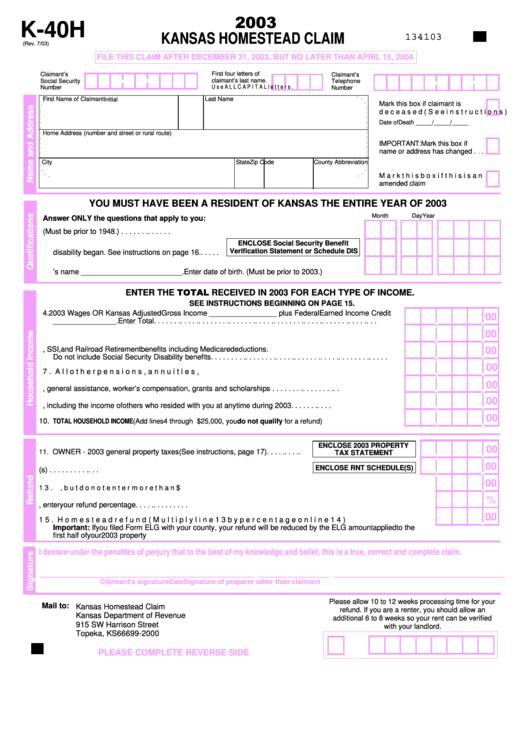

Form K40h Kansas Homestead Claim 2003 printable pdf download

A homestead is the house, mobile or manufactured home, or other dwelling. File your state taxes online; File your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided. Web the current kansas homestead refund program is an entitlement for eligible taxpayers based upon their household income and their property tax liability.

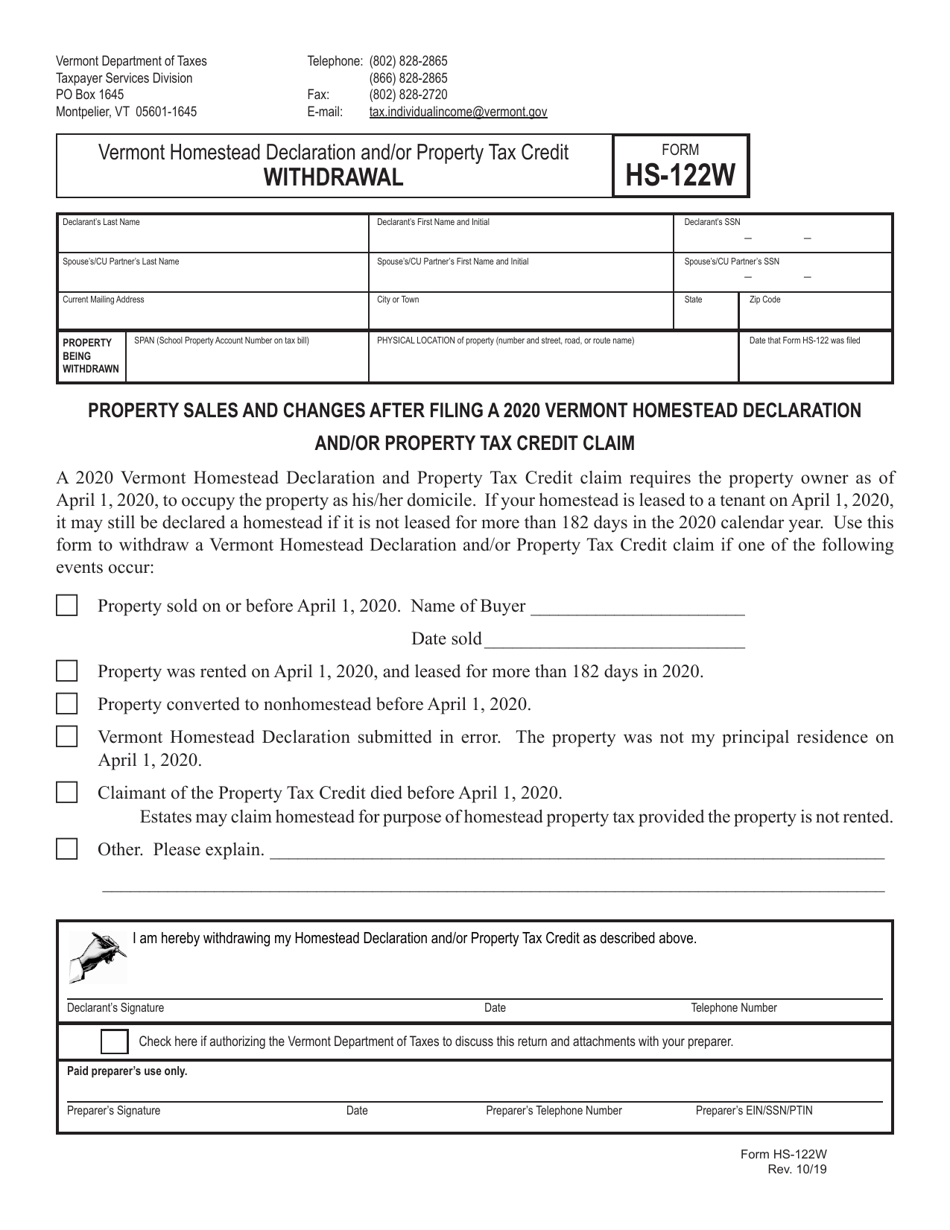

Form HS122W Download Printable PDF or Fill Online Vermont Homestead

Web kansas homestead tax refund or safe senior refund. Your refund percentage is based. Easily fill out pdf blank, edit, and sign them. Web the homestead refund is a rebate of a portion of the property taxes paid on a kansas resident's homestead. Your refund percentage is based on your total household.

2020 Update Houston Homestead Home Exemptions StepByStep Guide

Complete, edit or print tax forms instantly. Your refund percentage is based on your total household. Web kansas homestead tax refund or safe senior refund. This form is for income earned in tax year 2022, with tax returns due in april. The county clerk's office is happy to assist with filing the kansas homestead claim or the property tax relief.

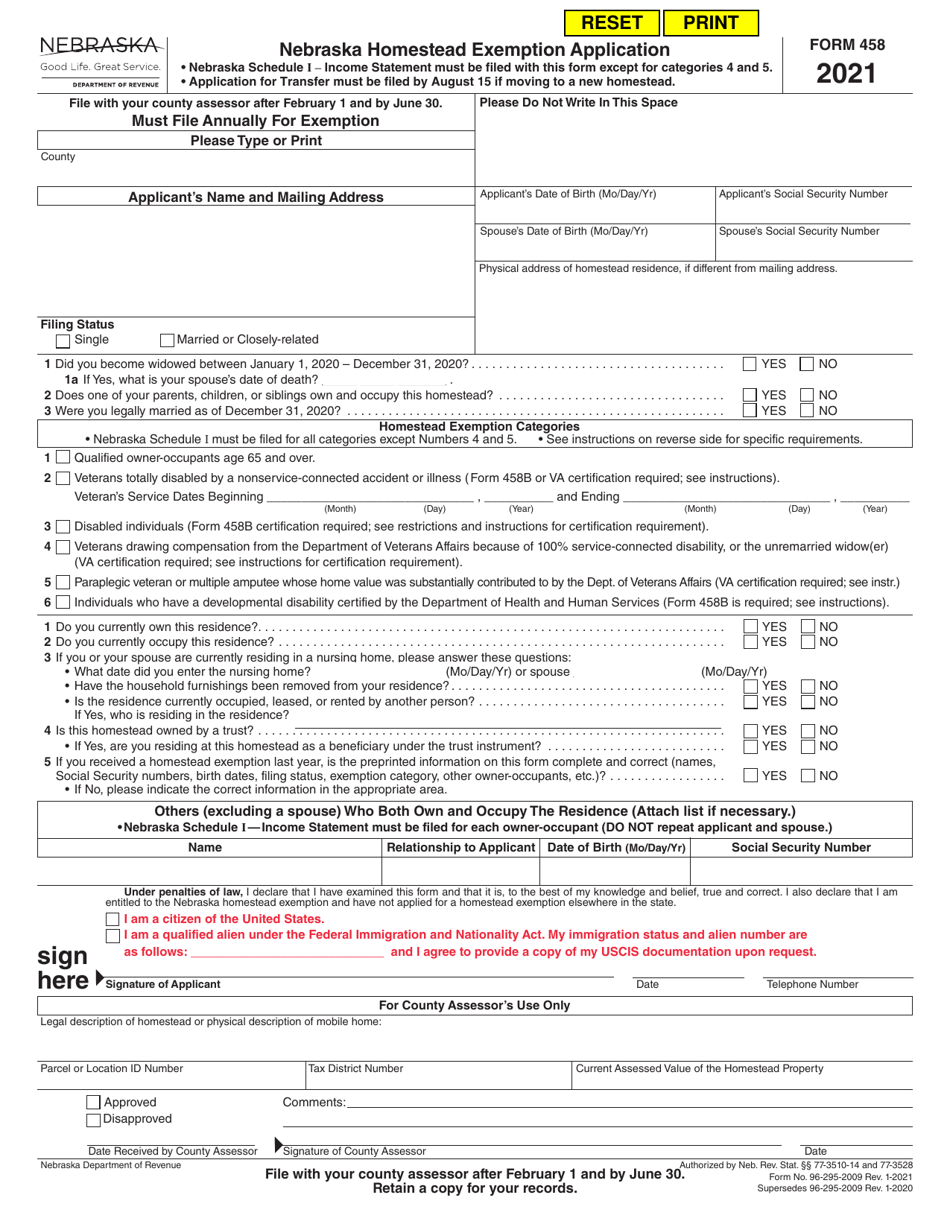

Form 458 Download Fillable PDF or Fill Online Nebraska Homestead

This form is for income earned in tax year 2022, with tax returns due in april. Your refund percentage is based. Register and subscribe now to work on ks homestead or property tax refund for homeowners. Register and subscribe now to work on ks homestead or property tax refund for homeowners. A new property tax refund for homeowners, 65 years.

Get Your Homestead Tax Exemption Texas Homestead Tax Exemption Info

Income of $20,900 or less, and a resident of kansas all of. A homestead is the house, mobile or manufactured home, or other dwelling. Register and subscribe now to work on ks homestead or property tax refund for homeowners. Register and subscribe now to work on ks homestead or property tax refund for homeowners. Complete, edit or print tax forms.

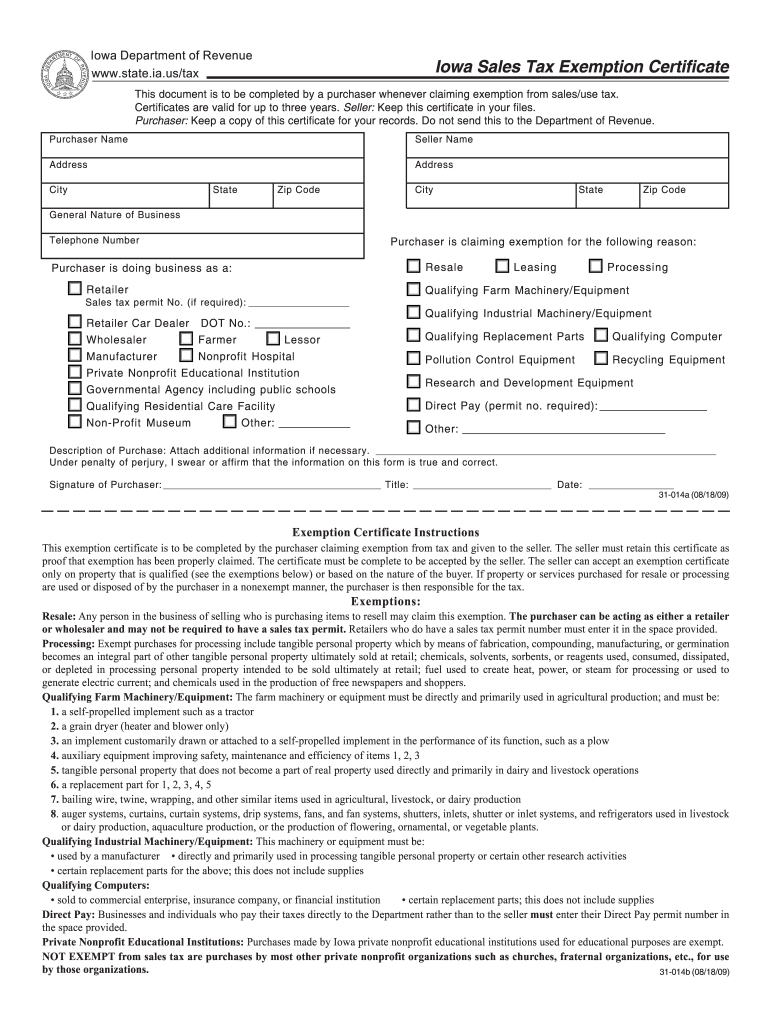

Iowa Sales Tax Exemption Certificate Fillable Form Fill Out and Sign

The county clerk's office is happy to assist with filing the kansas homestead claim or the property tax relief claim (safe senior) for people who do not have to file. File this claim after december 31, 2020, but no later than april 15, 2021. The page numbers on instructions may not be consecutive. All hometead and food sales tax refunds.

Iowa Homestead Tax Credit Morse Real Estate Iowa and Nebraska Real Estate

The county clerk's office is happy to assist with filing the kansas homestead claim or the property tax relief claim (safe senior) for people who do not have to file. Complete, edit or print tax forms instantly. File your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided. Web kansas homestead.

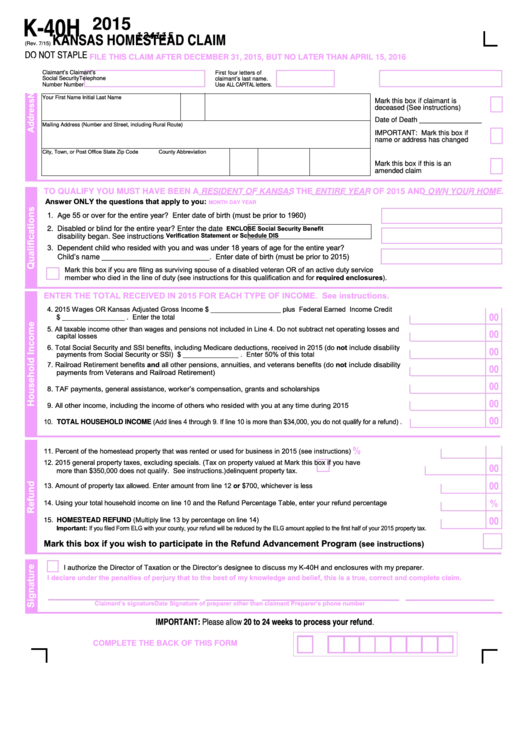

Fillable Form K40h Kansas Homestead Claim 2015 printable pdf download

Web a homestead is the house, mobile or manufactured home, or other dwelling subject to property tax that you own and occupy as a residence. Your refund percentage is based. All hometead and food sales tax refunds are done electronically, county clerk's office does not have any. Register and subscribe now to work on ks homestead or property tax refund.

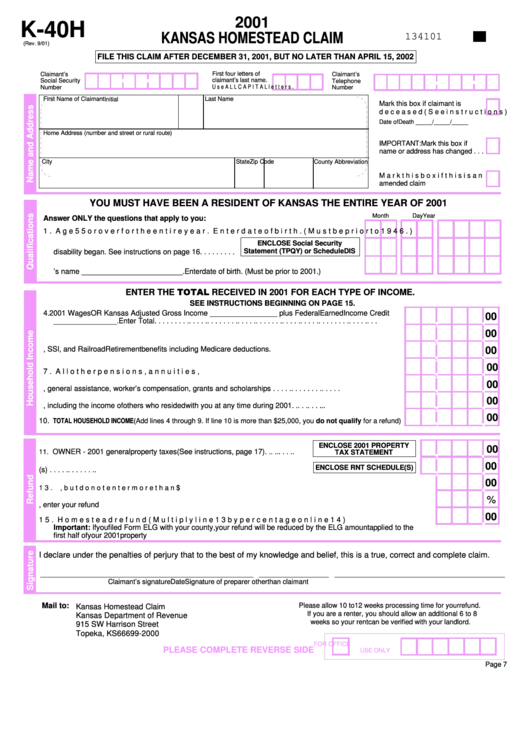

Fillable Form K40h Kansas Homestead Claim 2001 printable pdf download

File your state taxes online; Your refund percentage is based. Complete, edit or print tax forms instantly. File your state taxes online; Complete, edit or print tax forms instantly.

2018 Form KS DoR K40 Fill Online, Printable, Fillable, Blank pdfFiller

The homestead refund program offers a refund for homeowners who meet the. Web the current kansas homestead refund program is an entitlement for eligible taxpayers based upon their household income and their property tax liability that provides a refund. Your refund percentage is based. This form is for income earned in tax year 2022, with tax returns due in april..

Complete, Edit Or Print Tax Forms Instantly.

Web the kansas homestead refund act provides a refund to kansans who own their homes or pay rent and meet one of the following three requirements: All hometead and food sales tax refunds are done electronically, county clerk's office does not have any. Your refund percentage is based. Web kansas homestead tax refund or safe senior refund.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

The page numbers on instructions may not be consecutive. Register and subscribe now to work on ks homestead or property tax refund for homeowners. Register and subscribe now to work on ks homestead or property tax refund for homeowners. File your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided.

Complete, Edit Or Print Tax Forms Instantly.

Web a homestead is the house, mobile or manufactured home, or other dwelling subject to property tax that you own and occupy as a residence. The homestead refund program offers a refund for homeowners who meet the. Complete, edit or print tax forms instantly. File your state taxes online;

File Your State Taxes Online;

Web the homestead refund is a rebate of a portion of the property taxes paid on a kansas resident's homestead. Web the current kansas homestead refund program is an entitlement for eligible taxpayers based upon their household income and their property tax liability that provides a refund. Easily fill out pdf blank, edit, and sign them. Income of $20,900 or less, and a resident of kansas all of.