Kentucky Form 720 Instructions 2021

Kentucky Form 720 Instructions 2021 - Web download the taxpayer bill of rights. Go out of business, or 2. Include federal form 1120 with all supporting schedules and statements. How to obtain additional forms Web file a final return if you have been filing form 720 and you: Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue code must use form pte and related schedules. Web law to file a kentucky corporation income tax and llet return. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Form pte is complementary to the federal forms 1120s and 1065. How to obtain forms and instructions

Follow the simple instructions below: Go out of business, or 2. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. How to obtain forms and instructions The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. If you are only filing to report zero tax and you won't owe excise tax in future quarters, check the final return box above part i of form 720. How to obtain additional forms You can print other kentucky tax forms here. Won't owe excise taxes that are reportable on form 720 in future quarters. Web how to fill out and sign ky form 720 instructions 2021 online?

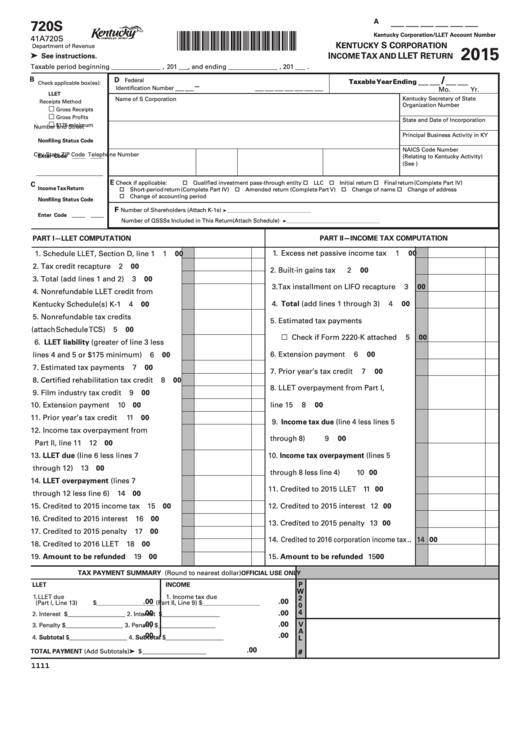

Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue code must use form pte and related schedules. Web we last updated the kentucky s corporation income tax and llet return instructions in february 2023, so this is the latest version of form 720s instructions, fully updated for tax year 2022. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. How to obtain forms and instructions Get your online template and fill it in using progressive features. Web law to file a kentucky corporation income tax and llet return. Won't owe excise taxes that are reportable on form 720 in future quarters. Form pte is complementary to the federal forms 1120s and 1065. If you are only filing to report zero tax and you won't owe excise tax in future quarters, check the final return box above part i of form 720.

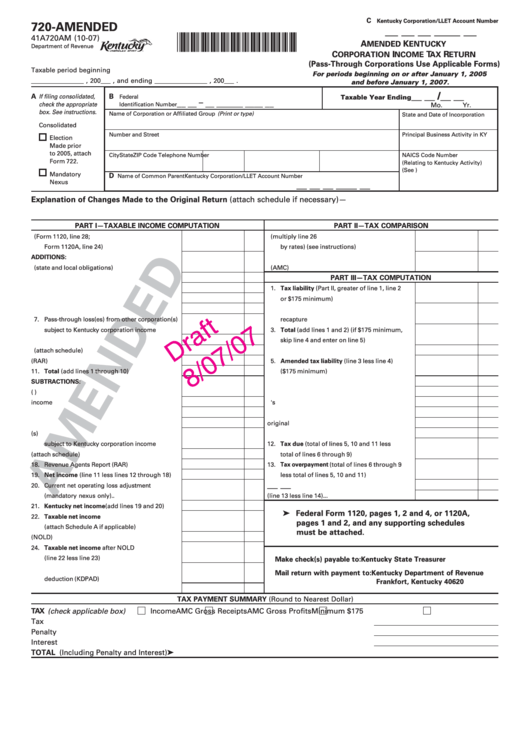

Form 720Amended Amended Kentucky Corporation Tax Return

If you are only filing to report zero tax and you won't owe excise tax in future quarters, check the final return box above part i of form 720. Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet in column a, line 1(b). Web download the taxpayer bill of rights. Won't.

Form 720 Vi Fill Online, Printable, Fillable, Blank PDFfiller

Get your online template and fill it in using progressive features. Web file a final return if you have been filing form 720 and you: You can print other kentucky tax forms here. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web we last updated the kentucky corporation income tax and llet.

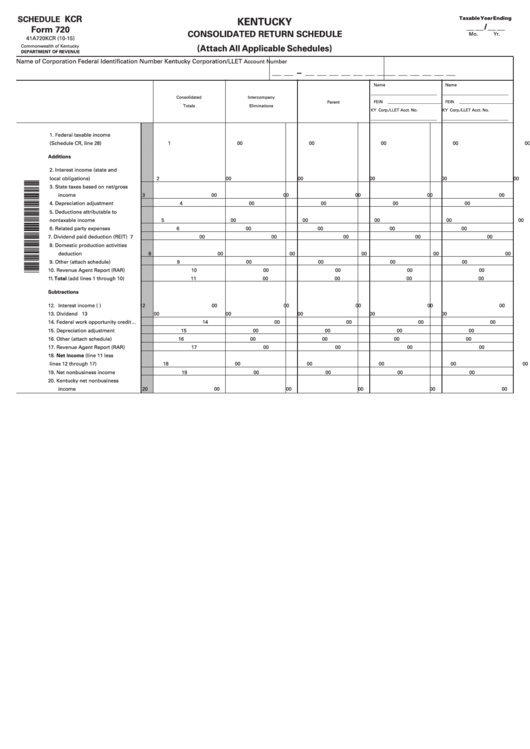

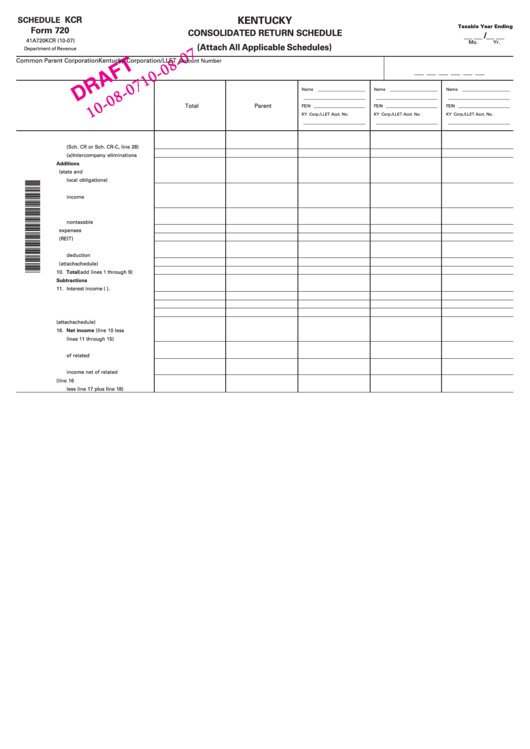

Fillable Schedule Kcr (Form 720) Kentucky Consolidated Return

Form 720 is complementary to the federal form 1120 series. How to obtain forms and instructions Web how to fill out and sign ky form 720 instructions 2021 online? Web file a final return if you have been filing form 720 and you: The kentucky department of revenue conducts work under the authority of the finance and administration cabinet.

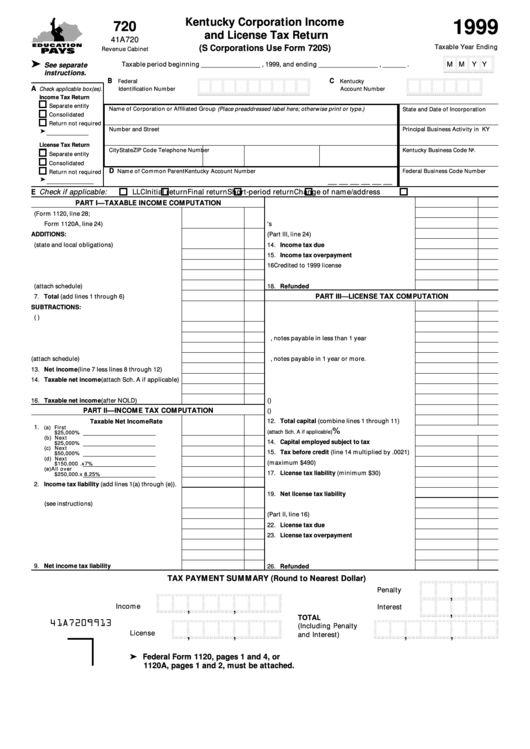

Form 720 Kentucky Corporation And License Tax Return 1999

If you are only filing to report zero tax and you won't owe excise tax in future quarters, check the final return box above part i of form 720. Web we last updated the kentucky s corporation income tax and llet return instructions in february 2023, so this is the latest version of form 720s instructions, fully updated for tax.

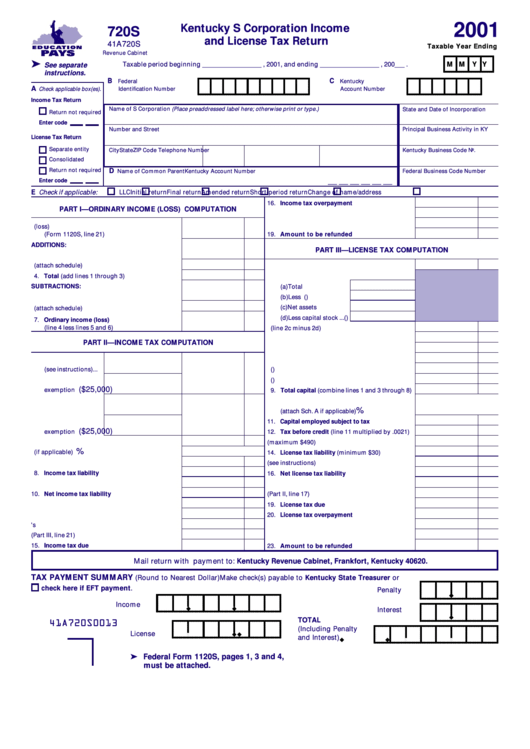

Kentucky Form 720S 2019

Get your online template and fill it in using progressive features. Form pte is complementary to the federal forms 1120s and 1065. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue code must use form pte and related schedules. Web we last updated the kentucky s corporation income tax and llet return instructions.

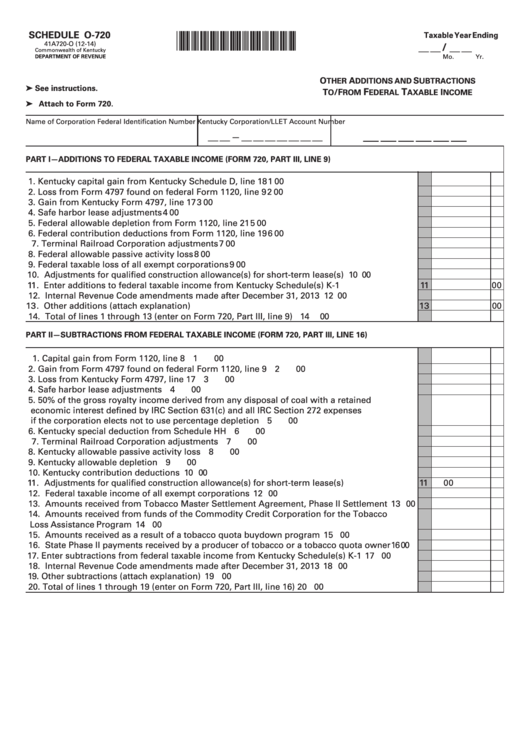

Fillable Schedule O720 (Form 41a720O) Other Additions And

Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet in column a, line 1(b). If you are only filing to report zero tax and you won't owe excise tax in future quarters, check the final return box above part i of form 720. Web we last updated the kentucky s corporation.

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

Get your online template and fill it in using progressive features. Follow the simple instructions below: Won't owe excise taxes that are reportable on form 720 in future quarters. Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet in column a, line 1(b). Web law to file a kentucky corporation income.

Fillable Form 720s Kentucky S Corporation Tax And Llet Return

Get your online template and fill it in using progressive features. Go out of business, or 2. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue code must use form pte and related schedules. Web file a final return if you have been filing form 720 and you: Web line 1(a)—specify if kentucky.

Form 720 Kentucky Corporation Tax And Llet Return 2013

Web we last updated the kentucky s corporation income tax and llet return instructions in february 2023, so this is the latest version of form 720s instructions, fully updated for tax year 2022. Enjoy smart fillable fields and interactivity. Go out of business, or 2. Web file a final return if you have been filing form 720 and you: Web.

Form 720 Draft Schedule Kcr Kentucky Consolidated Return Schedule

Web file a final return if you have been filing form 720 and you: How to obtain additional forms Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue code must use form pte and related schedules. Form 720 is complementary to the federal form 1120 series. Web we last updated the kentucky s.

You Can Print Other Kentucky Tax Forms Here.

Go out of business, or 2. Follow the simple instructions below: If you are only filing to report zero tax and you won't owe excise tax in future quarters, check the final return box above part i of form 720. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022.

Web File A Final Return If You Have Been Filing Form 720 And You:

Form pte is complementary to the federal forms 1120s and 1065. Web how to fill out and sign ky form 720 instructions 2021 online? How to obtain additional forms Include federal form 1120 with all supporting schedules and statements.

Web We Last Updated The Kentucky S Corporation Income Tax And Llet Return Instructions In February 2023, So This Is The Latest Version Of Form 720S Instructions, Fully Updated For Tax Year 2022.

Get your online template and fill it in using progressive features. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue code must use form pte and related schedules. How to obtain forms and instructions

Enjoy Smart Fillable Fields And Interactivity.

Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet in column a, line 1(b). Web law to file a kentucky corporation income tax and llet return. Form 720 is complementary to the federal form 1120 series. Line 1(b)— enter the amount of current year estimated taxable net income and kgr or kgp.