Kentucky Form 720

Kentucky Form 720 - • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t. Form 720 is used by taxpayers to report. This form is for income earned in tax year 2022, with tax returns due in april. Web send form 720 to: Web top center of the form, and compute the kentucky capital gain from the disposal assets using kentucky basis. Web law to file a kentucky corporation income tax and llet return. Web download the taxpayer bill of rights. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022.

Web download the taxpayer bill of rights. Web law to file a kentucky corporation income tax and llet return. Web law to file a kentucky corporation income tax and llet return. If you aren't reporting a tax that you normally. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. This form is for income earned in tax year 2022, with tax returns due in april. Web send form 720 to: Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. Web we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Form 720 is used by taxpayers to report.

Cocodoc is the best website for you to go, offering you a convenient and easy to edit version of kentucky form 720 as you need. Web you must file form 720 if: Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Web law to file a kentucky corporation income tax and llet return. Web we last updated kentucky form 720s from the department of revenue in may 2021. Enter the capital gain from kentucky converted schedule d, line. This form is for income earned in tax year 2022, with tax returns due in april. Web download the taxpayer bill of rights. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web form 720 (2022) subtractions—continued 31 terminal railroad corporation adjustments 32 kentucky allowable passive activity loss 33 kentucky allowable.

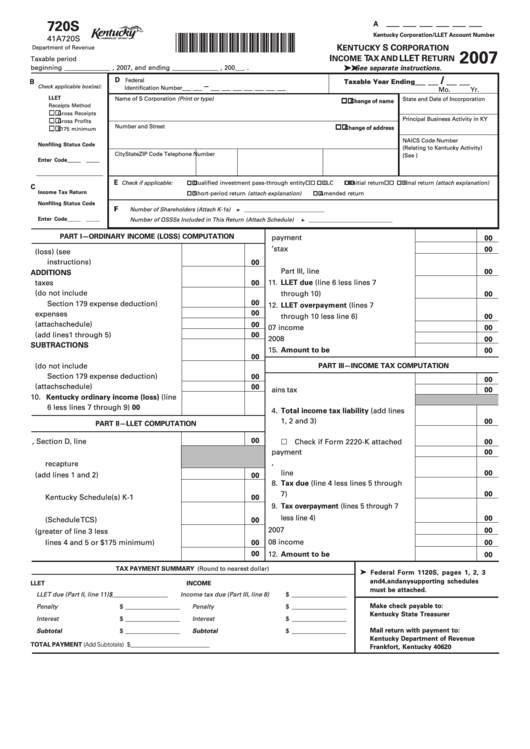

Form 720s Kentucky S Corporation Tax And Llet Return 2007

Web form 720 (2022) subtractions—continued 31 terminal railroad corporation adjustments 32 kentucky allowable passive activity loss 33 kentucky allowable. Web we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Web download the taxpayer bill of rights. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. Any corporation.

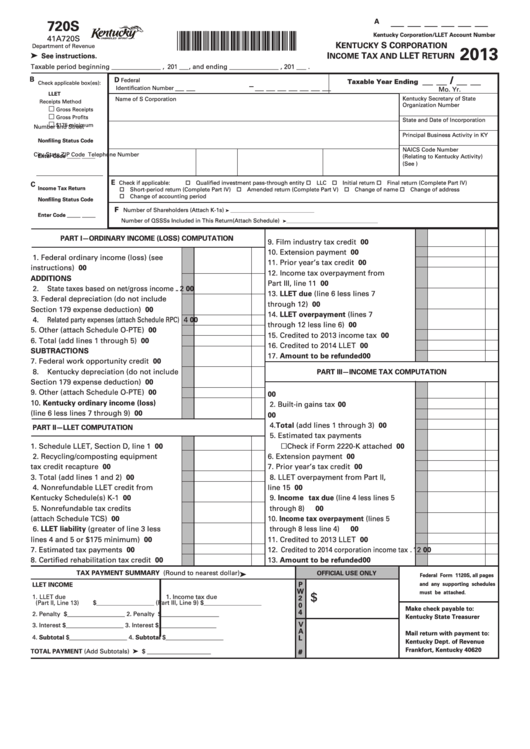

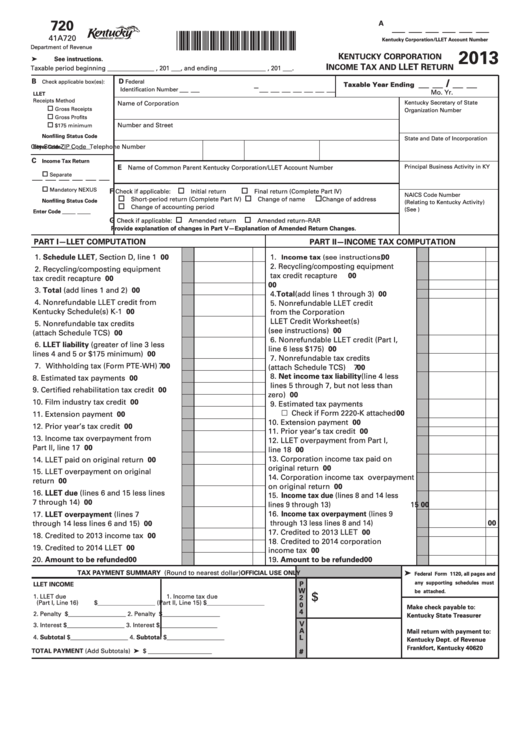

Form 720s Kentucky S Corporation Tax And Llet Return 2013

Enter the capital gain from kentucky converted schedule d, line. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t. Cocodoc is the best website for you to go, offering you a convenient and easy to edit version of kentucky.

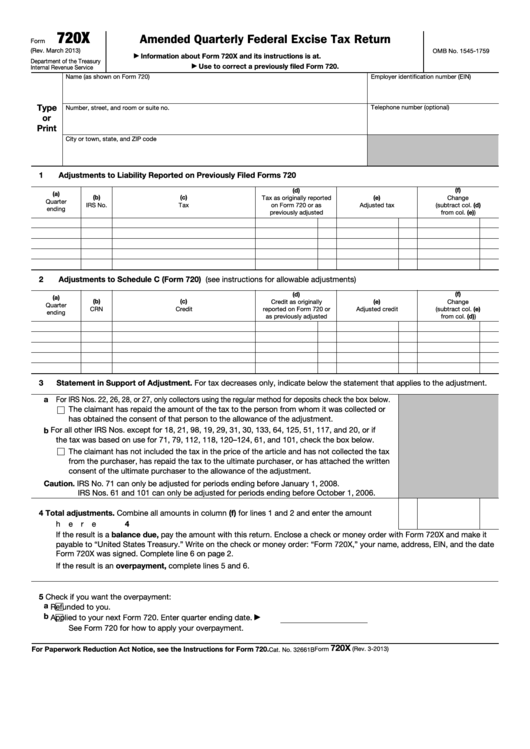

Fillable Form 720X Amended Quarterly Federal Excise Tax Return

Web send form 720 to: Web law to file a kentucky corporation income tax and llet return. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web you must file form 720 if: Enter the capital gain from kentucky converted schedule d, line.

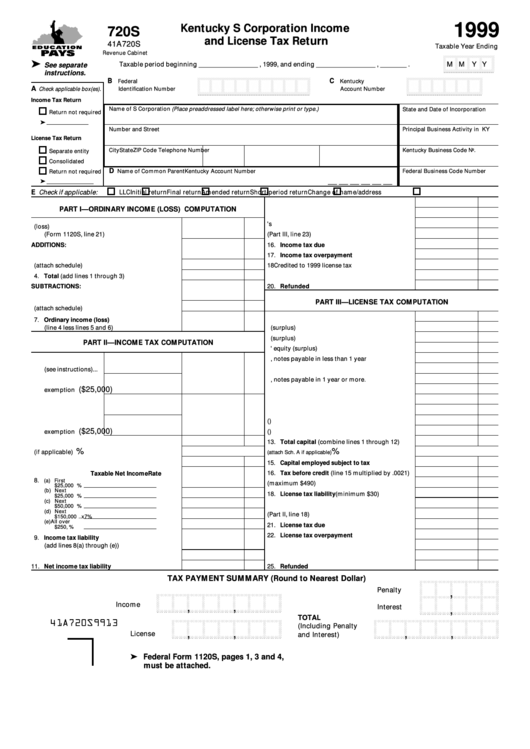

Form 720s Kentucky S Corporation And License Tax Return 1999

Form 720s is a kentucky corporate income tax form. Web form 720 (2022) subtractions—continued 31 terminal railroad corporation adjustments 32 kentucky allowable passive activity loss 33 kentucky allowable. Web we last updated kentucky form 720s from the department of revenue in may 2021. Web we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. This.

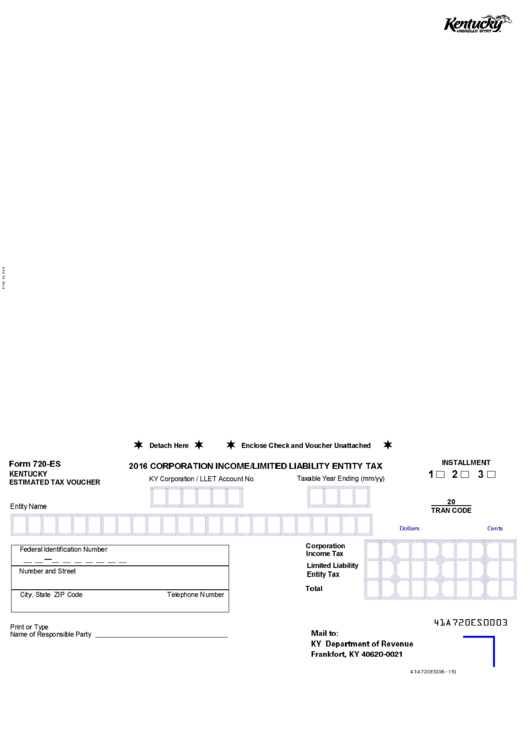

Fillable Form 720Es Kentucky Estimated Tax Voucher Corporation

Web send form 720 to: Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Form 720s is a kentucky corporate income tax form. Web law to file a kentucky corporation income tax and llet return. Form 720 is used by taxpayers to report.

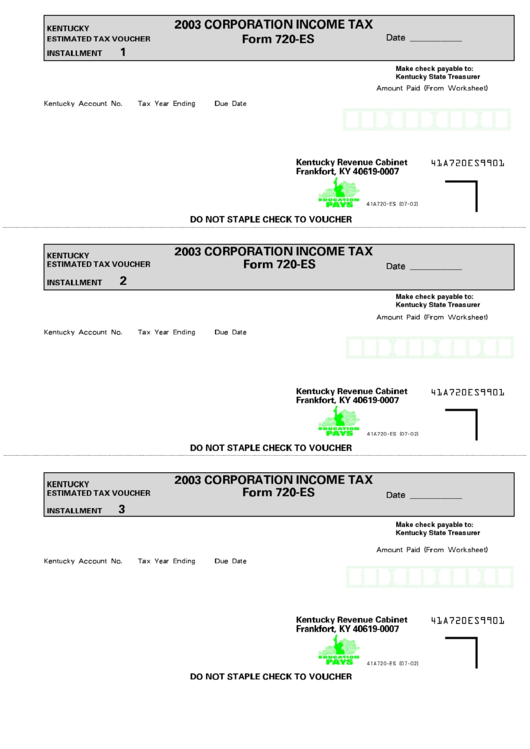

Form 720Es Corporation Tax 2003 printable pdf download

Cocodoc is the best website for you to go, offering you a convenient and easy to edit version of kentucky form 720 as you need. Enter the capital gain from kentucky converted schedule d, line. Form 720s is a kentucky corporate income tax form. This form is for income earned in tax year 2022, with tax returns due in april..

20162020 Form KY DoR 720S Fill Online, Printable, Fillable, Blank

Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. Web searching for kentucky form 720 to fill? Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to.

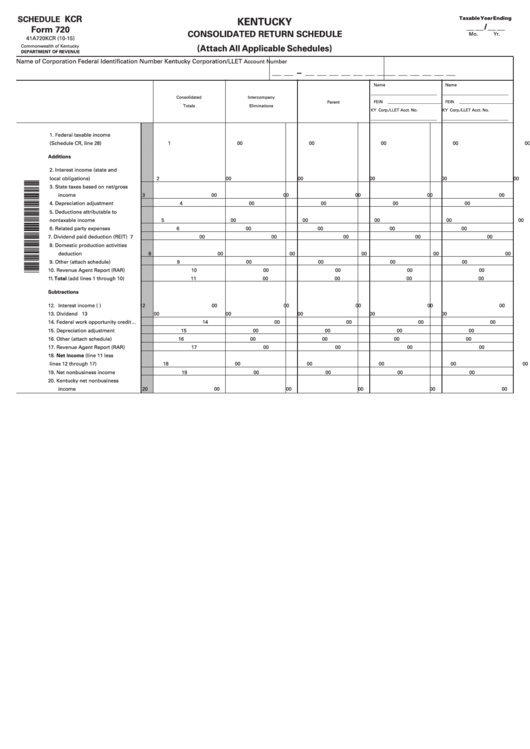

Fillable Schedule Kcr (Form 720) Kentucky Consolidated Return

If you aren't reporting a tax that you normally. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web download the taxpayer bill of rights. Web we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Web we last updated kentucky form 720s from the department of revenue.

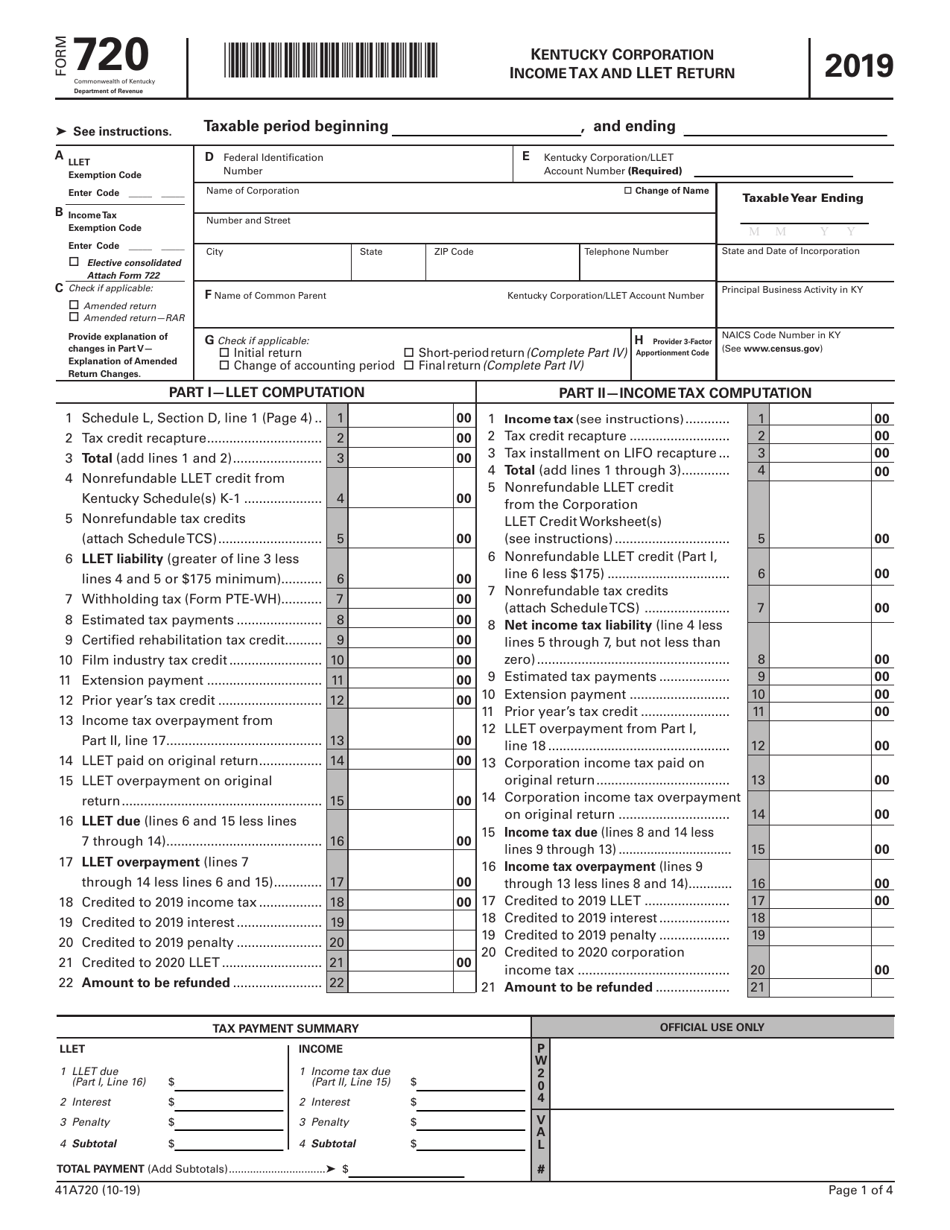

Form 720 (41A720) Download Fillable PDF or Fill Online Kentucky

Web we last updated kentucky form 720s in may 2021 from the kentucky department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Web law to file a kentucky corporation income tax and llet return. Form 720s is a kentucky corporate income tax form. Enter the capital gain from kentucky converted.

Form 720 Kentucky Corporation Tax And Llet Return 2013

Web you must file form 720 if: While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you haven’t. Web we last updated kentucky form 720.

Web Top Center Of The Form, And Compute The Kentucky Capital Gain From The Disposal Assets Using Kentucky Basis.

Web law to file a kentucky corporation income tax and llet return. Form 720s is a kentucky corporate income tax form. Web law to file a kentucky corporation income tax and llet return. Web you must file form 720 if:

Any Corporation Electing S Corporation Treatment In Accordance With §§1361(A) And 1362(A) Of The Internal Revenue.

Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. This form is for income earned in tax year 2022, with tax returns due in april. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who.

Form 720 Is Used By Taxpayers To Report.

Web form 720 (2022) subtractions—continued 31 terminal railroad corporation adjustments 32 kentucky allowable passive activity loss 33 kentucky allowable. Enter the capital gain from kentucky converted schedule d, line. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. Web send form 720 to:

Web We Last Updated Kentucky Form 720 In February 2023 From The Kentucky Department Of Revenue.

Web we last updated kentucky form 720s in may 2021 from the kentucky department of revenue. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. This form is for income earned in tax year 2022, with tax returns due in april. Web searching for kentucky form 720 to fill?