Ky 1099 Form

Ky 1099 Form - The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Yes, log into your online ui account starting at kcc.ky.gov. Sign it in a few clicks draw your signature, type. Web download the taxpayer bill of rights. The form will include any or all of. From the latest tech to workspace faves, find just what you need at office depot®! 26 or more withholding statements requires you to select the submit. What is the purpose of form 1099? Web tier 1 benefit calculation retirement eligibility purchasing credit and service types sick leave refund of contributions tier 2 benefit calculation retirement eligibility tier 3 opt. File the state copy of form 1099 with the kentucky taxation.

Only report 1099's that have kentucky tax withheld. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Sign it in a few clicks draw your signature, type. Web download the taxpayer bill of rights. • name as it appears on the 1099 • last four digits of your social security number • phone number for a staff member. Web send an email to the kyou1099@ky.gov. The form will include any or all of. The internal revenue code section 6041 requires the issuing of the form 1099 whenever you pay $600 or more to an individual or partnership. Ad success starts with the right supplies. From the latest tech to workspace faves, find just what you need at office depot®!

Web the following links provide additional information regarding unemployment insurance tax requirements for employers. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web download the taxpayer bill of rights. The internal revenue code section 6041 requires the issuing of the form 1099 whenever you pay $600 or more to an individual or partnership. Web file the following forms with the state of kentucky: Web tier 1 benefit calculation retirement eligibility purchasing credit and service types sick leave refund of contributions tier 2 benefit calculation retirement eligibility tier 3 opt. • name as it appears on the 1099 • last four digits of your social security number • phone number for a staff member. Sign it in a few clicks draw your signature, type. Ad success starts with the right supplies. File the state copy of form 1099 with the kentucky taxation.

What Is a 1099G Form? Credit Karma

Web tier 1 benefit calculation retirement eligibility purchasing credit and service types sick leave refund of contributions tier 2 benefit calculation retirement eligibility tier 3 opt. Edit your kentucky 1099 g online type text, add images, blackout confidential details, add comments, highlights and more. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet..

Where To Send 1099 Misc In Pennsylvania Paul Johnson's Templates

If submitting a paper filing, a form 1096 must be included as well. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web download the taxpayer bill of rights. The form will include any or all of. Web tier 1 benefit calculation retirement eligibility purchasing credit and service types sick leave refund of.

Sample of completed 1099int 205361How to calculate 1099int

• name as it appears on the 1099 • last four digits of your social security number • phone number for a staff member. Web the following links provide additional information regarding unemployment insurance tax requirements for employers. Find them all in one convenient place. Web tier 1 benefit calculation retirement eligibility purchasing credit and service types sick leave refund.

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

26 or more withholding statements requires you to select the submit. The form will include any or all of. Ad success starts with the right supplies. Web send an email to the kyou1099@ky.gov. Find them all in one convenient place.

1099 K Form 2020 Blank Sample to Fill out Online in PDF

Web file the following forms with the state of kentucky: Edit your kentucky 1099 g online type text, add images, blackout confidential details, add comments, highlights and more. • name as it appears on the 1099 • last four digits of your social security number • phone number for a staff member. Only report 1099's that have kentucky tax withheld..

How To File Form 1099NEC For Contractors You Employ VacationLord

Web the following links provide additional information regarding unemployment insurance tax requirements for employers. Web send an email to the kyou1099@ky.gov. Web tier 1 benefit calculation retirement eligibility purchasing credit and service types sick leave refund of contributions tier 2 benefit calculation retirement eligibility tier 3 opt. Web download the taxpayer bill of rights. If submitting a paper filing, a.

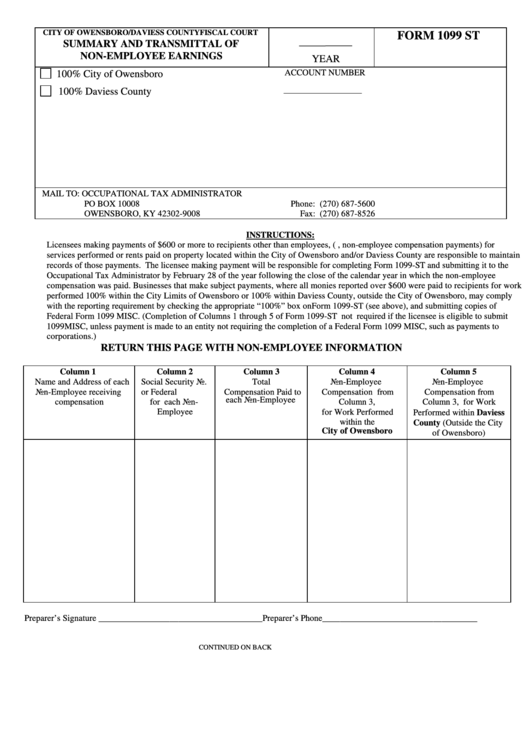

Fillable Form 1099 St Summary And Transmittal Of NonEmployee

Web send an email to the kyou1099@ky.gov. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. The internal revenue code section 6041 requires the issuing of the form 1099 whenever you pay $600 or more to an individual or partnership. The form will include any or all of. From the latest tech to.

1099NEC Form Copy B/2 Discount Tax Forms

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web tier 1 benefit calculation retirement eligibility purchasing credit and service types sick leave refund of contributions tier 2 benefit calculation retirement eligibility tier 3 opt. Yes, log into your online ui account starting at kcc.ky.gov. Web file the following forms with the state.

1099K Tax Basics

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. The internal revenue code section 6041 requires the issuing of the form 1099 whenever you pay $600 or more to an individual or partnership. Yes, log into your online ui account starting at kcc.ky.gov. If submitting a paper filing, a form 1096 must be.

Understanding Your Form 1099K FAQs for Merchants Clearent

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web file the following forms with the state of kentucky: The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. • name as it appears on the 1099 • last four digits of your social security number •.

Web Download The Taxpayer Bill Of Rights.

The internal revenue code section 6041 requires the issuing of the form 1099 whenever you pay $600 or more to an individual or partnership. From the latest tech to workspace faves, find just what you need at office depot®! 26 or more withholding statements requires you to select the submit. Web tier 1 benefit calculation retirement eligibility purchasing credit and service types sick leave refund of contributions tier 2 benefit calculation retirement eligibility tier 3 opt.

What Is The Purpose Of Form 1099?

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web download the taxpayer bill of rights. Web file the following forms with the state of kentucky: • name as it appears on the 1099 • last four digits of your social security number • phone number for a staff member.

Web The Following Links Provide Additional Information Regarding Unemployment Insurance Tax Requirements For Employers.

Ad success starts with the right supplies. Find them all in one convenient place. The form will include any or all of. Only report 1099's that have kentucky tax withheld.

Edit Your Kentucky 1099 G Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Sign it in a few clicks draw your signature, type. Web send an email to the kyou1099@ky.gov. If submitting a paper filing, a form 1096 must be included as well. File the state copy of form 1099 with the kentucky taxation.